Add your feed to SetSticker.com! Promote your sites and attract more customers. It costs only 100 EUROS per YEAR.

Pleasant surprises on every page! Discover new articles, displayed randomly throughout the site. Interesting content, always a click away

Bill White Homes

Bill & Mary White with Baird & Warner Real EstateToday’s Real Estate Market: The ‘Unicorns’ Have Galloped Off 1 Jun 2023, 3:31 pm

Comparing real estate metrics from one year to another can be challenging in a normal housing market. That’s due to possible variability in the market making the comparison less meaningful or accurate. Unpredictable events can have a significant impact on the circumstances and outcomes being compared.

Comparing this year’s numbers to the two ‘unicorn’ years we just experienced is almost worthless. By ‘unicorn,’ this is the less common definition of the word:

“Something that is greatly desired but difficult or impossible to find.”

The pandemic profoundly changed real estate over the last few years. The demand for a home of our own skyrocketed, and people needed a home office and big backyard.

- Waves of first-time and second-home buyers entered the market.

- Already low mortgage rates were driven to historic lows.

- The forbearance plan all but eliminated foreclosures.

- Home values reached appreciation levels never seen before.

It was a market that forever had been “greatly desired but difficult or impossible to find.” A ‘unicorn’ year.

Now, things are getting back to normal. The ‘unicorns’ have galloped off.

Comparing today’s market to those years makes no sense. Here are three examples:

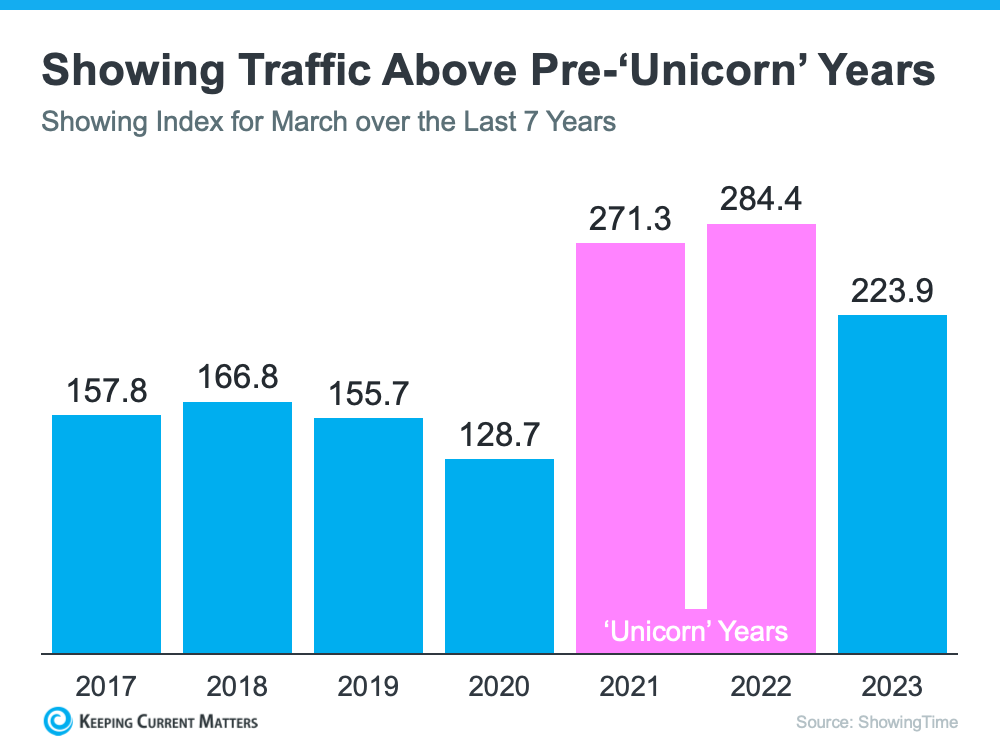

Buyer Demand

If you look at the headlines, you’d think there aren’t any buyers out there. We still sell over 10,000 houses a day in the United States. Of course, buyer demand is down from the two ‘unicorn’ years. But, according to ShowingTime, if we compare it to normal years (2017-2019), we can see that buyer activity is still strong (see graph below):

