Add your feed to SetSticker.com! Promote your sites and attract more customers. It costs only 100 EUROS per YEAR.

Pleasant surprises on every page! Discover new articles, displayed randomly throughout the site. Interesting content, always a click away

UGE International

At UGE we’re bringing solar power to communities and businesses around the worldUGE Achieves Notice to Proceed Milestone for 1.3-Megawatt Rooftop Community Solar Project in Medford, New York 15 Apr 2025, 2:19 pm

April 15, 2025 – UGE, a leader in commercial and community solar, announces that it has reached the ‘Notice to Proceed’ (NTP) milestone for its 1.3MW community solar project in Medford, New York. The NTP milestone indicates that financing for the project has closed and all necessary permits and interconnection agreements for the project are in place.

The project will be built atop Medford Logistics Center, a 130,000 square-foot industrial center in the heart of Long Island, developed by UGE’s long-term partner Wildflower LTD. This will be UGE’s eighth rooftop solar project completed with Wildflower, with a seventh currently under construction.

This is the second project for which UGE will leverage the Domestic Content Adder, an Investment Tax Credit introduced via the Inflation Reduction Act. Designed to strengthen the United States’ solar manufacturing industry, the Domestic Content Adder rewards solar developers for using domestically produced equipment in their projects. Eager to support a stronger domestic solar manufacturing industry, UGE established a Module Supply Agreement last year with Heliene, one of North America’s fastest growing solar manufacturers. For this and other projects under construction, UGE is utilizing U.S.-made solar modules from Heliene, inclusive of US-made cells.

Each year, the Medford Logistics solar project will offset roughly 1,500 metric tons of Carbon Dioxide (CO2) equivalent, the amount produced by burning approximately 170,000 gallons of gasoline. It will produce enough electricity to power roughly 200 homes each year.

As part of an ongoing partnership announced in November 2021, wireless provider T-Mobile will serve as the project’s anchor energy off-taker, supporting T-Mobile’s commitment to power its business using 100% renewable energy

Having reached NTP, the Medford project will now enter deployment and construction, the final phase before commercial operation. Once complete, the projects will join UGE’s operating portfolio, which currently stands at 25MW. The Medford project is projected to complete construction and begin operating this fall.

About UGE

UGE develops, owns, and operates community and commercial solar & battery storage projects. Our distributed energy solutions provide cheaper, cleaner energy to businesses and households throughout the United States. With the backing of NOVA Infrastructure and leaning on more than a decade of experience across 500 megawatts of projects, we’re working daily to make renewable energy accessible and affordable for all. Visit us at www.ugei.com. For more information, contact UGE at info@ugei.com.

About Wildflower

Wildflower creates innovative, sustainable and socially beneficial physical infrastructure in New York City by fusing design, entrepreneurship, and community engagement. Wildflower currently owns over 3 million square feet of real estate in the New York metro area.

The post UGE Achieves Notice to Proceed Milestone for 1.3-Megawatt Rooftop Community Solar Project in Medford, New York appeared first on UGE International.

UGE Achieves Notice to Proceed Milestone for 1.5 Megawatt Community Solar Project in Newport, Maine 16 Jan 2025, 3:43 pm

January 16, 2025 – UGE, a leader in commercial and community solar, announces that it has reached the ‘Notice to Proceed’ (NTP) milestone for its 1.5MW community solar project in Newport, Maine. The NTP milestone indicates that financing for the project has closed and all necessary permits and interconnection agreements for the project are in place.

UGE’s newest community solar project will be built on former farm and recreation land in Newport, Maine, which is owned by a local family. Each year, the project will offset nearly 2,000 metric tons (over 4 million pounds) of CO2 emissions, the equivalent produced by burning over 215,000 gallons of gasoline. At 1.5MW it will produce enough electricity to power more than 350 homes.

This is the first project for which UGE will be awarded the Domestic Content Adder, an Investment Tax Credit introduced via the Inflation Reduction Act. Designed to strengthen the United States’ solar manufacturing industry, the Domestic Content Adder rewards solar developers for using domestically produced equipment in their projects. Eager to support a stronger domestic solar manufacturing industry, UGE established a Module Supply Agreement earlier this year with Heliene, one of North America’s fastest growing solar manufacturers. For this and other projects under construction, UGE is utilizing U.S.-made solar modules from Heliene, inclusive of US-made cells.

The Newport project will generate a meaningful amount of clean renewable energy, even though community solar projects such as this are much smaller in size than utility-scale solar farms. Community solar projects benefit from being easier to blend into the surrounding landscape and conceal with trees and other natural barriers than larger utility-scale solar farms.

Having reached NTP, the Newport project will now enter deployment and construction, the final phase before commercial operation. Once complete, the projects will join UGE’s operating portfolio, which currently stands at 24MW. The Newport project is projected to complete construction and begin operating this summer.

About UGE

UGE develops, owns, and operates community and commercial solar and battery storage projects. Our distributed energy solutions provide cheaper, cleaner energy to businesses and households throughout the United States. With the backing of NOVA Infrastructure and leaning on more than a decade of experience across 500 megawatts of projects, we’re working daily to make renewable energy accessible and affordable for all. Visit us at www.ugei.com. For more information, contact UGE at info@ugei.com.

