Add your feed to SetSticker.com! Promote your sites and attract more customers. It costs only 100 EUROS per YEAR.

Pleasant surprises on every page! Discover new articles, displayed randomly throughout the site. Interesting content, always a click away

CryptoUnit

CRYPTOUNITWhy is Bitcoin price up today?[2023-10-30] 30 Oct 2023, 2:17 am

Bitcoin (BTC) Price Prediction 2023, 2024, 2025–2030

Bitcoin Price Projection for 2025

The anticipated Bitcoin price for 2025 ranges from a low of $73,064 to a high of $177,384. If Bitcoin (BTC) reaches the upper end of this projection, it could experience a substantial gain of 414.94% compared to its current price.

Bitcoin Price Forecast for 2030

The Bitcoin price forecast for 2030 falls within the range of $144,947 on the lower side to $266,409 on the higher side. If Bitcoin reaches the upper end of this projection, it would signify a remarkable increase of 673.38% in comparison to today’s price.

| Year | Yearly Low | Yearly High |

|---|---|---|

| 2024 | $ 29,478 | $ 116,004 |

| 2025 | $ 73,064 | $ 177,384 |

| 2026 | $ 78,723 | $ 107,693 |

| 2027 | $ 76,505 | $ 80,217 |

| 2028 | $ 76,257 | $ 101,417 |

| 2029 | $ 100,714 | $ 305,028 |

| 2030 | $ 144,947 | $ 266,409 |

Bitcoin’s Moving Averages and Relative Strength Index (RSI) Analysis

Analyzing Bitcoin’s 50-Day and 200-Day Simple Moving Averages (SMAs) alongside the 14-Day Relative Strength Index (RSI) can provide insights into its price trends.

Based on our technical indicators, the 200-Day SMA for Bitcoin is projected to rise in the coming month and reach $29,225 by November 28, 2023. Additionally, the short-term 50-Day SMA is estimated to reach $35,223 by the same date.

The Relative Strength Index (RSI) is a widely-used momentum oscillator that gauges whether a cryptocurrency is oversold (when RSI is below 30) or overbought (when RSI exceeds 70). Presently, the RSI stands at 81.55, indicating that the Bitcoin market is in an overbought condition. This suggests a potential price increase for BTC.

Daily Simple Moving Average (SMA)

| Period | Value | Action |

|---|---|---|

| SMA 3 | $ 34,049 | BUY |

| SMA 5 | $ 34,094 | BUY |

| SMA 10 | $ 32,163 | BUY |

| SMA 21 | $ 29,724 | BUY |

| SMA 50 | $ 28,007 | BUY |

| SMA 100 | $ 27,951 | BUY |

| SMA 200 | $ 28,201 | BUY |

Daily Exponential Moving Average (EMA)

|

Value | Action |

|---|---|---|

| EMA 3 | $ 34,088 | BUY |

| EMA 5 | $ 33,981 | BUY |

| EMA 10 | $ 32,884 | BUY |

| EMA 21 | $ 30,899 | BUY |

| EMA 50 | $ 29,005 | BUY |

| EMA 100 | $ 28,296 | BUY |

| EMA 200 | $ 27,559 | BUY |

Weekly Simple Moving Average (SMA)

| Period | Value | Action |

|---|---|---|

| SMA 21 | $ 28,305 | BUY |

| SMA 50 | $ 25,321 | BUY |

| SMA 100 | $ 28,372 | BUY |

| SMA 200 | $ 28,385 | BUY |

Weekly Exponential Moving Average (EMA)

| Period | Value | Action |

|---|---|---|

| EMA 21 | $ 28,161 | BUY |

| EMA 50 | $ 27,211 | BUY |

| EMA 100 | $ 27,819 | BUY |

| EMA 200 | $ 25,892 | BUY |

Key Moving Averages and Oscillators for Bitcoin on October 30, 2023

Moving averages are popular tools in financial markets, serving the purpose of smoothing out price fluctuations over specific timeframes. It’s important to note that moving averages are lagging indicators, based on historical price data. Below is a table detailing two types of moving averages: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Bitcoin’s Market Data as of October 30, 2023

As of October 30, 2023, the live price of Bitcoin (BTC) stands at $227.26 per BTC/USD, with a total market capitalization of $34.48 billion USD. The 24-hour trading volume for Bitcoin is $203.35 million USD. The price of Bitcoin to USD is continuously updated in real-time, and it has experienced a 1.15% increase in the last 24 hours. The circulating supply of Bitcoin is approximately 151.70 million.

About Bitcoin (BTC)

Bitcoin (BTC) is a cryptocurrency widely used for trading and covering fees on the Binance cryptocurrency exchange. Furthermore, it serves as the foundational cryptocurrency for the Binance Chain ecosystem. As one of the most popular utility tokens worldwide, Bitcoin is utilized for a broad spectrum of applications and use cases.

Bitcoin was initially introduced through an Initial Coin Offering (ICO) conducted from June 26th to July 3rd, 2017, precisely 11 days before the Binance Exchange commenced trading operations. During the ICO, the offering price was set at 1 ETH for 2,700 BTC or 1 BTC for 20,000 BTC. Nevertheless, it’s important to note that possessing Bitcoin (BTC) does not entitle users to a share of Binance’s profits nor does it represent an investment in the exchange.

Bitcoin (BTC) has found applications both within the Binance Chain ecosystem and in external contexts. Originally launched as an ERC-20 token on the Ethereum blockchain, Bitcoin has since migrated to the main Binance Chain. Although the initial total supply was established at 200 million coins, the supply is gradually decreasing due to periodic coin burns. The current price of Bitcoin is updated in real-time and is readily available on the Binance exchange.

Factors Behind the Surge in Bitcoin Price Today

Introduction

Bitcoin, the world’s most famous cryptocurrency, has seen a significant surge in price today, leaving both investors and analysts eager to understand the reasons behind this sudden price increase. In this report, we will delve into several key factors contributing to Bitcoin’s bullish trend, which has brought it to new heights.

Institutional Interest

One of the primary drivers of Bitcoin’s price surge today is the increasing interest and investment from institutional players. Major financial institutions, including banks and asset management firms, have started to view Bitcoin as a legitimate asset class. The adoption of Bitcoin as a store of value and a hedge against inflation by institutions has boosted confidence in the cryptocurrency, attracting more investors and capital.

Inflation Concerns

Bitcoin is often seen as “digital gold,” and this comparison becomes more pronounced during times of economic uncertainty and rising inflation. Today, global markets are facing concerns about inflation, primarily driven by central banks’ aggressive monetary policies and the increased money supply. Investors are turning to Bitcoin as a hedge against the devaluation of traditional currencies, much like they would invest in physical gold.

Market Sentiment

Market sentiment plays a significant role in driving Bitcoin’s price movements. Positive news, such as regulatory developments that favor cryptocurrencies or endorsements from influential figures, can lead to a bullish sentiment. The overall bullish sentiment today has likely been reinforced by positive news and increasing optimism in the cryptocurrency market.

Adoption and Acceptance

Bitcoin’s growing adoption as a means of payment and an investment vehicle has contributed to its price rise. More businesses, both large and small, are accepting Bitcoin as a form of payment, and more financial institutions are offering services related to cryptocurrencies. This increased accessibility and use of Bitcoin is bolstering its value and attracting new investors.

Technological Developments

Bitcoin’s underlying technology, the blockchain, continues to evolve. Technological advancements, such as the implementation of the Lightning Network for faster and cheaper transactions, are making Bitcoin more attractive to users and investors. These developments are enhancing the cryptocurrency’s utility and driving its price higher.

Regulatory Clarity

Clearer regulatory frameworks for cryptocurrencies provide investors with a sense of security and confidence in the market. Today, several countries are taking steps to regulate and provide legal clarity to the crypto industry. Regulatory clarity reduces uncertainty and fosters trust among market participants, which can stimulate increased investment in Bitcoin.

Geopolitical Uncertainty

Geopolitical tensions and uncertainties can also affect Bitcoin’s price. Economic sanctions, trade disputes, and political instability in various parts of the world can drive investors to seek refuge in cryptocurrencies like Bitcoin. The uncertainty surrounding global events today may have contributed to the recent price surge.

Supply and Demand Dynamics

Bitcoin’s fixed supply of 21 million coins is a fundamental aspect of its price dynamics. As demand for Bitcoin continues to rise, its scarcity makes each individual coin more valuable. Today, with growing interest from both retail and institutional investors, the supply and demand dynamics are favoring higher prices.

Speculation

Speculation remains a significant factor in Bitcoin’s price movements. Traders and investors looking to profit from short-term price fluctuations can contribute to sudden price spikes. The fear of missing out (FOMO) often drives people to buy into Bitcoin when it starts surging, which can create a self-fulfilling prophecy of rising prices.

