Add your feed to SetSticker.com! Promote your sites and attract more customers. It costs only 100 EUROS per YEAR.

Pleasant surprises on every page! Discover new articles, displayed randomly throughout the site. Interesting content, always a click away

Dimerco

Mobile Intelligence Logistics Service ProviderGlobal Trade Compliance: What Every Freight Manager Should Know 11 Apr 2025, 11:13 am

The Basics of Trade Compliance

Driving a car. Filing your taxes. Playing a board game. These and just about every activity you can think of have rules and instructions telling you what you can, can’t, and must do. International commerce is no different.

The set of rules governing global business transactions can be broadly referred to as Global Trade Compliance. It’s a system of processes that importers and exporters use to make sure they adhere to the laws and regulations controlling the movement of information between trading partners and worldwide government agencies.

Unfortunately, these processes are not covered in one handy reference guide; they’re different for each country and regulating agency. The size and complexity of this challenge make it hard for freight managers to stay on top of this critically important requirement.

This section takes the complex subject of global trade compliance and breaks it down – in a question-and-answer format – to provide you with a foundational understanding of the subject.

What are the core elements of global trade compliance?

Customs and other government agencies want to know the answer to four basic questions:

- What’s the product? Every product you import must have a Harmonized System code (HS code) that classifies the type of product it is and helps to determine the duty, tax rate, and other potential government charges or fees. The code selected must be accurate and not based on which code has the lowest duty.

- How much is it worth? This value equals the total amount you, as the importer, paid to the foreign seller. Many importers believe that the value is what is listed on the commercial invoice, but that may not be true. Additional items and services (packaging, engineering services) that are provided by the buyer to the seller are also dutiable. These are called “assists.”

- Where was the product made? The Country of Export is not necessarily the product’s actual Country of Origin, and it’s up to the importer to report the accurate origin of the goods to Customs. Accurate reporting of the country of origin is critically important and may cause an increase or decrease in the duty.

- How much of it is there? The quantity, weight, or other related data about the items you’ve purchased are typically sourced from the commercial invoice or packing list. The HS code determines which statistical data elements you must report.

These 4 questions all boil down to one thing: MONEY. Customs authorities audit companies to ensure the US government receives the money it is owed.

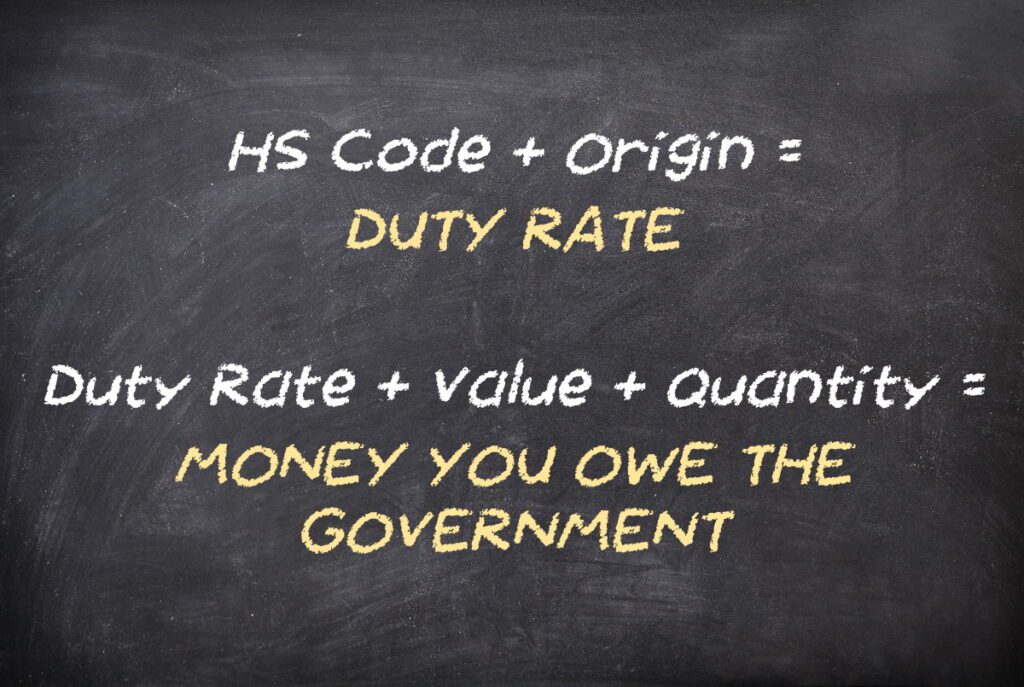

HS Code + Origin = Duty Rate.

Duty Rate + Value + Quantity = Money you owe the government.

What are the consequences of noncompliance?

If the answers to the questions above are (intentionally or unintentionally) wrong, that could lead to:

- Government inspections that disrupt your supply chain – inspections that you, as the importer, pay for

- Hefty fines should an issue be found

- Penalties for repeat offenders, including a years-long customs audit, seizure of goods, and even debarment (loss of import privileges)

Consequences could easily equate to a 6- or 7-figure profit loss linked to delays, lost revenues, and fines.

One recent compliance failure involved a civil enforcement action against an importer that markets a branded sweetener product. The company is alleged to have violated laws that prevent goods made with forced labor from entering the USA. CBP assessed $575,000 USD in fines on this enforcement action.

Who is responsible for global trade compliance?

The ultimate responsibility for trade compliance lies with the importer. A customs broker can advise you on things like HS codes, but all legal and financial liabilities fall to the importer.

Let’s say Distributer B buys product from Manufacturer A and sells it to Retailer C. The retailer is importing product based on information provided by Company B, but it remains the retailer’s responsibility to ensure the HS code and quantities are accurate and to vet company A. This may include visiting factories to ensure labor and other practices there are compliant with applicable laws.

Whose job is trade compliance within an importer’s organization?

It’s different in each company. For instance, a large company might have a dedicated global trade compliance officer with a staff of supporting people. In other companies, the head of logistics might own trade compliance. In small and mid-sized enterprises (SMEs), it could be the purchasing manager, the finance manager, or even the owner trying to juggle trade compliance duties along with other priorities.

For a role that is so important, with requirements that are so complex, trade compliance is often an under-resourced function.

Why? Because the function itself is mistakenly viewed as just a cost center – a necessary evil. In reality, superior trade compliance can give a company a real-world competitive advantage. It can speed customs clearance, avoid supply chain disruption, and reduce customer complaints – all revenue-enhancing, profit-enhancing benefits.

What is “tariff engineering?”

This question goes a little beyond the basics of trade compliance, but the practice of tariff engineering has gotten more attention recently. Tariff engineering has long been used by best-in-class importers to ensure the lowest possible, compliant duty for their products. When the Trump Administration added US tariffs on certain commodities from certain parts of the world, companies began sourcing products from new regions, re-engineering their products and researching whether they could classify their products compliantly in a different, more appropriate section of the tariff. Changing an HS code for a previously imported product has repercussions, however, and must be considered very carefully.

There are 5300 HS codes, so you would think there would be one single code for your specific product. But there are grey areas. The same product could fall under multiple HS classifications depending on the product’s essential character. An experienced international customs broker will understand these nuances and can provide valuable advice.

Of course, companies may choose to slightly reengineer the product to enable the change in classification, like adding a plastic coating or decoration to an item to alter its most appropriate HS code, potentially saving thousands of dollars in customs duties.

What are the advantages of investing more time and resources into global trade compliance?

Businesses hesitate to sink more money into a function they already consider a cost center. But investing time into a properly resourced trade compliance program – whether those resources are internal or external – makes bottom-line sense. Among the advantages:

- Keep duty rates as low as compliantly possible through an expert understanding of things like free trade agreements, tariff engineering, foreign trade zones, and the many other factors that impact the duties you pay.

- Improve delivery times and avoid supply chain delays that anger customers

- Lower the risk of fines related to compliance violations

- Maintain your reputation – with government agencies and trading partners

How can I learn more about global trade compliance to protect my organization?

Your existing business partners – freight forwarders, customs brokers, 3PLs – are a great (and often free!) source of expert advice. Arrange to meet with them regularly to review your product line and compliance efforts. They can help fine-tune your program and keep you current on changes in compliance requirements. It’s also a good idea to involve these partners earlier in the product development process to ensure you consider the effects that product composition and source country have on duty costs.