The post UGE Achieves Notice to Proceed Milestone for 1.5 Megawatt Community Solar Project in Newport, Maine appeared first on UGE International.

How Rooftop Community Solar Helps New York City Building Owners Meet Local Law 97, 94, and 92 Requirements 14 Jan 2025, 4:16 pm

In New York City, buildings are subject to several local climate laws passed in 2019 as part of the Climate Mobilization Act. Here, we’ll be providing an overview of three of those laws: Local Laws 92, 94, and 97. We’ll share how serving as a community solar host is not only a path to compliance and/or liability reduction under these laws, but also a new source of long-term lease revenue for building owners.

Local Law 97

LL97 was put in place to help reduce the amount of greenhouse gases emitted by buildings in New York City. The target under LL97 is for all buildings 25,000 square feet and larger to reduce their emissions over a series of compliance periods through 2050. Emissions limits will grow more stringent in each proceeding compliance period. The first compliance period started last year: 2024-2029.

All buildings covered under LL97 will be required to submit a report regarding their emissions to the Department of Buildings by May 1, 2025.

Via this calculator, you can enter your building’s address and find out how much you will owe in penalties each year if your building’s emissions are not sufficiently reduced.

Building owners can significantly reduce their buildings’ reported emissions by installing rooftop solar. Traditionally, this requires a significant upfront financial investment and complex project management which is not a feasible route for many building owners.

Community solar, however, is a model of solar project ownership in which an entity separate from the building’s owner pays for, owns, and operates a rooftop solar project on a building. In return, the building owner receives long-term lease payments for their rooftop space where the solar project sits in addition to reducing and oftentimes erasing their LL97 fine liability.

For building owners looking for ways to significantly reduce their building’s reported emissions with no capital investment, earn long-term lease revenue on rooftop space that would otherwise go unmonetized, and maximize the value of their asset, becoming a community solar host is an ideal option.

Local Laws 92 and 94

LLs 92 and 94 are essentially equivalent but apply to buildings of different sizes: 94 applies to large buildings while 92 is for smaller buildings.

The two laws require buildings under construction and buildings undergoing certain renovations to install sustainable roofs, which can be either a rooftop solar project, a green (vegetation) roof, or a combination of the two.

Becoming a community solar host will automatically bring your building into compliance with whichever of these two laws is applicable to your building.

You can learn more about Local Laws 92 and 94 here.

Working with us

Based in New York City, we’ve been working in solar in the city for over a decade and have had the pleasure of partnering with dozens of building owners like yourself.

While we’d love to work with any and all building owners, in order for project economics to be feasible, we are only able pursue projects on buildings with rooftops and/or parking lots totaling at least 30,000 square feet. In some cases, we are able to include smaller buildings as part of a larger portfolio.

If you own or represent a building with a rooftop or parking lot exceeding 30,000 square feet and would like to learn more about how becoming a community solar host can help you comply with New York City’s local climate laws, please fill out the Get Started form at the bottom of this page and we’ll be in touch shortly!

The post How Rooftop Community Solar Helps New York City Building Owners Meet Local Law 97, 94, and 92 Requirements appeared first on UGE International.

UGE’s Operating Portfolio Grows by 16MW with December CODs Across Four States 9 Jan 2025, 2:14 pm

New York, NY – January 9, 2025 – UGE, a leader in commercial and community solar, announces that it has reached Commercial Operation (“COD”) on six new solar projects totaling 16MW. The projects include UGE’s first two community solar projects in Maryland; its first community solar project in Oregon, a second municipal PPA project in Texas; and two community solar projects in Maine. With the completion of these six projects, UGE’s operating portfolio now stands at 24MW, with projects operating across six states.

Together the six new projects will offset over 19,500 metric tons of CO2 equivalent each year, the amount produced by driving roughly 50 million miles in an average passenger car. The projects will produce enough electricity to power roughly 4,000 homes.

The Maryland, Oregon, and Maine projects will all join their respective states’ community solar programs, bringing cheaper, cleaner electricity to households and businesses that aren’t able to install solar on their own rooftops. The Texas project will bring affordable renewable energy to the rural municipality where it’s sited.

Among the projects are UGE’s first project to qualify for the Energy Community Tax Credit put into place via the Inflation Reduction Act of 2022. The Credit incentivizes renewable energy developers like UGE to site projects on contaminated land or in communities historically dependent on the nonrenewable energy economy. UGE’s two Maryland projects qualify for the Energy Community Credit under the coal facility closure category, which was designed to promote economic revitalization in regions affected by the closure of coal mines and coal-fired power plants.

The Oregon project is UGE’s largest to reach commercial operation since transitioning to an independent power purchaser (“IPP”) model. The Texas project is UGE’s second in the town of Smithville, and UGE’s first to receive a grant from the Rural Energy for America Program (“REAP”). The two new Maine projects, both located in the Bangor area, bring UGE’s total operating portfolio in the state to 7.5MW across four projects. One of the two Maine projects is built atop a former concrete fabrication and storage site.