Conclusion

In conclusion, the surge in Bitcoin’s price today is the result of a combination of factors, including institutional interest, concerns about inflation, positive market sentiment, growing adoption, technological advancements, regulatory clarity, geopolitical uncertainty, supply and demand dynamics, and speculation. These elements have converged to drive Bitcoin to new heights. However, it’s essential to remember that the cryptocurrency market is highly volatile, and prices can change rapidly. Investors should exercise caution and conduct thorough research before making any investment decisions in the cryptocurrency space.

The post Why is Bitcoin price up today?[2023-10-30] appeared first on CryptoUnit.

Why is Bitcoin price up today?[2023-10-29] 29 Oct 2023, 9:00 am

Today’s BTC Price

As of now, the current price of Bitcoin stands at $34,097.77 per (BTC / USD), boasting a total market capitalization of $665.79 billion USD. Over the past 24 hours, there has been a trading volume of $15.51 billion USD. The BTC to USD price is continually updated in real-time. Furthermore, Bitcoin has experienced a slight decrease of -0.04% in the last 24 hours, with a circulating supply of 19.53 million.

Bitcoin (BTC) in Brief

Bitcoin, initially introduced in 2009 by the enigmatic Satoshi Nakamoto, ranks as one of the most widely recognized cryptocurrencies in the market. In terms of market capitalization, it has consistently held the top spot, setting the stage for the emergence of numerous other alternative coins (altcoins). Bitcoin marked a watershed moment for digital payment solutions.

Being the world’s pioneer cryptocurrency, Bitcoin’s value has evolved significantly. Importantly, one doesn’t need to purchase an entire Bitcoin, as it can be subdivided into smaller units known as satoshis, a tribute to its creator. A satoshi is the equivalent of 0.00000001 Bitcoin.

Bitcoin functions solely as a digital currency and lacks a physical token. Transactions involving Bitcoin are fully transparent and immune to censorship, establishing a global, censorship-resistant medium for financial exchanges. It operates as a financial system supported by a decentralized network of computers, referred to as “nodes,” rather than relying on centralized banks or government entities, thereby championing “decentralization.”

What Drives Bitcoin’s Price Volatility?

Since its inception, Bitcoin’s price has been marked by high volatility, attributed to various factors. Firstly, the cryptocurrency market is comparatively smaller and less actively traded than traditional financial markets, making it susceptible to substantial price swings triggered by significant transactions. Secondly, Bitcoin’s value is influenced by public sentiment and speculation, which can lead to short-term price fluctuations. Media coverage, influential opinions, and regulatory developments create uncertainty, impacting demand and supply dynamics and contributing to price oscillations.

An additional crucial factor is Bitcoin’s fixed supply. With only 21 million Bitcoins set to ever exist, its scarcity can result in drastic price shifts depending on demand. This is further exacerbated by the actions of “whales,” large Bitcoin holders, whose substantial transactions can substantially influence the market.

When Was Bitcoin Invented?

Bitcoin came into existence in 2009, conceived by an anonymous individual or group operating under the pseudonym Satoshi Nakamoto. This digital asset is underpinned by a decentralized, peer-to-peer network and blockchain technology, allowing users to conduct secure and anonymous transactions without intermediaries. In 2008, Satoshi Nakamoto published the Bitcoin whitepaper, outlining the cryptocurrency’s design and principles. The first-ever Bitcoin transaction, entailing the transfer of 10 Bitcoins to a developer, occurred on January 12, 2009. Since then, Bitcoin has gained traction as an alternative store of value and payment system, reshaping the financial industry.

Who is the Creator of Bitcoin?

The creator of Bitcoin remains a mystery, known solely by the pseudonym Satoshi Nakamoto. The innovation behind Bitcoin surfaced in 2008 when Nakamoto released the whitepaper elucidating the cryptocurrency’s decentralized, peer-to-peer structure and utilization of blockchain technology. In 2009, Nakamoto mined the inaugural Bitcoin block, with the first Bitcoin transaction transpiring on January 12th of the same year. Despite extensive investigations and conjecture, the genuine identity of Satoshi Nakamoto has remained undisclosed.

Numerous individuals have been proposed as potential Satoshi Nakamoto candidates, but none of these claims have been definitively substantiated.

How Does Bitcoin Operate?

Bitcoin operates on a decentralized, peer-to-peer network, enabling individuals to execute transactions without intermediaries. The transparency and security of transactions are maintained through the underlying blockchain technology, which stores and verifies recorded transaction data. Miners validate transactions by solving intricate mathematical problems through computational power. The initial miner to find the solution receives a cryptocurrency reward, leading to the creation of new Bitcoins. Once validated, the data becomes a permanent record in the existing blockchain. Bitcoin offers an alternative, transparent, and secure method of transaction, redefining traditional finance.

When is the Next Bitcoin Halving?

The upcoming Bitcoin halving is anticipated to occur in April 2024. The precise date is contingent on the block height, denoting the number of blocks preceding a specific block in the blockchain. Bitcoin experiences a halving approximately every 210,000 blocks, with the next halving expected in April 2024 when the block height reaches 840,000.

Bitcoin halving events, which take place roughly every four years, involve reducing the rewards granted to Bitcoin miners for block mining by half. This was integrated into the Bitcoin protocol to sustain its value as a deflationary currency. By decreasing the issuance of new Bitcoins, the protocol aims to counteract the devaluation that frequently affects inflationary currencies over time.

Will Bitcoin Halving Impact BTC’s Price?

Historically, Bitcoin’s price has exhibited an upward trajectory in the months leading up to a halving event, as investors and traders anticipate a reduction in the supply of new Bitcoins. Post-halving, the price may continue to rise if demand remains robust and surpasses the diminished supply. Additional factors such as market sentiment, regulatory developments, and global events can also exert influence on Bitcoin’s price. Keep an eye on our Bitcoin Halving Countdown to gain insights into the mechanics of Bitcoin halving.

For the most up-to-date Bitcoin (BTC) prices, please visit Binance, where live price information is available in real-time.

Analyzing the Factors Behind Today’s Surge in Bitcoin Price

Introduction

Bitcoin, the world’s leading cryptocurrency, has been making headlines today as its price experiences a notable surge. The reasons behind such sudden fluctuations in the value of Bitcoin are multifaceted and influenced by a combination of factors, including market sentiment, technical indicators, and external events. In this report, we will delve into the key factors contributing to the rise in Bitcoin’s price today.

Market Sentiment and Investor Confidence

Market sentiment plays a pivotal role in shaping the price of Bitcoin. Positive sentiment, often fueled by optimistic news and events, can trigger a buying frenzy, leading to an upswing in the cryptocurrency’s value. Recently, the sentiment around Bitcoin has been largely positive, driven by several factors:

a. Regulatory Clarity: The regulatory landscape for cryptocurrencies is slowly becoming clearer in various parts of the world. When regulators provide a structured and transparent framework for cryptocurrency operations, it tends to boost investor confidence. In regions like the United States and the European Union, progress in regulating the crypto space has contributed to the bullish sentiment.

b. Institutional Adoption: Large financial institutions and corporations are increasingly recognizing the potential of Bitcoin as a store of value and a hedge against inflation. Investments from major players, such as Tesla and Square, have been driving confidence in Bitcoin as a legitimate asset.

c. Global Economic Uncertainty: Economic turmoil and currency devaluation in some countries have driven individuals and institutions to seek refuge in Bitcoin, which is often seen as a safe-haven asset similar to gold.

Technical Analysis and Chart Patterns

Traders and analysts often rely on technical analysis and chart patterns to make investment decisions. Certain technical indicators can signal buy or sell opportunities, influencing the actions of traders and investors. Today’s surge in Bitcoin’s price may be partly attributed to these technical factors:

a. Golden Cross: A “golden cross” occurs when a short-term moving average crosses above a long-term moving average. This event is often seen as a bullish signal, suggesting that positive momentum is building, and traders should consider entering long positions. The occurrence of a golden cross can attract traders and investors, contributing to a price rally.

b. Breakout Patterns: Traders pay close attention to chart patterns, such as “bull flags” and “cup and handle” formations, which can signal a breakout to the upside. When these patterns emerge and are confirmed, traders often take long positions, which can drive the price higher.

Global Events and News Catalysts

Cryptocurrency markets are highly responsive to external news events, which can act as significant catalysts for price movements. Several events or developments have been influencing Bitcoin’s recent surge:

a. El Salvador’s Adoption: In September 2021, El Salvador became the first country in the world to adopt Bitcoin as legal tender. This historic move has drawn global attention to the cryptocurrency and its potential for international adoption.

b. Macro-Economic News: Economic events, such as changes in interest rates, inflation reports, and geopolitical tensions, can affect Bitcoin’s price. Traders often turn to Bitcoin as a hedge against economic instability.

c. Institutional Investments: Announcements of large institutions or companies adding Bitcoin to their balance sheets can significantly impact market sentiment and drive the price up. The “smart money” is often followed by retail investors.

