Add your feed to SetSticker.com! Promote your sites and attract more customers. It costs only 100 EUROS per YEAR.

Pleasant surprises on every page! Discover new articles, displayed randomly throughout the site. Interesting content, always a click away

LIC Housing Finance Share Price Target 2025, 2026 To 2030 12 Apr 2025, 7:32 am

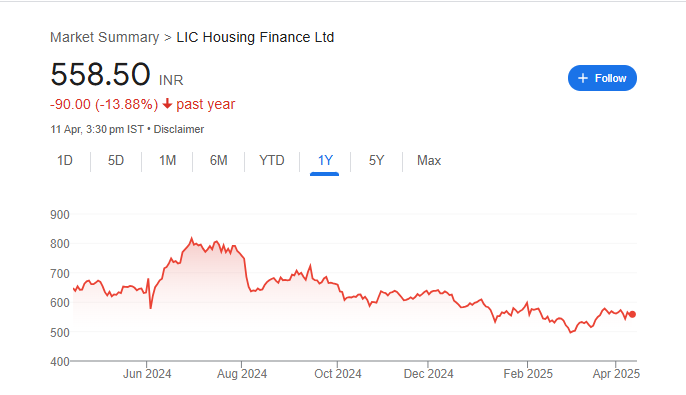

LIC Housing Finance Ltd. is one of India’s leading housing finance companies, established in 1989 and promoted by Life Insurance Corporation (LIC) of India. The company offers long-term loans to individuals for purchasing, constructing, or renovating homes, as well as providing finance to builders and developers. As of April 2025, LIC Housing Finance’s share price is approximately ₹559.65, with a market capitalization around ₹30,721 crore. LIC Housing Finance Share Price on 12 April 2025 is 558.50 INR. This article will provide more details on LIC Housing Finance Share Price Target 2025, 2026 to 2030.

LIC Housing Finance Company Info

- CEO: T Adhikari (3 Aug 2023–)

- Founded: 19 June 1989

- Headquarters: Mumbai

- Number of employees: 2,349 (2024)

- Revenue: 20,005 crores INR (US$2.5 billion, 2023)

- Subsidiaries: Lichfl Care Homes Limited, Lichfl Financial Services Ltd., LIC Housing Finance Ltd., Asset Management Arm.

LIC Housing Finance Share Price Chart

LIC Housing Finance Share Price Details

- Today Open: 568.90

- Today High: 571.10

- Today Low: 557.35

- Mkt cap: 30.72KCr

- P/E ratio: 5.96

- Div yield: 1.61%

- 52-wk high: 826.75

- 52-wk low: 483.70

LIC Housing Finance Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹830

- 2026 – ₹1000

- 2027 – ₹1200

- 2028 – ₹1400

- 2029 – ₹1600

- 2030 – ₹1800

LIC Housing Finance Share Price Target 2025

LIC Housing Finance share price target 2025 Expected target could be ₹830. Here are five key factors that could influence the growth of LIC Housing Finance Ltd.’s share price by 2025:

-

Strong Financial Performance

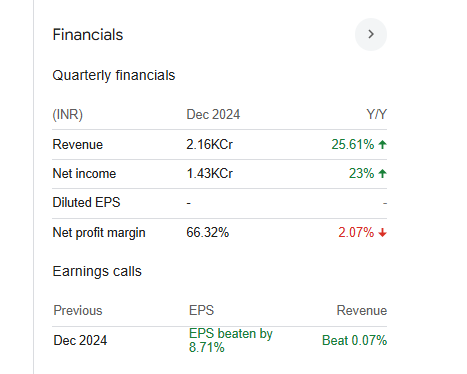

In Q3 FY25, LIC Housing Finance reported a 22.75% year-on-year increase in net consolidated profit, reaching ₹1,434.89 crore. This robust performance indicates the company’s resilience and potential for continued growth. -

Expansion into Affordable Housing

The company has launched specific products targeting the affordable housing segment, aiming for double-digit growth. This strategic move could open new revenue streams and enhance market presence. -

Analyst Recommendations and Price Targets

Analysts have set a 12-month price target of ₹690 for LIC Housing Finance, suggesting a potential upside from current levels. Such positive outlooks can boost investor confidence and drive share price appreciation. -

Improved Asset Quality

The company’s gross non-performing assets (NPAs) stood at 2.74%, with net NPAs at 1.46% as of December 31, 2024. Maintaining low NPA levels reflects effective risk management and financial stability. -

Cost of Funds and Interest Rate Environment

The cost of funds increased slightly to 7.78% in Q3 FY25 due to tighter liquidity and rising benchmark rates. Managing funding costs effectively will be crucial for sustaining margins and profitability.

LIC Housing Finance Share Price Target 2030

LIC Housing Finance share price target 2030 Expected target could be ₹1800. Here are five key factors that could influence the growth of LIC Housing Finance Ltd.’s share price by 2030:

-

Projected Share Price Appreciation

Analysts anticipate a significant increase in LIC Housing Finance’s share price, with projections suggesting a rise to approximately ₹922.50 by April 2025 and further growth to around ₹4,285.54 by 2030, reflecting a positive long-term outlook. -

Strategic Bond Issuances

The company plans to raise substantial funds through bond reissuances, aiming to enhance liquidity and support expansion initiatives. For instance, LIC Housing Finance is set to raise ₹20 billion through the reissue of 7.6450% bonds maturing in February 2030, which could strengthen its financial position and fund growth projects. -

Analyst Recommendations and Price Targets

Positive analyst sentiments can bolster investor confidence. Nomura, for example, adjusted LIC Housing Finance’s price target to ₹735 from ₹700, maintaining a ‘Buy’ rating, indicating optimism about the company’s future performance. -

Government Initiatives in Housing Sector

Government policies promoting affordable housing and infrastructure development can increase demand for housing finance. LIC Housing Finance, with its extensive reach and product offerings, is well-positioned to capitalize on such initiatives, potentially driving growth. -

Economic Factors and Interest Rate Trends

Macroeconomic conditions, including GDP growth, employment rates, and interest rate movements, significantly impact the housing finance sector. Favorable economic indicators and stable interest rates can lead to increased borrowing and loan disbursements, positively influencing LIC Housing Finance’s performance and share price.