“Successfully achieving Commercial Operation for six projects in one month is a massive achievement, and I’m deeply proud of our team for the weeks, months, and years of work that went into getting here,” said Nick Blitterswyk, CEO of UGE. “Our operating portfolio grew roughly five-fold in 2024, showing what our team is capable of now that we’ve transitioned to a model whereby we develop, own, and operate our projects, and I’m excited for all we will accomplish in the coming years on our mission to make renewable energy accessible and affordable for all.”

About UGE

UGE develops, owns, and operates community and commercial solar & battery storage projects. Our distributed energy solutions provide cheaper, cleaner energy to businesses and households throughout the United States. With the backing of NOVA Infrastructure and leaning on more than a decade of experience across 500 megawatts of projects, we’re working daily to make renewable energy accessible and affordable for all. Visit us at www.ugei.com. For more information, contact UGE at info@ugei.com.

The post UGE’s Operating Portfolio Grows by 16MW with December CODs Across Four States appeared first on UGE International.

UGE Completes 847kW Rooftop Community Solar Project in Queens, New York 7 Nov 2024, 2:49 pm

New York, NY – November 7, 2024 – UGE, a leader in commercial and community solar, announces that it has reached commercial operation on its 847kW rooftop community solar project in Queens, New York.

Each year, the new Queens project will offset over 1,000 metric tons (roughly 2.5 million pounds) of CO2 emissions, the equivalent produced by burning nearly 125,000 gallons of gasoline. At 847kW it will produce enough electricity to power more than 200 homes.

The project sits atop a new 250,000-square-foot warehouse and parking facility in College Point, Queens which is owned by New York City-based real estate developer Wildflower Ltd LLC. This is UGE’s sixth solar project completed with Wildflower, with a seventh under construction and an eighth in development.

New York’s progressive renewable energy policies at both the City and State level have helped UGE and Wildflower develop their expanding portfolio of commercial solar projects. In 2019 New York City passed pioneering legislation, Local Laws 92 and 94, that requires all new buildings and existing buildings undergoing certain renovations to implement solar or other green roofing. The partnership between UGE and Wildflower has allowed Wildflower to meet these requirements while simultaneously earning recurring lease revenue from UGE. The solar projects will also allow Wildflower to be complaint with Local Law 97, which sets greenhouse gas emissions caps on buildings over 25,000 square feet. Local Law 97 went into effect this year.

“Our long-term partnership with UGE supports Wildflower’s mission to create innovative, sustainable, and socially beneficial physical infrastructure in New York City,” said Adam Gordon, Managing Partner of Wildflower. “We are pleased to be bringing yet another community solar project to life with UGE.”

UGE will reserve 50% of the project’s energy output for Low- to Moderate-Income (LMI) subscribers, allowing these households and businesses to save upwards of 10% on their electricity costs. As electricity rates continue to rise across the country, these savings become increasingly meaningful for Americans looking for ways to save money in today’s inflationary environment.

With the addition of the College Point project, UGE’s operating portfolio now stands at 7.9 MW. UGE has an additional 17.2 MW of projects currently in deployment and construction, as well as a significant portfolio in development.

About UGE

UGE develops, owns, and operates community and commercial solar & battery storage projects. Our distributed energy solutions provide cheaper, cleaner energy to businesses and households throughout the United States. With the backing of NOVA Infrastructure and leaning on more than a decade of experience across 500 megawatts of projects, we’re working daily to make renewable energy accessible and affordable for all. Visit us at www.ugei.com. For more information, contact UGE at info@ugei.com.

About Wildflower

Wildflower creates innovative, sustainable and socially beneficial physical infrastructure in New York City by fusing design, entrepreneurship, and community engagement. Wildflower currently owns over 3 million square feet of real estate in the New York metro area.

The post UGE Completes 847kW Rooftop Community Solar Project in Queens, New York appeared first on UGE International.

UGE International Ltd. Announces Closing of Plan of Arrangement 15 Aug 2024, 9:53 pm

Toronto, Ontario–(Newsfile Corp. – August 16, 2024) – UGE International Ltd. (TSXV: UGE) (OTCQB: UGEIF) (the “Company” or “UGE“) is pleased to announce the closing of the previously announced plan of arrangement (the “Arrangement“) pursuant to which 1000896425 Ontario Ltd. (the “Purchaser“), an affiliate of NOVA Infrastructure Fund II, LP, acquired, with an effective date of August 15, 2024 (the “Effective Date“) all of the issued and outstanding common shares of the Corporation (the “Common Shares“) for C$2.00 per Common Share (the “Consideration“), other than Common Shares held by certain management representatives and shareholders of the Corporation (the “Rolling Shares“) which Rolling Shares were rolled over into the private entity that will carry on the business of the Company. The Arrangement was approved by the Company’s shareholders (the “Shareholders“), holders of the Company’s compensation warrants (the “Warrantholders“) and holders of the Company’s convertible debentures (the “Debentureholders“, and collectively with the Shareholders and Warrantholders, the “Securityholders“) on July 31, 2024 and by the Superior Court of Justice (Commercial List) on August 6, 2024.

With the Arrangement now complete, the Common Shares will be halted from trading on the TSX Venture Exchange (the “TSX-V“) and UGE intends to cause the Common Shares to be delisted from the TSX-V and OTC Markets as soon as reasonably practicable. In connection therewith, UGE intends to submit an application to the applicable securities regulators to cease to be a reporting issuer and to terminate its public reporting obligations.

