Add your feed to SetSticker.com! Promote your sites and attract more customers. It costs only 100 EUROS per YEAR.

Pleasant surprises on every page! Discover new articles, displayed randomly throughout the site. Interesting content, always a click away

Simsol Software

Property Estimating, Claims Processing and Claims AnalyticsSimsol Executive’s Response to PIRC Cancellation 7 Jul 2021, 9:02 am

An Open Letter for the Insurance Industry about Transparency and Better Serving Insureds.

As a response to the insurance industry’s slow movement to standardize data, the Restoration Industry Association began a journey to solve this issue utilizing definitions, data standards, and various other protocols to allow insurance officials to exchange vital information thus enabling claim data to be shared more easily. The thought behind this valiant task being that if everyone involved in a claim would use the same format, information could be securely “shared” so that claims would not end up in a data warehouse in the middle of a theoretical desert. As a veteran of 30 plus years in the property claims world, Simsol is very much behind this effort. It has long been our belief that it is time we allowed transparency to reign. At the risk of dating myself, I always think of Brad Pitt’s anguished use of the plea “What’s in the BOX?!?!” in the movie ‘Se7en’ as a pretty accurate representation of the Insured’s state of mind while frantically tapping out random letters and numbers at the very worst times of their lives.

This effort is not new. Originally founded as an off-shoot of CIECA (Collision Industry Electronic Commerce Association), the PIRC (Property Insurance & Restoration Committee) was formed to…and I quote ‘…define business information passing between parties as it relates to the property restoration and related industries. We are asking for responses and feedback from the industry at large relative to the work the committee has done so far, and to emphasize the importance of continued work in this area. It is critical for the success of the work is an expanded participation (e.g. insurance carriers) can be recruited.’ Many years ago, Francis Postava, our CEO was involved in the first steps. There were weekly phone calls so that the committee could begin forming a standardized way of communication between both carriers and adjusting firms so that no matter which system was utilized, the data was able to flow freely and cut down the length of a claim settlement. There was an important meeting set for one of the largest insurer’s campuses and hopes were high.

The reports I have heard depict an extremely well-meaning group of people just trying to help the insured return more quickly to an as-before status. Unfortunately, no agreement was reached at that time. The main group urged for the hold-outs to see the bigger picture, but sadly it fell on deaf ears. Clearly, this effort would not be successful without the cooperation of the whole industry.

Tragically, the whole industry depended primarily on one estimating company. But that was then, this is now! I was so proud to represent Simsol at the weekly meetings! This was going to work, everyone is on board with helping the insured, right? Well, I sat and watched 4 people struggle to make some progressive movements with few carriers insight. There are three main estimating systems. I was there nearly every meeting. The next largest estimating system showed up occasionally and was generous enough to sporadically sponsor an event. The largest estimating system was conspicuous in its absence. I found this shocking as this company had publicly changed to embrace the rights of the insured. It was curious in that the point of pain was always centered in one area. In response, the PIRC attempted to gain support and understanding by launching a virtual meeting where folks would be encouraged to tell their stories. I was happy to help out by advertising on our socials and began writing a small speech to explain the problems. That meeting was abruptly canceled.

The next ray of hope was that our committees would team up at the upcoming RIA convention. Since it is held in my little corner of the world, I was certainly ready to speak to the group of people that were the most affected by having one company essentially in control, especially when that company seemed to operate through the kind of a favored nation of a system which made it very difficult for the smaller companies to compete. I was anxious to learn of upcoming plans of more favorable legislation and if there was any way we could help them, at least in one of the categories that we cover. Our company is in the midst of splitting our services so that we are able to better serve the various categories of the industry, however unbelievably, this was also canceled. In a déjà vu kind of situation, shortly thereafter the entire PIRC was shut down. No conferences would be held, be they virtual or traditional.

This was so sad to me because everyone had such good intentions. Naturally, the pandemic did not help this endeavor. When taking stock of what could have gone better, one word comes to mind: participation. In fact, don’t take my word for it. Here is the reason the committee meetings shut down, straight from the source, ‘Due to lack of industry participation, and complications of the COVID-19 pandemic, we have decided to cancel the PIRC and committee meetings for the foreseeable future.’ In my view, the pandemic was the ideal time to take stock of what we can do better to serve the policyholders. As an example, Simsol Suite (formerly Simsol Software) a claims management and estimating system provider certainly made sure that virtual adjusting could be attained and worked to better our own system.