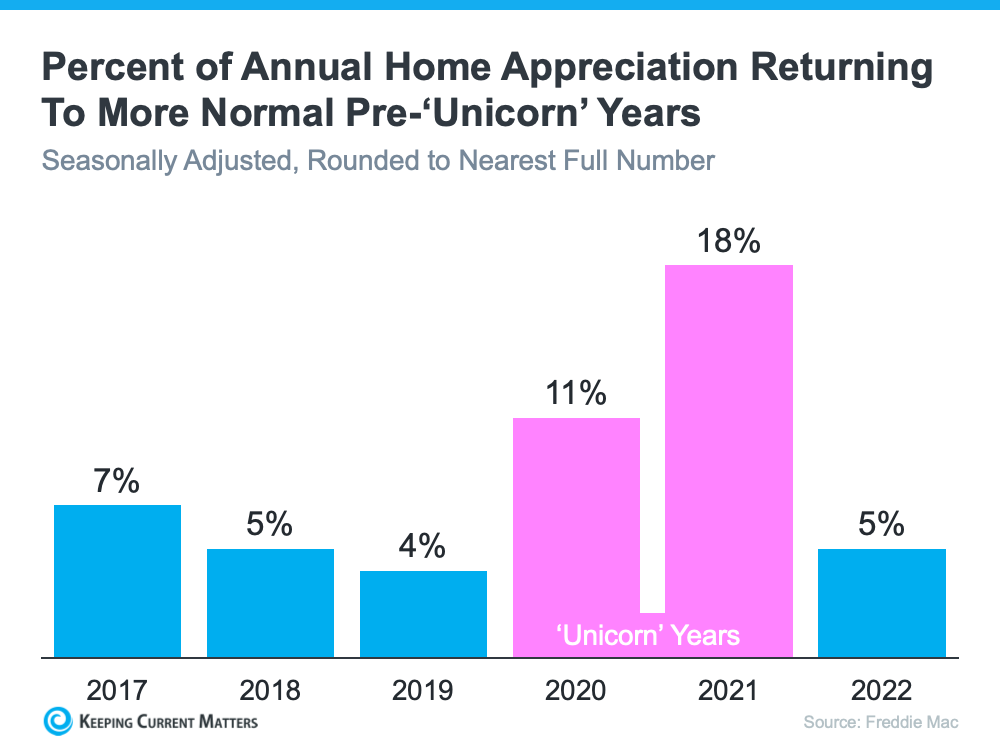

Home Prices

We can’t compare today’s home price increases to the last couple of years. According to Freddie Mac, 2020 and 2021 each had historic appreciation numbers. Here’s a graph also showing the more normal years (2017-2019):

We can see that we’re returning to more normal home value increases. There were several months of minimal depreciation in the second half of 2022. However, according to Fannie Mae, the market has returned to more normal appreciation in the first quarter of this year.