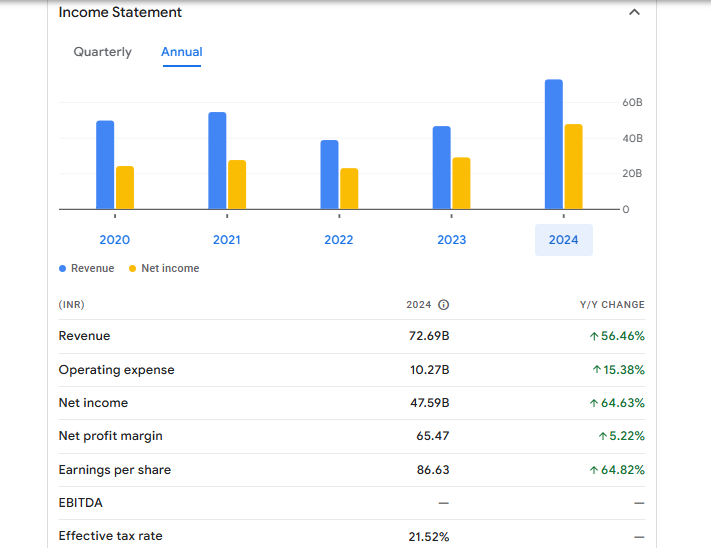

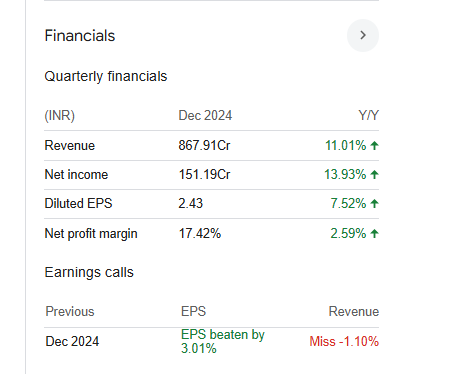

Financial Statement Of LIC Housing Finance

| (INR) | 2024 | Y/Y change |

| Revenue | 72.69B | 56.46% |

| Operating expense | 10.27B | 15.38% |

| Net income | 47.59B | 64.63% |

| Net profit margin | 65.47 | 5.22% |

| Earnings per share | 86.63 | 64.82% |

| EBITDA | — | — |

| Effective tax rate | 21.52% | — |

Read Also:- Taneja Aerospace Share Price Target 2025, 2026 To 2030

Taneja Aerospace Share Price Target 2025, 2026 To 2030 12 Apr 2025, 7:13 am

Taneja Aerospace & Aviation Ltd. (TAAL) is a notable player in India’s aerospace and defense sector, offering services like aircraft manufacturing, maintenance, and airfield management. The company’s share price has experienced fluctuations, with a 52-week range between ₹309 and ₹710 as of December 2024. Looking ahead, various analyses project the share price to reach between ₹1,800 and ₹2,100 by 2030, depending on the company’s performance and market conditions. Taneja Aerospace Share Price on 12 April 2025 is 278.70 INR. This article will provide more details on Taneja Aerospace Share Price Target 2025, 2026 to 2030.

Taneja Aerospace Company Info

- Founded: 1988

- Headquarters: India

- Number of employees: 31 (2024)

- Parent organization: Indian Seamless Group

- Subsidiaries: TAAL Technologies Pvt. Ltd., First Airways, Inc.

Taneja Aerospace Share Price Chart

Taneja Aerospace Share Price Details

- Today Open: 285.00

- Today High: 285.00

- Today Low: 278.70

- Mkt cap: 710.70Cr

- P/E ratio: 48.94

- Div yield: 0.90%

- 52-wk high: 710.00

- 52-wk low: 218.55

Taneja Aerospace Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹710

- 2026 – ₹900

- 2027 – ₹1100

- 2028 – ₹1300

- 2029 – ₹1500

- 2030 – ₹1700

Taneja Aerospace Share Price Target 2025

Taneja Aerospace share price target 2025 Expected target could be ₹710. Here are five key factors that could influence the growth of Taneja Aerospace & Aviation Ltd.’s share price by 2025:

-

Expansion in India’s Aviation Sector

India’s aviation industry is experiencing rapid growth, with expectations of a substantial increase in the aircraft fleet size over the next five years. This expansion presents significant opportunities for companies like Taneja Aerospace, which provides aircraft maintenance and manufacturing services. -

Diversified Service Offerings

Taneja Aerospace offers a range of services, including aircraft maintenance, avionics retrofitting, and airfield management. This diversification allows the company to tap into various revenue streams, enhancing its potential for growth. -

Financial Performance and Profitability

The company has demonstrated positive financial metrics, with a net income of ₹125.8 million and a profitability score of 64/100. These indicators suggest a stable financial foundation, which could support future growth. -

Investor Sentiment and Market Activity

Recent market activity shows a surge in investor interest, with the stock gaining 25.88% over a six-day period. Positive investor sentiment can drive share prices upward, reflecting confidence in the company’s prospects. -

Challenges in Revenue Growth

Despite the positive indicators, the company has faced challenges, including a -1.50% sales growth over the past five years and a low return on equity of 9.23%. Addressing these issues will be crucial for sustaining long-term growth.

Taneja Aerospace Share Price Target 2030

Taneja Aerospace share price target 2030 Expected target could be ₹1700. Here are five key factors that could influence the growth of Taneja Aerospace & Aviation Ltd.’s share price by 2030:

-

Diversified Service Portfolio

Taneja Aerospace offers a range of services, including aircraft maintenance, avionics retrofitting, and airfield management. This diversification allows the company to tap into various revenue streams, enhancing its potential for growth. -

Global Aerospace Market Expansion

The global aerospace and defense materials market is projected to reach $34.4 billion by 2030, indicating robust industry growth. Taneja Aerospace, being part of this sector, stands to benefit from increased demand for aerospace components and services. -

Financial Performance and Investor Confidence

The company has demonstrated positive financial metrics, with a net income of ₹125.8 million and a profitability score of 64/100. These indicators suggest a stable financial foundation, which could support future growth. -

Technological Advancements and Innovation

Taneja Aerospace’s involvement in avionics retrofitting and other modifications positions it well to capitalize on technological advancements in the aerospace industry. Staying ahead with innovation can lead to increased demand for its services. -

Market Sentiment and Share Price Projections

Investor sentiment plays a crucial role in share price movements. Projections suggest that Taneja Aerospace’s share price could reach between ₹1,944 to ₹2,333 by 2030, reflecting positive market expectations.

Financial Statement Of Taneja Aerospace

| (INR) | 2024 | Y/Y change |

| Revenue | 303.52M | -4.72% |

| Operating expense | 120.29M | 20.12% |

| Net income | 111.31M | 1.32% |

| Net profit margin | 36.67 | 6.32% |

| Earnings per share | — | — |

| EBITDA | 190.97M | 2.58% |

| Effective tax rate | 28.20% | — |

Read Also:- Resourceful Automobile Share Price Target 2025, 2026 To 2030

Resourceful Automobile Share Price Target 2025, 2026 To 2030 12 Apr 2025, 6:46 am

Resourceful Automobile is a growing company in the two-wheeler automobile sector, mainly known for its Yamaha dealership under the name Sawhney Automobile. After its IPO in 2024, the stock gained a lot of attention due to strong investor interest. As the company plans to expand its showroom network and improve services in the Delhi-NCR region, many investors are hopeful about its future. The share price target of Resourceful Automobile will depend on how well it grows its business, manages its finances, and keeps up with changes in the automobile industry. Resourceful Automobile Share Price on 12 April 2025 is 50.00 INR. This article will provide more details on Resourceful Automobile Share Price Target 2025, 2026 to 2030.