As an older company, we began the adjusting business by chance. One brother happened to be a flood adjuster, hungry for the most claims and one was a computer programmer who worked two jobs. I enabled the company to run while holding my infant. My free time consisted of hand assembling handbooks, driving to beat the Fed Ex truck in the pouring rain, and insisting that ‘we must have crossed wires’ on the phone when my daughter was fussy while I was on the phone with a customer. As Simsol’s “team mom” I made sure everyone had clean laundry and hot meals. When we were hit directly by Hurricane Charley, it became very clear that better communication needed to be established for significant changes to be made. When I came back to Simsol after raising my child, I was frankly shocked to see the magnitude of problems that had yet to be solved in the insurance industry. I wish I was in a position to bring about positive change in the legislature and keep the insured at the forefront of the claims evolution.

I have said it before, and I’ll say it again. We, as the insurance industry, sell trust. To speak of the “insured” as if it doesn’t include all of us makes no sense to me. I remain hopeful that there can be change here, but it is a slow process. I had hoped that the PIRC would be a vehicle for that change and maybe someday it will. For now, the veil of obscurity is allowed to remain in place.

At Simsol, we aim to lift the veil and let transparency reign. But at the moment, hunger for change leaves me imploring again and again, “What’s in the box?!?”

Karen Palmer, COO

Simsol Suite

Ready to experience the Simsol difference?

Let us help you with all your professional estimating needs.

No Credit Card Required. 100% Risk-Free. Free Tech Support

The post Simsol Executive’s Response to PIRC Cancellation appeared first on Simsol Software.

Top InsurTech Companies: Simsol Software 22 Jun 2021, 7:27 pm

First Analysis’ Report on the Top Innovative InsurTech Companies: Simsol Software

June 22, 2021

Simsol Software is proud to be a part of the revolution of the InsurTech Industry. To be an effective leader of change in this movement, we must all stay on top of the trends in the automatization of the field to know where we can make positive impacts. In a recent report, Terry Kiwala from First Analysis profiles over thirty innovative companies driving this transformation – and Simsol has made the list.

Outlined in First Analysis’ report, “Simsol streamlines workflow and communications among managers, carriers, and adjusters, importing property characteristic macros and dynamically managing workflow. Its pricing database automates loss estimates by pricing materials based on local market demand. Third-party adjusters can manage photos and use Simsol’s sketching tools to develop comprehensive loss estimates. We view Simsol as an important innovator and efficiency enabler whose technology may be adopted by numerous other stakeholders to improve visibility into claims adjudication and the value of underlying collateral.”

“We couldn’t be more proud of our team at Simsol, and the new innovative product solutions for the Claims Processing Industry to be released soon.”, says Karen Palmer, COO of Simsol Software. “We can’t wait to share these new tools that will revolutionize the way companies improve their claims process and ultimately help their insureds.”

About Simsol Software

Simsol provides software solutions for all aspects of the claims life-cycle. Simsol’s suite of claims processing tools allow for a seamless claims experience from the first contact with the insured to closing to reporting on analytics. Since 1989, Simsol Software has been developing easy-to-use, stable, and affordable solutions for the property insurance and construction industry. As pioneers of computer estimating for property adjusters, Simsol was the first vendor to automate all of the most frequently used functions of property adjusting into a single software application. Learn more at www.simsol.com

About the Technology Transformation Outlined by First Analysis

Historically, the insurance industry has been characterized by manual processes, large agent-based sales forces, and slow, arbitrary and contentious claims processing (prompting the infamous industry acronym DDD: “deny, dispute, defend”). While the underlying insurance products are already highly profitable, carriers and administrators increasingly see an opportunity to boost profitability from underwriting and servicing policies by improving operational efficiency and accuracy.

Read the report to see how First Analysis created this Top InsurTech Innovator List:

The link above will redirect you to First Analysis’ website where you can fill out a form and receive your free copy.

About the Author:

Terry Kiwala is a vice president specializing in research and investment in software-as-a-service (SaaS) businesses, particularly in enterprise productivity applications. He is a thought leader in his sector, having authored widely read industry research. He uses his industry knowledge and expansive network to uncover promising investment opportunities and help companies navigate their strategic paths and accelerate growth. Prior to joining First Analysis in 2019, he was chief financial officer of Vokal, a software development company, senior vice president at Tribeca Flashpoint Media Arts Academy, and associate vice president at National-Louis University. Earlier, he was an investment banking analyst at Lehman Brothers. He earned a bachelor’s degree in economics and government from the University of Notre Dame.

He is a CFA charterholder.