Supply and Demand Dynamics

Bitcoin’s price is also influenced by its supply and demand dynamics, which are inherent to its design. With a fixed supply cap of 21 million coins, changes in demand can lead to price surges:

a. Halving Events: Bitcoin experiences a “halving” approximately every four years. During a halving, the reward given to miners for confirming transactions is reduced by half. This supply reduction has historically been associated with price increases, as it highlights the scarcity of new coins.

b. Scarcity and FOMO: As more investors and institutions recognize Bitcoin’s scarcity, the fear of missing out (FOMO) can drive up demand. Investors rush to buy Bitcoin to secure their share of a limited supply.

c. Hodling Behavior: A significant number of Bitcoin holders adopt a “hodling” strategy, which means they keep their coins long-term rather than actively trading them. This behavior further restricts the available supply and can lead to price appreciation.

Conclusion

The surge in Bitcoin’s price today is the result of a complex interplay of factors, ranging from market sentiment and technical analysis to external events and supply and demand dynamics. As the cryptocurrency market continues to mature and gain recognition as a legitimate asset class, Bitcoin’s price movements will likely remain subject to both rapid fluctuations and long-term trends.

Investors and analysts should remain vigilant and consider a holistic approach when assessing the cryptocurrency market. While today’s rise in Bitcoin price may be a momentous event, it serves as a reminder that the cryptocurrency landscape is dynamic and influenced by a multitude of factors, making it a continually intriguing and challenging space for traders and enthusiasts alike.

The post Why is Bitcoin price up today?[2023-10-29] appeared first on CryptoUnit.

Why is Bitcoin price up today? [2023-10-28] 28 Oct 2023, 2:52 am

Analyst Suggests Bitcoin’s 14% Weekly Surge Marks the ‘End of an Era’ as Major Tech Companies Divest

The recent uptick in Bitcoin’s value, combined with gains seen across all sectors of digital assets, serves as a clear indicator of the extensive cryptocurrency rally.

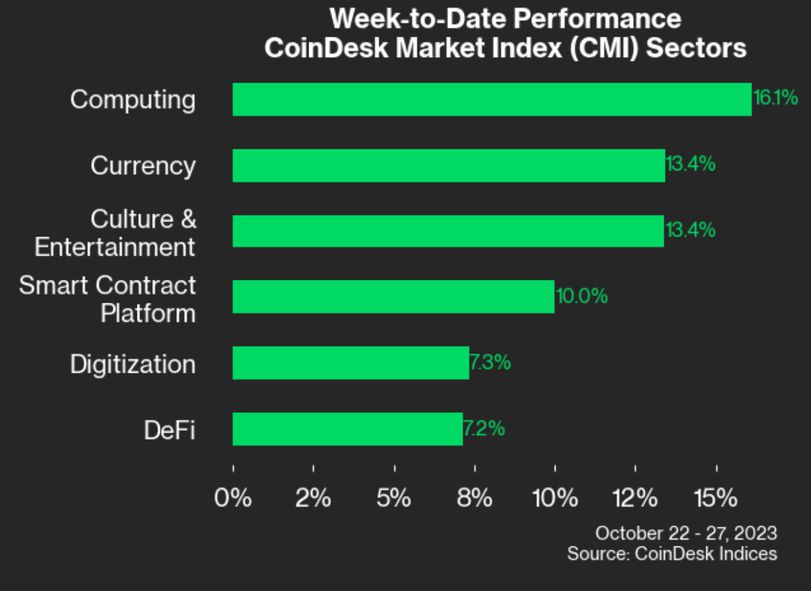

Data from CoinDesk reveals that Bitcoin (BTC) has not only enjoyed a surge in price this week but has also prompted gains across the broader cryptocurrency market. In just one week, BTC witnessed an increase of over 14%, stabilizing at around $33,700 after reaching its highest annual point at $35,000, although it couldn’t break through that threshold. Bitcoin’s performance aligns closely with the 14% increase seen in the CoinDesk Market Index (CMI).

Remarkably, the CoinDesk Computing Sector (CPU), an index tracking protocols focused on constructing and supporting Web3 infrastructure and distributed computing, demonstrated the most significant gains. The CPU sector surged by over 17%, primarily driven by the success of tokens like Chainlink (LINK) and Fetch.AI (FET).

Even sectors that had previously lagged behind, such as decentralized finance (DCF) and digitization (DTZ), saw an increase of over 7% this week, underscoring the breadth of the cryptocurrency rally.

Noteworthy performers in the cryptocurrency market included the infamous meme coin pepe (PEPE), which saw a 76% surge after a token burn, LINK, which gained over 44% due to the trend of real-world asset tokenization, and Injective Protocol’s native token (INJ), adding an additional 58% to its impressive performance following a token upgrade in August.

Crypto’s ‘Uptober’ and the Decline of Big Tech

What adds to the significance of this bullish week in the cryptocurrency market is the underwhelming performance of U.S. equities, as pointed out by Coinbase analysts David Duong and David Han.

According to their report, BTC experienced a significant 4.3 standard deviation increase in performance compared to the past three months, while the S&P 500 and Nasdaq saw a decrease of nearly 2.5 to 3.0 standard deviations during the same period.

Duong and Han stated, “This substantial divergence partially reflects a deteriorating macro trading environment in contrast to Bitcoin’s positive idiosyncratic narrative.”

“Uptober” is indeed living up to its name, as noted by Charlie Morris, the founder of investment advisory firm ByteTree, in a Friday market update. Morris pointed out that the Nasdaq, which is heavily tech-focused, is experiencing a decline while Bitcoin and gold are advancing. This signals a shift in the investment landscape away from the ever-expanding, large U.S. tech corporations.

“Big tech is currently overpriced, and following underwhelming results this week, the sector no longer exhibits the rapid growth necessary to justify premium prices,” Morris explained. “Though they had room to cut costs, true growth comes from increasing sales rather than reducing expenses.”

Why is Bitcoin Price Up Today? Analyzing the Factors Behind the Surge

Introduction

Bitcoin, the world’s most renowned cryptocurrency, has exhibited remarkable price volatility in recent years. Today, the digital asset is experiencing another surge in value, leaving investors and enthusiasts alike to ponder the reasons behind this latest price increase. This article will delve into the factors that have contributed to Bitcoin’s price surge, shedding light on the key drivers behind its current upward trajectory.

Institutional Investment

One of the most significant factors driving Bitcoin’s price up today is the continued influx of institutional investment. Institutional players, including prominent investment firms, corporations, and even governments, have recognized the potential of cryptocurrencies as a store of value and an investment asset. Notable companies like Tesla and Square have allocated significant portions of their treasury reserves to Bitcoin. These endorsements from influential corporations have encouraged more investors to consider Bitcoin as a legitimate asset class.

Growing Acceptance

Bitcoin’s growing acceptance as a means of payment and store of value has boosted its price. Increasingly, mainstream companies and online retailers are accepting Bitcoin as a method of payment. This acceptance not only legitimizes the cryptocurrency but also enhances its utility, contributing to its attractiveness as an investment.

Supply Scarcity

Bitcoin’s price surge can also be attributed to its fixed supply. Bitcoin operates on a capped supply of 21 million coins, which creates scarcity and potentially drives up demand. As Bitcoin becomes more challenging to mine, the cost of acquisition rises, further bolstering its value. This scarcity factor has attracted both long-term investors looking to preserve wealth and traders aiming to capitalize on the asset’s growth potential.

Safe-Haven Asset

In times of economic uncertainty and geopolitical instability, Bitcoin is increasingly seen as a safe-haven asset, much like gold. Investors turn to Bitcoin as a hedge against currency devaluation and economic turmoil. With global events such as the COVID-19 pandemic and inflation concerns, the appeal of Bitcoin as a safe-haven asset has grown, driving its price upward.

Institutional Support

The endorsement and participation of well-established financial institutions have played a pivotal role in the recent surge. Traditional banks and investment firms are offering Bitcoin investment products, making it easier for their clients to gain exposure to the cryptocurrency market. Moreover, regulatory clarity has improved, providing institutions with a more secure environment in which to invest.

Positive Market Sentiment

Market sentiment plays a crucial role in the price movement of Bitcoin. Positive news, developments, and endorsements can create a surge in buying activity, driving prices up. Recently, Bitcoin has received positive attention from influential figures in finance and technology, further boosting market sentiment. These endorsements and positive narratives have contributed to the current price increase.