Resourceful Automobile Company Info

- Headquarters: India

- Number of employees: 8 (2024).

Resourceful Automobile Share Price Chart

Resourceful Automobile Share Price Details

- Today Open: 50.00

- Today High: 50.00

- Today Low: 50.00

- Mkt cap: 13.28Cr

- P/E ratio: 16.19

- Div yield: N/A

- 52-wk high: 128.00

- 52-wk low: 46.29

Resourceful Automobile Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹130

- 2026 – ₹150

- 2027 – ₹170

- 2028 – ₹190

- 2029 – ₹210

- 2030 – ₹230

Resourceful Automobile Share Price Target 2025

Resourceful Automobile share price target 2025 Expected target could be ₹130. Here are five key factors that could influence the company’s share price growth by 2025:

-

Expansion of Showroom Network

The company plans to utilize IPO proceeds to open new showrooms in Delhi/NCR, aiming to increase its market presence and customer base. -

Dependence on Yamaha Dealership

A significant portion of revenue comes from its Yamaha dealership. Any changes in Yamaha’s performance or policies could directly impact Resourceful Automobile’s sales. -

Industry Volatility

The automotive sector faces rapid changes due to evolving technologies, economic conditions, and consumer preferences, which could affect demand for traditional vehicles. -

Financial Health and Debt Management

The company has outstanding unsecured loans. Effective debt management and financial planning are crucial for sustaining growth and investor confidence. -

Market Sentiment Post-IPO

Initial enthusiasm led to overvaluation concerns, with the stock experiencing a 25% drop from its listing price. Market perception and investor sentiment will play a role in future price movements.

Resourceful Automobile Share Price Target 2030

Resourceful Automobile share price target 2030 Expected target could be ₹230.

Here are several key factors could influence the company’s growth trajectory:

-

Expansion of Showroom Network

The company intends to utilize IPO proceeds to open new showrooms in Delhi/NCR, aiming to increase its market presence and customer base . -

Dependence on Yamaha Dealership

A significant portion of revenue comes from its Yamaha dealership. Any changes in Yamaha’s performance or policies could directly impact Resourceful Automobile’s sales . -

Industry Volatility and Technological Advancements

The automotive sector is undergoing rapid changes due to evolving technologies, economic conditions, and consumer preferences. The rise of electric vehicles and autonomous technologies could affect demand for traditional two-wheelers . -

Financial Health and Debt Management

Effective debt management and financial planning are crucial for sustaining growth and investor confidence. The company’s ability to manage its financial obligations will play a significant role in its long-term success . -

Market Sentiment and Regulatory Environment

Initial enthusiasm led to overvaluation concerns, with the stock experiencing a significant drop from its listing price. Market perception and investor sentiment, along with regulatory changes, will play a role in future price movements .

Financial Statement Of Resourceful Automobile

| (INR) | 2024 | Y/Y change |

| Revenue | 193.60M | -0.12% |

| Operating expense | 14.57M | -26.01% |

| Net income | 19.47M | 369.04% |

| Net profit margin | 8.83 | 312.62% |

| Earnings per share | — | — |

| EBITDA | 36.48M | 143.22% |

| Effective tax rate | 25.27% | — |

Read Also:- Indian Hotels Share Price Target 2025, 2026 To 2030

Indian Hotels Share Price Target 2025, 2026 To 2030 12 Apr 2025, 6:11 am

Indian Hotels Company Limited (IHCL), part of the Tata Group, is one of the most trusted and well-known names in the hospitality industry. From luxury stays to smart budget options, the company has something for every kind of traveler. Over the years, it has built a strong presence both in India and overseas. Indian Hotels Share Price on 12 April 2025 is 788.80 INR. This article will provide more details on Indian Hotels Share Price Target 2025, 2026 to 2030.

Indian Hotels Company Info

- CEO: Puneet Chhatwal (6 Nov 2017–)

- Founded: 1902

- Founder: Jamshedji Tata

- Headquarters: Mumbai

- Number of employees: 18,359 (2024)

- Parent organization: Tata Group

- Revenue: 6,951 crores INR (US$870 million, FY24).

Indian Hotels Share Price Chart

Indian Hotels Share Price Details

- Today Open: 793.75

- Today High: 799.95

- Today Low: 778.35

- Mkt cap: 1.12LCr

- P/E ratio: 62.27

- Div yield: 0.22%

- 52-wk high: 894.90

- 52-wk low: 506.45

Indian Hotels Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹900

- 2026 – ₹1000

- 2027 – ₹1100

- 2028 – ₹1200

- 2029 – ₹1300

- 2030 – ₹1400

Indian Hotels Share Price Target 2025

Indian Hotels share price target 2025 Expected target could be ₹900. Here are five key factors influencing Indian Hotels’ share price target for 2025:

-

Robust Industry Growth

The Indian hospitality sector is experiencing strong growth, driven by increased demand from MICE (Meetings, Incentives, Conferences, and Exhibitions), cultural festivals, and the wedding season. RevPAR (Revenue Per Available Room) is expected to rise 12-14%, with metro cities seeing surges in business and event-driven tourism. Government initiatives, infrastructure improvements, and rising foreign tourist arrivals further support long-term growth, positioning India as a competitive global tourism hub.

-

Strategic Expansion Plans

IHCL aims to double its portfolio to over 700 hotels by 2030, with its operational hotels increasing from 230 to 500 in the next five years. This expansion strategy focuses on both domestic growth in Tier 2 and 3 cities and international markets with a strong Indian diaspora.

-

Capital-Light Business Model

The company’s capital-light approach involves strategic leases and management contracts, minimizing financial risk while expanding its footprint. This model allows IHCL to grow its presence without significant capital expenditure, enhancing profitability.

-

Positive Analyst Outlook

Motilal Oswal has maintained a ‘Buy’ rating on Indian Hotels with a target price of ₹950, implying a 20% upside from the current trading price. This positive outlook reflects confidence in the company’s growth prospects and operational efficiency.

-

Favorable Market Dynamics

The Indian hospitality sector is anticipating strong growth in Q4FY25, driven by high demand from MICE activities, weddings, and cultural events. Major cities like Mumbai and Delhi NCR are expected to perform well, while spiritual tourism is significantly boosting revenue. Government initiatives and favorable economic factors are set to further enhance the industry’s prospects.

Indian Hotels Share Price Target 2030

Indian Hotels share price target 2030 Expected target could be ₹1400.

Here are several key factors are expected to influence IHCL’s growth trajectory:

-

Ambitious Expansion Plans

Under its ‘Accelerate 2030’ strategy, IHCL aims to double its hotel portfolio to over 700 properties and achieve consolidated revenue of ₹15,000 crore by 2030. This expansion includes both domestic growth in Tier 2 and 3 cities and international markets with a strong Indian diaspora.