The post Top InsurTech Companies: Simsol Software appeared first on Simsol Software.

Simsol is proud to announce our New Vice President of Development, Doug Goldberg. 18 May 2021, 8:30 pm

Simsol is proud to announce our New Vice President of Development, Doug Goldberg. At Simsol, we pride ourselves on promoting talent from within the organization. Doug started at Simsol as a Technical Support Representative in January of 2017.

In April 2019, Mr. Goldberg expressed interest in joining the development team, primarily working on front-end projects. His previous positions had given him the talent to supervise others and roadmap what he saw as the best way for the Simsol dev team to proceed.

In collaboration with Megan McAuliffe, acting CTO, he organized the entire development team to expand their skills in full-stack development through educational courses on the latest technologies. Doug’s enthusiasm and encouragement have served to impress upper management so much that they advanced his position to reflect his skill level. In November 2020, the decision was made by management to promote Mr. Goldberg as Simsol’s New Vice President of Development.

One of Doug’s most recent accomplishments is overseeing the New Claimswire Mapping tool. This served as a great first step in creating our claims portals. There will be several portals that will work together to support the new paradigm of property claims adjudication. This architecture has allowed Simsol to act agnostically, thus allowing for the carriers to choose any insurtech/estimating system for each claim. Mr. Goldberg brings a wealth of knowledge and experience in the latest development tools on the market.

Mr. Goldberg served in the US Army Reserves for six years and worked in signal operations at the MacDill Air Force Base in Tampa, FL. In 2010, he started learning software development and has continued to stay on top of the most latest technologies.

In his spare time, Doug enjoys basketball with friends as well as playing the guitar. His interest in boxing has spurred him into taking lessons and has just begun jiu-jitsu with a member of his team. This illustrates his understanding of the importance of teamwork even in his free time.

“Doug is a true asset to Simsol, and we’re looking forward to the continuing contributions he brings to our development team. Our upper management has been in the process of changing for several years and Doug and Megan have been incredibly helpful in bringing new ideas to change the claims paradigm. As an older company, it is of utmost importance that we are all focused on making the team more forward-thinking. Doug Goldberg, through his enthusiasm and initiatives, has encouraged our company to rise to new levels of excellence. We’ll soon be bringing these improvements to market,” according to Karen Palmer, COO of Simsol. “We’ve already seen concrete examples of Doug’s innovation and look forward to seeing what comes next from our new vice president.”

Ready to experience the Simsol difference?

Let us help you with all your professional estimating needs.

No Credit Card Required. 100% Risk-Free. Free Tech Support

The post Simsol is proud to announce our New Vice President of Development, Doug Goldberg. appeared first on Simsol Software.

2021 Updates for Simsol Software Now Available 20 Mar 2021, 5:45 pm

What’s New in Simsol Software?

We are excited to announce new updates for Simsol Software. Our Development and Quality Assurance Teams have been working hard to get these releases ready for you. The updates now available for download are Simsol’s Build 8.3.0.3, the 3rd Quarter Pricing Database, and the Insurance to Value (I2V) 2020 Database. The most significant changes to these updates include new Trade and Subtrade additions to allow for the separation of remediation actions, flood loss clean up, and PPE. We have also improved the ‘Water Did Not Enter’ field in the Preliminary Report wizard.

Simsol’s 8.3.0.3 Changes:

New Trade and Subtrade Additions

- Remediation, Flood loss Clean-Up, and Personal Protection Equipment (PPE) Trades and Subtrades have been added to allow for better specifications:

- Remediation activities are generally involved in fire losses or heavy water losses and in most flood losses. In flood losses, these occur after the initial flood loss clean-up of the soil or silt and debris carried in by the floodwaters.

- The PPE Subtrade will identify the PPE suits, gloves, and masks when added to an estimate separate from a combined scope (e.g., flood loss clean-up with PPE, which includes the PPE items in the unit pricing).

- We also added a labor Subtrade to each of the new trades. This will separate the addition of labor hours for carpenters, painters, masonry, roofing, and more. For example, if 10 hours of additional carpenter labor is added, it will now be separated on the detailed trade summary to reflect labor hours for the carpentry trade.