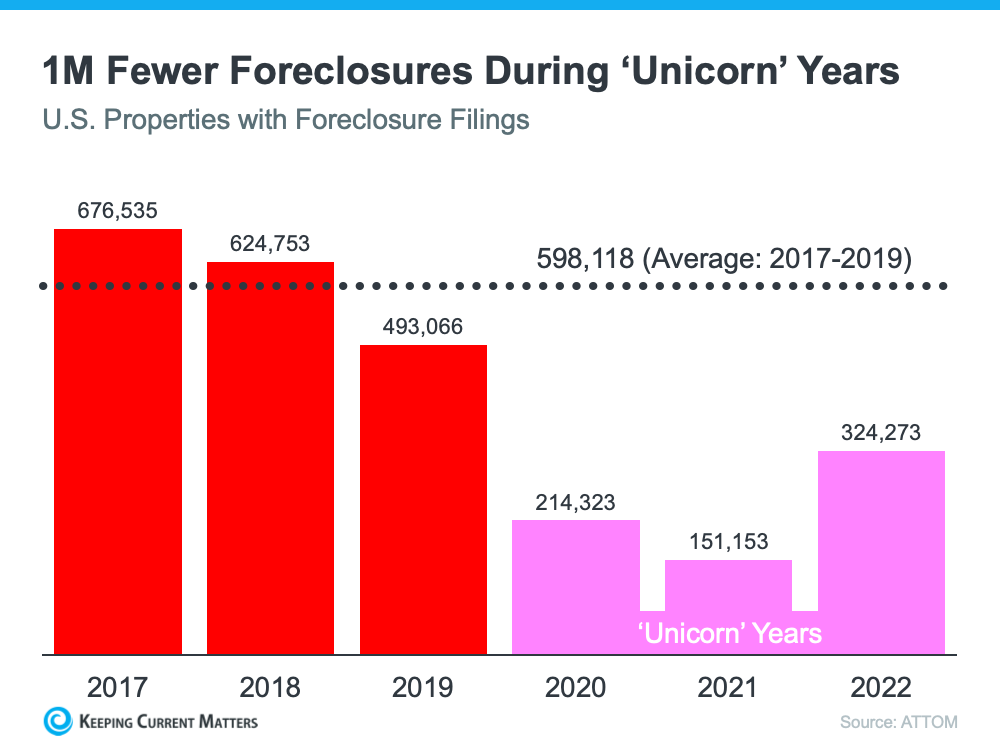

Foreclosures

There have already been some startling headlines about the percentage increases in foreclosure filings. Of course, the percentages will be up. They are increases over historically low foreclosure rates. Here’s a graph with information from ATTOM, a property data provider:

There will be an increase over the numbers of the last three years now that the moratorium on foreclosures has ended. There are homeowners who lose their home to foreclosure every year, and it’s heartbreaking for those families. But, if we put the current numbers into perspective, we’ll realize that we’re actually going back to the normal filings from 2017-2019.

Bottom Line

There will be very unsettling headlines around the housing market this year. Most will come from inappropriate comparisons to the ‘unicorn’ years. A real estate professional is a great resource to help you keep everything in proper perspective.

The post Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off appeared first on Bill White Homes.

Three Things to Do Before Selling Your Home 25 May 2023, 3:48 pm

Naperville Houses for Sale – 3 Things to Do Before Selling Your Home

The time has come: you and your family have outgrown your current place, and are looking for something a little bit larger to call home. Before you list your property among the other Naperville houses for sale, there are some things you can do to make it stand out among the rest. Here are three tasks that you can do before putting the “For Sale” sign in your front lawn to make your place appeal to potential buyers.

Update your landscaping – One of the biggest things that grabs someone’s attention when looking at a home is the curb appeal and landscaping. You could have the most beautiful building when it comes to Naperville houses for sale, but if your landscaping and exterior needs work it could cost you a closing. One of the best things you can do before putting your home on the market is to update and clean up your landscaping. It may seem like a minor detail, but your home’s exterior is the first thing a potential buyer sees – so make sure it looks sharp.

Get rid of the personalization – While you may think your home’s vintage-looking décor adds to its personality, think again. Removing your personal touch of décor and flair that your home has can help it stand out among the other Naperville houses for sale on the market. Potential buyers like to visualize their style when walking through your home, so clearing the space of anything that may cloud that could help you sell. Start by repainting with neutral colors and decluttering the home of anything unnecessary to help give the person looking at your home a blank slate.

When in doubt, clean it out – This phrase about cleaning should be the standard you hold yourself to when getting ready to sell your home. Not only does this rule apply to the inside of your home, but the exterior of it as well. Along with personalized touches to your home, clutter also clouds a potential buyer’s vision of how they could see themselves living there. Additionally, cleaning things out and making more room your home shows the person looking at it how large space is currently.

If you’re looking to list or look at Naperville houses for sale, let us be your guide at Bill White Homes. Contact us for more information regarding buying or selling a new home in the Naperville area here today.

The post Three Things to Do Before Selling Your Home appeared first on Bill White Homes.

Is Homeownership Still Considered Part of the American Dream? 25 May 2023, 3:44 pm

Since the birth of our nation, homeownership has always been considered a major piece of the American Dream. As Frederick Peters reports in Forbes:

“The idea of a place of one’s own drives the American story. We became a nation out of a desire to slip the bonds of Europe, which was still in many respects a collection of feudal societies. Old rich families, or the church, owned all the land and, with few exceptions, everyone else was a tenant. The magic of America lay not only in its sense of opportunity but also in the belief that life could in every way be shaped by the individual. People traveled here not just for religious freedom, but because in America anything seemed possible.”