-

Diversification into New Business Segments

IHCL is focusing on diversifying its revenue streams by expanding into new business segments. The company plans to generate 25% or more of its revenue from new and re-imagined businesses, such as food and beverage retail through Qmin and experiential stays via ama Stays & Trails.

-

Capital-Light Business Model

The company’s capital-light approach involves strategic leases and management contracts, minimizing financial risk while expanding its footprint. This model allows IHCL to grow its presence without significant capital expenditure, enhancing profitability.

-

Projected Increase in Management Fees

IHCL has set a target of ₹10 billion in management fees by 2030. However, projections indicate that the company may surpass this milestone earlier, reaching ₹11 billion by FY27 at a CAGR of 33% over the next three years.

-

Favorable Industry Dynamics

The Indian hospitality sector is experiencing strong growth, driven by increased demand from MICE (Meetings, Incentives, Conferences, and Exhibitions), cultural festivals, and the wedding season. Government initiatives, infrastructure improvements, and rising foreign tourist arrivals further support long-term growth, positioning India as a competitive global tourism hub.

Financial Statement Of Indian Hotels

| (INR) | 2024 | Y/Y change |

| Revenue | 69.16B | 17.08% |

| Operating expense | 25.19B | 16.60% |

| Net income | 12.59B | 25.58% |

| Net profit margin | 18.21 | 7.31% |

| Earnings per share | 8.86 | 25.81% |

| EBITDA | 22.17B | 21.41% |

| Effective tax rate | 25.86% | — |

Read Also:- MMTC Share Price Target 2025, 2026 To 2030

MMTC Share Price Target 2025, 2026 To 2030 12 Apr 2025, 3:29 am

If you’re looking to invest in MMTC shares or just want to understand its future growth potential, you’re in the right place. MMTC Limited is one of India’s largest trading companies, known for its role in exports and imports of commodities like metals, minerals, and agro products. Over the years, it has shown resilience and adaptability in a fast-changing market. MMTC Share Price on 12 April 2025 is 50.31 INR. This article will provide more details on MMTC Share Price Target 2025, 2026 to 2030.

MMTC Company Info

- Founded: 26 September 1963

- Headquarters: New Delhi

- Number of employees: 361 (2024)

- Revenue: 28,997.23 crores INR (US$3.6 billion, 2019)

- Subsidiaries: MMTC-PAMP India Private.

MMTC Share Price Chart

MMTC Share Price Details

- Today Open: 50.47

- Today High: 50.90

- Today Low: 49.76

- Mkt cap: 7.56KCr

- P/E ratio: 49.40

- Div yield: N/A

- 52-wk high: 131.80

- 52-wk low: 44.50

MMTC Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹135

- 2026 – ₹160

- 2027 – ₹180

- 2028 – ₹200

- 2029 – ₹220

- 2030 – ₹240

MMTC Share Price Target 2025

MMTC share price target 2025 Expected target could be ₹135. Here are five key factors influencing MMTC Ltd.’s share price target for 2025:

-

Commodity Price Fluctuations

As a major trading company dealing in metals, minerals, and agricultural products, MMTC’s revenue is significantly influenced by global commodity prices. Volatility in these markets can directly impact the company’s profitability and, consequently, its stock performance.

-

Government Policies and Regulations

Being a public sector enterprise, MMTC’s operations are closely tied to government trade policies, import-export regulations, and international trade agreements. Any changes in these areas can affect the company’s trading activities and financial outcomes.

-

Global Economic Conditions

MMTC’s performance is linked to the global economic environment. Factors such as international demand for commodities, currency exchange rates, and geopolitical developments can influence the company’s trade volumes and margins.

-

Operational Efficiency and Diversification

Efforts to improve operational efficiency, diversify product offerings, and expand into new markets can enhance MMTC’s competitiveness. Strategic initiatives aimed at reducing costs and increasing revenue streams are crucial for sustaining growth.

-

Financial Performance Metrics

Investors closely monitor MMTC’s financial indicators, including sales growth, profit margins, and return on equity. Consistent improvement in these metrics can boost investor confidence and positively influence the share price.

MMTC Share Price Target 2030

MMTC share price target 2030 Expected target could be ₹240. Here are several key factors are expected to influence MMTC Ltd.’s growth trajectory:

-

Business Diversification and Technological Advancements

MMTC is actively working on transforming its business operations by investing in new technologies and diversifying its offerings. These initiatives are aimed at enhancing operational efficiency and tapping into new revenue streams, which could significantly boost the company’s growth by 2030.

-

Expansion into High-Growth Sectors

The company’s strategic focus on expanding its presence in high-growth sectors, such as agro-products and coal, is expected to contribute positively to its overall business performance. By tapping into these sectors, MMTC aims to reduce its reliance on traditional trading activities and explore new avenues for revenue generation.

-

Impact of Government Policies and Infrastructure Initiatives

Government policies, including the National Infrastructure Pipeline, which anticipates ₹100 trillion in investments by 2025, are likely to increase demand for MMTC’s traded commodities. Such infrastructure initiatives can provide a favorable environment for the company’s growth.

-

Financial Performance and Restructuring Efforts

MMTC’s financial performance has shown signs of improvement, with net profits reported in recent quarters. The company’s ongoing restructuring efforts and focus on operational efficiency are expected to enhance its profitability and investor confidence over the long term.

-

Global Commodity Market Dynamics

As a major trading company dealing in metals, minerals, and agricultural products, MMTC’s revenue is significantly influenced by global commodity prices. Fluctuations in these markets can directly impact the company’s profitability and, consequently, its stock performance.

