Add your feed to SetSticker.com! Promote your sites and attract more customers. It costs only 100 EUROS per YEAR.

Pleasant surprises on every page! Discover new articles, displayed randomly throughout the site. Interesting content, always a click away

Business Radar

Know your business, 360°Adverse Media Screening and AML Compliance: What Financial Institutions Need to Know 11 Apr 2025, 3:34 pm

For financial institutions, one of the key responsibilities today is anti-money laundering (AML) compliance. Criminal networks are evolving faster than ever – moving vast sums across borders in seconds – and regulators are tightening expectations in response. In this environment, financial institutions can’t afford outdated tools.

One of the most important tools for this process is adverse media screening, also called negative news screening. This process involves using artificial intelligence or manual searches to identify media coverage that signals reputational, financial or regulatory risk related to clients or third parties.

What is Adverse Media Screening – and Why It Matters

At its core, adverse media screening involves monitoring a wide range of unstructured data – news sites, official papers, public records – to flag links to financial crimes, corruption, fraud, or other reputational red flags. It can also reveal information on bankruptcies, sanctions, or organized crime.

While traditional compliance tools rely on structured data like sanction lists, adverse media screening expands the view. With AI-powered tools, institutions gain the ability to scan news in real-time, filter out noise, and surface relevant risks – before they become costly problems.

When integrated into onboarding and monitoring workflows, it supports a more dynamic, risk-based approach that aligns with evolving regulatory expectations, resulting in faster reviews and fewer costly surprises.

The Pitfalls of Manual Screening

Despite spending over $200 billion a year on compliance, the global financial industry continues to fall behind in the fight against money laundering. Criminal networks are evolving faster than most institutions’ AML systems can detect them, often by using the very technologies compliance teams haven’t yet adopted. At the same time, regulators are tightening expectations, and reputational risks are rising. Many institutions still rely on slow, manual processes to identify risk. This comes with various challenges.

- There is a tremendous amount of data to be found on the internet. At any given moment, billions of bits of data are being published online, and processing those manually is nearly impossible.

- Another challenge with a manual process is false positives. For example, common names of either companies or people can mislead searchers. Once you find a source, it’s important to double check that you have the right entity. AI can do this in seconds.

- Language barriers can pose challenges too. No human knows all the languages on the planet. Even if you know the major languages, you could still miss languages or dialects where the subject of your search may have hidden negative media. This challenge can easily be overcome with Business Radar, which scans local and mainstream adverse media sources in over 100 languages.

- Manual checks require significant investments in time and labor. Employees are an expensive resource, requiring the skills and time to Google clients, potential clients and donors thoroughly. This also takes what is often a well-trained staff and diverts them from other critical tasks that could help prevent money laundering.

Manual processes simply can’t keep up with the volume or complexity of today’s regulatory demands. That’s why adverse media screening tools are now considered essential.

The Benefits of Automated Adverse Media Screening

Automated systems not only meet but often exceed current adverse media screening guidelines. They enable teams to scale their efforts with speed and accuracy.

Using artificial intelligence accelerates the screening process. Not only can it process enormous amounts of data in a very short period, but it can also conduct real-time continuous monitoring once the initial investigation is completed.

Advanced algorithms reduce false positives and focus attention on genuine risks. This significantly improves the accuracy of the results you receive.

Many automated systems can monitor activity in many languages; they can analyze a much wider range of sources than a human team would be able to.

By automating adverse media screening, you can allocate AML resources more effectively and focus your team on analysis rather than data collection.

Instead of spending hours searching, your compliance team can spend time on what matters – analysis and decision-making.

What to look for in an Adverse Media Screening Provider

Not all solutions are created equal. To avoid costly mistakes, focus on platforms built for financial institutions.

- Choose a provider with proven industry expertise.

Start with experience. Your screening partner should have deep AML and KYC expertise and a clear understanding of the regulatory demands facing financial institutions. That means more than just building technology; it requires a track record of applying it in high-stakes environments like banking, insurance, and advisory services. Business Radar, for example, supports organizations such as Deloitte, AIG, and other leading institutions, bringing firsthand insight into the challenges compliance teams face and what it takes to confidently meet evolving standards.

- Ensure comprehensive global coverage.

Risk doesn’t respect borders. Your screening provider must offer broad international coverage of news and compliance monitoring, but that alone isn’t enough. What matters is the ability to capture both global headlines and regional or local sources, often where risk surfaces first. A strong provider will monitor media across hundreds of countries and languages, including smaller publications and hard-to-reach jurisdictions. Look for platforms that index at scale—such as 150+ million sources in 190+ countries—so your team doesn’t miss critical signals simply because they appeared in a different language or geography.

- Relieve the burden of false positives.

Adverse media screening is only effective if your team can act on the results. Too often, tools generate an overwhelming volume of alerts, with most being irrelevant. Every false positive waste valuable staff time and increases the risk of missing a real threat. That’s why working with a provider that intelligently applies AI and machine learning to improve accuracy is essential. Advanced platforms like Business Radar combine GPT-powered summarization with advanced ML-based classification to reduce false positives and sharpen risk detection. Business Radar reduces false positives by up to 90%, freeing up your team for more productive tasks.