Additionally, a research paper released just prior to the shelter-in-place orders issued last year concludes:

“Homeownership is undeniably the cornerstone of the American Dream and is inseparable from our national ethos that, through hard work, every American should have opportunities for prosperity and success. It is the stability and wealth creation that homeownership provides that represents the primary mechanism through which many American families are able to achieve upward socio-economic mobility and greater opportunities for their children.”

Has the past year changed the American view on homeownership?

Definitely not. A survey of prospective homebuyers released by realtor.com last week reveals that becoming a homeowner is still the main reason this year’s first-time homebuyers want to purchase a home. When asked why they want to buy, three of the top four responses center on the financial benefits of owning a home. The top four reasons for buying are:

59% – “I want to be a homeowner”

33% – “I want to live in a space that I can invest in improving”

31% – “I need more space”

22% – “I want to build equity”

Millennials believe most strongly in homeownership.

The survey also reports that 62% of millennials say a desire to be a homeowner is the main reason they’re buying a home. This contradicts the thinking of some experts who had believed millennials were going to be the first “renter generation” in our nation’s history.

While reporting on the survey, George Ratiu, Senior Economist at realtor.com, said:

“Americans, even millennials who many thought would never buy, have a strong preference for homeownership for the same reasons many generations before them have — to invest in a place of their own and in their communities and to build a solid financial foundation for themselves and their families.”

Odeta Kushi, Deputy Chief Economist for First American, also addresses millennial homeownership:

“Millennials have delayed marriage and having children in favor of investing in education, pushing marriage and family formation to their early-to-mid thirties, compared with previous generations, who primarily made these lifestyle choices in their twenties…Delayed lifestyle choices delay the desire for homeownership.”

Kushi goes on to explain:

“As more millennials get married and form families, millennials remain poised to transform the housing market. In fact, the housing market is already experiencing the earliest gusts of the tailwind.”

Bottom Line

As it always has been and very likely always will be, homeownership continues to be a major component in every generation’s pursuit of the American Dream.

The post Is Homeownership Still Considered Part of the American Dream? appeared first on Bill White Homes.

Wondering What’s Going on with Home Prices? 20 Feb 2023, 4:42 pm

The recent changes in home prices are top of mind for many as the housing market begins gearing up for spring. It can be hard to navigate misleading headlines and confusing data, so here’s what you should know about today’s home prices.

Local price trends still vary by market. But looking at national data, Nataliya Polkovnichenko, Ph.D., Supervisory Economist at the Federal Housing Finance Agency (FHFA), explains:

“U.S. house prices were largely unchanged in the last four months and remained near the peak levels reached over the summer of 2022. While higher mortgage rates have suppressed demand, low inventories of homes for sale have helped maintain relatively flat house prices.”

Month-over-month home price changes can be seen in the chart below. The data also shows that price depreciation peaked around August. Since then, any depreciation has been even milder. In other words, today’s home prices aren’t in a freefall.

Wondering What’s Going on with Home Prices? | Simplifying The Market

What Does This Mean for You?

If you currently own your house, you may be concerned about even the smallest decline in prices. But keep in mind how much home values grew over the last few years. Compared to that growth, any declines we’re seeing nationally are likely to be minimal. Selma Hepp, Chief Economist at CoreLogic, shares:

“. . . while prices continued to fall from November, the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring’s peak.”

It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the home prices in your area if you’re planning to make a move this spring.

Bottom Line

To understand what’s going on with home prices in your market and how they could impact your goals, contact us today!

The post Wondering What’s Going on with Home Prices? appeared first on Bill White Homes.

Why it makes sense to move before spring 26 Jan 2023, 3:56 pm

Spring is usually the busiest season in the housing market. Many buyers wait until then to make their move, believing it’s the best time to find a home. However, that isn’t always the case when you factor in the competition you could face with other buyers at that time of year. If you’re ready to buy a home, here’s why it makes sense to move before the spring market picks up.