Financial Statement Of MMTC

| (INR) | 2024 | Y/Y change |

| Revenue | 53.40M | -99.85% |

| Operating expense | 1.65B | -28.85% |

| Net income | 1.92B | -87.70% |

| Net profit margin | 3.60K | 8,027.55% |

| Earnings per share | — | — |

| EBITDA | -1.63B | -49.41% |

| Effective tax rate | 3.91% | — |

Read Also:- Tips Industries Share Price Target 2025, 2026 To 2030

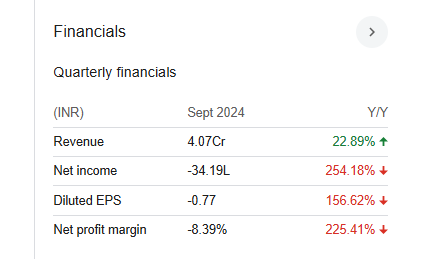

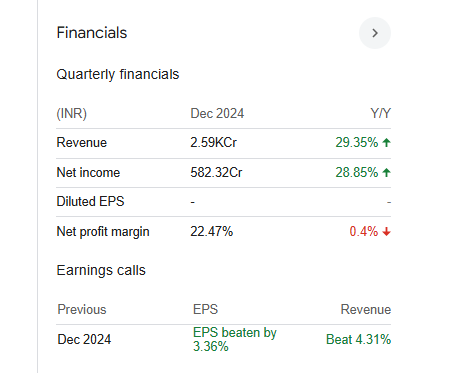

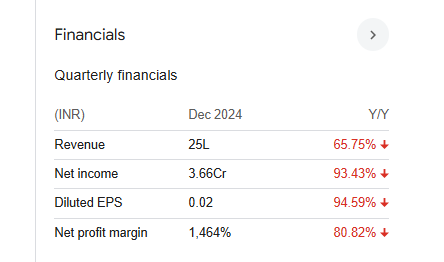

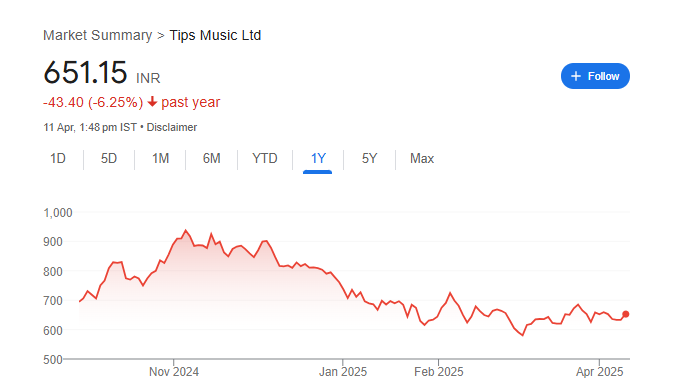

Tips Industries Share Price Target 2025, 2026 To 2030 11 Apr 2025, 8:30 am

Tips Industries is one of India’s well-known music and film production companies. With a strong presence in the entertainment industry for many years, Tips has built a large library of songs and movies that continue to attract audiences across generations. In today’s digital world, the company is also growing its reach through online platforms like YouTube, Spotify, and other music streaming apps. Tips Industries Share Price on 11 April 2025 is 651.05 INR. This article will provide more details on Tips Industries Share Price Target 2025, 2026 to 2030.

Tips Industries Company Info

- Headquarters: India, Mumbai

- Number of employees: 50 (2024)

- Subsidiary: TIPS Films Private Limited.

Tips Industries Share Price Chart

Tips Industries Share Price Details

- Today Open: 652.95

- Today High: 663.00

- Today Low: 640.60

- Mkt cap: 8.33KCr

- P/E ratio: 51.54

- Div yield: 1.08%

- 52-wk high: 950.00

- 52-wk low: 551.30

Tips Industries Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹950

- 2026 – ₹1100

- 2027 – ₹1250

- 2028 – ₹1400

- 2029 – ₹1550

- 2030 – ₹1700

Tips Industries Share Price Target 2025

Tips Industries share price target 2025 Expected target could be ₹950. Here are five key factors influencing Tips Industries Ltd.’s share price target for 2025:

-

Robust Financial Performance

Tips Industries has demonstrated strong financial health, boasting a profitability score of 91/100. The company has achieved an exceptional 3-year average Return on Equity (ROE) of 68% and Return on Invested Capital (ROIC) of 116%. Additionally, it maintains a positive free cash flow of ₹2.2 billion and positive operating income of ₹1.9 billion.

-

Strong Solvency Position

The company’s solvency score stands at 81/100, indicating a solid financial foundation. With a high Altman Z-Score of 45.67, negative net debt of ₹-2.3 billion, and a low debt-to-equity ratio of 0.01, Tips Industries showcases financial stability and low leverage.

-

Positive Market Sentiment

Tips Industries has received a ‘Buy’ rating from MarketsMOJO, attributed to its strong management efficiency, low debt-to-equity ratio, and healthy long-term growth prospects. Notably, the company has achieved a high ROE of 40.61%, reflecting efficient management practices.

-

Favorable Industry Trends

The entertainment sector, encompassing music and media, is experiencing significant growth. As consumer demand for digital content rises, companies like Tips Industries are well-positioned to capitalize on these trends, potentially driving revenue and share price growth.

-

Technical Indicators and Price Targets

Technical analysis suggests that Tips Industries’ share price is in an uptrend, with potential targets ranging from ₹699 to ₹1,714.90. These targets serve as support and resistance levels, indicating possible future price movements based on market dynamics.

Tips Industries Share Price Target 2030

Tips Industries share price target 2030 Expected target could be ₹1700. Here are several key factors are expected to influence Tips Industries Ltd.’s growth trajectory:

-

Expansion of Digital Music Streaming

The global shift towards digital music consumption continues to accelerate. Tips Industries has been actively releasing new music content and leveraging digital platforms to reach a wider audience. This trend is expected to bolster the company’s revenue streams and market presence by 2030.

-

Robust Financial Performance

Tips Industries has demonstrated strong financial health, boasting a profitability score of 91/100. The company has achieved an exceptional 3-year average Return on Equity (ROE) of 68% and Return on Invested Capital (ROIC) of 116%. Additionally, it maintains a positive free cash flow of ₹2.2 billion and positive operating income of ₹1.9 billion.

-

Strategic Partnerships and Collaborations

The company’s collaborations with major streaming platforms and content creators are expected to enhance its distribution network and content library. These strategic alliances are likely to contribute to sustained growth and a stronger market position by 2030.

-

Market Expansion and Diversification

Tips Industries is exploring opportunities to expand its footprint in international markets and diversify its content offerings. This includes venturing into regional languages and different music genres, which can attract a broader audience and open new revenue channels.

-

Technological Advancements and Innovation

Embracing new technologies, such as artificial intelligence for music recommendation and blockchain for rights management, can enhance user experience and operational efficiency. Staying at the forefront of technological innovation is crucial for maintaining competitiveness in the evolving music industry landscape.

Financial Statement Of Tips Industries

| (INR) | 2024 | Y/Y change |

| Revenue | 2.42B | 29.34% |

| Operating expense | 707.03M | -9.75% |

| Net income | 1.27B | 66.18% |

| Net profit margin | 52.64 | 28.48% |

| Earnings per share | — | — |

| EBITDA | 1.60B | 58.22% |

| Effective tax rate | 25.43% | — |

Read Also:- Tarc Share Price Target 2025, 2026 To 2030

Tarc Share Price Target 2025, 2026 To 2030 11 Apr 2025, 8:17 am

If you’re curious about TARC and its share price future, you’re in the right place! TARC Limited is a growing real estate company known for its premium residential and commercial projects, especially in Delhi. Investors and market watchers often keep an eye on this stock because of its potential in the fast-moving real estate sector. Tarc Share Price on 11 April 2025 is 147.00 INR. This article will provide more details on Tarc Share Price Target 2025, 2026 to 2030.

Tarc Company Info

- Founded: 2016

- Headquarters: India

- Number of employees: 187 (2024)

- Subsidiaries: TARC Green Retreat Limited, Monarch Buildtech Pvt. Ltd., Travel Mate (India) Pvt. Ltd.