- Unified compliance hub

Adverse media screening works best when part of a broader, integrated approach to AML. Instead of relying on multiple systems, look for a solution that combines key compliance functions, including know your business (KYB) or PEP checks, UBO data, sanctions screening, and real-time media monitoring within a single platform. This improves consistency, streamlines workflows and simplifies audits. Business Radar consolidates over 1,400 global sanctions lists and tracks activity across 210+ risk categories, helping your team stay aligned, responsive, and audit-ready from day one.

- User-friendly platforms with strong support

The best compliance tools are the ones your team actually wants to use. Look for platforms with intuitive dashboards, streamlined workflows, and scalability to adjust to your organization’s changing needs. Equally important is strong support. A dedicated Customer Success Manager should provide hands-on training, best-practice guidance, and quick resolution when issues arise. Business Radar is built with usability in mind, making it easier for teams to onboard quickly and stay focused on what matters most: managing risk.

- Seamless integration

Adverse media screening should easily connect with the systems your team already uses. The best solutions offer the ability to integrate the application into your systems via API. This allows your compliance platform to plug into existing AML/KYC workflows, CRMs, and internal tools without added complexity. Business Radar offers integration features like Single Sign-On (SSO) and automation options that make it simple to build screening into your daily processes, maximizing efficiency.

- Include a roadmap for continuous improvement.

Effective compliance isn’t static. As regulations evolve and risk profiles shift, your screening strategy must adapt, or you risk inefficiencies. Choose a provider that allows you to refine search criteria, set performance benchmarks, and adjust workflows over time. Business Radar’s machine learning models improve with ongoing user feedback, helping teams boost accuracy, reduce review time, and stay aligned with changing regulatory expectations.

Understanding the Regulatory Landscape in Europe

Europe has some of the world’s strictest AML requirements. Under the 6th Anti-Money Laundering Directive (6AMLD), financial institutions must conduct enhanced due diligence, including adverse media checks on high-risk clients.

Organizations are expected to define “high-risk” using internal frameworks. Business Radar helps by categorizing over 200 risk types to support this. The European Banking Authority further emphasizes the need to include media screening in AML risk assessments, a stance echoed by Germany’s BaFin (AuA 2.0).

Final takeaway

Adverse media screening is no longer optional for financial institutions managing real compliance risk. It has become a critical part of modern AML and KYC programs – bringing speed, accuracy and visibility into threats that traditional tools miss. With regulatory expectations rising and manual processes reaching their limits, now is the time to invest in technology that strengthens oversight, reduces false positives, and support smarter decisions, The institutions that get ahead of this shift are the ones best positioned to manage risk – and protect their reputations.

To enhance your institution’s compliance efforts, consider leveraging advanced tools like Business Radar’s Adverse Media Screening solution. Stop wasting hours on manual screening, and book a demo to see how Business Radar can provide better, more accurate results.

Het bericht Adverse Media Screening and AML Compliance: What Financial Institutions Need to Know verscheen eerst op Business Radar.

What is KYB? The Know-Your-Business Verification and Compliance Process Explained. 3 Apr 2025, 1:53 pm

What is KYB?

Every year, the United Nations Office on Drugs and Crime (UNODC) estimates that between €715 billion and €1.81 trillion worth of money gets laundered (Europol, 2022). That’s roughly 2-5% of the worlds yearly Gross Domestic Product (GDP). Money that is “dirty” is derived from illegal activities such as selling drugs. To legitimize this money and introduce it back into the legal financial system in vast quantities, it is laundered, allowing criminals to use the money in legit ways such as buying villas and yachts.

Since the beginning of banks, financial institutions have always looked at how they can avoid dirty money being laundered. That’s why the first dedicated anti-money laundering legislation, known as the Bank Secrecy Act (BSA), was introduced in 1970 in the U.S (Financial Crimes Enforcement Network, n.d.). Since then, due diligence would never be the same. Other countries followed suit, and strict Know Your Business (KYB) and Know Your Customer (KYC) laws were implemented worldwide to evaluate the legitimacy of flowing money. The establishment of the Financial Action Task Force in 1989 further brought the issue to a global stage, as member countries of the FATF universally agreed to cooperate and standardize certain best practices. As of March 2025, the FATF comprises of 40 members, two of which are regional organizations (The European Commission & The Gulf Cooperation Council). The Russian Federation has had its membership suspended as of February 2023 (FATF, n.d.).

KYB, or Know Your Business, is the process of verifying the identity and legitimacy of companies before engaging with them. It is a critical component of Anti-Money Laundering (AML) efforts, but its use extends beyond that, supporting fraud prevention, regulatory compliance, risk management, and third-party due diligence. The goal is to confirm that a business is genuine and to identify potential risks before entering a commercial relationship.

KYB Verification processes aim to tackle and verify the following aspects of due diligence:

Verifying the business

- This process involves identifying and confirming the profile of a business. It usually includes the verification of the business name and address, its registration documents and its taxpayer ID number (TIN).

Conducting risk assessments

- Thoroughly understanding the relationships, purposes and environments of the business in question is key to conducting a thorough risk assessment. A key aspect is to understand the entire corporate structure of a business, including all subsidiaries worldwide.