Spring Should Bring a Wave of Buyers to the Market

In most years, the housing market goes through predictable seasonal trends in activity. Winter is typically a quiet point in the year, while spring sees a surge of buyers begin their search. And experts project that this year will be no exception.

Right now, buyer demand is low due to a combination of normal seasonal trends and a reaction to last year’s rise in mortgage rates. But rates have started to come down since last November, which has more and more potential buyers planning to jump into the market. That means right now is a sweet spot if you’re in a good position to buy, before more buyers reappear. Affordability is beginning to improve, but demand is still low — for now. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), shares:

“. . . expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.”

If you’re ready to buy a home, right now is the best time to do so before your competition grows and more buyers enter the market.

Today’s Sellers Are Motivated

Low demand from buyers often means sellers are more motivated to work with you, and that can set you up to buy a home on your terms. In fact, sellers have been more willing to negotiate this winter because there are fewer buyers in the market. According to a recent article from Forbes:

“. . . sellers gave concessions to buyers in 41.9% of home sales in the fourth quarter of last year.”

But keep in mind, the advantages buyers have this winter won’t last forever. The competition you face could be greater if you wait until spring to make a move, and increased buyer demand means sellers will have less motivation to negotiate with you. Be sure to work with a trusted real estate professional to learn what you can expect in your local market right now.

Bottom Line

If you’re in a position to buy a home, it may make sense to move before spring. Working with your team of expert real estate advisors is the best way to learn about the current market and what it means for you. Connect with a professional today to determine the best plan to achieve your homebuying goals.

The post Why it makes sense to move before spring appeared first on Bill White Homes.

Preapproval in 2023…what you need to know 21 Jan 2023, 9:43 pm

One of the first steps in your home-buying journey is getting pre-approved. To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you. Business Insider explains:

“In a preapproval [sic], the lender tells you which types of loans you may be eligible to take out, how much you may be approved to borrow, and what your rate could be.”

Basically, pre-approval gives you critical information about the home-buying process that’ll help you understand your options and what you may be able to borrow.

How does it work? As part of the pre-approval process, a lender will look at your finances to determine what they’d be willing to loan you. From there, your lender will give you a pre-approval letter to help you understand how much money you can borrow. That can make it easier when you set out to search for homes because you’ll know your overall numbers. And with higher mortgage rates impacting affordability for many buyers today, a solid understanding of your numbers is even more important.

Pre-Approval Helps Show You’re a Serious Buyer

Another added benefit is pre-approval can help a seller feel more confident in your offer because it shows you’re serious about buying their house. A recent article from Forbes notes:

“From the seller’s perspective, a preapproval [sic] letter from a reputable local lender often can make the difference between accepting and rejecting an offer.”

This goes to show, even though you may not face the intense bidding wars you saw if you tried to buy during the pandemic, pre-approval is still an important part of making a strong offer. In fact, Christy Bieber, Personal Finance Writer at The Motley Fool explains it may be the most important part of making an offer:

“Pre-approval maximizes the chances you’ll be able to actually close the deal – and sellers want to see that.

The fact that a pre-approval gives you a better chance of getting your offer accepted is undoubtedly the most important reason to complete this step . . .”

Bottom Line

Getting pre-approved is an important first step toward buying a home. It lets you know what you can borrow and shows sellers you’re serious about purchasing their home. Connect with a local real estate professional and a trusted lender so you have the tools you need to purchase a home in today’s market.

The post Preapproval in 2023…what you need to know appeared first on Bill White Homes.

Confused About What’s Going on in the Housing Market? Lean on a Professional. 27 Dec 2022, 5:28 pm

If you’re thinking about buying or selling a home, you probably want to know what’s really happening with home prices, mortgage rates, housing supply, and more. That’s not an easy task considering how sensationalized headlines are today. Jay Thompson, Real Estate Industry Consultant, explains:

“Housing market headlines are everywhere. Many are quite sensational, ending with exclamation points or predicting impending doom for the industry. Clickbait, the sensationalizing of headlines and content, has been an issue since the dawn of the internet, and housing news is not immune to it.”

Unfortunately, when information in the media isn’t clear, it can generate a lot of fear and uncertainty in the market. As Jason Lewris, Cofounder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

But it doesn’t have to be that way. Buying or selling a home is a big decision, and it should be one you feel confident making. To help you separate fact from fiction and get the answers you need, lean on a local real estate advisor.