Tarc Share Price Chart

Tarc Share Price Details

- Today Open: 153.90

- Today High: 153.90

- Today Low: 145.55

- Mkt cap: 4.34KCr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 269.95

- 52-wk low: 103.22

Tarc Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹270

- 2026 – ₹290

- 2027 – ₹310

- 2028 – ₹330

- 2029 – ₹350

- 2030 – ₹370

Tarc Share Price Target 2025

Tarc share price target 2025 Expected target could be ₹270. Here are five key factors influencing TARC Ltd.’s share price target for 2025:

-

Record Sales and Project Pipeline

TARC Ltd. has reported record annual sales in FY25, driven by the launch of new projects like TARC Ishva and Phase II of TARC Kailasa in New Delhi. As of March 31, 2025, the total Gross Development Value (GDV) of projects under development has surpassed ₹7,700 crore, highlighting the company’s robust pipeline in the luxury real estate segment.

-

Analyst Price Targets

Analysts have set a share price target of ₹325.00 for TARC Ltd., suggesting a potential upside of approximately 125% from the current trading price. This optimistic outlook reflects confidence in the company’s growth prospects.

-

Market Capitalization and Trading Activity

With a market capitalization of ₹4,258.24 crore as of April 9, 2025, TARC Ltd. maintains a significant presence in the real estate sector. The stock’s trading activity and investor interest are influenced by its market position and performance.

-

Financial Metrics

TARC Ltd. is trading at 3.70 times its book value. However, the company has a low interest coverage ratio and a low return on equity of -7.08% over the last three years. These financial metrics indicate areas where the company may need to improve to enhance investor confidence.

-

Real Estate Market Trends

The overall performance of the real estate sector, especially in the luxury segment, can significantly impact TARC Ltd.’s growth. Demand for premium residential developments in limited supply markets, like New Delhi, supports the company’s strategic focus and potential for increased revenues.

Tarc Share Price Target 2030

Tarc share price target 2030 Expected target could be ₹370.

Here are several key factors are expected to influence TARC Ltd.’s growth trajectory:

-

Long-Term Share Price Forecast

According to WalletInvestor, TARC Ltd.’s share price is projected to reach ₹466.12 by April 2030, suggesting a potential upside of approximately 225% over five years.

-

Insider Ownership and Confidence

Insiders hold a significant stake in TARC Ltd., with two investors owning a majority of 65%. Recent insider purchases indicate strong confidence in the company’s future prospects.

-

Strategic Real Estate Development

TARC Ltd. focuses on luxury residential projects in New Delhi, a market with high demand and limited supply. This strategic positioning is expected to drive growth in the coming years.

-

Financial Performance and Metrics

While TARC Ltd. has shown growth, certain financial metrics such as a low interest coverage ratio and a return on equity of -7.08% over the last three years highlight areas for improvement.

-

Market Trends and Economic Factors

The overall performance of the real estate sector, especially in the luxury segment, can significantly impact TARC Ltd.’s growth. Demand for premium residential developments in limited supply markets, like New Delhi, supports the company’s strategic focus and potential for increased revenues.

Financial Statement Of Tarc

| (INR) | 2024 | Y/Y change |

| Revenue | 1.12B | -69.57% |

| Operating expense | 1.06B | -35.42% |

| Net income | -770.46M | -478.80% |

| Net profit margin | -68.68 | -1,344.20% |

| Earnings per share | — | — |

| EBITDA | 536.64M | -66.41% |

| Effective tax rate | 10.43% | — |

Read Also:- Coffee Day Share Price Target 2025, 2026 To 2030

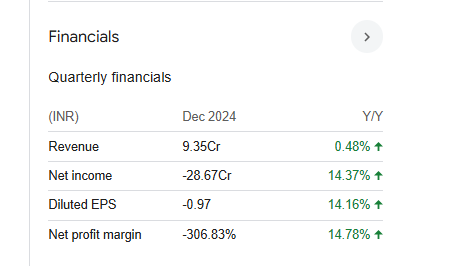

Coffee Day Share Price Target 2025, 2026 To 2030 11 Apr 2025, 8:02 am

Coffee Day, known best for its Café Coffee Day outlets, has long been a familiar name among coffee lovers in India. Whether it’s a friendly catch-up or a peaceful solo moment, many people have found comfort in its cozy cafes and quality coffee. Over the years, Coffee Day Enterprises has seen its fair share of ups and downs, especially on the business and stock market front. Coffee Day Share Price on 11 April 2025 is 27.09 INR. This article will provide more details on Coffee Day Share Price Target 2025, 2026 to 2030.

Coffee Day Company Info

- Headquarters: India

- Number of employees: 144 (2024)

- Subsidiaries: Café Coffee Day, Tanglin Developments Limited, Coffee Day Trading Ltd, Coffee Day Hotels & Resorts Pvt.Ltd.

Coffee Day Share Price Chart

Coffee Day Share Price Details

- Today Open: 27.29

- Today High: 27.29

- Today Low: 27.09

- Mkt cap: 581.85Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 74.65

- 52-wk low: 21.28

Coffee Day Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹75

- 2026 – ₹100

- 2027 – ₹125

- 2028 – ₹150

- 2029 – ₹175

- 2030 – ₹200

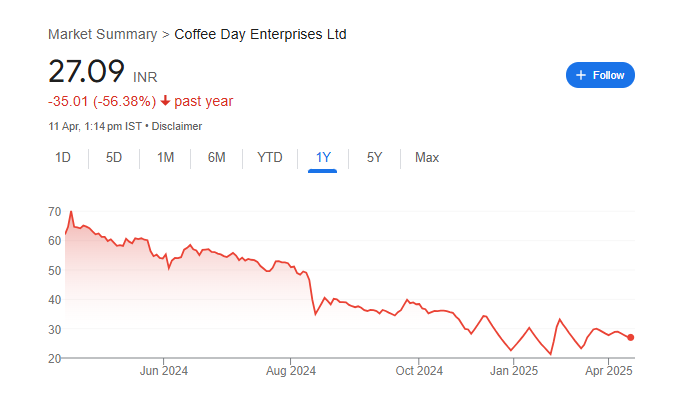

Coffee Day Share Price Target 2025

Coffee Day share price target 2025 Expected target could be ₹75. Here are five key factors influencing CDEL’s share price target for 2025:

-

Debt Restructuring and Reduction

CDEL has made strides in addressing its debt burden, notably settling an outstanding debt of ₹205 crore in March 2025. This settlement, involving payments in tranches and asset sales, signals the company’s commitment to financial restructuring and has positively impacted investor sentiment.

-

Operational Challenges and Legal Proceedings

Despite debt reduction efforts, CDEL faces ongoing operational challenges, including insolvency proceedings initiated due to a ₹228 crore default. These legal issues contribute to market uncertainty and can affect the company’s share price trajectory.

-

Brand Strength and Market Presence

CDEL’s flagship brand, Café Coffee Day, remains a recognized name in India’s coffee retail sector. The brand’s strong market presence provides a foundation for potential recovery, assuming effective management and strategic initiatives are implemented.