Networking with peers on LinkedIn is a great way to stay current and to problem-solve.

Trade associations are a cost-effective way to learn trade compliance best practices from peers. They often offer affordable seminars that help you master this complex subject and enhance your value within your company.

We live in a global economy where businesses depend on the ability to trade seamlessly and efficiently with other companies around the world. There are ground rules that allow this to happen. Global trade compliance experts understand these ground rules and can give their companies a decided competitive edge.

Download Guide

Looking for a complete resource on global shipping?

Download Dimerco’s Global Shipping Guide — your go-to reference for navigating transportation modes, Incoterms, trade compliance, customs clearance, and more.

Get the Guide and ship smarter across borders.

Understanding HS codes

The World Customs Organization publishes the Harmonized Tariff Schedule, which lists every variety of product type and assigns each a 10-digit code. A product’s HS code determines how much it will cost you to clear customs.

Most of your shipping documents will require an accurate HS Code to tell officials about the cargo and, therefore, how much you need to pay. For the same product, the first 6 digits are usually the same in every country, but there could be differences in the last four.

HS codes define what duties you pay.

Some products are subject to duties when you import them. Others enter for free due to special tariffs and trade agreements.

HS codes define your regulatory obligations.

Sometimes, agencies outside Customs take an interest in imported products. For example, in the US, the Food and Drug Administration (FDA) regulates imports of foods, pharmaceuticals, medical devices, cosmetics, and certain other products. The Environmental Protection Agency (EPA) regulates chemical products. Such regulations trigger more paperwork and, possibly, extra fees.

The importer of record is ultimately responsible for assigning the right HS code to imported products. But unless you understand the Harmonized Tariff Schedule very well, it can help to work with someone who does. A licensed customs broker can make sure your documentation provides the correct product classification and that you pay exactly what you owe and no more.

Don’t have time to dig into the details of HS codes? Many freight forwarders have a customs brokerage division and can assist you with choosing the right HS Code and staying compliant.

Importer of record responsibilities

An Importer of Record (IOR) is the business or individual responsible for compliance with all laws and regulations that apply to imports. For this section of the guide, let’s assume it’s a company importing into the US, where US Customs and Border Protection (CBP) has established detailed requirements that must be followed.

At the heart of these compliance details is a very simple idea. You need to know your business partners.

CBP wants evidence of exactly where the products were made, an ability to trace products back to component materials, a manufacturing process that meets established legal standards (e.g., no forced labor), and a safe, secure shipping process. The IOR also needs to clearly and accurately state the type and value of products being imported.

The following Q&A will elaborate on Importer of Record responsibilities.

What’s the downside of noncompliance with Importer of Record responsibilities?

You risk CBP audits, fines, penalties, and, in extreme cases, a loss of importing privileges. While rare, import bans do occur. For example, the CBP banned US imports from Malaysia’s Top Glove Corporation, the world’s largest glove manufacturer, when it found evidence that products were being made by forced labor. This was a huge financial hit to the company since the US accounts for nearly one-quarter of its approximately $1 billion USD in global sales. The import ban was lifted in September 2021 when the company provided clear evidence that it had addressed CBP concerns.

How frequent are CBP questions and audits?

There is no set timetable or average. If your company’s imports fall under one of CBP’s Priority Trade Issues (like apparel, antidumping, trade agreements, etc.), or if you’ve had a recent surge in import activity, you should be prepared for CBP outreach.

What does an IOR need to import into the US?

IOR responsibilities include providing your company’s Importer of Record number, which is either your IRS business registration number or, if your business is not registered with the IRS or you do not have a business, your social security number. You may also request a CBP-assigned number by completing a CBP Form 5106.

While a customs broker is not required to clear goods imported into the US, the complexity of the process and regulatory obligations make using such an expert a smart investment. When using a customs broker, you must sign a Customs Power of Attorney, authorizing the broker to act on your behalf.

All commercial shipment clearances in the US require a customs bond, which can be posted for a single entry or for multiple transactions throughout the year (continuous bond).

CBP does not require an importer to have a license or permit, but other Partner Government Agencies (PGAs), like US Fish and Wildlife or the Food and Drug Administration, may require a permit, license, or other registration, depending on the commodity you are importing. CBP usually acts in an administrative capacity and gathers information for these other agencies.

What are Importer of Record responsibilities?

In 1993, the Customs Modernization Act introduced the concept of “reasonable care.” It requires IORs to enter, classify, and determine the value of imported merchandise, and to provide other information necessary to enable CBP to properly assess duties, collect accurate statistics, and determine whether all legal obligations have been met. A customs broker or other expert can help with this process, but the IOR owns the ultimate responsibility.

If you don’t have the staff to give this issue the attention it deserves, then hire an expert for international customs brokerage and compliance to ensure you meet the legally required reasonable care standard.

What are practical steps to demonstrate reasonable care?

It comes down to implementing a documented Customs Compliance Program at your company – comprehensive processes and procedures that ensure your company meets the reasonable care standard. Here are some examples of items that should be included in your compliance program:

- Clear record-keeping processes. CBP requires specific records be kept for five years. If they ask for paperwork regarding specific imports, the agency will usually give you at least 30 days to provide it. Common records sought are international shipping documents like a bill of lading, an airway bill, a commercial invoice, a packing list or a customs entry summary.

- Procedures to ensure proper classification (HS CODES) and valuation. For more on this, see our primer on global trade compliance.

- Procedures to ensure proper country of origin declaration. This must be declared to CBP and marked on your products.

For importers of record, there’s a lot at stake if you don’t follow clearly established responsibilities. You risk fines, penalties, delays, damage to your brand, and, ultimately, the inability to service your customers.

Key International Shipping Documents

No one loves paperwork. But when it comes to global commerce, international shipping documents are essential to getting goods delivered successfully and making money.

If you’re arranging global shipments of imports or exports, don’t think of paperwork as a necessary evil; think of it as PROTECTION. Incomplete or inaccurate paperwork could trigger a range of negative consequences. These could include delayed shipments, inflated duty rates, or disputes about damage and liability. A little attention to detail at the front end can avoid these costly headaches.

One thing is for sure: Your cargo can’t move unless the right information moves with it. To help you master all paperwork requirements, here’s information on five of the most important international shipment documents, the role of each in the shipping process, and why each is important.

Shipper’s Letter of Instruction

The Shippers Letter of Instruction (SLI) is what the name implies. It’s your detailed export shipment instructions summary for your freight forwarder to follow. It’s sort of a cover memo for your other paperwork. The SLI is not actually a required document by law. However, it could be the most important global shipping document you prepare.

When you start the shipping process, you should list all relevant details such as commodity, weight, value, and special handling requirements. The SLI provides written proof of who needs to do what in the transaction.

If you don’t have your own SLI template, most forwarders can provide one.

Why is the Shipper’s Letter of Instruction important?

You contract with a freight forwarder to expertly handle the many details of the shipping process. But, due to cargo ownership and legalities, no forwarder can just step in and make decisions on your behalf.

The Shipper’s Letter of Instruction provides a limited Power of Attorney to your forwarder to serve as your agent for actions involving carriers, ports, cargo insurance, customs and other matters.

The SLI documents your request in detail so that, if the instructions are not followed, clear evidence exists. Details matter in SLIs. For instance, if you want to ship from Hong Kong to Chicago via LA but don’t specify the exact routing, the shipment could be routed via the East Coast, taking more time and money. SLIs spell out the details to minimize the potential for errors.

Bill of Lading

The Bill of Lading (BOL) is a legally binding agreement between the shipper and the transportation provider. The Shipper’s Letter of Instruction is created by the shipper for the carrier, whereas the BOL is issued by the carrier to the shipper.

Different types of BOLs exist – a trucker’s BOL (Freight bill) for over-theroad shipments, an ocean BOL, or OBL, for sea freight, and an Air Waybill, or AWB, for air freight shipments.

The BOL contains a lot of the same information as an SLI. They both include origin, destination, shipping date, and shipping instructions with shipper, consignee, commodity, piece count, weight, and measurement details. If information is incorrect in the SLI, the mistake will likely carry over to the BOLs and create problems.

Why is the Bill of Lading important?

In international trade, an original negotiable order bill of lading is an instrument of title and provides ownership of the cargo to the holder of the BOL. All other types of BOLs serve as evidence of receipt for two things: receipt of goods as well as the contract of carriage. The issuance of the BOL is proof that the carrier has received the goods from the shipper or their 3PL in good order and condition.