Technological Advancements

Ongoing technological advancements and improvements within the Bitcoin ecosystem have positively impacted its price. For instance, the integration of the Lightning Network has enhanced transaction speeds and lowered fees, making Bitcoin more attractive for everyday use. Additionally, increased security measures and scalability solutions have instilled confidence in investors.

Global Adoption

Bitcoin’s global adoption has been steadily growing, with countries like El Salvador officially recognizing it as legal tender. This type of recognition by governments and nations opens up new markets and creates fresh demand for Bitcoin, which translates to higher prices.

Trading Activity

Trading activity, including both spot and derivatives markets, plays a significant role in determining Bitcoin’s price. Increased trading volume, particularly in major cryptocurrency exchanges, can lead to heightened price volatility and surges. Traders looking for profit opportunities have contributed to the recent price increase through their speculative activities.

Speculative Nature

Bitcoin’s price is also influenced by speculation. Many investors are drawn to cryptocurrencies with the hope of significant returns, which can lead to frenzied buying and selling. Speculation, although volatile, has the potential to propel Bitcoin’s price upwards, albeit with greater risk.

Conclusion

The surge in Bitcoin’s price today can be attributed to a combination of factors, including institutional investment, growing acceptance, supply scarcity, safe-haven status, institutional support, positive market sentiment, technological advancements, global adoption, trading activity, and speculative interest. Understanding these driving forces is essential for both seasoned investors and newcomers in the cryptocurrency market. As Bitcoin’s role in the global financial landscape continues to evolve, its price dynamics will remain a subject of fascination and discussion in the financial world.

The post Why is Bitcoin price up today? [2023-10-28] appeared first on CryptoUnit.

Why is Bitcoin price up today? [2023-10-27] 27 Oct 2023, 1:59 am

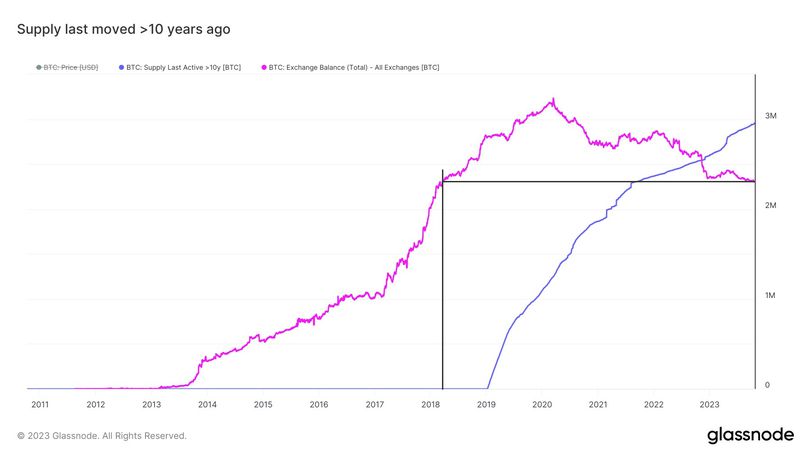

Bitcoin Nears ‘Supply Shock’ with 5-Year Low in Exchange Balances, Analyst Suggests

According to an interview with CoinDesk TV, Matt Weller, the global head of research at Forex.com, has highlighted that Bitcoin’s (BTC) supply is becoming increasingly limited due to exchange balances dropping to a five-year low. This situation sets the stage for a possible “supply shock.”

Data from Glassnode indicates that the amount of available Bitcoin on cryptocurrency exchanges, which refers to the liquid tokens that investors can easily buy and sell, has decreased by 2.3 million. This is the lowest reading since April 2018, down from 2.6 million a year ago and 3.2 million at its peak in May 2020.

Furthermore, Weller pointed out that approximately 3 million Bitcoin tokens have remained untouched for a decade. This is in comparison to the current overall supply of 19.5 million and Bitcoin’s maximum supply of 21 million.

Weller commented on this situation, stating, “This suggests a potential supply shock. With reduced supply in the market, even a slight increase in demand could lead to a rapid surge in prices.”

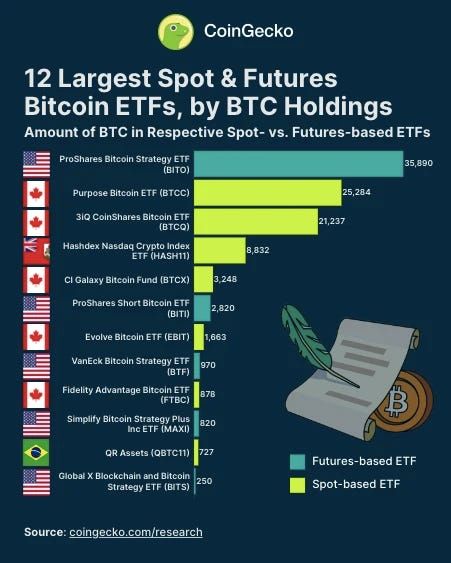

Weller also mentioned that spot exchange-traded funds (ETFs) could have a profound impact on Bitcoin’s supply and demand dynamics, especially in contrast to futures-based products. These spot ETFs could open the door to a new set of investors. He emphasized that this is particularly significant now as Bitcoin has regained its status as an “uncorrelated asset,” having decoupled from equities and rallying while U.S. stocks have entered correction territory.

Why is Bitcoin Price Up Today? A Comprehensive Analysis

Introduction

Bitcoin’s price is known for its volatility, and its daily fluctuations often leave investors and enthusiasts wondering, “Why is Bitcoin price up today?” In this article, we will delve into some of the key factors driving Bitcoin’s recent price surge, shedding light on the cryptocurrency market’s ever-changing dynamics.

Institutional Adoption

One of the most significant factors contributing to the recent surge in Bitcoin’s price is institutional adoption. Large financial institutions, hedge funds, and corporations have been increasingly allocating a portion of their portfolios to Bitcoin. This trend started with companies like Tesla and Square investing in Bitcoin and has continued to gain momentum.

The endorsement of cryptocurrencies by influential figures like Elon Musk and Michael Saylor has further bolstered institutional confidence in Bitcoin. The appeal of Bitcoin as a store of value, a hedge against inflation, and a portfolio diversifier has made it an attractive asset for these institutions.

Macro Economic Factors

Global economic uncertainty and the impact of central bank policies have played a vital role in Bitcoin’s price appreciation. The ongoing COVID-19 pandemic and unprecedented monetary stimulus measures have raised concerns about currency devaluation and inflation.

As a result, Bitcoin has been embraced as a digital alternative to traditional fiat currencies. Investors view it as a safe haven asset that can potentially protect their wealth in times of economic turmoil. The desire to escape fiat currency devaluation has driven an influx of funds into Bitcoin.

Regulatory Developments

The regulatory environment for cryptocurrencies has been evolving rapidly. While it can pose risks, it also offers the potential for greater legitimacy and broader adoption. In recent times, regulatory clarity has emerged as a driving force behind Bitcoin’s price rise.

Efforts to regulate and legitimize the crypto market have given institutional investors more confidence in participating. Clearer rules and oversight provide a sense of security that was previously lacking, making Bitcoin an attractive investment option for a wider range of investors.

Technological Advancements

Bitcoin’s underlying technology, blockchain, continues to evolve. Developers are constantly working on improving scalability, security, and overall network efficiency. These advancements have not only improved the Bitcoin network but have also reinforced confidence in the cryptocurrency.

Layer-2 solutions like the Lightning Network and Segregated Witness (SegWit) have enhanced transaction speed and lowered fees, making Bitcoin more practical for everyday use. As the technology behind Bitcoin matures, it becomes more appealing to a broader audience.

Scarcity and Halving Events

Bitcoin’s scarcity is a fundamental element contributing to its price appreciation. With a fixed supply capped at 21 million coins, Bitcoin becomes more valuable as demand increases. The halving events, which occur approximately every four years, reduce the rate at which new Bitcoins are created.

The most recent halving in May 2020 reduced the block rewards from 12.5 to 6.25 Bitcoins, further diminishing the available supply. This reduction in supply has historically been associated with significant price rallies as it emphasizes Bitcoin’s deflationary nature.

Speculative Trading and Media Hype

Speculative trading and media coverage also play a significant role in Bitcoin’s price movements. News reports, social media discussions, and celebrity endorsements can create hype and drive increased demand. Speculative traders often follow these trends, causing price fluctuations.

The “fear of missing out” (FOMO) is a common psychological factor among retail investors. When they witness significant price gains, they rush to invest in Bitcoin, leading to further price increases. This dynamic can be a double-edged sword, contributing to both rapid gains and sudden drops.

Increased Retail Participation

Retail investors are increasingly participating in the cryptocurrency market. User-friendly platforms and mobile apps have made it easier for individuals to buy, hold, and trade Bitcoin. Retail investors seeking exposure to potential high returns have flocked to the cryptocurrency space.