Identifying and screening direct and indirect owners

- Ultimate Beneficiary Owners (UBO’s) are the person(s) ultimately in control of the company – though they may not always be listed as official owners or shareholders. UBO’s typically own at least 25% of company shares or exercise a high level of control over the company, sometimes through a trust or alternative legal arrangement. Screening them is a key element of KYB verification, as these entities may be linked to sanctions, political parties or money laundering crimes.

Ongoing due diligence

- Simply screening a company once in accordance with KYB compliance regulations during onboarding is no longer enough. Companies must be monitored continuously for any suspicious activities or transactions. An ongoing process of due diligence is required to flag up any suspicions.

KYB vs KYC

KYC – or Know Your Customer – is a process similar to KYB verification. In fact, both share a common objective – to comply with AML regulations and ensure the safety of financial transactions, preventing the laundering of money. However, where KYC focuses on individuals and customers who must comply when named, KYB compliance regulations focus on addressing corporations, businesses and other entities.

When is KYB relevant?

KYB compliance screening is relevant in any sector where businesses are required to verify other businesses for regulatory, risk management or compliance purposes. Some examples include:

| Industry | Examples | Applications |

| Finance | Banks, FinTech companies, Neobanks | Legal requirements to verify businesses onboarded to prevent fraud and money laundering. |

| Crypto, Blockchain | Exchanges, wallets, DeFi platforms | Staying compliant with AML and counter-terrorism laws in unregulated markets. |

| E-commerce | Amazon, eBay and B2B marketplaces | Ensure sellers on websites are legitimate and compliant to laws. |

| Insurance agencies | Credit risk insurance, B2B insurance | Assess business legitimacy and risk before offering insurance. |

| Logistics and Supply Chain | Manufacturing companies with big supply chains, companies with large logistics operations. | Verify third party vendors and partners to mitigate risk and ensure compliance with international sanctions, tariffs and laws. |

Why is KYB important?

- The importance of KYB compliance is multi-faceted. During a time of intense global tensions, a rise in wars and trade wars, and overall global instability, verifying who you do business with has never been more important. In fact, Reuters notes that 70% of compliance professionals notice a shift in attitude; where compliance was previously seen as a “tick it off” task to adhere to regulations, it is now an integral part of business strategies (Reuters, 2023). There are key reasons why KYB verification is important:

Regulatory compliance

- All member countries of the FATF must ensure an adherence to a similar minimum standard of due diligence and KYB processes. These members also agree to cooperate and work together on an international level to establish proper anti-money laundering (AML) and counter terrorist financing (CTF) regulations and laws. It is therefore imperative that companies located in FATF member countries oblige to these regulations. Failure to comply can lead to unlawful business.

Fraud prevention

- KYB processes can prevent fraud through the detection of fake or shell companies, which are used to open bank accounts and process illegal transactions. This is a key step in laundering dirty money for criminals.

- KYB checks verify a company’s legitimacy through their registration, operating address, UBOs and corporate structure. This helps track and flag suspicious entities, companies and transactions.

- Fraud rings, which are multiple companies set up and linked between each other to hide illegal activities such as money laundering, can also be blocked via KYB compliance.

Risk assessment

- Without identifying who exactly is behind a business, it is impossible to gauge the level of risk when onboarding or doing business with them. Strong KYB processes can turn a suspicion into a conclusion, allowing quick decision making.

- As situations change quickly, a continuous risk assessment is required. Continuously monitoring and conducting KYB checks helps keep an updated, real time risk assessment of companies.

Reputation protection

- Through proper KYB processes, a company can protect its own reputation by knowing exactly who they do business with. This keeps suspicious and criminal entities far away. The risks of reputational damage from doing business with criminal entities can be severe – as we discovered on our previous blog looking at adverse media and how to monitor the reputation and sentiment of your company in the media.

- There are real, negative implications of failing to conduct proper KYB checks – from association to the company and regulatory issues to weakened stakeholder confidence and internal culture damage. Trust is hard to build, and once it is killed through association with crime, it is extremely difficult to recover.

Supply chain integrity

- Supply chain integrity follows the idea of ensuring that big companies with complex supply chains have vendors, suppliers, contractors and partners who are legitimate, compliant to law, ethical and stable. Failure to ensure this puts your business at risk of trading with unvetted, suspicious and high-risk third parties that can disrupt business operations and reputation.

- A strong KYB screening solution also avoids financial consequences for companies. If a vendor or supplier repeatedly has money issues and has adverse media written about this, companies should think twice before trusting them with products and other potentially sensitive information. The risk of insolvency can have detrimental effects on a supply chain.