A trusted expert is your best resource to understand what’s happening at the national and local levels. They’ll be able to debunk the headlines using data you can trust. And using their in-depth knowledge of the industry, they’ll provide context so you know how current trends compare to the normal ebbs and flows in the industry, historical data, and more.

Then, to make sure you have the full picture, they’ll tell you if your local area is following the national trend or if they’re seeing something different in your market. Together, you’ll use all of that information to make the best possible decision for you.

After all, making a move is a potentially life-changing milestone. It should be something you feel ready for and excited about. And that’s where an agent comes in.

Bottom Line

If you have questions about the headlines or what’s happening in the housing market today, connect with a real estate professional for expert insights and advice.

The post Confused About What’s Going on in the Housing Market? Lean on a Professional. appeared first on Bill White Homes.

Mistakes to Avoid During Your Home Inspection 24 Oct 2022, 5:33 pm

Before buying a home, you need to make sure it’s not going to fall apart days after you move in. The first way to do this is to walk through a potential home. The most reliable method, however, is to have a home inspection. After all, a walkthrough can be quick and unreliable, while bringing in a professional is trustworthy. However, there are some mistakes you can make even when it comes to home inspections. And when it comes to making sure a potential home is safe, you need to be specific. So, to help you out, we’ve put together a list of mistakes to avoid during your home inspection, and we hope you find it helpful.

Not looking into the inspector

One of the mistakes to avoid during your home inspection is neglecting to research your inspector before hiring them. Just like with any profession, some inspectors are much worse than others. That can be due to a lack of experience or the wrong inspector. Either way, you shouldn’t take any chances regarding your and your home’s safety. Take the time to look into your inspector’s work experience; check if there were problems or complaints about their work. If you spot a few too many issues, you should probably consider a different home inspector. Remember, this is something you shouldn’t take any risks with, so be thorough. Additionally, when it comes to the home itself, you should look into how to know you’ve found your dream house. After all, that’s not something that happens often, so pay attention when looking.

One of the mistakes to avoid during your home inspection is not doing a background check on the inspector.

Refusing to get a presale inspection

On the flip side, if you’re selling the home, not getting an inspection before selling it can be a big mistake. That is because buyers usually get a home inspection done to ensure no issues are present. And if there are issues, buyers tend to give up on the property, which isn’t good for you. So, getting a presale inspection allows you to fix potential problems ahead of time, ensuring buyers don’t lose interest. Additionally, if you do this before listing the home, you could get away with listing the house for a higher price. All in all, getting a presale home inspection only benefits you as a seller. And if you’re buying and selling at the same time, consider some useful tips for buying and selling a house at the same time.

Not being present for the inspection

Being present for the home inspection has a lot of benefits for you. Firstly, you get to see the problems for yourself, if there are any. Second, you can ask your inspector as many questions about the home as you like. Home inspectors will often take the time to explain everything they’ve seen to homeowners if they’re present for the inspection. Also, reading the inspection report isn’t enough to give you a good idea of the situation. So, getting to see it in person is the best call, especially if you’re buying a home. That said, inspections can take quite a bit of time, so make sure to set aside the time. Additionally, make sure to plan for your move; experts from helixmoveva.com note that planning a move can take a lot of time, and you should be prepared for it ahead of time.

Being present during the home inspection has a lot of benefits.

Not preparing the home before the inspection

Another one of the mistakes to avoid during your home inspection which sellers make is not preparing the home ahead of time. The last thing you want is for your inspector to have to empty a closet to get into the attic. Ensure the home inspector has easy access to the house before arriving. Home inspections last a while anyway, so ensure you clear out everything so your home inspector doesn’t have to spend extra time just trying to get somewhere. Unlock the utility closet, shed, or basement, and make sure all access points are usable. Your home inspector will appreciate it, and you will save time. Also, when looking into buying a new home, consider the neighborhood amenities to look for when buying a home. You want to make sure your new home has everything you need.