The cumulative effect of numerous small investments can have a substantial impact on Bitcoin’s price. Retail traders are more likely to buy during price surges, driving up demand.

Conclusion

The question of why Bitcoin’s price is up today can be answered by considering a combination of factors. Institutional adoption, macroeconomic conditions, regulatory developments, technological advancements, scarcity, speculative trading, media coverage, and retail participation are all intertwined in shaping Bitcoin’s price trajectory.

While these factors contribute to Bitcoin’s recent price gains, it’s essential to remember that the cryptocurrency market remains highly speculative and volatile. Prices can fluctuate rapidly in both directions, and investors should approach the market with caution and a long-term perspective. As the cryptocurrency ecosystem continues to evolve, monitoring these key factors is crucial for understanding the dynamics of Bitcoin’s price movements.

The post Why is Bitcoin price up today? [2023-10-27] appeared first on CryptoUnit.

Why is Bitcoin price up today? [2023-10-26] 26 Oct 2023, 9:30 am

“We Remain the Most Compliant Crypto Exchange Today,” States Binance’s New CMO in Exclusive Interview

In a captivating interview, Rachel Conlan divulges crucial insights into the current state of Binance, the leading cryptocurrency exchange, during a turbulent period.

Navigating the intricate world of cryptocurrency, Rachel Conlan has recently assumed her role as Chief Marketing Officer at Binance, having initially joined the company as Vice President of Global Marketing.

With two decades of experience in the realm of media marketing, Conlan’s professional journey has spanned various sectors, including consumer packaged goods, luxury, as well as the highly regulated domains of pharmaceuticals and sports.

Reflecting on her diverse career path and the unpredictable nature of the crypto industry, Conlan humbly acknowledged, “I’m a veteran with 20 years of experience.”

Describing her transition into the world of cryptocurrency, Conlan likened it to a roller coaster ride, noting its ever-changing, dynamic, and often tumultuous nature.

At Binance, Conlan is continuously adapting to the rapid pace of change, asserting, “Every day feels like I’m earning a mini MBA in what’s next and how to transform.”

In an exclusive interview with CryptoPotato during Token2049 in Singapore, the new CMO of Binance shared her motivations for joining the company, the current challenges she faces (which are substantial), and addressed the pressing question regarding regulatory concerns surrounding Binance. Spoiler alert: Conlan assures that everything will resolve itself in a few months.

Why Binance?

Transitioning to a role at a prominent platform like Binance involves a series of considerations, especially considering the scale and influence of the exchange. For Conlan, her decision was deeply personal, driven by a quest for purpose. She reflected on the existential void that many people grapple with, stating, “Purpose is missing from a lot of our lives.” She further emphasized how an opportunity like this, to be a part of change, can be incredibly compelling.

Conlan’s decision was sealed through her interaction with Binance’s co-founder, Yi He, whom she found inspiring and impossible not to support.

“The Crypto Industry Faces a Reputation Challenge”

Rising to Meet the Challenges of Binance’s Contemporary Landscape

Heading the marketing efforts for a global giant like Binance comes with its unique set of challenges. Conlan openly acknowledged the industry’s reputation issues in the mainstream world. She emphasized the need for a multifaceted approach with education at its core, stating, “Addressing these challenges and countering the ‘Binance FUD’ in the media requires providing the right educational tools to our dedicated community. As a market leader, Binance is committed to educating and guiding our users on best crypto practices, and it’s my responsibility to ensure that education is delivered effectively to the right audience.”

However, the challenges aren’t limited to reputation. The ever-evolving regulatory landscape has been a significant concern for the crypto industry, with Binance often coming under scrutiny.

Conlan explained, “Regrettably, international cooperation is often lacking, so we work with countries individually. Richard Teng, our Head of Regional Markets, and his team maintain constant communication with regulators worldwide, offering guidance on the necessary regulatory frameworks.”

When asked about Binance’s regulatory journey, Conlan responded firmly, “We remain the most compliant exchange today.”

She shed light on Binance’s proactive approach to address these concerns, emphasizing, “We continue to collaborate with regulators to establish better frameworks. In an industry where the legality and acceptance of cryptocurrencies remain debated, Binance’s commitment to compliance is not just commendable but indispensable.”

Conlan acknowledged the complex nature of complying with diverse sets of rules across different markets and products. She also stressed the need to adapt quickly to changes and conveyed her confidence in Binance’s current position in the market.

“The CZ Approach: A Flat Organizational Structure Maintained”

In an earlier interview with former CSO Gin Chao in 2019, Binance was described as a flat organization where CEO CZ (Changpeng Zhao) was easily accessible to nearly anyone in the company. In 2023, Conlan confirmed that the flat organizational structure is still intact, even as the company has expanded to thousands of employees worldwide. She highlighted her regular interactions with CZ, noting that communication with him is concise and meaningful.

Conlan elaborated on the remarkable ability of CZ and Yi He, working closely together, to absorb a vast amount of information and make rapid, informed decisions when necessary.

“CZ’s Engagement with the Community on Social Media”

Regarding CZ’s active engagement with various social media accounts, including interactions with CryptoPotato, Conlan highlighted Binance’s commitment to its user community and its dedication to evolving based on user feedback. She emphasized the significance of community feedback in shaping Binance’s direction.

While Yi He’s role often stays behind the scenes, Conlan recognized her essential contribution as a co-founder and highlighted the impressive gender balance within the leadership team and the organization as a whole.

“Binance’s Short-Term Future”

Looking ahead, Conlan discussed Binance’s global expansion, noting that they have over 150 million users and significant room for growth considering the global penetration of cryptocurrencies. She acknowledged the cyclical nature of the crypto market and the industry’s relative nascency. Conlan expressed optimism about future developments, especially with events like the Bitcoin halving driving momentum.

Conlan concluded by sharing a personal anecdote, illustrating the growing impact of crypto. Her 75-year-old aunt’s interest in Bitcoin for retirement purposes highlighted the broader societal shift toward cryptocurrency adoption and investment.

Why is Bitcoin Price Up Today? A Comprehensive Analysis

Introduction

Bitcoin, the world’s leading cryptocurrency, has exhibited remarkable price fluctuations throughout its history. Traders and investors around the globe eagerly await daily price movements, and on days when Bitcoin’s value rises significantly, the question that inevitably arises is: “Why is Bitcoin price up today?” In this article, we will delve into some of the key factors that influence Bitcoin’s price, including market sentiment, macroeconomic conditions, regulatory developments, and institutional adoption.

Market Sentiment

One of the primary drivers of Bitcoin’s daily price movements is market sentiment. The cryptocurrency market is highly sensitive to news and events, and a positive sentiment can lead to a surge in demand. On days when Bitcoin’s price is up, it is often due to a combination of positive news, investor optimism, and general excitement in the market.

For instance, positive news related to Bitcoin adoption by a major company or a notable figure can lead to a surge in demand. Furthermore, social media trends and discussions can influence investor sentiment, causing a wave of buying activity. Bitcoin’s price is also closely tied to investor confidence and fear in the market, as reflected in the widely followed Fear and Greed Index.

Macro-economic Conditions

Bitcoin, often referred to as “digital gold,” is considered a safe-haven asset by many investors. During times of economic uncertainty or market turbulence, investors may flock to Bitcoin as a hedge against traditional financial assets like stocks and bonds. This safe-haven status is especially evident when there are concerns about inflation, economic instability, or geopolitical tensions.

In 2020, for example, the COVID-19 pandemic triggered massive government stimulus measures, which raised concerns about currency devaluation and inflation. These concerns led many institutional investors to view Bitcoin as a store of value, resulting in a surge in demand and a notable increase in its price.

Regulatory Developments

The regulatory environment plays a crucial role in determining the trajectory of Bitcoin’s price. Regulatory actions taken by governments can either boost confidence in the cryptocurrency or lead to significant uncertainty and price volatility.

Positive regulatory developments, such as clarity on tax treatment or the approval of Bitcoin exchange-traded funds (ETFs), have historically been associated with price increases. Conversely, the threat of more stringent regulations, like bans on cryptocurrency trading or mining, can lead to price declines.

On days when Bitcoin’s price is up, it might be in response to positive regulatory news, indicating a more favorable stance by authorities towards cryptocurrencies. Conversely, price declines could be driven by regulatory uncertainty or fears of impending restrictions.

Institutional Adoption

Institutional adoption of Bitcoin has gained substantial momentum in recent years. Large corporations, investment funds, and even traditional banks have shown an increasing interest in Bitcoin as an asset class. Institutional participation has provided significant credibility to the cryptocurrency market, attracting a new wave of investors and capital.