Improved the ‘Water Did Not Enter’ Field in Preliminary Report Wizards

Improved Installer and AutoUpdater Tools

Bundled 2020 Pricing in Simsol’s Standalone Installers

3rd Quarter Pricing Database Changes:

New Items:

- Flood clean-up with Personal Protection Equipment (PPE):

- Added 12” O.C. Roof Framing or Roofs with a Pitch Greater than 6/12

- Items added for 2×4, 2×6, 2×8, 2×10, and 2×12 framing

Pricing Fluctuations:

- Materials: +/-1%

- Equipment: +/-1%

- Roof & Floor Trusses: 5% to 7% increase

- Includes TJI, W Fink, and Gable End Scissor trusses

- Wall & Ceiling Assemblies: 8% to 15% increase

- Assemblies include framing, drywall, and insulation

- Cabinets: 8% to 15% increase in material costs

Insurance to Value (I2V) – 2020:

New 2020 Insurance to Value (I2V) Report Database sourced from Craftsman Publishing.

Ready to experience the Simsol difference?

Let us help you with all your professional estimating needs.

No Credit Card Required. 100% Risk-Free. Free Tech Support

The post 2021 Updates for Simsol Software Now Available appeared first on Simsol Software.

New Updates for Simsol Software Now Available 6 Aug 2020, 1:45 pm

What’s New in Simsol Software?

We are excited to announce new updates for Simsol Software. Our Development and Quality Assurance Teams have been working hard to get these releases ready for you. The updates now available for download are Simsol’s Build 8.3.0.3, the 3rd Quarter Pricing Database, and the Insurance to Value (I2V) 2020 Database. The most significant changes to these updates include new Trade and Subtrade additions to allow for the separation of remediation actions, flood loss clean up, and PPE. We have also improved the ‘Water Did Not Enter’ field in the Preliminary Report wizard.

Simsol’s 8.3.0.3 Changes:

New Trade and Subtrade Additions

- Remediation, Flood loss Clean-Up, and Personal Protection Equipment (PPE) Trades and Subtrades have been added to allow for better specifications:

- Remediation activities are generally involved in fire losses or heavy water losses and in most flood losses. In flood losses, these occur after the initial flood loss clean-up of the soil or silt and debris carried in by the floodwaters.

- The PPE Subtrade will identify the PPE suits, gloves, and masks when added to an estimate separate from a combined scope (e.g., flood loss clean-up with PPE, which includes the PPE items in the unit pricing).

- We also added a labor Subtrade to each of the new trades. This will separate the addition of labor hours for carpenters, painters, masonry, roofing, and more. For example, if 10 hours of additional carpenter labor is added, it will now be separated on the detailed trade summary to reflect labor hours for the carpentry trade.

Improved the ‘Water Did Not Enter’ Field in Preliminary Report Wizards

Improved Installer and AutoUpdater Tools

Bundled 2020 Pricing in Simsol’s Standalone Installers

3rd Quarter Pricing Database Changes:

New Items:

- Flood clean-up with Personal Protection Equipment (PPE):

- Added 12” O.C. Roof Framing or Roofs with a Pitch Greater than 6/12

- Items added for 2×4, 2×6, 2×8, 2×10, and 2×12 framing

Pricing Fluctuations:

- Materials: +/-1%

- Equipment: +/-1%

- Roof & Floor Trusses: 5% to 7% increase

- Includes TJI, W Fink, and Gable End Scissor trusses

- Wall & Ceiling Assemblies: 8% to 15% increase

- Assemblies include framing, drywall, and insulation

- Cabinets: 8% to 15% increase in material costs

Insurance to Value (I2V) – 2020:

New 2020 Insurance to Value (I2V) Report Database sourced from Craftsman Publishing.

Ready to experience the Simsol difference?

Let us help you with all your professional estimating needs.

No Credit Card Required. 100% Risk-Free. Free Tech Support

The post New Updates for Simsol Software Now Available appeared first on Simsol Software.

Hindsight is 2020 16 Jul 2020, 1:02 pm

In researching what weather trends may be forthcoming, our COO, Karen Palmer, came upon a report authored by Adam Smith of NOAA. Based on this report and the unprecedented set of circumstances that we have faced in 2020, Ms. Palmer took a long hard look at where Simsol Software has been and where we are headed.

Below you will find the findings of Ms. Palmer as well as the report by Mr. Adam Smith. It is with his kind permission we can share his report with you.

The post Hindsight is 2020 appeared first on Simsol Software.

9 Tips to Prevent Losing Property Insurance Claim Data 30 Apr 2020, 2:38 pm

As a claims adjuster, one of the worst things that can happen to you is losing property insurance claim data. When you have a plate full of tasks, the possibility of computer failures and making time for preventative maintenance tasks range from an afterthought to an inconvenience. However, computer crashes can happen to anyone at any time, and when they do, it takes your critical claim data with them. By establishing minimal maintenance habits it can save you from a disastrous data-jeopardizing computer crash in the future.