Consequences of failure to conduct thorough KYB checks

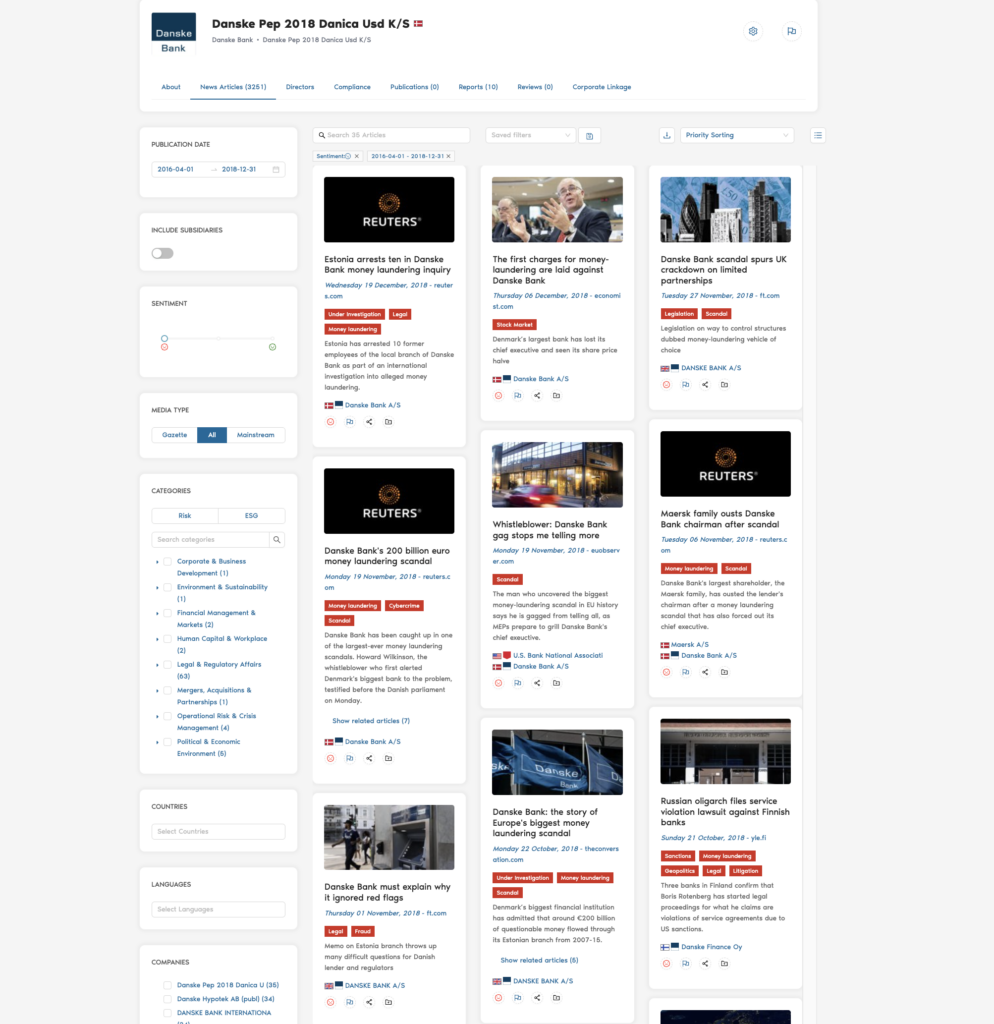

Danske Bank Scandal

In 2017, the Estonian Financial Supervision Authority published a report on Danske Bank – Denmark’s largest bank – and found over €800 billion worth of suspicious transactions in their Tallinn branch. It has since become the biggest money laundering scandal in Europe. Here’s what happened (U.S Department of Justice, 2022):

- Incoming funds from Estonia, Russia, Latvia, Cyprus, the UK and over 150 other countries were laundered and distributed between each other and various other countries around the world.

- Ten former employees of the local bank branch were arrested by Estonian authorities in December 2018, and the branch closed its doors in 2019.

- Investigations uncovered inadequate KYB procedures, allowing high-risk clients to access the U.S financial system through Danske Bank’s Estonian branch.

- Admitting to defrauding the U.S and covering up AML deficiencies, the bank was fined $2 billion by U.S and Danish authorities.

- Thomas Boregen, CEO at the time, resigned in 2018 and was charged by Danish authorities in 2019 for neglecting responsibilities. The banks former finance director, Henrik Ramlau-Hansen, was also charged with failure to prevent suspicious transactions.

ING Bank Money Laundering Case

In 2018, a leading financial institution in the Netherlands, ING Bank, faced allegations of failure to prevent money laundering (Netherlands Public Prosecution Service, 2018).

- The Dutch Prosecution Service found that between 2010 and 2016, many ING clients could take advantage of ING’s inadequate AML and KYB policy implementation.

- Inadequate screening meant that many high-risk clients onboarded – resulting in the laundering of hundreds of millions of euros.

- Due to ING’s failure of vetting clients and monitoring suspicious transactions, telecom company VEON was able to secure contracts in Uzbekistan by paying bribes through ING.

- The case was settled in 2018, and ING agreed to pay a fine worth €775 million.

Having established what KYB compliance is, and why it’s so important for companies in various industries, the next steps are finding the right ways of implementing KYB verification processes into your business’ workflow.

At Business Radar, we provide seamless integration into your systems for the most thorough KYB checks that reduce false positives by up to 90%. Book a demo today and see how Business Radar’s all-in-one solution can help automate your KYB processes, saving you time and money while ensuring the most reliable results. Simply fill out the demo form below:

Het bericht What is KYB? The Know-Your-Business Verification and Compliance Process Explained. verscheen eerst op Business Radar.