On days when Bitcoin’s price is up, it is not uncommon for news to break about institutions allocating funds to Bitcoin or major corporations adding Bitcoin to their balance sheets. These actions demonstrate growing institutional confidence in the long-term value of Bitcoin and often result in price appreciation.

Supply and Halving Events

Bitcoin’s supply is capped at 21 million coins, and its issuance is controlled by a process known as “halving.” Approximately every four years, the block reward for miners is reduced by half, which reduces the rate at which new Bitcoins are created. This event, known as a halving, has historically led to increased demand and price appreciation.

Halving events generate excitement and anticipation in the cryptocurrency community, leading to a bullish sentiment. Traders and investors often expect that a reduction in the supply of new Bitcoins will result in increased scarcity and drive up prices.

Conclusion

Bitcoin’s daily price movements are influenced by a complex interplay of factors, including market sentiment, macroeconomic conditions, regulatory developments, institutional adoption, and supply-related events like halving. On days when Bitcoin’s price is up, it is usually the result of a combination of these factors, with positive sentiment, institutional interest, and regulatory clarity often playing significant roles.

However, it is essential to remember that the cryptocurrency market is highly speculative and prone to volatility. Investors should exercise caution and conduct thorough research before participating in the market, as both upward and downward price movements are inherent in the world of cryptocurrencies.

The post Why is Bitcoin price up today? [2023-10-26] appeared first on CryptoUnit.

Why is Bitcoin price up today? [2023-10-25] 25 Oct 2023, 8:17 am

Bitcoin has surged past the $30,000 mark for the first time in more than two months, and there are several potential reasons behind this notable milestone

In Brief

Bitcoin surpasses $30,000, while the overall cryptocurrency market cap soars to $1.17 trillion, with significant gains in major cryptocurrencies.

Ripple’s legal victory has had a positive impact on the broader cryptocurrency market.

Key figures are noting a potentially more lenient stance from the SEC on cryptocurrencies, hinting at possible future approval of Bitcoin ETFs.

Here are some intriguing Bitcoin price predictions that you should be aware of.

Cryptocurrency Market Rejuvenation

Bitcoin recently achieved the significant milestone of crossing the $30,000 threshold, marking its first foray into this territory since early August. One influential factor propelling this rally appears to be the prevailing enthusiasm within the cryptocurrency space and the general upward trend of the market.

Several other digital assets, including Ether (ETH), Ripple (XRP), Cardano (ADA), Dogecoin (DOGE), Shiba Inu (SHIB), and others, have also experienced substantial gains, contributing to the overall market capitalization reaching $1.17 trillion, according to data from CoinGecko.

Ripple’s Third Legal Victory Against the SEC

Another factor that could be driving Bitcoin’s recent price surge is Ripple’s recent courtroom triumph against the US Securities and Exchange Commission (SEC).

Just this week, Ripple’s CEO, Brad Garlinghouse, and Executive Chairman, Chris Larsen, were acquitted of all charges brought by the regulatory agency. In addition to triggering a surge in XRP’s price, this development has led to a widespread increase in the value of digital assets across the market.

It’s worth noting that Ripple’s initial legal victory against the SEC in mid-July had a similar impact on the industry. At that time, XRP’s price soared by 70%, surpassing $0.85, while Bitcoin also rose above $31,000.

A Softer Stance from the SEC

The recent actions, or perhaps inactions, of the SEC may also be contributing to Bitcoin’s recent gains. Some prominent individuals, including Cathie Wood, the CEO of Ark Invest, and John Deaton, a US attorney, have suggested that the regulatory body may be altering its previously adversarial stance toward the cryptocurrency sector.

Wood has proposed that the agency is becoming more receptive to the idea of approving a Bitcoin exchange-traded fund (ETF) in the United States, raising hopes that such a financial product may soon be introduced in the country.

Deaton, who represents thousands of XRP investors in their lawsuit against the SEC, noted that SEC Chairman Gary Gensler refrained from criticizing the digital asset industry when false reports indicated that BlackRock’s Bitcoin ETF application had been granted. He pointed out that this was a departure from the past, when the Commission’s leader routinely criticized the sector at every opportunity.

Analyzing the Surge in Bitcoin Price Today

Introduction

Bitcoin, the pioneer of cryptocurrencies, has witnessed a significant surge in its price today, prompting investors and enthusiasts to ponder the underlying reasons. As the cryptocurrency market is known for its volatility, understanding why Bitcoin’s price is up today is essential for anyone involved in the space. In this article, we will delve into various factors that may be contributing to the current upswing in Bitcoin’s value.

Market Sentiment and Speculation

One of the most fundamental aspects influencing Bitcoin’s price is market sentiment and speculative trading. Traders often respond to positive news, rumors, and events that can potentially affect the future demand and supply of Bitcoin. Today’s price increase may be linked to an overall positive sentiment in the cryptocurrency space, with investors believing in the long-term potential of digital assets. Positive speculation can attract more buyers and drive the price upward.

Institutional Investments

In recent years, institutional interest in Bitcoin has grown significantly. Major financial institutions, hedge funds, and publicly traded companies have been adding Bitcoin to their portfolios as a hedge against inflation and a store of value. When these entities make substantial investments in Bitcoin, it can drive up demand and consequently raise the price. Today’s increase might be due to new institutions entering the market or existing ones increasing their positions.

Regulatory Developments

The regulatory environment greatly influences the cryptocurrency market. News of favorable regulatory developments, such as government support or clear guidelines for cryptocurrency trading, can boost investor confidence and lead to higher prices. Conversely, adverse regulatory news can have a negative impact. Today’s surge could be attributed to positive regulatory signals or the absence of negative news that might have been expected.

Global Economic Conditions

Bitcoin is often viewed as “digital gold” and a hedge against economic uncertainties and fiat currency devaluation. Economic conditions, such as inflation or currency crises, can lead to increased interest in Bitcoin as a safe haven asset. Current global economic factors might be driving investors to seek refuge in Bitcoin, causing its price to rise.

Technological Developments

Bitcoin’s price can be influenced by technological advancements and updates to the underlying blockchain. Improvements in security, scalability, and efficiency can enhance the utility of Bitcoin, making it more attractive to investors. Announcements of technical innovations or upgrades in the Bitcoin network could be contributing to the current price surge.

Market Liquidity and Trading Volumes

High liquidity and trading volumes are essential for price movements in the cryptocurrency market. If there is a sudden increase in trading activity, it can lead to price spikes. Additionally, a substantial inflow of capital into the market can create bullish momentum. Today’s Bitcoin price rise could be linked to a surge in liquidity and trading volumes.

Media Coverage and Hype

The media plays a crucial role in shaping public perception of Bitcoin. Positive news coverage and hype generated by influencers and prominent figures can drive retail investors to enter the market. High retail demand can, in turn, lead to increased buying pressure and higher prices. A surge in media attention may have played a part in the current price increase.

Global Events

Global events, such as geopolitical tensions or public health crises, can have a significant impact on financial markets, including cryptocurrencies. Uncertainty and fear can drive investors towards alternative assets like Bitcoin. The current geopolitical or health-related events may be contributing to the upswing in Bitcoin’s price.

Demand for Alternative Investments

The traditional financial market offers limited investment options with attractive returns. Bitcoin, with its potential for substantial gains, is becoming an appealing choice for those seeking alternative investments. An increased desire for diversification and higher returns could be driving today’s price surge.

Conclusion

The surge in Bitcoin’s price today can be attributed to a multitude of factors, including market sentiment, institutional investments, regulatory developments, economic conditions, technological advancements, liquidity, media coverage, global events, and the demand for alternative investments. It is important to remember that the cryptocurrency market is highly speculative and volatile, and prices can fluctuate rapidly in response to a variety of influences. As the cryptocurrency landscape continues to evolve, monitoring these factors is essential for anyone interested in understanding and predicting Bitcoin’s price movements.

The post Why is Bitcoin price up today? [2023-10-25] appeared first on CryptoUnit.

Why is Bitcoin price up today?[2023-10-24] 24 Oct 2023, 12:18 pm

Why is Bitcoin price up today?[2023-10-24]

Bitcoin Surpasses $35,000, Achieving Its Highest Value in 16 Months; Options Positioning Suggests Potential for Further Gains

On Monday, Bitcoin (BTC) made a significant leap, surpassing the $35,000 mark, marking its highest price point since May 2022. This surge is part of the ongoing October bull run in cryptocurrency markets, driven by growing optimism surrounding the potential approval of a Bitcoin exchange-traded fund (ETF) in the United States.

Within the last 24 hours, Bitcoin experienced an impressive increase of over 11%, reaching $33,316. While it pulled back slightly from its peak, the overall gain remained substantial.