By applying the tips below, you can better prevent computer crashes from occurring so your data will remain safe, secure, and out of harm’s way.

Preventing a Computer Crash in the Field Adjusting World

1. Keep your Computer Dry and Clean

Face it – when working in the field there will be water, dirt, and moist areas. New tech has been better than ever at managing water; however, water is not a laptop’s friend. Keep your computer off of floorboards, and when you’re not in your car, put your laptop in a well-ventilated area. You can also keep a hand towel in your vehicle to wipe off dirty hands before entering data on your device

2. Use External and Cloud Storage

To keep your computer operating efficiently, you should keep at least 500 megabytes of unused disk space on your computer. This may mean needing to delete old or unnecessary files. Make sure to regularly rid your system of unwanted cookies and other files that could clutter up your computer and cause a crash. Consider using cloud-based storage for your claim data. Services like Google Drive or OneDrive are excellent options. SimDrive Claim Backup Utility for Simsol integrates with Google Drive to make this task effortless.

3. Use a computer with a Solid State Drive

When purchasing a new computer, consider spending a bit more for a solid-state drive (SSD). More traditional HDD’s consist of spinning platters with a read head, these mechanical parts can easily be damaged in transport. This can create an unsafe environment for your stored data. If you don’t have an SSD, be sure to defragment your computer on a regular schedule to clean up your drive and maintain fast processing speeds.

4. Update your Programs and Computer Regularly

Maintenance includes updating all antivirus software, operating versions and patches, and dusting to keep things running smoothly. Be sure to prevent claim loss in your Simsol program by excluding the program from scanning Simsol.

5. Use a Surge Protector

While it’s usually calm after the storm (hah), protect your motherboard from the damaging effects of power surges by using a surge protector when charging your devices. This prevention tip is inexpensive and easy to do but can save you from losing data and functioning devices.

6. Never open emails from an unknown source

A spam email can easily be the source of a computer virus that could harm your device and cause you to lose your property claim data. We know this is EXTREMELY difficult to do when in the field, and you have insured’s sending you documents left and right – however, the least you can do is double-check the sources of the emails and never click on anything that looks slightly suspicious. It’s better to ask the sender to resend a document, or to open it on an old unused device to prevent you from losing your current claim data.

7. Be mindful of the number of programs you’re running

Operating too many at a time could cause a system to overload and crash. Be sure to restart at least once a week, or whenever you notice your system lagging.

8. Be vigilant of warning signs

If you notice your computer moving slower than usual, freezing up, making new noises, or some other new occurrence, don’t ignore the change. Have your laptop looked at by a certified professional to rule out a potential drive crash or another device failure.

9. Save and back-up your work

Getting into this habit can save you time, the embarrassment of losing important personal or business data, and money you wouldn’t have lost if you had planned ahead. Consider using a platform built for your estimating software, like SimDrive for Simsol, to automatically back up your claim data to your Google Drive, it can also recover lost property claim data in the event of a computer crash.

Preparing for the worst

While these preventative tips can prolong your computer’s lifetime and reduce the possibility of a computer crash, it is also important to have a plan in place that you can turn to if a computer crash does occur. Prevention is always the best route to take, but it still does not eliminate the potential for a computer crash.

If a computer crash or other computer failure does occur, despite the steps you’ve taken, you will want to already have a plan in place that will allow you to restore your data. Protecting essential data from being lost forever by using a secure web-based storage facility could be the dividing line between business success and failure.

NOW AVAILABLE

Never Lose a Claim Again!

Automatically backups your Simsol Files to your Google Drive.

The post 9 Tips to Prevent Losing Property Insurance Claim Data appeared first on Simsol Software.

Introducing Simdrive: a New Claim Google Back-Up Solution 2 Apr 2020, 1:57 pm

Simdrive will automatically back-up Simsol claims to Google Drive.

We are proud to announce the release of our latest solution, Simdrive. Simdrive integrates Simsol’s Property Estimating Platform with Google Drive to automatically back-up claims to the Google Cloud.

Insurance carriers, claims adjusters, and restoration companies can now have peace of mind of never losing an estimate due to computer failure. Since Simsol is a computer-based software and not web-based, the estimates in Simsol are stored locally on the computer’s hard-drive. Before Simdrive, if a user were not diligent in backing up their claim data, computer hard-drive failure would result in total claim data loss. This problem is now solved with the addition of Simdrive. The new utility runs in the background to automatically and securely back-up Simsol claim files to Google Drive, as well as restore claim data from Google Drive.