-

Financial Performance Metrics

The company’s financial indicators reflect ongoing challenges, with a net loss of ₹354.49 crore and a high debt-to-equity ratio of 43.55. These metrics highlight the need for continued financial discipline and operational efficiency to improve investor confidence.

-

Analyst Projections and Market Sentiment

Analyst projections for CDEL’s share price in 2025 vary, with some estimates ranging from ₹45.51 to ₹53.06, suggesting cautious optimism. These projections are contingent on the company’s ability to execute its turnaround strategy effectively.

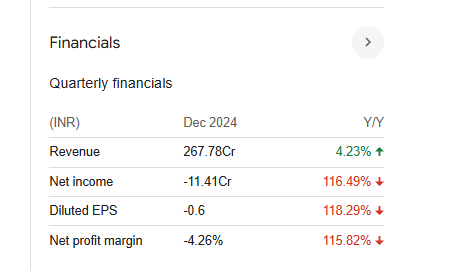

Coffee Day Share Price Target 2030

Coffee Day share price target 2030 Expected target could be ₹200. Here are several key factors are expected to influence CDEL’s growth trajectory:

-

Global Coffee Market Expansion

The global coffee market is projected to grow significantly, with estimates suggesting it could reach USD 323.72 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. This overall market growth presents opportunities for CDEL to expand its market share and revenue streams.

-

Rising Demand for Specialty Coffee

Consumer preferences are increasingly shifting towards specialty and premium coffee products. The specialty coffee market is expected to grow at a CAGR of 10.4% from 2025 to 2030, reaching USD 183.0 billion by 2030. CDEL’s ability to cater to this demand through product innovation and quality enhancement could drive growth.

-

Expansion of Coffee Shop Culture

The global coffee shop market is anticipated to grow, with projections indicating it could reach USD 133.98 billion by 2030, at a CAGR of 6.83% from 2023 to 2030. Strengthening and expanding CDEL’s Café Coffee Day outlets, especially in emerging markets, could capitalize on this trend.

-

Adaptation to Consumer Convenience Trends

The increasing demand for convenience, such as ready-to-drink coffee and efficient delivery services, is reshaping the coffee industry. Embracing these trends through strategic partnerships and service diversification could enhance CDEL’s competitive edge.

-

Financial Restructuring and Operational Efficiency

Addressing existing financial challenges through effective debt management and improving operational efficiencies will be crucial. Demonstrating fiscal responsibility and profitability can bolster investor confidence and positively impact share price.

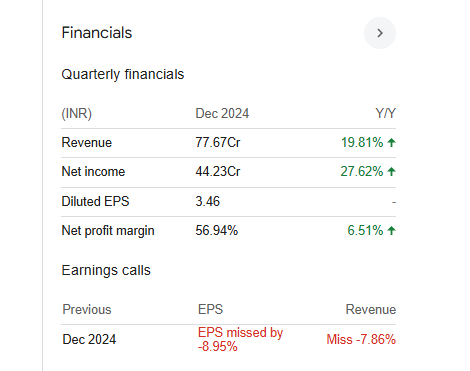

Financial Statement Of Coffee Day

| (INR) | 2024 | Y/Y change |

| Revenue | 10.23B | 10.52% |

| Operating expense | 5.39B | -43.41% |

| Net income | -3.23B | 15.09% |

| Net profit margin | -31.52 | 23.18% |

| Earnings per share | — | — |

| EBITDA | 1.33B | 146.28% |

| Effective tax rate | 16.67% | — |

Read Also:- Sona BLW Precision Forgings Share Price Target 2025, 2026 To 2030

Sona BLW Precision Forgings Share Price Target 2025, 2026 To 2030 11 Apr 2025, 7:49 am

Sona BLW Precision Forgings, also known as Sona Comstar, is a trusted name in the auto components industry. The company is well-known for its advanced technology and strong focus on electric vehicle (EV) parts. Over the years, it has earned the confidence of investors and customers alike with consistent performance and innovation. Sona BLW Precision Forgings Share Price on 11 April 2025 is 427.85 INR. This article will provide more details on Sona BLW Precision Forgings Share Price Target 2025, 2026 to 2030.

Sona BLW Precision Forgings Company Info

- CEO: Vivek Vikram Singh (5 Jul 2019–)

- Founded: 1995

- Headquarters: India

- Number of employees: 1,672 (2024)

- Parent organization: Sona Autocomp Holding Private Limited

- Subsidiaries: Sona Comstar eDrive Private Limited, NOVELIC.

Sona BLW Precision Forgings Share Price Chart

Sona BLW Precision Forgings Share Price Details

- Today Open: 428.70

- Today High: 430.50

- Today Low: 416.00

- Mkt cap: 26.60KCr

- P/E ratio: 43.58

- Div yield: 0.75%

- 52-wk high: 768.65

- 52-wk low: 380.00

Sona BLW Precision Forgings Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹770

- 2026 – ₹900

- 2027 – ₹1000

- 2028 – ₹1100

- 2029 – ₹1200

- 2030 – ₹1300

Sona BLW Precision Forgings Share Price Target 2025

Sona BLW Precision Forgings share price target 2025 Expected target could be ₹770. Here are five key factors influencing Sona BLW’s share price target for 2025:

-

Strong Electric Vehicle (EV) Segment Growth

Sona BLW’s revenue from Battery Electric Vehicles (BEVs) has shown significant growth, with BEV programs contributing 78% to the net order book of ₹23,100 crore as of Q2 FY25. This focus on the EV segment positions the company well for future growth.

-

Robust Financial Performance

In Q2 FY25, the company reported revenue of ₹925 crore, marking a 17% year-over-year growth. The EBITDA stood at ₹255 crore with a margin of 27.6%, and the net profit was ₹144 crore, reflecting a 16% YoY increase. Such strong financials support investor confidence.

-

Global Expansion Initiatives

Sona BLW has inaugurated a new manufacturing plant in Mexico to cater to the growing EV demand in North America. This expansion enhances the company’s global footprint and access to key markets.

-

Positive Analyst Outlook

Analysts have given Sona BLW a “Buy” rating with a target price of ₹725, reflecting optimism about the company’s growth prospects. This positive outlook can influence investor sentiment and share price.

-

Innovation in Automotive Technology

Sona BLW is focusing on developing advanced automotive systems and components, particularly for the EV market. Their commitment to innovation positions them as a key player in the evolving automotive industry.

Sona BLW Precision Forgings Share Price Target 2030

Sona BLW Precision Forgings share price target 2030 Expected target could be ₹1300.

Here are Several key factors are expected to influence Sona BLW’s growth trajectory:

-

Surging Electric Vehicle (EV) Adoption

India’s EV market is projected to experience a compound annual growth rate (CAGR) of 45.5%, with sales potentially reaching over 16 million units by 2030. Sona BLW, specializing in EV traction motors and control units, is well-positioned to capitalize on this trend.