Adverse Media Monitoring: What It Is and How you can Protect Your Business from Negative Press. 24 Mar 2025, 3:12 pm

What is Adverse Media?

Adverse media is exactly what it sounds like – negative news published across various sources. Research suggests that media reports with negative news catch 30% more attention than non-negative reports (Letterly, 2024). The media prioritizes negative news due to its higher engagement rates.

The idea of a “negativity bias” refers to a phenomenon where humans are inclined to pay more attention to negative information rather than positive (The Decision Lab, n.d). Negative news stories often elicit stronger emotional reactions of outrage, anger or fear. This increases engagement, creating a dopamine economy: a system of business providing instant gratification, and benefiting from the monetization of attention, designed to be addictive. Media algorithms are designed to push content that maintains the most attention and engagement, resulting in a greater presence of negative news. Psychological research also shows that negative events have a stronger psychological impact than positive ones of the same magnitude (Baumeister et al., 2001).

How does adverse media impact my business?

The threat of adverse media on a business can be detrimental. As a business professional, monitoring the adverse media around your business is an integral part of KYB/KYC processes, risk strategies, supply chain monitoring, marketing strategies, brand reputation management and is relevant to almost any industry.

Warren Buffet himself once said “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently”. Plus, the idea of managing your reputation isn’t new, either. Socrates, who lived from 470BCE – 399BC, once said: “Regard your good name as the richest jewel you can possibly be possessed of”.

The question is, how damaging can negative news be for a business? You may have heard of the phrase “All PR is good PR“. But is that really true? Let’s have a look at some famous cases in which adverse media played a significant role:

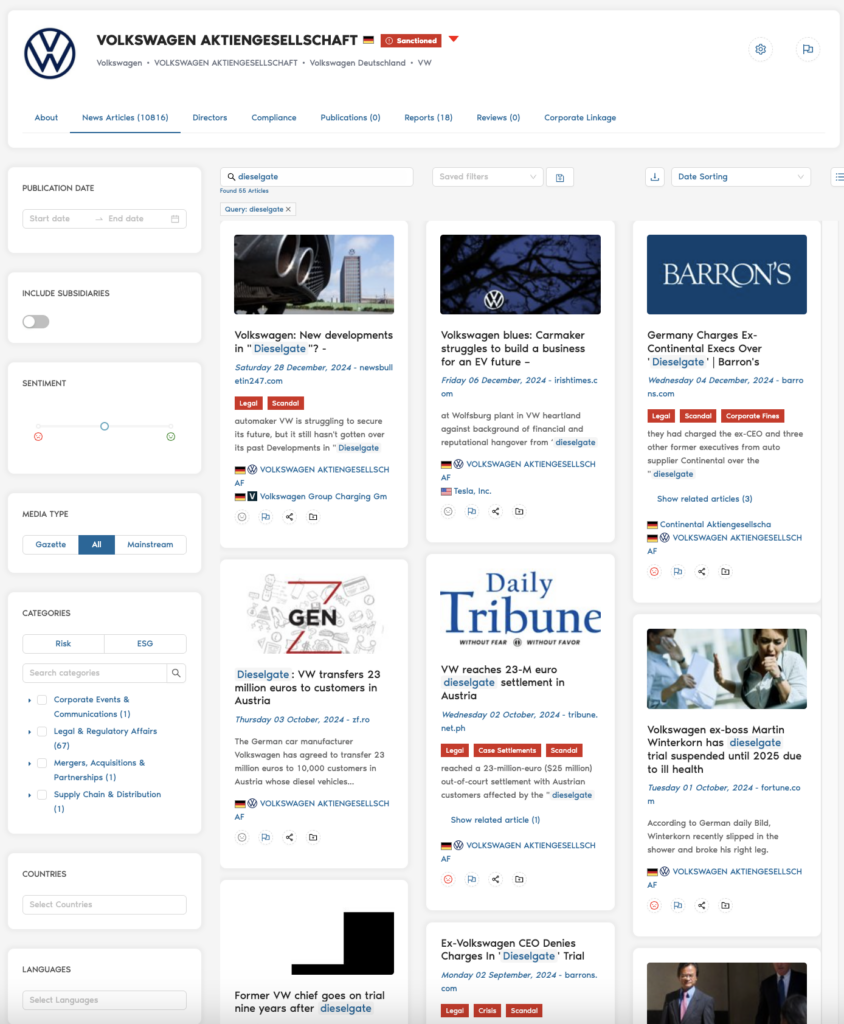

Volkswagen, 2015

Business Radar: Volkswagen media profile

In 2015, German automobile manufacturer Volkswagen was growing strong with a year-on-year growth of 4-5% annually from 2012 to 2015. In 2014 alone, Volkswagen had sold over 10 million vehicles for the first time. That all changed when the so called “diesel-dupe” scandal came to the news. After extensive media coverage, The Environmental Protection Agency found that many Volkswagen car engines had integrated software that could detect when an emissions test was being conducted, changing the car’s performance to fabricate better results. Later, Volkswagen admitted to selling over 11 million vehicles with the cheating software globally.

Consequences:

- Stock price plummet: From €250 to €92 per share in just six months.

- Reputational damage leading to a 2% decline in annual vehicle sales.