Not reading the inspection report

Even if you’re present for the home inspection, you should take the time to read the inspection reports. Although your home inspector should verbally explain all the issues they find, reading through the report is still an excellent idea. There could be something they forgot to mention in the report, and you might as well read through it since you paid for it. Additionally, you can use the report when hiring experts to do repairs, as you can give them detailed descriptions of the problems. All in all, even if you’re sure you understood everything regarding the inspection, take the time to read the report anyway. As we already mentioned, the safety of your home isn’t something you should take chances with. So, ensuring nothing got glossed over is vital after any home inspection.

Once you receive the report, make sure to read through it.

Mistakes to avoid during your home inspection – wrap up

There are a lot of mistakes one can make when getting a home inspection. And this can be not nice since your home’s safety should always be taken seriously, and you can’t afford to take any chances with it. So, being there in person and asking specific questions is very important, as well as reading the report afterward. If you’re the one selling the home, remember that there are a lot of benefits to getting a home inspection done before listing the home. We hope this list of mistakes to avoid during your home inspection helps you, and we wish you a good day.

Photos used from Pexels

The post Mistakes to Avoid During Your Home Inspection appeared first on Bill White Homes.

6 Tips for Making Your Investment Property Appeal to Renters 13 Sep 2022, 3:10 pm

After your first investment property purchase, you may be eager to get it on the market and available to rent. However, you will benefit from taking the time to make the necessary changes that will add value to the home and the renter’s experience. Consider these tips to make your property appeal to more renters.

Ready to purchase a Naperville investment property? Reach out to Bill White Homes for exceptional real estate service!

1. Prioritize Repairs

Most homes need at least a few small repairs after purchase. Even a simple paint job can make the entire place look different. You can DIY something that simple, but don’t be apprehensive about hiring someone to do repairs properly. It’s much easier to get them done before someone moves in. You can also avoid complaints and costly maintenance requests if you get the job done right the first time around.

2. Make Valuable Renovations

Think about changes you can make to the home that will add value and allow you to increase the monthly rent. For example, research shows that outdoor living space, open floor plans, and green appliances are among the top things renters look for in a home. Take the time to make the outdoor area as nice as the inside. You can add a simple patio to the backyard with plenty of space for furniture. Upgrade the kitchen appliances and remodel the bathroom to include more modern fixtures. Even small changes, such as replacing the carpet can add significant value.

3. Market Effectively

Marketing is an important component for any real estate investor. One simple thing you can do is create a PDF to showcase your property and use it to email interested renters. You can even use a PDF editor online to make changes to documents and drawings as you make upgrades. Just upload the file to the website and make the changes. Then you can download and share. Hire a professional web developer to create a website for your company as well. That way you can show all your properties in one place. After your first investment property purchase, you may be eager to get it on the market and available to rent. However, you will benefit from taking the time to make the necessary changes that will add value to the home and the renter’s experience. Consider these tips to make your property appeal to more renters.

4. Register Your Business

As a rental property owner, your business now is to cater to the needs of the property and the tenant. However, things can go wrong. Protect yourself and your assets from possible liability lawsuits by registering your company as a limited liability company. An LLC provides liability protection, and you can use the company name on the deed for your property. Hire a lawyer to complete the registration process for you, or you can do it online at a significantly lower price.

5. Hire a Property Manager

A good property manager will handle all the tasks a landlord would handle. They will ensure you have well-vetted tenants, make all the arrangements for rent collection, handle any issues with default payments, and schedule maintenance staff. Be sure to find someone you trust, or you can hire an established company to act as a property manager for you.

6. Focus on Amenities

You can add value to the rent by including amenities. It can be as big as installing a swimming pool or as small as including a microwave. If your property is in a high-demand area for business travelers, consider furnishing the apartment. Then you can market it to corporations.

Once you have the home ready and the renters are moved in, your job changes. Being a good landlord requires patience and sometimes empathy. Treat your tenants with respect, and they will likely return the favor.

The post 6 Tips for Making Your Investment Property Appeal to Renters appeared first on Bill White Homes.