Consequences of an inaccurate BOL include exposure to claims, unclear liabilities or inability to identify the party at fault. Disputes arise when a BOL indicates that goods are received in good condition, but the consignee says otherwise. For example, a BOL might state “5 pieces.” Actually, it should clearly spell out the details, like “20 cartons on 5 pallets.” It will be hard to get your full freight claim paid or prove you have not received the correct freight if the BOL is incorrect or unclear.

Commercial Invoice

In international trade, a Commercial Invoice is used as a customs document by the exporter or importer. It’s the proof of sale between a seller and a buyer. It acts like your freight passport and allows global shipments to clear customs. There is no standard format, but a Commercial Invoice must include:

- Name and address of the buyer and seller

- Detailed description of the goods

- Country where the goods were manufactured

- HS code for the commodity being shipped

- Value of the goods

- Terms of Sale (Incoterm)

You could add additional details if you have them, such as order number, purchase order number or any other customer reference number.

The Commercial Invoice is important because it’s required for customs clearance to determine the duties and taxes due. Inaccurate information on a Commercial Invoice may lead to underpayment or overpayment of the duties and taxes. An incorrect customs declaration can lead to legal consequences as well as lengthy shipment delays.

Ultimately, these shipping documents are designed to protect you from shipment delays, compliance violations, and liability. Align with a global freight forwarder that understands what documentation is required. They will work patiently with you to ensure all the necessary details are handled.

Packing List

Like a Commercial Invoice, a Packing List is generated by the seller/ exporter and contains similar information. While the Commercial Invoice reflects the financial transaction, the Packing List mentions the count, weight, measurement, and description of the cargo being shipped. It allows parties to verify, all along the supply chain journey, that what was shipped is what was received.

The Packing List is important because it’s the original source document to check for discrepancies with the commercial invoice, BOL, and actual cargo received.

Certificate of Origin

Depending on where your cargo is going, the Certificate of Origin (or Country of Origin Certificate) could be a very important international shipping document. It certifies that goods were manufactured or processed in a particular country. Typically, Certificates of Origin are issued by an official organization, like a country’s Chamber of Commerce.

Based on the cargo destination and the applicable trade agreements in place, the Certificate of Origin will determine what duties are applied to the shipment. For instance, the US has 14 free trade agreements with 20 different countries where US goods get reduced or zero duty rates.

The Certificate of Origin is important because, should you make an incorrect origin declaration or misrepresent the origin country, your shipment may be refused, assessed a penalty fee, or become subject to a rigorous compliance program.

In a busy global shipping department, it’s tempting to skip or rush through paperwork details.

Don’t do it.

Simplifying Compliance with the Right Freight Forwarding Partner

Trade compliance can feel overwhelming—but it doesn’t have to be. With countless regulations, country-specific rules, and critical documentation requirements, it pays to have an experienced partner by your side. A knowledgeable freight forwarder like Dimerco not only keeps your cargo moving but also helps ensure every shipment is fully compliant. From accurate HS coding to importer responsibilities and risk mitigation, we support your trade compliance efforts so you can avoid delays, reduce costs, and focus on growing your business in global markets.

How to Choose the Right Global Transportation Mode 11 Apr 2025, 11:13 am

Choosing the Right Global Transportation Mode

In global shipping, choosing the right transportation mode is a crucial decision that impacts customer satisfaction, company profitability, and the environment. You’ve got 4 options for shipping globally. Well, 5 if you include combining multiple modes to complete the journey. Let’s look at each.

Air freight

Did you know that, according to IATA, air freight makes up just 1% of the total volume of global trade but 35% of the value of goods shipped? Air freight is the fastest mode and is used by industries whose products are high value (electronics components, aerospace parts, pharmaceuticals), high demand (fashion products nearing the peak selling season) or perishable (seasonal flowers, fresh food).

PROs |

CONs |

|

|

Ocean freight

90% of global trade moves on ocean vessels. Our global economy is heavily dependent on reliable maritime shipping.

PROs |

CONs |

|

|

Rail

Rail transport is normally associated with domestic freight, but it can be an economical choice for cross-border moves. For example, a cross-border rail solution from China to Europe ships 20 days faster than ocean freight and as much as 30% cheaper than air freight.

PROs |

CONs |

|

|

Truck

Trucking services can be a very economical option for cross-border shipments within a region, such as between the US and Canada and Mexico and between China and Southeast Asia.

PROs |

CONs |

|

|

Multi-modal

Multi-modal shipments involve 2 or more types of transportation modes. A multi-modal strategy can help deal with a variety of freight disruptions. Here’s an example. There is very limited direct air service from China to Mexico, so some freight forwarders offer a China-to-Mexico shipping solution via the US that ships products via air freight from China into a US city near the border and then trucks products, in bond, to the final Mexico customer.

Download Guide

Looking for a complete resource on global shipping?

Download Dimerco’s Global Shipping Guide — your go-to reference for navigating transportation modes, Incoterms, trade compliance, customs clearance, and more.

Get the Guide and ship smarter across borders.

Key Criteria: Which Mode to Choose

When determining the best transportation mode, here are the key criteria you should examine.

Product

Your product characteristics (size, shelf life, hazmat) may limit your options. For instance, flammables, aerosol cans and many other products cannot ship via air.

Urgency

You’ll save money if a longer transit time is acceptable. But sometimes it’s not. For instance, components en route to an Apple factory in advance of a new iPhone launch aren’t traveling by sea freight.

Origin and Destination

Where are you shipping from? Do you have easy access to maritime ports or international airports? Your destination may also impact mode choice. When a Fortune 100 technology company’s air shipments into Shanghai were cancelled due to COVID restrictions, Dimerco routed freight to Hong Kong International Airport and coordinated last-mile distribution via truck from Hong Kong direct to factories in China.

Although there are only 4 options to choose from, decisions on mode choice can be complicated and costly without proper analysis.

Cost

Faster is always better when it comes to shipping. But staying within your budget is critical to maintaining profitability. Many electronics components ship between China and Southeast Asia via air freight. But shipping via truck can reduce those costs over 50% vs. air freight.

Capacity

Sometimes there is insufficient freight capacity on your preferred mode and you will need to be flexible. For instance, an electronics company was shipping air freight from Batam, Indonesia to LA via Singapore. But air freight capacity is limited out of Batam, so the company now ships via ocean to Singapore and onto LA via air.

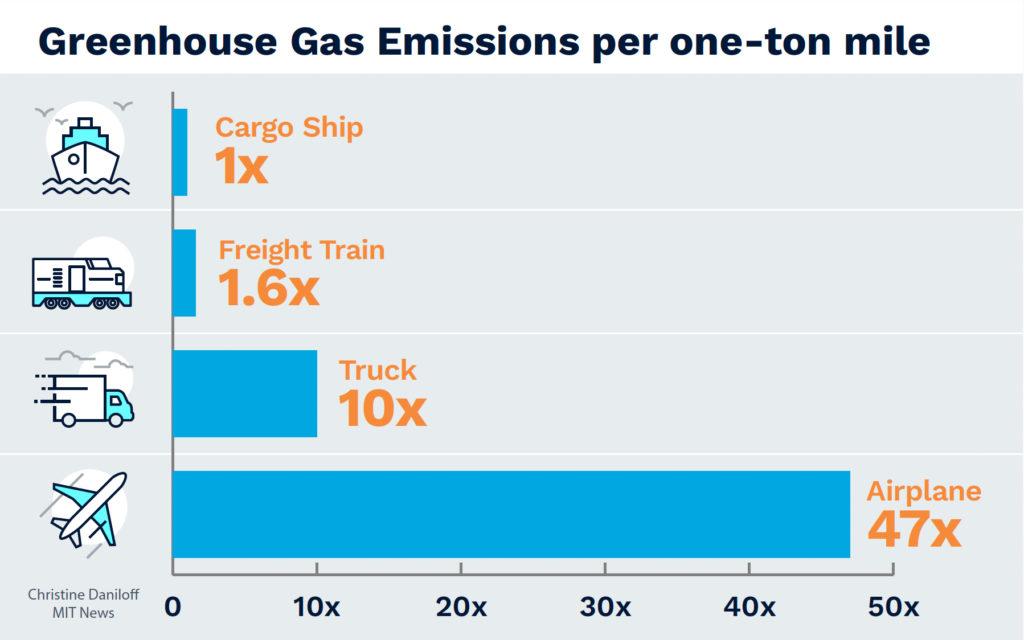

Sustainability

The accompanying diagram shows the relative contribution of different freight modes to greenhouse gas emissions (GHGs). This is becoming a priority for large multinationals, who have made public commitments to reduce their carbon footprints by specific dates. Your future mode choices may lead you, more and more, toward greener freight options.