- Multiple government investigations across the world, public outrage and lawsuits.

- Over €30 billion in fines paid globally.

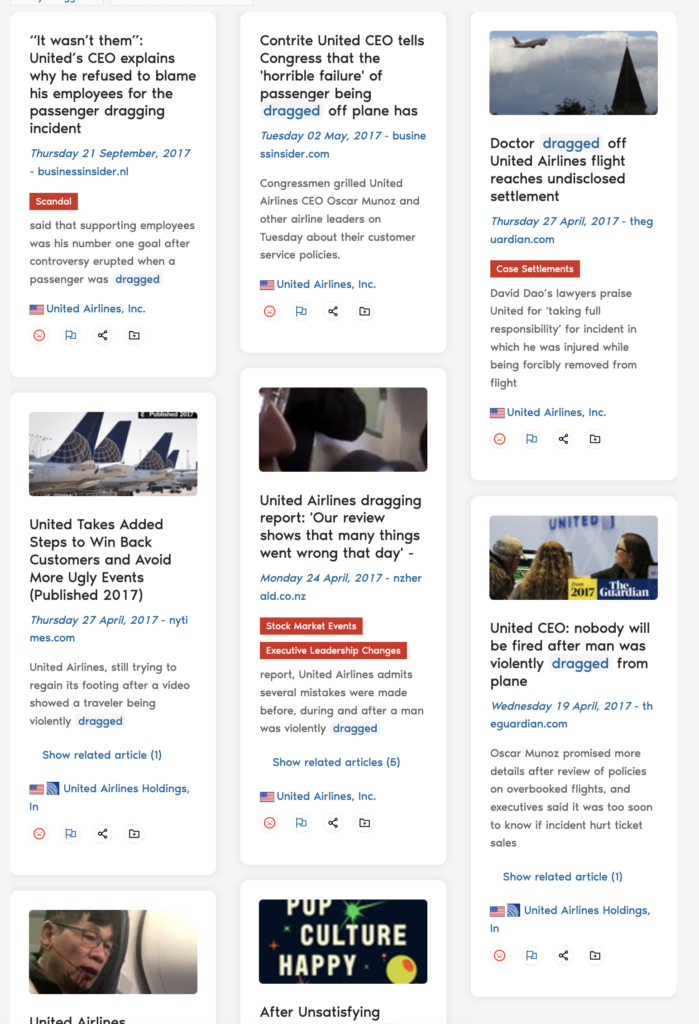

United Airlines, 2017

Business Radar: United Airlines media profiles

In 2017, millions were stunned when a video of a passenger being brutally dragged off an overbooked United Airlines flight in Chicago went viral on social media. David Dao, a 69-year-old Vietnamese American pulmonologist refused to disembark an overbooked flight, claiming he had patients to see the next day. Security officers from the Chicago Department of Aviation violently dragged him off the flight, striking his head against an armrest. Warren Buffet, a major investor in the airline, called United out for making a “terrible mistake“.

Consequences:

- United Continental Holdings stocks, parent company of United Airlines, dropped 6% in one day, wiping out $1 billion in market value.

- Calls for boycotts flooded social media, with many loyal customers posting videos of themselves cutting their United Airlines loyalty and credit cards.

- Reputational damage: 6.8 million views within a day. Number one trending topic on Weibo China and Vietnam, gathering 470 million users’ attention.

- Government investigations.

The airline eventually settled the lawsuit for an undisclosed amount, in addition to paying every customer on board the flight an additional $500. United Airlines also implemented 10 new policy changes.

Although the above examples are extreme and highlight signs of corruption and weak company policies, it is the adverse media aspect that caused the biggest damage. You cannot put a price on reputation, which severely affects customer perception.

How can you understand the media landscape around your business?

Adverse media can be destructive. Whether that be through suffering stock prices, reputational damage or paying substantial amounts for legal settlements – monitoring negative news and being a step ahead is important for risk strategies. Banks, large companies with sophisticated supply chains, conglomerates and consultancies need to monitor up to thousands of companies to ensure avoiding damage through adverse media. Even if it’s not your company, simply doing business with a company known for its adverse media can put into question your company values, standards and ethics. Tools like Business Radar’s Adverse Media Screening Solution continuously monitor your media landscape and alert you of potential risks.

So how can you monitor what the media says about you, your suppliers, partners or investors? And how should you prepare? There are several components to a good adverse media strategy. Let’s analyze what you can do:

- Establish Risk Criteria

- Choose Adverse Media Sources

- Automated Monitoring and Alerts

- Establish an internal response plan

1. Establish Risk Criteria

Establishing the risk indicators most relevant to your business will help in narrowing down your search. Consider your industry, your values and the regulatory requirements you need to meet. Business radar has over 200 predefined risk and ESG categories based on industry standards. Some example indicators include:

| Type | Example Indicators |

| Business risk | Accounting errors, fraud, insolvency, cybercrime |

| Environmental risk | Air quality, pollution, waste management, water shortages |

| Regulatory risk | Corporate governance, money laundering, regulations, sanctions, legislations |

| Social and Labor risk | Child labor, worker safety, employee health and safety, labor practices |

2. Choose Adverse Media Sources

Once the risk criteria have been established, it is time to focus on where the media will come from. Monitoring official lists and unstructured media sources can help in understanding the broader image. Be mindful of the sources you choose – try to avoid sources with a bias. At Business Radar, we exclude any extreme bias articles and include local gazette media in addition to mainstream sources – you can contact us if you want to learn more. Some good starting points are:

- Sanction lists – from official databases and government watchlists:

- OFAC Sanctions List

- Interpol & FBI Lists

- World Bank & IMF

- EU & UK Sanction Lists

- Unstructured adverse media sources: News and media monitoring

- Google News, Bloomberg, BBC, CNN, Reuters

- Stock Exchanges (financial papers and information)

- Gazette and local media, such as Hessischer Rundfunk, which covers local media in Hessen, Germany.