-

Strategic Global Investments

The company plans to invest approximately $130 million globally over the next few years to support its electrification initiatives. These investments aim to enhance production capacities and technological capabilities, particularly in key markets like North America and Europe.

-

Technological Advancements

Sona BLW is focusing on developing high-power-density EV systems capable of handling high torque requirements with lightweight designs. These innovations are expected to improve vehicle efficiency and performance, making the company’s products more attractive to automakers.

-

Diversified Product Portfolio

The company’s broad range of products, including differential assemblies, drive motors, and e-axles, allows it to cater to various segments of the automotive industry. This diversification helps mitigate risks associated with dependence on specific products or markets.

-

Robust Financial Health

Sona BLW has demonstrated strong financial performance, with significant increases in profits, cash flow, and revenue over the past five years. Its debt-free status provides financial flexibility to invest in growth opportunities and withstand market fluctuations.

Financial Statement Of Sona BLW Precision Forgings

| (INR) | 2024 | Y/Y change |

| Revenue | 31.85B | 19.95% |

| Operating expense | 10.70B | 21.27% |

| Net income | 5.17B | 30.86% |

| Net profit margin | 16.24 | 9.07% |

| Earnings per share | 8.94 | 31.64% |

| EBITDA | 8.63B | 34.85% |

| Effective tax rate | 22.87% | — |

Read Also:- Sonata Software Share Price Target 2025, 2026 To 2030

Sonata Software Share Price Target 2025, 2026 To 2030 11 Apr 2025, 3:59 am

Sonata Software is a well-known Indian IT services company that offers smart digital solutions across the globe. Over the years, it has gained trust for delivering quality work in areas like cloud computing, AI, and digital transformation. Investors looking for long-term growth often find Sonata an interesting choice due to its strong global presence and innovation-driven approach. Sonata Software Share Price on 11 April 2025 is 316.20 INR. This article will provide more details on Sonata Software Share Price Target 2025, 2026 to 2030.

Sonata Software Company Info

- CEO: Samir Dhir (8 Apr 2022–)

- Founded: 1986

- Headquarters: Bengaluru

- Number of employees: 6,043 (2024)

- Revenue: 5,553 crores INR (US₹700 million, 2022)

- Subsidiaries: Sonata Information Technology Limited.

Sonata Software Share Price Chart

Sonata Software Share Price Details

- Today Open: 316.90

- Today High: 324.70

- Today Low: 315.55

- Mkt cap: 8.77KCr

- P/E ratio: 20.54

- Div yield: 2.50%

- 52-wk high: 763.70

- 52-wk low: 286.40

Sonata Software Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹770

- 2026 – ₹900

- 2027 – ₹1100

- 2028 – ₹1300

- 2029 – ₹1500

- 2030 – ₹1700

Sonata Software Share Price Target 2025

Sonata Software share price target 2025 Expected target could be ₹770. Sonata Software is navigating a dynamic market landscape with several factors poised to influence its share price target for the year. Here are five key elements affecting its growth trajectory:

-

Strategic Focus on AI and Cloud Services

Sonata is intensifying its investments in artificial intelligence and cloud computing, aiming to derive 20% of its revenue from AI-enabled services by FY27. This strategic shift aligns with global digital transformation trends and positions the company for substantial growth in these high-demand sectors.

-

Expansion in Key International Markets

The company has reported significant revenue growth in the U.S., which now contributes 72% of its total revenue. Additionally, Sonata has secured major deals in the U.S. and Australia, indicating a strong foothold in these markets and potential for continued expansion.

-

Robust Deal Pipeline and Client Acquisitions

Sonata has secured several substantial deals, including data modernization for a leading U.S. financial institution and cloud services for a prominent technology company. These wins not only boost immediate revenue but also enhance the company’s reputation and client base.

-

Operational Challenges Impacting Margins

Despite revenue growth, Sonata faces margin pressures due to increased operating expenses from workforce expansion and investments in strategic sectors like healthcare and BFSI. These challenges have led to a YoY decline in EBIT and PAT margins, affecting short-term profitability.

-

Analyst Outlook and Share Price Targets

KRChoksey has assigned an “ACCUMULATE” rating to Sonata Software, with a revised target price of ₹679, reflecting a potential upside of 7.5% from its current price. The target price considers the company’s strategic initiatives in AI and cloud services, balanced against near-term margin challenges.

Sonata Software Share Price Target 2030

Sonata Software share price target 2030 Expected target could be ₹1700. Sonata Software is strategically positioned for growth, with several key factors expected to influence its share price target by 2030:

-

Expansion in AI and Cloud Services

Sonata is intensifying its investments in artificial intelligence (AI) and cloud computing, aiming to derive 20% of its revenue from AI-enabled services by FY27. This strategic shift aligns with global digital transformation trends and positions the company for substantial growth in these high-demand sectors.

-

Global Market Penetration

The company has reported significant revenue growth in the U.S., which now contributes 72% of its total revenue. Additionally, Sonata has secured major deals in the U.S. and Australia, indicating a strong foothold in these markets and potential for continued expansion.

-

Commitment to Sustainability and ESG

Sonata’s 2023–24 Sustainability Report highlights its dedication to environmental, social, and governance (ESG) initiatives. The company emphasizes equitable growth for employees, communities, and stakeholders, aiming to deliver a positive impact across people, planet, and prosperity.

-

Strategic Acquisitions and Partnerships

Sonata has made strategic acquisitions, such as the purchase of Encore IT Services Solutions Private Limited, to enhance its service offerings and expand its global footprint. These moves are expected to strengthen its position in key markets and drive revenue growth.

-

Positive Analyst Outlook

Analysts have given Sonata an “ACCUMULATE” rating, with a revised target price of ₹679, reflecting a potential upside of 7.5% from its current price. The target price considers the company’s strategic initiatives in AI and cloud services, balanced against near-term margin challenges.

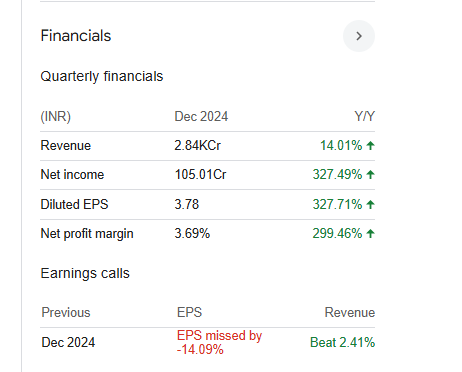

Financial Statement Of Sonata Software

| (INR) | 2024 | Y/Y change |

| Revenue | 28.43B | 14.01% |

| Operating expense | 2.75B | 25.03% |

| Net income | 1.05B | 327.49% |

| Net profit margin | 3.69 | 299.46% |

| Earnings per share | 3.78 | -18.20% |

| EBITDA | 1.57B | -13.60% |

| Effective tax rate | 23.25% | — |

Read Also:- Abbott Laboratories Share Price Target Tomorrow 2025, 2026 To 2030