Understanding the International Shipping Cost for Air and Ocean Freight

Transportation costs are by far your largest logistics expense. And if your supply chain is global, it’s critical to your bottom line that you closely manage your international shipping cost for air and ocean freight. That means having a good understanding of how those costs are calculated. You won’t become an expert overnight, but this article will give you a basic understanding of pricing for global shipping so you can be a smarter buyer.

Getting fair and accurate pricing for air and ocean freight shipping starts with you.

Carriers and freight forwarders need certain data to provide a solid rate quote, and companies don’t always take the time to gather and check this data before asking for a quote. Check out the accompanying sidebar for the information you’ll need before seeking a quote.

Forwarders will want information not only on what you are shipping, but also on the shipping terms. For instance, do you simply need port-to-port transportation? The cost for this service will obviously differ from the cost to provide door-to-door service.

The terms of sale between you and your buyer/supplier will also determine the scope of the shipping service and what will be included in your international shipping cost. If you are buying products from an overseas supplier and the Incoterm is ExWorks, then you are responsible for paying for all transportation from the overseas factory to your door. If the Incoterm is CIF Long Beach, for example, your costs and responsibilities start at the destination port.

For air and ocean freight, unless you have a direct contract with a carrier or are moving lots of volume, you’ll usually get a better international rate from a forwarder that has multiple contracts with carriers based on certain volume agreements by lane.

Air Freight Shipping Cost Calculations

There are different tiers of air freight service based on how quickly you need to move the freight. With Consolidated Air – the most cost-effective and sustainable mode – you tap into a forwarder’s fixed consolidated flight schedule on certain lanes. Standard Service, the next best option for your budget, meets your service requirements and gets it there faster than non-air-freight options. If you need Expedited and Next Flight Out (NFO) Service, that will obviously cost you more.

An air freight quote may include origin charges to get cargo to the airport and destination charges for delivery to the consignee. But let’s dive into the actual air freight charges and how they are calculated to determine your international shipping cost. The main thing you need to understand is that airlines charge based on either the gross weight of the cargo or the volumetric weight – whichever is greater. Volumetric weight, also known as dimensional weight, is an estimated weight based on the length, width, and height of a package.

Let’s dive a little further into the issue of volumetric weight.

There are space and weight limitations for cargo on an aircraft, and carriers need to protect themselves from unprofitable cargo. For instance, a large shipment of cotton balls won’t weigh much, but it will take up a lot of space, preventing the carrier from loading other goods in the cargo bay. Conversely, two pallets of steel bars will also limit the amount of other cargo that can be loaded, this time because of aircraft weight limits. So the cotton will get priced using volumetric weight, while the steel bars will be charged using the gross weight. Air cargo rate calculations are based per kilo. Airlines charge whichever is greater between the gross and the volumetric weight, and they refer to it as the “chargeable weight.”

Beyond the actual freight charge, your air freight shipments are subject to many additional fees, called accessorial charges, which may include:

- Fuel surcharges that reflect the cost carriers have associated with fuel – these surcharges change frequently in line with fuel prices

- Security surcharges that cover screenings at airports to comply with regulations

- Customs brokerage fees

- Terminal handling fees

- Dangerous goods fees for hazmat cargo

There are many more accessorials that may impact your international shipping cost, depending on the airline and your shipment specifications.

Some Key Data Required for Air and Ocean Freight Quotes

- Description of commodity (HS Code)

- Quantity being shipping

- Total weight

- Total shipment dimensions

- Pick-up location

- Delivery location

Ocean Freight Shipping Cost Calculations

Calculating rates for ocean shipping tends to be a little more complicated than air freight because charges may differ based on the specific port, terminal, and country you ship to. Like air freight, you’ll have carrier charges to move the freight, as well as charges at origin and destination to move goods to and from the port.

The biggest factor impacting rates for ocean freight shipping services is deciding whether the goods require a dedicated full-container-load (FCL) or whether goods can be consolidated with other cargo in a less-than-container-load shipment (LCL).

For FCL, shipping lines charge a flat fee based on the type of container used. The three primary types are a 20-foot, a 40-foot, and a 40-foot-high-cube container.

Calculating LCL rates gets a little more difficult because you are sharing the shipping cost with other shippers. LCL is priced based on Revenue Ton (R/T), and R/T is calculated based on weight or size, whichever is greater. The idea is similar to gross weight and volumetric weight in air freight. In LCL, when converting weight to R/T, it is often based on the factor of 1000KG = 1 R/T. For size, 1CBM = 1R/T. The conversion factor varies by lane, so you would want to keep this in mind.

This handy CBM calculator can help you calculate a consignment’s weight and volume. Sea freight consolidators run consolidation programs to all major global ports. They book a certain volume of full containers with the carrier and then consolidate multiple shipments into the container at a warehouse near the port.

Small-volume shippers can save money by shipping LCL, even though the LCL rate per cubic meter is more than FCL due to the added consolidation-related handling. But because the FCL rate is cheaper, it could be worth using a full container even if your volume is well short of what a full container could hold. The tipping point for moving from LCL to a 20-foot container varies for different lanes, but a general starting point would be around 20CBM.

In addition to the carrier freight charges, expect to see some of these additional charges in your ocean shipping quote:

- Container freight station charges (for LCL only)

- Terminal handling charges

- Customs brokerage

- Pick-up and delivery charges

- Bunker charge (fuel surcharge)

- Currency adjustment factor (compensates for exchange rate risks when cargo is payable in a foreign currency)

Many people need to “touch” air and ocean freight during its journey – forwarders, truckers, customs brokers, port personnel, terminal operators, consolidators, customs agents, and security workers. Because none of these touches are free, they need to be accounted for in your international shipping cost.

Building Air Freight Shipments: What You Need to Know

If you’re shipping air freight, your main concern is getting the freight where it needs to be, and fast. You’re not necessarily concerned about the equipment used and exactly how the freight moves from origin to destination. Truckers, forwarders, and air carriers take care of those details and keep you in the loop. But the container types used and who prepares the cargo can actually have a big impact on what you pay, how fast your shipment moves through airports and customs agencies, and the damage that could occur in transit.

That’s why it helps to have at least a basic understanding of air freight containers and pallets and how those are prepared for shipment. Check out this reference guide on air shipping container types. Here are some basic questions about what goes on behind the scenes as air cargo moves from your dock to your customer.

What is a ULD?

A unit loading device (ULD) is the air freight equivalent of the ocean container. It allows for the safe, fast, efficient transit of freight on passenger and cargo aircraft. A steamship line can put upwards of 20,000 stacked containers on one vessel. With airplanes, it’s a different story. Loading spaces are small and irregularly shaped. That’s why there are many different ULDs, in different sizes and shapes, to make the best use of the available space.

There are two basic types of ULD: a closed metal container that houses freight inside and a metal pallet onto which cargo can be loaded.

Cargo on pallets is covered with a net and secured under the ULD. Whether you’re moving pallets of merchandise, cars, or expensive equipment, ULDs are secured to the body of the aircraft to keep the freight from shifting, even during the most turbulent flights.

Air cargo can be tendered to the carrier either loose or already containerized. Once loose freight is checked in, it is loaded by the carrier into a ULD.

When would you use a container or a pallet?

Containers have the following advantages:

- Make loading and unloading faster and easier

- Protect against any kind of weather – do not require the extra wrapping that you’d want for the palleted cargo

- Protect better against damage – no need for corner guards or other special protective packaging

- Prevent unauthorized access to the cargo

ULD pallets, sometimes referred to in the industry as “cookie sheets,” are cheaper to use than containers. Other advantages:

- Accept oversized cargo that won’t fit in a container

- Take up less room than containers since they are flat and can be stored efficiently and returned by plane

- Have more options for how to build the pallet (size and shape) depending on where on the plane the airline ULD pallet is being loaded

As a shipper, the choice of ULD is typically made for you by the airline or your freight forwarder. It’s a little different if you’re shipping temperature-sensitive cargo. You’ll want a specialized, temperature-controlled airline ULD.