- Industry specific news sources (such as TechCrunch)

3. Automated Monitoring and Alerts

Since timing is limited and scanning the news manually every day is a tedious exercise, you’ll want to set up a monitoring and alerts system. This way, you can ensure to always be updated on relevant events, even when you do not have the time to search the internet yourself. Using Business Radar, you can set up an unlimited number of alerts on your portfolios. Simply choose the risk categories relevant to the respective list of companies and receive news to your inbox on a daily, weekly or monthly basis. Book yourself a free demo to see how it works.

You can also do this manually, though it requires extra steps and can be less accurate. Start by listing the keywords that will help you find the specific information you’re looking for. For example, “McDonalds Controversy” or “Elon Musk Fraud”. Should an adverse situation occur with these keywords, the goal is t be notified right away.

If you are struggling to find the right keywords for your manual search, you can also use SEO tools like Ubersuggest, which provide alternative and related keywords to a specific word. The more extensive your list, the more informed you will be.

You can then customize the frequency at which you want to receive updates. Choose real-time for the most accurate and up to date information. Alternatively, you can also choose between daily, weekly or monthly updates.

For more tech-savvy users, using AI and NLP (Natural Language Processing) tools like AWS Comprehend or Google Cloud NLP can help analyze news sentiments and detect negative keywords in a context. The sentiment analysis can flag adverse media specifically.

4. Establish an internal response plan

Whether you’re monitoring negative news on your own business(es) and its subsidiaries or your partners, suppliers or other stakeholders, you need to know how to react to certain events.

As a company, you can make the best efforts to avoid adverse media being written about you. But an affiliation with another company that is being mentioned in the news can affect your reputation as well. A negative news story can be published at any time, for any reason, and it is difficult to see these stories coming. For this reason, a strong internal response plan should be in place, to be executed upon the discovery of such an article.

Firstly, aim to keep an updated risk assessment and define the levels of severity in the case of an adverse event. Consider the type of damage that can be most detrimental to your company and use the risk criteria established in part 1 to keep an up-to-date risk assessment.

Second, it is useful to have a crisis team at hand in the case of an adverse media event. Assign certain roles and responsibilities and ensure you have at least a team consisting of experts who are trained to handle situations where quick reaction is important. Consider senior leadership roles, PR teams and legal teams, for instance.

Finally, there should be established guidelines on addressing media fallouts with certain protocols in place. Liaise with the crisis team before an adverse media event takes place and discuss certain procedures and protocols.

Monitoring adverse media is important, yet a lengthy process requiring the collection, processing and monitoring of data from multiple sources. At Business Radar, we simplify the process by structuring thousands of daily news articles into one comprehensive solution, allowing you to filter by gazette media, sentiment and more. Business Radar also always avoids extreme-bias publications for the best results. Discover how adverse media monitoring can save time and manage your risk strategy during a free, short demo with our team. Simply fill out the form below:

Het bericht Adverse Media Monitoring: What It Is and How you can Protect Your Business from Negative Press. verscheen eerst op Business Radar.

AI-Enabled Transformation: Navigating CSRD compliance for sustainable business futures 22 Jan 2024, 1:02 pm

The Corporate Sustainability Reporting Directive (CSRD) is a regulatory framework established by the European Union. It aims to enhance and standardize sustainability reporting across companies. The directive requires large companies and all publicly listed companies to provide detailed and regular reports on their environmental and social impact, governance, and sustainability practices, starting from 2024. The goal of CSRD is to increase corporate transparency and accountability, ensuring that businesses contribute positively to environmental protection, social responsibility, and sustainable growth. This initiative is part of the broader EU Green Deal strategy, which seeks to promote sustainable economic development within the EU. By mandating comprehensive sustainability reporting, the CSRD intends to better inform investors, consumers, and other stakeholders, fostering a more sustainable, inclusive, and ethical business environment.

The Corporate Sustainability Reporting Directive (CSRD) and European sustainability reporting standards offer extensive technical information, but their impact extends far beyond that. They signify a transformative shift in organizational structures. I aim to delve into the nuances of this transformation, to set the stage for understanding its depth and breadth.

Our objective is to develop the necessary expertise and services to effectively support our clients on their transformative journey. This process is not only thrilling for us but also marks a significant turning point for our clients. Reflecting on the CSRD, especially in its broader context, it’s crucial to consider its origins. Fundamentally, it’s a component of the EU Green Deal, designed to expedite the transformation of Europe’s business landscape. Ultimately, the goal is to foster a sustainable economy.