As at the Effective Date: (i) each Shareholder is entitled to receive the Consideration per Common Share; (ii) each Warrantholder is entitled to receive the balance of the Consideration and the exercise price of their respective compensation warrant; and (iii) each Debentureholder is entitled to receive the Consideration per Common Share they hold after giving effect to the conversion of their convertible debentures (inclusive of principal and interest accrued thereon). To receive their respective Consideration, registered Shareholders, Warrantholders and Debentureholders must surrender the certificates representing their UGE securities together with a duly completed and corresponding executed Letter of Transmittal to TSX Trust. The Letter of Transmittal was mailed to UGE Securityholders with UGE’s management information circular dated June 28, 2024. The Letters of Transmittal, applicable to each Securityholder, is for use by registered Securityholders only and is not to be used by beneficial holders of Common Shares (“Beneficial Shareholders“). A Beneficial Shareholder does not hold Common Shares in its name but such shares are held by an intermediary such as a brokerage firm, or clearing agency such as CDS. If you are a Beneficial Shareholder, your intermediary will submit the required documentation in order to receive your consideration.

A copy of the Purchaser’s early warning report will be filed on the Corporation’s profile on SEDAR+ at www.sedarplus.ca and available upon request by contacting Chris Beall at +1 646 889 8100.

About UGE International Ltd.

UGE develops, owns, and operates community and commercial solar & battery storage projects. Our distributed energy solutions provide cheaper, cleaner energy to businesses and households throughout the United States. With over 500 megawatts of project experience, UGE is working daily to make renewable energy accessible and affordable for all. Visit us at www.ugei.com. For more information, contact UGE:

Nick Blitterswyk – investors@ugei.com or +1 917 720 5685.

About NOVA Infrastructure

Founded in 2018, NOVA Infrastructure (http://www.novainfra.com) is a value-added, middle market infrastructure investment firm focused on North America. NOVA seeks to make investments that pair the downside protection features of the infrastructure asset class with operationally focused, value-added upside strategies. NOVA targets investments in environmental services, transportation, energy / energy transition, and digital sectors.

Ellen DeGiusti – edegiusti@sloanepr.com.

Forward-looking statements and forward-looking information

Certain statements made herein, including statements relating to matters that are not historical facts and statements of the Company’s beliefs, intentions and expectations about developments, results and events which will or may occur in the future, constitute “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information relates to future events or future performance, reflect current expectations or beliefs regarding future events and is typically identified by words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “likely”, “may”, “plan”, “seek”, “should”, “will” and similar expressions suggesting future outcomes or statements regarding an outlook. Forward-looking information and statements include, but are not limited to, information and statements regarding the timing to delist the Common Shares; and the application by UGE to cease to be a reporting issuer and terminate its public reporting obligations.

Forward-looking information is based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such information. There can be no assurance that such information will prove to be accurate.

Although the Company believes that the forward-looking information in this news release is based on information and assumptions that are current, reasonable and complete, this information is by its nature subject to a number of factors, many of which are beyond the Company’s control, that could cause actual results to differ materially from management’s expectations and plans as set forth in such forward-looking information.

Readers are cautioned not to place undue reliance on forward-looking information. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, which contribute to the possibility that the predicted outcomes will not occur. Events or circumstances could cause the Company’s actual results to differ materially from those estimated or projected and expressed in, or implied by, this forward-looking information.

Investors and others should carefully consider the factors and other uncertainties and potential events and should not rely on the Company’s forward-looking information to make decisions with respect to the Company. Furthermore, the forward-looking information contained herein are made as of the date of this document and the Company does not undertake any obligation to update or to revise any of the included forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law. All forward-looking information contained herein is expressly qualified by this cautionary statement.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

The post UGE International Ltd. Announces Closing of Plan of Arrangement appeared first on UGE International.

A Guide to Capitalizing on the Domestic Content Adder for Community and Commercial Solar Developers 12 Aug 2024, 3:35 pm

In May, the Department of Treasury released much anticipated guidance on the Domestic Content Adder, the tax credit included in the Inflation Reduction Act (“IRA”) which is designed to strengthen the United States’ solar equipment manufacturing industry.

For solar developers like us at UGE, this critical guidance answered key questions, allowing us to move ahead with plans to capitalize on the Domestic Content Adder for most of our projects going forward.

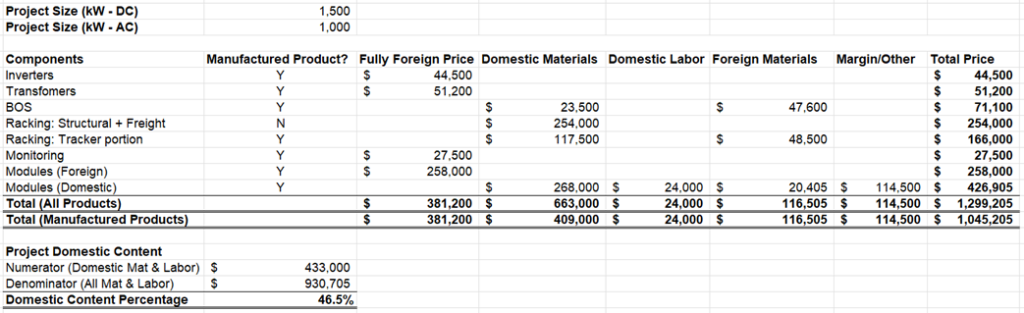

In this guide, we’ll summarize the criteria for qualifying for the Domestic Content Adder, explain how to calculate the domestic content make-up of a project using the Adjusted Percentage Rule, and provide an illustrative analysis of the calculation for a community or commercial-scale project.