How is your ability to secure reliable air freight capacity affected by airline ULDs and who builds them?

Passenger airlines often overbook and then must ask some people to deplane and travel on a later flight. That happens with air cargo, too! The potential for your freight to be offloaded is lessened if you work with a freight forwarder that has Block Service Agreements (BSAs) with the airline. Larger forwarders essentially pre-purchase airline cargo space well before they have customers for that space. These BSAs correspond to a certain volume of cargo (metric tons) over a certain time in certain lanes.

It’s common to achieve most of this committed tonnage through fully built-up ULDs. So, if your cargo is moving with a forwarder that builds the ULD and tenders it to the airline, the space is secured. On the other hand, if the cargo is tendered loose to the airline, the airline builds the ULD, mixing your cargo with freight from other forwarders. In this case, the air carrier is not obligated to transport this freight on a particular flight as part of any existing BSA. So, if the carrier has accepted more freight than it can fit, it can offload your cargo.

How is shipping speed affected by who builds the ULDs?

In air freight, flight times are predictable; handling times are not.

If you want to minimize total transit time, you may be better off working with a freight forwarder to build ULDs at origin and then receive and deconsolidate ULDs at its container freight station (CFS) near the destination airport.

The reason is simple: congestion at airport cargo facilities. Bottlenecks are caused by high freight volumes combined with COVID-related circumstances – mainly manpower shortages.

At origin, ULDs built by a forwarder and sent, as ready-to-ship units, to the airline are called BUPs (Bulk Unitization Program). These BUPs greatly reduce handling time at the cargo terminal by combining lots of separate items into a single unit. For that reason, BUPs benefit from preferential conditions and more rapid handling at the airport.

At the destination, BUPs are turned over to the forwarder for unloading. These BUPs can be available up to 3-4 days faster than airline-loaded ULDs. Let’s take an example.

A flight arrives at LAX from China at midnight. If your goods ship as loose cargo with the airline, that means the airline and its handling agent are responsible for processing the inbound freight. Under normal market conditions, the earliest it might be available, if you are lucky, is some time the next day. If there is a congestion delay, it could be up to a week. In contrast, if your goods arrive as a BUP shipment from China, your forwarder could likely pick up its own cargo by noon, bring it back to the CFS, and, if the consignee is nearby, deliver the next day.

How is the timing of customs clearance affected by who builds the ULDs?

In the US, the Transportation and Safety Administration (TSA) requires that all air cargo be screened before it is loaded onto a passenger flight. To keep goods flowing, the TSA certifies independent cargo screening facilities to screen cargo prior to providing it to airlines. This Certified Cargo Screening Program (CCSP) allows shippers to avoid long waits at airport Customs facilities by having a qualified forwarder with BUP capability build ULDs and pre-screen the cargo.

A pre-screened BUP can save at least 6–8 hours compared to screening at the airport.

How is product damage or loss affected by who builds the ULDs?

Cargo handling at airline terminals is more about speed than quality. Typically, shipments must be tendered to the airline 6 hours before departure. For a Boeing 747-400 freighter, which can fit cargo volumes equivalent to five semi-trucks, that’s a lot of ULDs for cargo handling agents to build in a very short amount of time.

When you rush, you get careless, and the damage percentage increases. An experienced forwarder that is being paid to build BUP shipments does not operate under the same time pressures. And it typically has people trained to follow careful procedures around proper loading and securing of airline ULDs. Those people are incented for a job well done and will be held accountable for errors that lead to lost inventory or damage. You rarely see the same structure and discipline with airport cargo handling operations.

You don’t need to be an expert in air freight to ship effectively. But it helps to understand the basics about how airline ULDs are built, who builds them, and how these decisions impact the cost and speed of your cargo. After that, you can leave the details to an expert.

Ocean Freight Container Specifications

No symbol is more representative of global trade than the ocean shipping container. Close to 800 million containers are shipped globally (World Bank, 2019 data). But containers come in different shapes and sizes. It’s wise to be familiar with the different options so you can choose the one that makes the most operational and financial sense for your company.

Following is a Q&A on ocean freight container specifications and what you need to know.

Is there a guide that provides the dimensions of all the different types of ocean containers?

Check out this comprehensive guide on ocean freight container specifications.

How much weight can I load into a container?

The max weight for a container is the “maximum gross cargo weight” listed on the container door. That’s typically around 55,000 lbs for a 40-ft container. But most shippers try to stay within legal road weight restrictions. For instance, in the US, restrictions on roads limit total weight to 80,000 pounds for a standard tractor-trailer. When you factor in the weight of the truck, chassis and container, that leaves about 42,000–44,000 lbs for the actual cargo. If you go over that, you’ll need to use trucking partners with special equipment and special permits to transport heavy loads.

If you ship dense cargo – like knockdown furniture or stone or metal products – it could make good financial sense to maximize the container weight and then pay extra for specialized land-side transportation. If you can add 10,000 more pounds to every container you ship, you’ll ship 25% fewer containers, so the ocean savings could more than make up for the added road transport costs. It will depend on the commodity. In the US, as an example, most shippers try to keep container cargo weight below 37,000 lbs for 20’ and 42,000 lbs for 40’ to meet road transport weight limits.

Should I ship in a 40-ft or 20-ft container?

A 20-foot container holds half the cargo of a 40-foot container, but in the US, it costs about 80–90% as much. In other trade lanes, the cost difference could be greater. 20-ft containers are suitable for heavy cargo because such cargo may hit a max weight limit in a 40-ft container long before the container is even close to full. You can still save a little by shipping in a smaller box, so you’ll need to evaluate your specific needs. Let’s take an example. If you have a shipment of auto parts that weighs 74,000 lbs, you may be able to fit the entire shipment into a 40-foot container, but weight restrictions prevent you from doing so. In this case, shipping two 20-ft containers – each loaded with 37,000 lbs of cargo – would be your cheapest option. A knowledge of ocean freight container specifications helps you make these decisions.

Should I ship FCL or LCL?

When you ship a full-container-load (FCL), it means you have enough cargo to fill or nearly fill a container. When you ship a less-than-container-load (LCL), it means your shipment is small, and you may be able to reduce your shipping cost by using a freight forwarder to consolidate your cargo. Even though LCL will cost you more per unit of freight shipped, you save by sharing the shipping cost with other small-volume shippers. There is a breakeven point at which a large LCL load equals the price of a dedicated 20-ft container. An experienced global freight forwarder can advise what that point is based on your commodity, shipping lane, and current market rates.

While LCL shipping has advantages for small-volume shippers, here are some downsides you should be aware of:

- Longer ship times. FCL loads can move directly to the port of origin and to the consignee at the destination. LCL loads must go through a container freight station at each side for consolidation/deconsolidation. How much time can this add to the trip? As an example, from LA to Shanghai LCL service adds around 9 days versus FCL.

- Increased chance for damage. More touches mean more opportunity for damage. Also, you are sharing the container with other products, so shifting cargo in transit could cause problems.

- Customs delays. With an LCL shipment, if just one of the partial shipments on the container experiences issues, it delays the whole shipment.

Who loads the container?

It’s almost always the shipper that loads the freight for FCL loads. Loading of LCL containers is done by the freight forwarder arranging the consolidation. Proper loading requires exact knowledge of ocean freight container specifications.

What if my freight doesn’t fit in a standard ocean container?

Freight that is over height or over width is called out-of-gauge cargo, or OOG. For cargo that fits within the width and length dimensions of a container but is too high, Open Top containers are the most economical choice. These are loaded from the top by a crane and dropped into the container.

Over-width cargo can use a Flat Rack container, which has the sides and top open. The floor of a Flat Rack is a foot thicker than the floor of a standard container. You want to make sure that the load is tightly secured to avoid damage. And you’ll need protection against the elements with a tarp or shrink wrap, depending on the product.

Both Open Top and Flat Rack containers come in 20-ft and 40-ft options. These specialized containers will cost a little more. If your shipment is deemed OOG cargo, it will require special permits when it travels on the road, making it more expensive to ship. Railroads won’t accept OOG cargo at all.

How about shipments requiring temperature control?