“We created this solution based on the countless stories from our clients losing their estimates, and we knew it was up to us to create a solution to eliminating these unfortunate events. We looked at many options, but at the end of the day, integrating with Google Drive was the best choice”, started Frank Postava, CEO of Simsol Software.

Another reason we decided on integrating with Google Drive is that Google offers 15 GB of free storage. Simdrive is now available to all Simsol Property Estimating Software users.

The post Introducing Simdrive: a New Claim Google Back-Up Solution appeared first on Simsol Software.

Simsol Software Leverages Matterport Platform to Improve Accuracy of Property Estimates 27 Feb 2020, 5:34 pm

ORLANDO, Fla., February 27, 2020 (Newswire.com) – Simsol Software, developers of property repair and claims processing solutions, today announced its adoption of the Matterport spatial data platform to help estimators process claims faster and more accurately.

In an industry where measurements are often “squared off,” Simsol’s software and Matterport’s Cortex artificial intelligence computations will be used to quickly generate highly accurate property estimates. Insurance adjusters will be able to take digital measurements to validate the estimate and input notes using Mattertags within a Matterport 3D scan of the property. This allows for a three-dimensional and interactive approach to estimation.

“Simsol is committed to providing our clients with the most advanced insuretech solutions. We are thrilled to partner with Matterport, the leader in 3D data capture and AI, who shares our passion for providing the most accurate information to insurers, enabling a swift return to stability for our customers,” said Karen Palmer, COO of Simsol Software.

Simsol Software was one of the original pioneers of digital estimation for property adjusters and was the first to automate all of the most frequently used estimation functions into a single software application. Created by a veteran adjuster, it follows the workflows of the insurance estimating and claim adjusting processes. The company’s simple interface enables adjusters and contractors to deliver the most precise and centralized claims processing experience.

About Simsol Software

Simsol Software provides software solutions that enable seamless processing of insurance claims. Since 1989, the company has been developing easy-to-use, stable and affordable solutions for the property insurance and construction industries. As pioneers of digital estimating for adjusters, Simsol was the first to automate all of the most frequently used functions of property adjusting into a single software application. Learn more at simsol.com.

The post Simsol Software Leverages Matterport Platform to Improve Accuracy of Property Estimates appeared first on Simsol Software.

NEW Simsol 8.2 Build Release 22 Oct 2019, 3:45 pm

A brand new build of Simsol Property Estimating has just been released. This build focuses on software enhancements from suggestions contributed by our users.

New Mass Close Claim Functionality

You now have the ability to close all of your claims with just one-click. The improved ‘Close’ button can now mass-close your claims from the claims grid. This button will no longer lock your estimates. It will apply a Date Closed to all claims selected in the Claims Grid.

Preliminary Report Form Improvements

One of the improvements we made to the forms is the ability to change the ‘Date of Report’ Field manually. This field will now be able to be adjusted to accommodate re-submissions of older claim files. We also fixed the ‘Type of Basement’ radio option and the minor ‘Seasonal Residency’ issue, as well as other cosmetic changes.

Updated AutoUpdater Utility for Future Product

Something is coming soon! We’ve updated our AutoUpdater to accommodate our latest product: Simdrive. To learn more about our new product that’s coming soon. Check it out here.

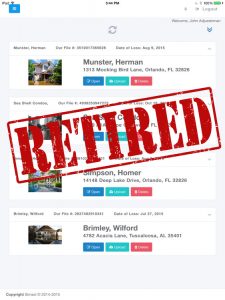

Phase One of Clipboard Sunset

We always want to provide our users with the most reliable and best tools on the market for estimating. While many of our users loved and used Clipboard, it has fallen short of our quality standards. Because of this, we have officially started Simsol Clipboard’s retirement. Clipboard is no longer available for download in app stores. In this release of Simsol, any account that has not already activated their Clipboard Account will no longer have the option to send or sync Clipboard claims. If you currently have Clipboard installed and enabled in Simsol, you will still be able to utilize the full functionality of Clipboard without issue. Our team is looking for alternative solutions.

Other Build enhancements Include:

- Fixed the Ability to Create and Store Template Form Groups

- Added Updated Quarterly Pricing Databases to Stand-Alone Installer

- Improved Claimswire Upload Screens

- Corrected Private Flood and ICC Forms

- Improvement for updating and installing fresh copies of Simsol

The post NEW Simsol 8.2 Build Release appeared first on Simsol Software.