Domestic Content Adder Criteria

The Domestic Content Adder is rewarded to developers via either a 10% Investment Tax Credit (ITC) Adder, or a $0.03/kWh Production Tax Credit (PTC) Adder. , for community and commercial solar, the ITC will almost always prove more favorable because of the higher average off-take rates for these types of projects.

It is also important to note that – at least as of now – the criteria for qualifying for the ITC versus the PTC will diverge over time. As currently written, the IRA outlines that t

At the highest level, to qualify for the Domestic Content Adder, all structural components used in the projects must be 100% domestic content, while the manufactured components must be comprised of at least 40% domestic content. The general breakdown of structural versus manufactured products is as follows:

- Structural Components: Steel within racking products is classified as structural components and the steel must be 100% manufactured in the US. Driven piles and ground screws in ground mounted tracker-based racking are considered structural components, alongside the entirety of a steel fixed tilt or rooftop racking system. If a racking system is made of aluminum instead of steel, however, it is considered a manufactured product.

- Manufactured Components: Manufactured components consist of the rest of the project that isn’t considered a structural component. This includes the tracker portion of a ground mount system. As noted above, racking systems made of aluminum are also considered manufactured components. The breakdown of these materials will determine the domestic content percentage on a project.

Using the Adjusted Percentage Rule

To allow developers to calculate the amount of domestic content within the manufactured components of any given project, the Department of Treasury released a tool called the Adjusted Percentage Rule. The Adjusted Percentage Rule divides the cost of the domestically manufactured products and components by the total cost of manufactured products to determine the domestic cost percentage for a project. The domestic and total manufactured product costs only include direct material and direct labor costs in their totals. These costs are obtained from cost sheets provided by vendors.

To calculate the domestic content percentage, simply add together the percentages next to the product components manufactured, as opposed to assembled, in the United States. (Manufacturing involves altering the form or function of parts and raw materials by “adding value and transforming” them into a new product “functionally different from that which would result from mere assembly.”) The domestic content percentages are provided starting on page 15 of the IRS Safe Harbor and Adjusted Percentage Rule guidance.

The below example is for a grid-scale BESS calculation:

- If the cells, packaging, and thermal management system are made in the United States, but everything else is imported, the domestic content percentage is 38.0 + 3.3 + 4.9 = 46.2%.

- If the battery packs as well as all four components used to make them are manufactured in the United States, then the “production” number is also added to the percentage. In that case, the domestic content would be 38.0 + 3.3 + 4.9 + 5.2 + 21.1 = 72.5%.

- If some of the cells are made in the United States and some are imported, then only a fraction of the 38.0 for cells counts. For example, if 60% of the cells are US-made and 40% imported, then 38.0 x 60% = 22.8% would be credited to domestic content.

- If a component is not used in the product, then it is ignored.

The sample analysis below for a hypothetical community solar project provides an applied example of Adjusted Percentage Rule calculations:

Sourcing Domestic Content

According to SEIA, as of mid-July 2024 the U.S. currently has 167 GW of solar module manufacturing capacity and 175 GW of battery storage component manufacturing currently operating, under construction, or announced. While the industry still has a way to go until it is able to meet demand, growth has skyrocketed since the 2022 passage of the IRA, with new manufacturing plants and investment being announced constantly.

SEIA’s Solar & Storage Supply Chain Dashboard includes a live and interactive map presenting domestic manufacturers by product type and facility status – a useful resource for developers looking to form partnerships with domestic producers.

Many suppliers of PV modules, racking, and other manufactured components are offering or plan to offer products with at least some percentage of U.S.-made content, which when balanced within the total equipment makeup of a project can be used to reach the 40% domestic content minimum.

Our Approach: Long-Term Contracting

At UGE, we are pleased to have recently signed an MSA with North American solar manufacturer Heliene to source 93% U.S.-made modules, which we will begin using in our projects under construction as early as this fall. By guaranteeing the supply and domestic percentage of the modules we will use moving forward, we can balance the remainder of our equipment procurement to ensure we meet the requirements of the Domestic Content Adder.

In addition to allowing us to secure modules with the domestic content percent we need, our long-term contract with Heliene significantly reduces our supply chain risk. With anticircumvention lawsuits and geopolitical tensions creating uncertainty and delays in the solar supply chain, the benefits of domestic supply grow even clearer. Heliene is a company we’ve worked with for more than ten years, dating back to the days of the Ontario feed-in-tariff market, and one we look forward to working with for years to come.