20-ft and 40-ft refrigerated containers (reefers) have built-in air conditioning units that need to be continuously powered up and programmed to meet the product’s temperature and humidity requirements. Trucks that haul these containers to and from terminals need to have a generator set, or genset, unit. Terminals can provide plugs to keep reefers powered during loading and unloading. And the cargo ships themselves have plugs for reefers.

All steamship lines offer 40-ft reefers, but only some offer 20-foot reefers.

Reefer containers look different than standard containers on the inside. The walls will be aluminum, not steel. The floor, instead of wood, is a series of aluminum rails that allow air to circulate under the cargo. Reefers are mostly used for food products, but composite materials like carbon fiber may ship in reefers, as well.

BONUS TIP: think about insuring your temperature-controlled cargo. The A/C units usually work, but not 100% of the time. You don’t want to risk losing $40,000 worth of meat to avoid $175 on marine cargo insurance.

As you can see, there are many types and sizes of containers with different ocean freight container specifications. You want to make the right choice based on what you are shipping and the volume. Or you can rely on your freight forwarding partners to provide guidance.

Understanding Cargo Insurance

With most insurance – life, health, home – you buy it in the hope you’ll never have to use it.

Cargo insurance is much the same. But many global shippers often overlook insurance details and assume they are fully covered when, in fact, they’re not. That creates a huge risk for your company, particularly if you’re shipping high-value goods.

Here are some of the most common misperceptions about cargo insurance.

1. “ Events are rare. I don’t really need to insure my cargo.”

You never think it’s going to happen to you – until it does. And when it does, the costs, if you are not adequately insured, can really harm your business. In California in 2020, a full truckload of footwear worth $846,000 USD was stolen. A couple of years earlier, in Kentucky, thieves got away with a trailer of electronics worth $1 million USD. Homeowners understand that catastrophic events like fires are rare, but they insure anyway because without insurance they could not financially withstand the loss. Global shippers must look at cargo insurance more like home insurance.

2. “ My cargo is covered under the carrier’s policy.”

Carriers are liable – but only if it is proven that their negligence caused the loss. Even if it is, carrier liability is limited. You’ll receive only a small percentage of the product’s value. The best option to avoid this woefully inadequate coverage is to purchase All Risk Cargo Insurance when booking your global shipment. All Risk Cargo Insurance is the broadest, most comprehensive form of coverage. It insures the full value of the cargo in transit, from pickup to final delivery (normally 110% of cargo value).

Liability Coverage for Standard vs. All Risk Cargo Insurance

In the chart below, we look at the difference in what you would receive under the carrier’s liability insurance and an All Risk Cargo Insurance policy. The actual cost of the insurance, on a shipment-by-shipment basis, is quite small compared to the product value you would lose as a result of being under-insured with standard liability coverage.

Cargo of 100 kg $10,000 USD value |

Standard liability coverage (US route) |

All risk coverage |

| Air | $3,100 USD | $11,000 USD |

| Ocean | $500 USD | $11,000 USD |

| Domestic | $50 USD | $11,000 USD |

| Warehouse | $200 USD | $11,000 USD |

3. “ My cargo is covered under my company’s blanket insurance policy.”

It’s possible, but unlikely, that your blanket coverage would match what is offered under All Risk Cargo Insurance. In particular, many blanket policies fall short when it comes to international shipments.

4. “ When I purchase on CIF terms, I don’t have to worry about insurance; it’s the seller’s responsibility.”

CIF literally stands for Cost, Insurance, and Freight and refers to an Incoterm where the seller pays to cover the cost of ocean shipping and insurance to the buyer’s port. So yes, the seller must provide insurance. But they are only obligated to provide minimal coverage and may leave many risks uncovered. For instance, they may insure only the ocean passage and not door-to-door.

The other problem with relying on the seller to insure your cargo is that any claims would go through the seller. You are not in control. You would have to file and coordinate the claim with an overseas insurance agent that likely won’t have its own representatives in the US. Time zone differences and language barriers can also slow down the claims process and add unnecessary frustration..

5. “ The only time I’ll ever need coverage is when my cargo is lost or damaged.”

That would seem to make sense, but it’s not always accurate. There is a maritime law referred to as “General Average” that allows a vessel to jettison certain cargo in order to save lives, the vessel, or other cargo. The expense of the lost freight is then shared proportionally by all the other shippers. Under General Average, the vessel operator will not release your cargo until General Average Security is paid in full in cash or cash equivalent. When you obtain All Risk Cargo insurance, general average is included, and the insurance will post the guarantee needed to release your freight.

In some cases, General Average can be declared even when no cargo is lost. The best example is when the vessel Ever Given got stuck in the Suez Canal in March of 2021, resulting in billions of dollars in delayed shipments and General Average Security at 25% of cargo value for uninsured cargo.

6. “ If my product is rejected due to packaging damage, I am covered.”

Not true. Cargo insurance covers only damage to the goods and often will not pay to replace damaged packaging. If a retailer rejects your product based solely on package damage, cargo insurance will not protect you. That’s why it’s so important to invest the time and money to properly package your international shipments to prevent damage.

Companies generally do a good job of managing risk when it comes to things like computer systems going down, buildings being damaged, and employees filing workman’s compensation claims. But when it comes to protecting products while in transit, there is still confusion and, as a result, significant risk.

Partnering for Smarter Mode Selection and Freight Cost Control

Choosing the right transportation mode isn’t just about speed or cost—it’s about aligning logistics with your business priorities. From air and ocean to multi-modal solutions, each option comes with trade-offs in time, budget, and sustainability. That’s where a strategic freight forwarding partner like Dimerco adds value. With deep expertise, strong carrier relationships, and flexible routing strategies, we help global shippers make informed, cost-effective decisions—every time. Let us help you optimize your supply chain and move freight smarter across the world.

Understanding the Key Players in International Freight 11 Apr 2025, 11:10 am

Global shipping is complex—especially if you’re new to it. Between the acronyms, documentation, and dozens of service providers involved, it’s easy to feel overwhelmed. This post breaks down the key players you’ll encounter in international freight, what they do, and how they fit into your global supply chain. Whether you’re just starting out or training up your team, this is a great place to begin.

Download Guide

Looking for a complete resource on global shipping?

Download Dimerco’s Global Shipping Guide— your go-to reference for navigating transportation modes, Incoterms, trade compliance, customs clearance, and more.

Get the Guide and ship smarter across borders.

International Freight: The Players

As a global freight manager, you’ll be interacting with a variety of logistics providers. Here’s a quick review of who they are and what they do.

Consignee

That’s a fancy term for the recipient of the cargo being shipped. They are the ultimate owner of the product.

Carrier

The actual company operating the ship or plane or truck moving your stuff.

Freight Forwarder

Freight forwarders get your freight from one location to another. They arrange transit, organize your shipping documents, and send them to the right people. Your freight forwarder can often be your customs broker, but fewer customs brokers actually book space with air or ocean carriers.

Freight Broker

They are like freight forwarders in that they are intermediaries between you and carriers. But a freight broker is typically associated with domestic transportation, whereas freight forwarders focus on international transport.

Customs Broker

Customs Brokers process the necessary import or export paperwork and submit the documents directly to Customs. There is a customs broker in both the exporting and importing countries. You need to work with a broker that is knowledgeable about local customs regulations and practices.

NVOCC

Your freight forwarder can be an NVOCC, or “Non-Vessel Operating Common Carrier.” NVOCC’s manage ocean shipments under their own house bills, but they don’t typically move freight on their own vessels. Freight forwarders who are licensed NVOCCs can issue their own bills of lading – legal documents issued by a carrier to a shipper detailing the type, quantity, and destination of the goods being carried.