How to Know You’ve Found Your Dream House 23 Aug 2022, 4:34 pm

A house hunt requires lots of time and patience. You need to do research, inspect neighborhoods, and prospect the market. Also, you need to make compromises in some cases and become a great negotiator. And when you do find a great home, you still may wonder if it is THE ONE. But don’t worry! It’s not unusual for buyers to ask themselves such a question. After all, you are investing in a house where you will raise a family or retire, so it is a big decision. You must ensure that you are making the right choice and avoid buyer’s remorse. As a result, we want to help you in your quest for your dream house and show you how to know when you have found it. So keep reading to see how you can tell if you have found your future home.

You feel good about it

Do you know that sensation you get when you enter a house, and it simply seems right? That’s your gut feeling telling you that you found your dream house. It may hit you as soon as you set eyes on the property or open the front door. It can even happen when your realtor is talking to you about the house you are about to view. The feeling sticks to you further, and you get excited just thinking about the possibility of owning that house. Additionally, you want to show the home to all your friends and family and move into it immediately. And that is what we would call a perfect match.

So if a house you see makes you feel happy, trust your instinct. Of course, do not let it blind you and insist on seeing the house at least once more before making a decision. However, the fact that you get so excited is a great sign.

The price fits your budget

Unfortunately, it happens very often that the house you were dreaming of is way out of your budget. That means that you need to compromise and lower your expectations. However, just because you are looking at homes in a lower price range does not rule out the possibility of finding your dream home. Buying a less expensive, maybe older, house and then renovating it as needed could also be a great option. As a result, don’t lose your head, and don’t go bankrupt just to buy a house. Keep in mind that, in addition to the cost of the home, you will need to prepare for additional expenses. Property taxes, bills, insurance, closing fees, and house maintenance are a few examples. Instead, set a budget, be realistic, and you won’t be disappointed. In reality, you will be much happier when you find the ideal home that fits within your budget.

It fits your checklist

You are upsizing, and the property you are looking at has that one additional bedroom you need? You are looking for a home to retire to, and this one has a garden where you can take care of your beloved flowers? Then you might just have found your dream house! How to be a hundred percent sure? Well, before you begin house hunting, make a list of everything you want in your future home. Write down the number of bedrooms you need, bathrooms, and if you would like a laundry room or a garage. In addition, think of the features that are not mandatory but would make you happy. For example, a deck or porch, a yard, a pool, or an open floor kitchen are all realistic wishes. If most of them check your list, you have just found a great property.

You already imagine living in the house

If you have already decided on the colors for the walls and visualized what decorations you would put in each room, you have found your match. Also, if every room already has a purpose, and you can imagine your little ones playing in the yard, there is no doubt about it. You can make an offer and start packing your bags for the relocation. There is no better sign that lets you know you have found your dream house than already imagining yourself living there. However, if you want to settle in stress-free when the time comes, consider moving and hiring residential movers to help you with the relocation. With professional assistance, you can be in your new house and decorate the rooms in no time.

The house passes the home inspection

Besides checking the points listed above, your future house must pass a home inspection. You may be thrilled about the house, but your excitement level will decrease when you discover it has issues. And even if you are prepared to make small compromises here and there, some problems may be too significant to overlook. Therefore, never make an offer before asking for a home inspection. That will save you a lot of money, time, and disappointment in the future. However, the moment your potential home passes the home inspection, you can continue with your plans undisturbed.

You have confirmation from an expert.

There is no better partner you would want to have on a house hunt than a reputable real estate broker. A professional not only helps you in finding your dream house but also works hard to get you the best deal possible for it. They have the expertise and ability to spot a fantastic property when they see one. At the same time, they can spot when something is not quite right with other homes. Therefore, if you want to know for sure that you have found your dream house, choose to work with a professional. It’s safer, less stressful, and a lot of times cheaper.

In conclusion

If you find a property that checks all the points listed in this article, there is only one thing left for us to say: congratulations! You’ve just found your dream house. We wish you many happy memories in your new home and long and happy life.

Images used:

https://unsplash.com/photos/178j8tJrNlc

https://www.pexels.com/photo/woman-in-brown-suit-standing-beside-woman-in-gray-blazer-7642197/

https://www.pexels.com/photo/man-showing-a-blueprint-to-a-couple-7641859/

https://www.pexels.com/photo/a-man-checking-the-floor-of-the-house-8293746/

The post How to Know You’ve Found Your Dream House appeared first on Bill White Homes.