Recent days have witnessed a surge in optimism regarding the possibility of Bitcoin ETFs in the U.S., buoyed by a favorable court ruling in favor of Grayscale. This ruling has increased the likelihood that Grayscale’s prominent Bitcoin trust product, GBTC, may be transformed into an ETF. Additionally, BlackRock’s application to list a Bitcoin ETF took a step forward when its proposed product received an assigned unique ID number on the Depository Trust & Clearing Corp. website. Although this does not signify ETF approval, some interpreted it as a sign of the company’s confidence in winning approval.

Other major digital assets such as Chainlink’s (LINK), Polkadot’s native token (DOT), and Polygon’s (MATIC) have also performed admirably, with gains ranging from 6% to 10%. Ether (ETH) and Ripple-related token (XRP) experienced more modest gains of 2% to 3%.

In the U.S. stock market, early Monday losses were erased, resulting in a mixed finish. This change was accompanied by a sharp decline in the 10-year Treasury yield after reaching 5% for the first time in 16 years earlier in the session.

What Lies Ahead for Bitcoin’s Price?

The CoinDesk Bitcoin Trend Indicator BTI, which assesses the directional momentum and strength of Bitcoin’s price movement, has switched to a “significant uptrend.” This shift occurred as Bitcoin solidified its position above the $30,000 level, as noted by Todd Groth, the head of research at CoinDesk Indices. He stated, “BTC, ETH, and the CoinDesk Market Index (CMI) all moved up week-over-week, decoupling from tech stocks ($QQQ) and rising long-dated yields.”

Alex Thorn, the research head at digital asset investment firm Galaxy, suggested that the uptrend could accelerate further due to options dealers’ need to buy Bitcoin in the spot market to hedge their positions above the $30,000 price threshold. Thorn explained that, “At its peak around $32,500, almost $20 million of BTC will need to be purchased by options dealers for every 1% increase to maintain delta neutrality. The positioning implies that market makers need to buy back increasing amounts of delta as the spot price rises, which should contribute to the potential for short-term price volatility.”

Nevertheless, ByteTree analysts offered a more pessimistic outlook, noting a decline in transaction numbers on the Bitcoin blockchain, which decreased by 50% in a month. Additionally, the economic throughput of the Bitcoin network displayed a downtrend. ByteTree’s Shehriyar Ali and Seran Dalvi pointed out that this suggests the price is being driven primarily by the anticipation of positive news, which may not be the healthiest sign for the short term.

Galaxy’s Thorn added that the $26,750-$28,250 range would serve as a support zone for Bitcoin’s price. If the spot price moves lower into this range, dealers would also need to purchase Bitcoin to maintain delta neutrality, potentially providing additional support for the spot price if it descends into that range.

Bitcoin tops $35,000 to start the week as hopes grow over ETF

Bitcoin’s price surged at the beginning of the week, extending its gains from the previous week, driven by optimism surrounding the potential approval of a Bitcoin exchange-traded fund (ETF) and a shift towards safe-haven assets.

According to Coin Metrics, Bitcoin was trading approximately 5% higher, reaching $31,384.51. This marks its strongest performance since June. Although Bitcoin has touched the $30,000 mark multiple times in 2023, it has struggled to maintain that level or make significant upward movements, primarily due to the regulatory crackdown on cryptocurrencies in the United States, which has had a dampening effect on liquidity and trading volumes.

Investors are eagerly anticipating the approval of a Bitcoin ETF, which is expected to bring about a change in this situation. This approval is anticipated to occur between the end of the year and the first half of 2024. Notably, several firms have recently made adjustments to their filings to address earlier concerns raised by the U.S. Securities and Exchange Commission. Investors view these amendments as a positive signal, indicating that the agency is engaging constructively with the companies.

Why is Bitcoin price up today?

Factors Behind Today’s Bitcoin Price Surge

Introduction

The world of cryptocurrencies, particularly Bitcoin, is known for its rapid and often unpredictable price fluctuations. As we witness another surge in Bitcoin’s price today, it’s crucial to understand the multiple factors driving this phenomenon. In this analysis, we will delve into the reasons why Bitcoin’s price is up today and explore the implications of this surge for the cryptocurrency market and beyond.

Regulatory Developments

One of the key drivers behind today’s surge in Bitcoin’s price is regulatory developments. Regulatory clarity is essential for the long-term success and adoption of cryptocurrencies. In recent times, we have seen governments and financial regulators worldwide become more involved in the cryptocurrency space. The U.S., in particular, has been a focal point for regulation.

Recently, there have been promising signs of a positive shift in the regulatory environment. Speculation is growing around the approval of a Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC). An ETF would make it significantly easier for institutional investors to gain exposure to Bitcoin, potentially leading to substantial investments. As such, the anticipation of a more favorable regulatory landscape is boosting investor confidence and contributing to Bitcoin’s price increase.

Institutional Adoption

Institutional adoption of Bitcoin continues to play a pivotal role in its price dynamics. Major corporations and financial institutions are increasingly recognizing Bitcoin as a store of value and an asset class worth investing in. Companies like Tesla, Square, and MicroStrategy have already allocated substantial portions of their treasuries to Bitcoin.

The recent amendment of filings by several firms to address the SEC’s concerns is another positive sign. This shows that these institutions are actively working to comply with regulations and engage constructively with regulatory bodies. Such developments are viewed favorably by investors and can contribute to a surge in Bitcoin’s price.

Safe-Haven Asset Status

Bitcoin’s reputation as “digital gold” has been solidified in recent years. When traditional markets face uncertainty or economic instability, Bitcoin often benefits from a flight to safety. In today’s volatile world, characterized by inflation concerns, geopolitical tensions, and the ongoing impact of the global pandemic, investors are turning to assets like Bitcoin to protect their wealth.

Bitcoin is increasingly seen as a hedge against inflation, similar to gold. As central banks worldwide continue to print money to stimulate their economies, Bitcoin’s limited supply of 21 million coins becomes an attractive alternative. This perception as a safe-haven asset contributes to its price surge when traditional financial markets face challenges.

Technical Factors

Technical factors also have a significant impact on Bitcoin’s price. These include trading volumes, market sentiment, and the overall health of the cryptocurrency market. A surge in trading volumes indicates heightened interest and increased buying pressure. Market sentiment, influenced by news, events, and social media trends, can rapidly sway Bitcoin’s price.

Moreover, Bitcoin’s chart patterns, moving averages, and other technical indicators play a crucial role in price movements. Traders often base their decisions on these factors, which can lead to sudden price fluctuations. These technical elements, combined with macroeconomic factors, contribute to the ongoing volatility and price increases in the cryptocurrency market.

Network Fundamentals

The fundamentals of the Bitcoin network also impact its price. Transaction volumes, mining activity, and network security are essential metrics to consider. Bitcoin’s network is known for its security and resilience, making it a robust and reliable blockchain.

Recent developments, such as the Taproot upgrade, which improves privacy and smart contract capabilities, have strengthened Bitcoin’s network fundamentals. Additionally, the Lightning Network, designed to enhance scalability and reduce transaction costs, is gradually gaining traction. These advancements instill confidence in the long-term viability of Bitcoin, attracting more investors and contributing to its price surge.

Market Psychology

Psychology plays a significant role in Bitcoin’s price movements. Fear and greed often drive market sentiment. When Bitcoin experiences a sudden price surge, it creates a FOMO (Fear Of Missing Out) effect, prompting more investors to join the market. This influx of new capital further fuels the price increase.

However, it’s essential to remember that market psychology can be fickle. Rapid price swings, both up and down, can lead to panic selling, creating a cascading effect. This unpredictability underscores the importance of conducting thorough research and adopting a long-term investment perspective in the cryptocurrency market.

Conclusion

The surge in Bitcoin’s price today is a culmination of various factors, ranging from regulatory developments and institutional adoption to its status as a safe-haven asset. The cryptocurrency market remains dynamic, with technical and psychological elements at play. As Bitcoin continues to evolve, understanding these factors is essential for both seasoned investors and those new to the world of cryptocurrencies. While today’s surge is noteworthy, it’s just another chapter in the ongoing journey of Bitcoin and the broader crypto market. Investors should remain vigilant and informed to navigate this exciting and ever-changing landscape.

The post Why is Bitcoin price up today?[2023-10-24] appeared first on CryptoUnit.

Why is Bitcoin price up today? 23 Oct 2023, 6:29 am

What’s driving the increase in Bitcoin’s price today?

The price of Bitcoin (BTC $30,894) has surged today, reaching an intraday peak above $30,200, marking a two-month high. This increase follows the United States Securities and Exchange Commission’s announcement to dismiss all charges against Ripple’s leadership, including CEO Brad Garlinghouse. The crypto community has joyfully embraced Ripple’s victory.