Growing Domestic Solar Manufacturing

While there will be growing pains as supply chains develop to meet ever-increasing demand, a strong domestic solar manufacturing industry will significantly benefit solar developers, the U.S. economy, and an expedient and just transition to renewable energy in our country. Some of the most important reasons UGE supports investing in domestic solar manufacturing include:

- Job Creation: Expanding domestic manufacturing generates employment opportunities, fostering economic growth and stability within the U.S. Much of this job creation will take place in jurisdictions that have historically been more resistant to the renewable energy transition; as the clean energy industry begins to directly benefit these local economies, general attitudes on the issue can be expected to improve.

- Environmental Impact Mitigation: By reducing reliance on international supply chains, the U.S. minimizes the environmental footprint associated with cross-continental transportation of equipment.

- Enhanced Oversight: Domestic production enables stricter regulation and oversight, ensuring adherence to higher standards of human rights and environmental protection throughout the manufacturing process.

- Risk Mitigation and Energy Security: Decreasing reliance on foreign sources mitigates geopolitical risks and bolsters national energy security by fostering a more resilient and self-reliant energy infrastructure.

We encourage all solar developers to explore ways in which they can support domestic production so we may all benefit from a more secure and humanitarian energy transition.

The post A Guide to Capitalizing on the Domestic Content Adder for Community and Commercial Solar Developers appeared first on UGE International.

UGE International Ltd. Provides Update on Closing of Plan of Arrangement 9 Aug 2024, 11:53 am

TORONTO, August 9, 2024 – UGE International Ltd. (TSXV: UGE) (OTCQB: UGEIF) (the “Company” or “UGE”) announces that the closing of its previously announced plan of arrangement (the “Arrangement”) with 1000896425 Ontario Ltd. (the “Purchaser”), an affiliate of NOVA Infrastructure Fund II, LP, pursuant to an arrangement agreement (the “Arrangement Agreement”), dated May 28, 2024, is now expected to occur on or about August 14, 2024, as opposed to on or about August 8, 2024, as was previously stated in the Company’s news release dated July 31, 2024.

The Company acknowledges that the Purchaser has satisfied its obligations under the Arrangement Agreement, including depositing the aggregate cash consideration payable under the Arrangement with TSX Trust Company, acting as the depositary. A brief delay to the closing is required in order for certain shareholders who are participating as rolling shareholders to complete share transfers relating to their continued participation in UGE following the completion of the Arrangement.

About UGE International Ltd.

UGE develops, owns, and operates community and commercial solar & battery storage projects. Our distributed energy solutions provide cheaper, cleaner energy to businesses and households throughout the United States. With over 500 megawatts of project experience, UGE is working daily to make renewable energy accessible and affordable for all. Visit us at www.ugei.com. For more information, contact UGE:

Nick Blitterswyk – investors@ugei.com or +1 917 720 5685.

About NOVA Infrastructure

Founded in 2018, NOVA Infrastructure (http://www.novainfra.com) is a value-added, middle market infrastructure investment firm focused on North America. NOVA seeks to make investments that pair the downside protection features of the infrastructure asset class with operationally focused, value-added upside strategies. NOVA targets investments in environmental services, transportation, energy / energy transition, and digital sectors.

Ellen DeGiusti – edegiusti@sloanepr.com.

Forward-looking statements and forward-looking information

Certain statements made herein, including statements relating to matters that are not historical facts and statements of the Company’s beliefs, intentions and expectations about developments, results and events which will or may occur in the future, constitute “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information relates to future events or future performance, reflect current expectations or beliefs regarding future events and is typically identified by words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “likely”, “may”, “plan”, “seek”, “should”, “will” and similar expressions suggesting future outcomes or statements regarding an outlook. Forward-looking information includes, but is not limited to, statements with respect to the Arrangement, including closing and various other steps to be completed in connection with the Arrangement.

Forward-looking information is based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such information. There can be no assurance that such information will prove to be accurate. Such information is based on numerous assumptions, including assumptions regarding the ability to complete the Arrangement on the contemplated terms or at all, that the conditions precedent to closing of the Arrangement can be satisfied, and assumptions regarding present and future business strategies, local and global economic conditions, and the environment in which the Company operates.

Although the Company believes that the forward-looking information in this news release is based on information and assumptions that are current, reasonable and complete, this information is by its nature subject to a number of factors, many of which are beyond the Company’s control, that could cause actual results to differ materially from management’s expectations and plans as set forth in such forward-looking information, including, without limitation, the following factors, many of which are beyond the Company’s control and the effects of which can be difficult to predict: (a) the possibility that the Arrangement will not be completed on the terms and conditions, or on the timing, currently contemplated, and that it may not be completed at all due to a failure to satisfy all conditions of closing necessary to complete the Arrangement or for other reasons; (b) the possibility of adverse reactions or changes in business relationships resulting from the announcement or completion of the Arrangement; (c) risks relating to the retention of key personnel during the interim period; (d) the possibility of litigation relating to the Arrangement; (e) risks related to the diversion of management’s attention from the Company’s ongoing business operations; (f) risks relating to the ability of the Purchaser to complete the Arrangement; and (g) other risks inherent to the Company’s business and/or factors beyond its control which could have a material adverse effect on the Company or the ability to consummate the Arrangement. The Company cautions that the foregoing list is not exhaustive of all possible factors that could impact the Company’s results.