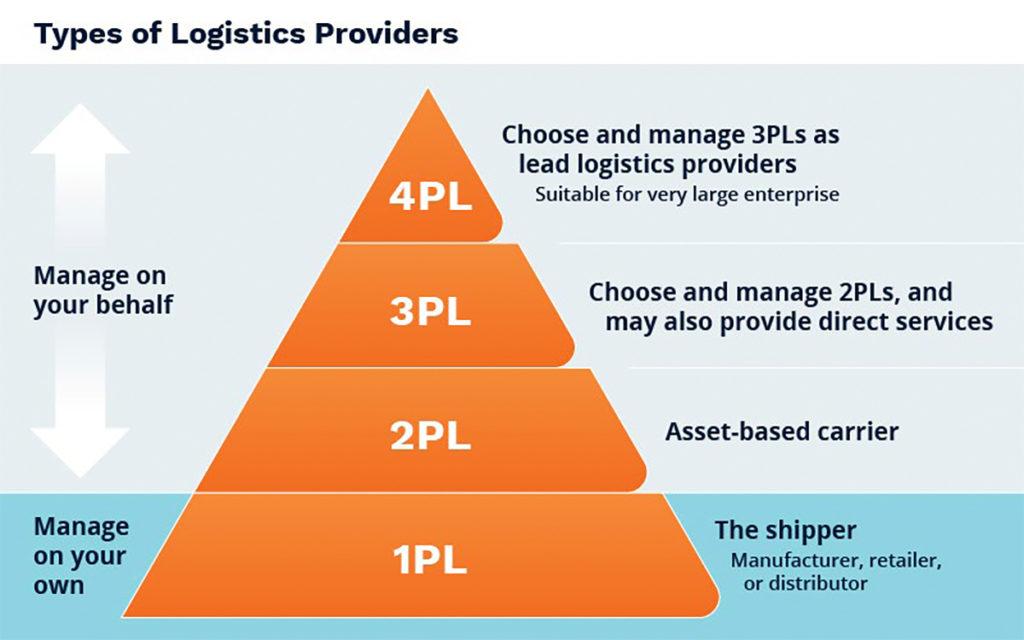

3PL

A 3PL (Third Party Logistics provider) is an outside company (not the shipper or receiver of the goods) that moves or stores freight between the origin and destination. For example, the trucking company that does the final delivery from the port to the destination is a 3PL.

4PL

These are managed transportation companies that manage 3PLs and serve as the “orchestrator” of a shipping process and the single point of contact for the shipper. This simple diagram might help explain the different types of providers.

Role of the Freight Forwarder

Of the key players just reviewed, you will have the most to do with a freight forwarder. These international shipping experts help you participate in international trade without having to master all the complexities involved – like negotiating and booking freight capacity, reviewing all required import/export documentation, assisting with duty payments, clearing customs, arranging insurance, and tracking and tracing shipments.

What a freight forwarder doesn’t do is physically transport your freight. That work is done by ocean carriers, airlines, railway operators, and trucking companies. The freight forwarder simply works out the most efficient method of shipping to meet your delivery requirements, then orchestrates the efforts of multiple providers to ensure cargo arrives on time, at the right place, for the right cost. Here are a few other questions to help you and your staff better understand the role of freight forwarders in the supply chain.

Can’t I just go directly to the carrier?

For air freight , you don’t contract with airlines, you will need to use a cargo agent. With ocean shipping, steamship lines won’t contract with you directly unless you are moving large volumes of cargo. If you do contract directly with an ocean freight carrier, it will limit your options. Just like a business traveler wants to evaluate multiple options before choosing the most convenient flight, cargo shippers want that same flexibility. If you go direct, you’ll be limited to the schedules and prices of only the carriers you have under contract, whereas a forwarder will look across all their carrier contracts to best match your requirement.

What about freight marketplaces? Are they an alternative to using freight forwarders?

Freight marketplaces are the cargo equivalent of Expedia and Priceline. But international forwarding is much more complex than travel agency services. If you book a personal trip from New York to London, the only supplier involved is the airline. With cargo shipments, you need a trucker to pick up the load, a carrier to ship it, a broker to clear customs, a transload site to deconsolidate, and a trucker at the destination to do the final delivery. Plus, every country’s rules and regulations are different. A simple booking software can’t solve the complexity of the global shipping process.

Another potential downside: What if something goes wrong during transit and intervention is required? Software can’t automatically reroute a shipment or troubleshoot a delay at customs. For these situations, you want to be able to reach out directly to an expert who understands and can fix the problem.

To be clear, marketplaces for global freight don’t replace forwarders, who still do the work behind the scenes. The software is meant to make the booking process faster and easier by looking at quotes from multiple forwarders. But, in doing so, it can undermine the advantage of having a close working relationship with your freight forwarder.

What should I look for when choosing a freight forwarder?

Here are a few of the most important criteria.

- Capacity in your high-volume lanes. That means they will likely have strong relationships with carriers that service that lane, giving you access to capacity with good negotiated rates that other forwarders may not have.

- Global network of owned offices. Many forwarders are smaller, independent companies that manage global projects through a network of other independent agents. This can work, but freight forwarders that rely on overseas agent partners won’t deliver the same level of service consistency as an owned office model, where each office works on a common system and follows customerspecific SOPs.

- Strong IT integration capabilities. You must be able to easily share data with your forwarder. But integrating systems can be a nightmare with the wrong partner. Many forwarders simply don’t have the resources to help, and they certainly won’t customize integrations to suit your exact needs. Look for a forwarder with its own IT resources that can complete system integrations quickly without the time (and sometimes extra cost) of going through 3rd party solutions.

- Multiple service offerings. This saves you the time and effort of arranging services that go beyond goods transport, like customs brokerage, insurance, and even warehousing services at the destination site.

Ultimately, freight forwarders make your life easier and allow your company to trade easily with overseas customers and suppliers.

What are the benefits of freight forwarding services?

- Save money. You benefit from the good rates forwarders can negotiate with carriers based on large freight volumes in a lane. Also, forwarders can consolidate your cargo with freight from other customers for a far lower consolidated rate.

- Access freight capacity. Because of the volume of freight they manage, larger forwarders have the purchasing muscle to secure the space you need.

- Gain flexibility. Forwarders examine a wide range of shipping modes and carriers to find the one that works best for your cost and service requirements.

- Access expertise. When importing or exporting products, it’s critical to have the most up-to-date information regarding customs regulations, duties and taxes. Without a reliable freight forwarding partner, you would have to develop that knowledge internally – and that comes with a cost.

- Focus on your core business. Every international shipment comes with a long list of document requirements and coordination points. Managing this complexity can easily deflect attention away from your business.

Choosing the Right Partner to Navigate Global Freight

Understanding the roles of different logistics providers is a crucial first step toward managing international freight effectively. While there’s no shortage of options, working with the right freight forwarder—one who combines capacity, service, and flexibility—can simplify everything. If you’re looking for a partner to help navigate the complexity and keep your supply lines flowing, Dimerco is here to help

How Incoterms Impact Costs, Risk, and Control in Global Commerce 11 Apr 2025, 11:04 am

Incoterms may look like a jumble of acronyms, but they play a vital role in global commerce. These international trade terms define who is responsible for transportation, insurance, customs clearance, and delivery. Choose the wrong one, and your company could face unexpected costs, delays, or compliance risks. This article breaks down the essentials of Incoterms and shares 9 best practices to help you manage risk and make smarter, more strategic decisions in global trade.

The Sales Agreement and Incoterms

Incoterms are the commercial selling terms between buyer and seller. You need to be familiar enough with Incoterms to intelligently manage your company’s costs, time commitments, and risks when it buys or sells goods internationally.

There are 11 Incoterms. They were developed by the International Chamber of Commerce to outline the responsibilities of buyers and sellers – basically, who pays what and when.

The “what” is the cost of transportation, insurance, customs duties and taxes. Some Incoterms put more onus on the buyer to arrange and pay for transportation and related costs. Some put more onus on the seller. Some represent a fairly equal sharing of responsibilities. It’s a continuum.

Let’s say you want to buy a box of peaches. You can invest the time and money to drive to the farm and pick up the peaches (little risk or transport costs for the farmer); or you can have the farmer deliver the peaches to your front door (very little risk or transport cost for you); or you could buy the peaches from the farmer’s stall at the Market halfway between your house and the farm (shared risk and transport cost).

To protect the peaches if they get dropped, you’ll pay all insurance for the farm pick up; the farmer will pay all insurance for the house delivery; and you’ll each buy insurance to cover your individual trips to and from the Farmer’s Market.

Our peach example doesn’t cover all the scenarios, but you get the idea.

You want to choose the Incoterm that aligns best with your business objective. One choice might be best to achieve the lowest possible cost. Another Incoterm would be best to minimize your time and risk. It depends on what you want to achieve and certain market conditions.

Don’t be intimidated by all the Incoterm acronyms (DDP, CIF, CFR….). Each just represents a point on a continuum of buyer-seller responsibility.

Download Guide

Looking for a complete resource on global shipping?