While it may be challenging for the Bitcoin price to maintain the $30,000 level, there’s a certain level of bullish momentum likely influenced by institutional investors’ recent adjustments to various spot Bitcoin exchange-traded fund (ETF) applications and the optimism of retail investors regarding the upcoming Bitcoin supply halving.

Growing Institutional Interest Boosts Bitcoin Market Sentiment

Despite significant macroeconomic challenges, the surge in spot Bitcoin ETF amendments in mid-October propelled BTC’s price above $30,000 for the first time in two months, lifting market sentiment.

After a favorable ruling from U.S. Court of Appeals Circuit Judge Neomi Rao in Grayscale Investments’ case against the SEC concerning the Grayscale Bitcoin Trust, many major institutions began applying for ETFs. On October 14, Grayscale received another victory as the SEC decided not to appeal the decision. This move potentially encouraged Grayscale to file for a new spot Bitcoin ETF on October 19.

So far, the SEC has rejected multiple spot Bitcoin ETF applications, even from notable entities like BlackRock, Fidelity, ARK Invest, and 21Shares, which has applied for approval three times.

The Bitcoin halving narrative resurfaces, with the next halving expected in April 2024. Analysts are still debating whether this event will have a bullish impact on BTC’s price this time. Capriole Investments notes that historically, Bitcoin’s best returns have occurred in the 12-18 months following each halving, with even greater 12-month performance if investing in the 4-6 months leading up to the halving.

Reports suggest that approval of a Bitcoin ETF could address liquidity issues, potentially generating $600 billion in new demand. A recent report from Capriole Investments also draws parallels to gold’s 350% return after the approval of a gold ETF, indicating the potential impact of an approved Bitcoin ETF.

Cryptounit believes ETF approval will lead to a $1 trillion increase in market capitalization.

Bitcoin Supply on Exchanges Declines Amid Price Rise

As Bitcoin’s price climbs, the amount of BTC available on exchanges remains lower than the monthly peak reached on September 4. Over 70,000 BTC have been removed from exchanges since that two-month high.

The market perceives coins leaving crypto exchanges as a bullish signal, given that traders typically withdraw their BTC when they want to hold it in self-custody long-term. On Oct. 19, long-term Bitcoin holders hit 76% of all BTC ownership for the first time in history.

Bitcoin’s price surge today, why?

Bitcoin, the world’s most renowned cryptocurrency, has been making headlines recently with a significant surge in its price. In this article, we will delve into the reasons behind this sudden and notable increase in Bitcoin’s value. As we explore various factors, it becomes evident that a combination of events and market dynamics is contributing to this surge.

Regulatory Developments

One of the key drivers behind Bitcoin’s recent price surge is regulatory developments. On this front, the United States Securities and Exchange Commission (SEC) made a major announcement that has reverberated throughout the crypto space. The SEC revealed that it would be dropping all charges against Ripple’s leadership, including CEO Brad Garlinghouse. This announcement was met with great enthusiasm in the cryptocurrency community. It indicates a more positive regulatory environment for cryptocurrencies, including Bitcoin, and this boost in sentiment has played a significant role in the recent price surge.

Institutional Interest

Institutional investors are increasingly recognizing the potential of cryptocurrencies as an asset class. This surge in institutional interest can be attributed to several factors. Notably, various spot Bitcoin exchange-traded fund (ETF) applications have been amended, a move that signals institutions’ growing appetite for exposure to Bitcoin. While these applications have not yet received approval from regulatory bodies, the mere fact that major financial institutions like BlackRock, Fidelity, ARK Invest, and 21Shares have applied for them multiple times is a clear indicator of their confidence in the cryptocurrency market.

In addition to ETF applications, large institutional investors are exploring ways to incorporate Bitcoin into their portfolios. This includes strategies like adding Bitcoin to their treasury reserves, a trend initiated by companies like Tesla and MicroStrategy. The entry of these prominent players into the Bitcoin market has bolstered its legitimacy and, in turn, driven its price upward.

Retail Investors’ Optimism

Retail investors also play a pivotal role in the dynamics of the Bitcoin market. The anticipation of the next Bitcoin supply halving is fueling optimism among retail investors. The next halving event is projected to occur in April 2024. Historically, each halving has been followed by a surge in Bitcoin’s price. According to historical data, most of Bitcoin’s returns materialized in the 12 to 18 months following each halving. This has generated enthusiasm among retail investors who believe that the upcoming halving will once again lead to bullish outcomes for Bitcoin.

Market Sentiment

Market sentiment is a crucial factor in driving Bitcoin’s price. The perception of Bitcoin as a store of value and a hedge against inflation has grown in recent times. In a world marked by economic uncertainties, the appeal of a decentralized digital asset like Bitcoin is undeniable. When positive news and developments, such as regulatory clarity and institutional investments, emerge, it bolsters confidence in Bitcoin’s long-term potential.

Conclusion

Bitcoin’s price surge today is a result of several converging factors. Regulatory developments have offered a more favorable environment for cryptocurrencies, institutional investors have expressed growing interest and made significant moves into the market, retail investors are excited about the upcoming halving, and overall market sentiment remains positive. As the cryptocurrency landscape continues to evolve and mature, it is likely that Bitcoin’s price will remain subject to a complex interplay of factors, making it essential for both seasoned investors and newcomers to stay informed and adapt to this ever-changing market. The future of Bitcoin remains uncertain, but its role in the global financial landscape is undoubtedly becoming more significant with each passing day.

The post Why is Bitcoin price up today? appeared first on CryptoUnit.

The Regulatory Conspiracy: Understanding the Plot Against Crypto, CZ, and Binance Orchestrated by the USA SEC and Big Banks 30 Jul 2023, 1:04 pm

Welcome to our in-depth exploration of the intriguing relationship between the USA Securities and Exchange Commission (SEC), big banks, and the world of cryptocurrencies. As the crypto industry continues to experience exponential growth, it has become increasingly vital to examine the intricate connections that shape its trajectory.

In this article, we delve into the mounting concerns surrounding the alleged coordination between the USA SEC and big banks, and how it impacts the thriving crypto ecosystem, particularly the renowned figure CZ and the well-established crypto exchange, Binance. By uncovering the potential collusion between these entities, we aim to shed light on the broader implications for the crypto industry.

Join us as we embark on a captivating journey to unravel the nexus that exists between the regulatory landscape, traditional financial institutions, and the disruptive force of cryptocurrencies. Through comprehensive analysis, we seek to bring transparency to this complex web of relationships and understand its ramifications for CZ, Binance, and the entire crypto community.

Stay tuned for an in-depth exploration of the regulatory landscape, the motivations of big banks, the targeted actions against CZ and Binance, and the broader implications for the crypto industry and its stakeholders. Through this examination, we hope to facilitate a deeper understanding of the intricate dynamics at play and explore potential solutions for a harmonious coexistence between regulators, big banks, and the innovative world of cryptocurrencies.

So, without further ado, let’s dive into the heart of the matter and unveil the connections between the USA SEC, big banks, and their impact on crypto, CZ, and Binance.

An Overview of the USA SEC’s Regulatory Role

Understanding the Role of the USA SEC in Safeguarding Investors and Maintaining Market Integrity

As an investor in the ever-evolving world of cryptocurrencies, it is crucial to comprehend the role of regulatory bodies like the USA Securities and Exchange Commission (SEC) in protecting your interests and ensuring a fair and transparent marketplace. The USA SEC serves as a guardian, responsible for maintaining market integrity and safeguarding investors against fraudulent practices within the securities industry.

The primary objective of the USA SEC is to instill confidence in the financial markets by enforcing regulations that promote fairness, transparency, and investor protection. By regulating securities offerings, exchanges, and brokers, the SEC aims to prevent market manipulation, fraudulent activities, and misleading disclosures that could harm investors.

Challenges Faced by the USA SEC in Regulating the Rapidly Evolving Crypto Landscape

However, the rapid growth and innovation within the crypto landscape have presented unique challenges for the USA SEC. Cryptocurrencies operate on decentralized networks, often transcending traditional regulatory boundaries. This decentralized nature, coupled with the ever-evolving technology behind cryptocurrencies, poses hurdles in effectively regulating this emerging market.

One of the major challenges faced by the USA SEC is striking the right balance between fostering innovation and protecting investors. The SEC must navigate through complex legal and technical aspects while ensuring that regulatory actions do not stifle technological advancements or discourage legitimate players in the crypto industry.

Furthermore, the global nature of cryptocurrencies and the absence of unified regulatory frameworks across jurisdictions make it challenging for the USA SEC to exert complete control. Coordinating efforts with international regulators becomes crucial to tackle cross-border issues and combat illicit activities in the crypto space effectively.

Recent Regulatory Actions Taken by the USA SEC Towards Cryptocurrencies and Crypto Exchanges