Readers are cautioned not to place undue reliance on forward-looking information. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, which contribute to the possibility that the predicted outcomes will not occur. Events or circumstances could cause the Company’s actual results to differ materially from those estimated or projected and expressed in, or implied by, this forward-looking information.

Investors and others should carefully consider the factors and other uncertainties and potential events and should not rely on the Company’s forward-looking information to make decisions with respect to the Company. Furthermore, the forward-looking information contained herein are made as of the date of this document and the Company does not undertake any obligation to update or to revise any of the included forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law. All forward-looking information contained herein is expressly qualified by this cautionary statement.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

The post UGE International Ltd. Provides Update on Closing of Plan of Arrangement appeared first on UGE International.

UGE Announces Securityholder Approval of Going Private Transaction 31 Jul 2024, 9:13 pm

TORONTO, July 31, 2024 – UGE International Ltd. (TSXV: UGE) (OTCQB: UGEIF) (the “Company” or “UGE”) is pleased to announce that the shareholders of the Company (the “Shareholders”), holders of the Company’s compensation warrants (the “Warrantholders”), and holders of the Company’s convertible debentures (the “Debentureholders”, and collectively with the Shareholders and Warrantholders, the “Securityholders”) have approved the proposed plan of arrangement (the “Arrangement”) involving 1000896425 Ontario Ltd., an affiliate of NOVA Infrastructure Fund II, LP, at the annual general and special meeting of Shareholders and special meeting of Securityholders (the “Meeting”) held earlier today.

The special resolution approving the Arrangement (the “Arrangement Resolution”) was approved at the Meeting by 99.747% of the votes cast by Securityholders present or represented by proxy at the Meeting. To be effective, the Arrangement Resolution required the affirmative vote of at (a) at least two-thirds of the votes cast by the Shareholders present in person or represented by proxy and entitled to vote at the Meeting; (b) at least two-thirds of the votes cast by the Securityholders, voting together as a single class present in person or represented by proxy and entitled to vote at the Meeting (with the Warrantholders and Debentureholders voting on an as-converted basis) and (c) a simple majority of the votes cast by the Shareholders present in person or represented by proxy and entitled to vote at the Meeting, other than the Rolling Shareholders (defined below) and any other person required to be excluded for the purpose of such vote under Multilateral Instrument 61-101 – Protection of Minority Securityholders in Special Transactions. The Rolling Shareholders consist of certain management representatives and shareholders of the Company that will receive consideration other than the all-cash consideration payable pursuant to the Arrangement.

Additional details of the voting results will be included in a report of voting results to be filed on SEDAR+ (www.sedarplus.ca) under UGE’s issuer profile.

The Arrangement is expected to become effective on or about August 8, 2024, subject to, among other things, UGE obtaining a final order from the Ontario Superior Court of Justice (Commercial List) in respect of the Arrangement and the satisfaction or waiver of certain other customary closing conditions. It is expected that shortly after completion of the Arrangement, the common shares of the Company will be delisted from the TSX Venture Exchange (the “TSX-V”). Additional details about the Arrangement and the Arrangement Resolution can be found in the management information circular of UGE dated June 28, 2024, a copy of which is available on SEDAR+ (www.sedarplus.ca) under UGE’s issuer profile.

About UGE International Ltd.

UGE develops, owns, and operates community and commercial solar & battery storage projects. Our distributed energy solutions provide cheaper, cleaner energy to businesses and households throughout the United States. With over 500 megawatts of project experience, UGE is working daily to make renewable energy accessible and affordable for all. Visit us at www.ugei.com. For more information, contact UGE:

Nick Blitterswyk – investors@ugei.com or +1 917 720 5685.

About NOVA Infrastructure

Founded in 2018, NOVA Infrastructure (http://www.novainfra.com) is a value-added, middle market infrastructure investment firm focused on North America. NOVA seeks to make investments that pair the downside protection features of the infrastructure asset class with operationally focused, value-added upside strategies. NOVA targets investments in environmental services, transportation, energy / energy transition, and digital sectors.

Ellen DeGiusti- edegiusti@sloanepr.com

Forward-looking statements and forward-looking information

Certain statements made herein, including statements relating to matters that are not historical facts and statements of the Company’s beliefs, intentions and expectations about developments, results and events which will or may occur in the future, constitute “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information relates to future events or future performance, reflect current expectations or beliefs regarding future events and is typically identified by words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “likely”, “may”, “plan”, “seek”, “should”, “will” and similar expressions suggesting future outcomes or statements regarding an outlook. Forward-looking information and statements include, but are not limited to, information and statements regarding the timing and ability of UGE to implement the Arrangement (if at all); the timing and ability of UGE to obtain the final order (if at all); the ability of UGE and 1000896425 Ontario Ltd. to satisfy the conditions precedent to the completion of the Arrangement (if at all); and the timing to delist the common shares of UGE (if at all).

Forward-looking information is based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such information. There can be no assurance that such information will prove to be accurate. Such information is based on numerous assumptions, including assumptions regarding the ability to complete the Arrangement on the contemplated terms or at all, that the conditions precedent to closing of the Arrangement can be satisfied, and assumptions regarding present and future business strategies, local and global economic conditions, and the environment in which the Company operates.