Download Dimerco’s Global Shipping Guide — your go-to reference for navigating transportation modes, Incoterms, trade compliance, customs clearance, and more.

Get the Guide and ship smarter across borders.

Incoterms: 9 Best Practices

Understanding and optimizing the terms of sale is very important. Follow these 9 best practices to save time, avoid unnecessary freight delays, and reduce your risk.

- Take responsibility for managing your own international freight shipments. Many importers who allow the seller to route international air/ocean shipments (CFR, CIF, CPT, CIP, DAP, DPU, and DDP terms) experience significant challenges when freight capacity is constrained and supply chain disruptions are common. Sellers sometimes refuse to move the goods, delaying shipments because of freight cost concerns or up-charging buyers for additional freight costs. Even small importers may find that routing their own cargo saves time, money, and customer relationships. Delegating responsibility in an international transaction can be tempting, particularly if you have a lean staff. But it may be better to control your own destiny. Importers new to freight negotiation can partner with a freight forwarder to help with the transition to a new Incoterm.

- Control customs clearance and final delivery. Port-related delays can really slow down your supply chain. You need to protect yourself from demurrage (charge for space the container takes up at the port if pickup is late), detention (charge for use of container beyond allowed free time), and storage charges. But, as a buyer, it’s hard to do that if you’re not in control of customs clearance and final delivery, as would be the case with CPT, CIP, DAP, DPU, and DDP terms. It’s really a lose-lose scenario for importers: You lack the control to avoid delays, but, as the consignee, you’re responsible for all charges. Consider buying under terms that allow you to closely control your exposure to these unplanned expenses (FOB, for example).

- Get internal alignment on purchase terms. Often, the Purchasing Department will decide on the terms of sale without truly understanding the logistics and compliance implications of that decision. Organize a cross-functional team to set standard Incoterms for your company’s international purchases. Ensuring alignment between compliance, logistics, sales, and purchasing teams avoids unanticipated costs, delay,s and lower-than-expected margins on customer sales.

- Be clear about payment terms in your purchase order. Many buyers assume that Incoterms cover the method or timing of payments, or when title or ownership of the goods passes from seller to buyer. This is not the case. One common misconception is that Incoterms are the contract between buyer and seller and that, if you buy FOB (Free On Board), title to the goods transfers when those goods are on board the vessel. No. Incoterms only establish who pays what and when and who assumes the risk. Be sure to cover payment terms and ownership transfer clearly in your purchase order.

- Understand who is obligated to insure the goods while in transit. Be sure your company has proper cargo insurance to cover your risk. A seller working under CIF terms (Cost, Insurance and Freight), for instance, is obligated to insure the goods to the destination port but may not purchase coverage commensurate with the cost of the goods. Don’t make assumptions that your risk is covered.

- Specify the port or place when opting for terms like DAP (Delivered at Place). “DAP New York,” for example, refers to a very wide area.

- Be cautious before selecting DDP terms (Delivered Duty Paid). Under this term, the seller is responsible for international shipping, customs clearance, duty payments, and local delivery at the destination. Global trade compliance and dealing with Customs requires expertise. Think through whether the seller can satisfy all import formalities. Likewise, opting for EXW (Ex Works) makes you, the buyer, responsible for picking up freight and all export procedures at origin. Do you have the expertise and resources to manage this process from thousands of miles away?

- Think through all paperwork requirements. If the terms of sale put the onus on you, the importer, to clear customs, specify which documents must be provided by the seller to facilitate export and import procedures. Let’s say a pair of shoes requires a special Fish and Wildlife certificate. Make sure the seller provides this certificate so you can clear Customs without delay. If you overlook this step, you could find yourself paying for goods you can’t get your hands on.

- Use a checklist to spell out the details associated with the agreed term of sale. Incoterms are handy abbreviations, but it’s wise to detail which party is responsible for each cost and compliance element. This way, there’s no room for confusion. It ensures that both parties will be satisfied with the transaction, setting a solid foundation for future sales. Lack of consistency and clarity can result in higher costs, delays, and, in some cases, both the buyer and the seller paying for the same charges (it happens!).

While sometimes confusing, Incoterms can be a strategic advantage for best-in-class importers and exporters. Managing Incoterms in advance, through a clearly communicated, companywide policy, is the best way to ensure your company is controlling costs and optimizing margins.

Using Incoterms Strategically in Global Commerce

In the fast-moving world of global commerce, Incoterms give you a clear framework to manage shipping costs, risk, and control. When chosen wisely, they help align internal teams, avoid costly missteps, and keep your international transactions running smoothly. The right Incoterm strategy—backed by the support of a freight forwarder like Dimerco—can give your business the edge it needs to compete and thrive on a global scale.

How to Navigate the Customs Clearance Process with Confidence 11 Apr 2025, 11:02 am

Understanding the Customs Clearance Process

Success in global trade involves finding quality suppliers, transporting goods in a volatile freight market, navigating trade wars and related tariffs, and a host of other factors. But one of your most critical day-to-day tasks is mastering the complexities of the customs clearance process, which, if not managed well, can stop your cargo dead in its tracks. Here’s a Q&A to help you understand the basics of customs clearance.

Download Guide

Looking for a complete resource on global shipping?

Download Dimerco’s Global Shipping Guide — your go-to reference for navigating transportation modes, Incoterms, trade compliance, customs clearance, and more.

Get the Guide and ship smarter across borders.

What is a customs clearance and why is it required?

All goods crossing the border from one country (or region in the case of the European Union) into another require a customs clearance. In the US, the customs agency is US Customs and Border Protection (CBP). A primary goal of customs agencies: PROTECTION.

- Protect the revenue of the country and enhance the nation’s economic prosperity by ensuring proper duties and taxes are collected.

- Protect consumers – make sure product standards are upheld so, for instance, food products are safe to eat and electrical products won’t malfunction.

- Protect and safeguard the country’s borders from smugglers, terrorists, and other bad actors who would use the global supply chain to harm others.

What’s the goal of the importer in the customs clearance process?

Pretty simple. Bring goods into the country without delay, in full compliance with laws and regulations, and at the lowest possible cost.

How much does customs clearance cost?

You’ll pay the following fees:

- Import Duties. The percent of the declared value you pay will depend on the product’s classification code and country of origin.

- Customs Clearance Fee. A broker oversees the customs clearance process, completes and files the necessary paperwork on your behalf, and acts as your expert partner to help ensure your company remains compliant. An outside broker’s fee will vary depending on the complexity of your products and the services provided.

- Inspection Fees. If your cargo is among the small percentage of import cargo that gets physically inspected, and delayed several days in the process, you’ll pay for the privilege. These inspection fees vary widely depending on the type, location, and scope of the exam

- Fees to Regulators. If your products are regulated by an agency other than Customs, you may have additional costs and paperwork to clear customs.

Depending on your product, you may also have to pay additional fees. Taking the US as an example, these may apply:

- Bond Payments. You’ll need to post a bond to guarantee duties and taxes that may be due on your imports. One option is to secure that bond through your customs broker (more on this role later). If you import regularly, you’ll probably buy a continuous bond that covers all imports into the US for a year. The bond amount is based on the estimated duties your company will owe during the year. If you import cargo sporadically, you can post a single-entry bond for each customs clearance instead.

- Merchandise Processing Fee (MPF). This fee is calculated and paid to CBP on all imported products at 0.3464% of the declared value of the cargo with a $27.75 minimum and $538.40 maximum charge (as of 10/1/21).

- Harbor Maintenance Fee (HMF). This fee is calculated and paid to CBP on ocean shipments only at 0.125% of the declared value.

What’s the role of the customs broker?

Customs brokers help you navigate the complexities of global commerce, including entry procedures, admissibility requirements, HS code classification, product valuation, and the duties and taxes imposed on imports.

Importers are ultimately responsible for making proper declarations and complying with regulations from Customs and other agencies. If you are not a licensed customs broker, then you need an expert broker working on your behalf – either as part of an independent customs brokerage firm or as part of your freight forwarder’s team. A good customs broker service provider will:

- Vet your products for priority trade issue and other government agency reporting requirements

- Review and prepare required documents, making sure they are complete and compliant, then submit them

- Vet your products for correct classification and valuation so duty payments are accurate

- Advise on a range of issues that can save you time and money

Other than the global transportation team, what corporate departments care about customs clearance?