Although the Company believes that the forward-looking information in this news release is based on information and assumptions that are current, reasonable and complete, this information is by its nature subject to a number of factors, many of which are beyond the Company’s control, that could cause actual results to differ materially from management’s expectations and plans as set forth in such forward-looking information, including, without limitation, the following factors, many of which are beyond the Company’s control and the effects of which can be difficult to predict: (a) the possibility that the Arrangement will not be completed on the terms and conditions, or on the timing, currently contemplated, and that it may not be completed at all due to a failure to obtain or satisfy, in a timely manner or otherwise, required shareholder and court approvals or satisfy other conditions of closing necessary to complete the Arrangement or for other reasons; (b) the possibility of adverse reactions or changes in business relationships resulting from the announcement or completion of the Arrangement; (c) risks relating to the retention of key personnel during the interim period; (d) the possibility of litigation relating to the Arrangement; (e) risks related to the diversion of management’s attention from the Company’s ongoing business operations; (f) risks relating to the ability of 1000896425 Ontario Ltd. to complete the Arrangement; and (g) other risks inherent to the Company’s business and/or factors beyond its control which could have a material adverse effect on the Company or the ability to consummate the Arrangement. The Company cautions that the foregoing list is not exhaustive of all possible factors that could impact the Company’s results.

Readers are cautioned not to place undue reliance on forward-looking information. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, which contribute to the possibility that the predicted outcomes will not occur. Events or circumstances could cause the Company’s actual results to differ materially from those estimated or projected and expressed in, or implied by, this forward-looking information.

Investors and others should carefully consider the foregoing factors and other uncertainties and potential events and should not rely on the Company’s forward-looking information to make decisions with respect to the Company. Furthermore, the forward-looking information contained herein are made as of the date of this document and the Company does not undertake any obligation to update or to revise any of the included forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law. All forward-looking information contained herein is expressly qualified by this cautionary statement.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

The post UGE Announces Securityholder Approval of Going Private Transaction appeared first on UGE International.

UGE Achieves Commercial Operation for Rooftop Community Solar Project in Staten Island, New York 15 Jul 2024, 8:46 pm

Toronto, Ontario–(Newsfile Corp. – July 16th, 2024) – UGE International Ltd. (TSXV: UGE) (OTCQB: UGEIF) (the “Company” or “UGE”), a leader in commercial and community solar, announces that its 510kW rooftop community solar project in Staten Island, New York reached commercial operation and has begun generating electricity.

UGE’s newest community solar project is built atop Expressway Plaza, a shopping center on Staten Island. At just over half a megawatt, the project will offset roughly 700 metric tons of CO2 emissions each year and will produce enough electricity to power approximately 140 homes.

Subscribers to the Expressway Plaza community solar project will save a minimum of 10% on their electricity bills. As electricity rates continue to rise across the country, these savings become increasingly meaningful for Americans looking for ways to save money in today’s inflationary environment.

The Expressway Plaza community solar project will join UGE’s Low-to-Moderate Income (LMI) program, meaning that at least 30% of the energy generated by the project will be reserved for LMI households. Strengthening renewable energy equity is one of UGE’s guiding goals; the Company’s stated target is for more than 25% of the off-take from its operational portfolio to serve LMI households by 2026.

Expressway Plaza is owned by Feldco, an East Coast-focused real estate developer.

“Feldco is a family-owned and operated business committed to sustainable construction and forging long-term relationships with the communities in which we operate,” said Greg Feldman, Partner and Vice President at Feldco. “By becoming a community solar host with UGE, we are advancing those commitments by providing energy cost savings and a source of clean energy to the community surrounding Expressway Plaza.”

Feldco will receive long-term lease payments in exchange for hosting the project. In addition, UGE covered the cost of a needed roof replacement on Expressway Plaza, ensuring the building remains structurally sound for the solar project’s lifetime of at least 22 years.

With the completion of this project, UGE’s operating portfolio now stands at 7.1MW. In addition to its operating portfolio, UGE has eight projects totaling 18.1MW in deployment and construction, the final phases of development.

UGE developed one of the very first rooftop community solar projects in New York City. Now, the project on Expressway Plaza is the tenth rooftop community solar project in metro New York City to join UGE’s operating portfolio. In addition, UGE has another two rooftop community solar projects in New York City currently under construction, both of which are projected to reach commercial operation early this fall.

About UGE

UGE develops, owns, and operates community and commercial solar & battery storage projects. Our distributed energy solutions provide cheaper, cleaner energy to businesses and households throughout the United States. With over 500 megawatts of project experience, we’re working daily to make renewable energy accessible and affordable for all.

For more information, contact UGE at: investors@ugei.com or +1 (917) 720-5685.

Forward-Looking Statements

Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties, certain of which are beyond the control of the Company. Forward-looking statements are frequently characterized by words such as “plan”, “continue”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “potential”, “proposed” and other similar words, or statements that certain events or conditions “may” or “will” occur. These statements are only predictions. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. Forward-looking statements include, but are not limited to, the anticipated use of proceeds, and the listing of the Green Debentures on the TSX Venture Exchange. The Company assumes no obligation to update forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

The post UGE Achieves Commercial Operation for Rooftop Community Solar Project in Staten Island, New York appeared first on UGE International.