Traditional risk management typically concentrates on immediate concerns or extrapolates from past trends. However, the CSRD compels a shift towards future-focused resilience, emphasizing risks related to environmental, social, and governance factors. This shift can be seen as a positive development for organizations, as it prompts a reevaluation of risk management strategies to enhance future preparedness. Additionally, it encourages the adoption of new technologies and explores innovative avenues to bolster organizational resilience.

One of the primary challenges in implementing the CSRD lies in data governance and control. This area currently lags behind the well-established controls and governance mechanisms in financial data. For many companies, bridging this gap is a significant hurdle. Financial reporting has evolved over decades through complex systems and controls, from the US GAAP and substantive approaches to the global IFRS standards, Sarbanes-Oxley Act, and COSO framework. These developments have taken generations to build the level of confidence currently seen in capital markets regarding financial reporting and governance, and even now, there are occasional surprises.

However, the pace must be quicker for non-financial reporting. While there are established non-financial reporting mechanisms, such as the GRI, their impact has been limited to a relatively small group of organizations. The CSRD, within a short timeframe of two to three years, demands a rapid development of similar controls and processes for non-financial reporting. This challenge extends to various parts of an organization, necessitating a comprehensive approach to building a robust control environment for non-financial data.

The complexity of CSRD compliance is heightened by the fact that much of the required data lies outside an organization’s immediate purview. A major challenge for our clients is not only gathering and managing data within their organization but also collating external data. This represents a significant big data challenge, emphasizing the need for robust data quality management processes.

A critical issue is determining the extent of an organization’s responsibility. Unlike financial reporting, which is relatively self-contained, CSRD and broader stakeholder expectations are pushing organizations to accept a wider scope of responsibility. This extends beyond supply chain, human rights, and welfare aspects, encompassing also scope two and three emissions. Traditionally, even leading organizations have focused mainly on their performance and that of their direct partners. However, the CSRD demands a broader perspective.

Many organizations, including industry leaders, are yet to develop due diligence processes aligned with expectations such as those outlined in the OECD guidelines. Looking forward, we anticipate a significant shift. Companies will increasingly recognize their role within a broader ecosystem, understanding that their impact goes beyond mere product and service delivery. It’s about the overall impact created by their operations and extended network.

In the context of the challenges and expectations outlined in the CSRD, AI plays a pivotal role in enabling organizations to effectively navigate and comply with these new requirements. Our software solution, ‘Business Radar‘, exemplifies this by providing industry leaders with a tool to monitor both clients and supply chains for ESG and CSRD signals.

AI’s capabilities are central to Business Radar’s effectiveness. It harnesses AI to scour global news media and extract relevant signals pertaining to companies and their group structures. This process isn’t just about gathering data; it’s about filtering and presenting only the information that is both relevant and accurate. Such precision is crucial in an environment overwhelmed with data, where the key challenge is discerning what is truly significant for decision-making.

By leveraging AI in this manner, Business Radar ar offers a transformative advantage. It enables leaders to stay ahead of emerging trends, regulatory changes, and potential risks within their ecosystem. This is not just about compliance; it’s about gaining insights that can drive strategic decisions, enhance resilience, and ultimately contribute to more sustainable and responsible business practices. The tool’s ability to distill vast amounts of data into actionable intelligence can be a game-changer for organizations striving to meet the evolving demands of the CSRD and broader stakeholder expectations.

Het bericht AI-Enabled Transformation: Navigating CSRD compliance for sustainable business futures verscheen eerst op Business Radar.

Business Radar wins big at FD Gazellen awards 20 Oct 2023, 8:50 am

We’re very happy to announce that we’re at the top of two FD Gazellen categories. The FD Gazellen Awards are curated by the Netherlands’ leading financial newspaper, Het Financieele Dagblad, and celebrate the country’s fastest-growing companies.

For the small business category in the Western region of the Netherlands, we’re listed as number 7. And for the overall, out of the top 100 companies, we slot in at the 21st place.

Being recognized confirms our hard work in Know-Your-Business (KYB) and corporate KYC.

Active intelligence to reduce risk exposure

In the current business landscape, staying on top of portfolio risk management and compliance comes down to having the latest information.

The issue is usually harnessing it in a smart way that saves time, money, and effort. This is why we’ve centralized our efforts to protect businesses via AI-driven, actionable intelligence, which produces a 96% signal accuracy, so businesses can accurately identify potential risks, seize opportunities and outsmart the competition.

Continuous compliance, continuous solutions

As the speed of information is also increasing along with the volume, regulators and supervisory bodies are gradually moving towards continuous compliance.

Responding to this, we’ve built our Business Radar solution that continuously scans nearly the entire Internet, in every language, so companies are in-the-know about events that affect their portfolio companies.

Plus, we scan 99% of all global company records and for UBO, PEP, AML/CTF, and adverse media.

Why we’re a fast-growing business

We do all of this in close relationship with our clients, whom we see as partners. Their feedback is used to refine our algorithms to ensure our information serves the needs of businesses and financial entities in today’s fast-paced world.

This is what has made us a fast-growing business: delivering relevant, accurate, and complete insights, available via a single, comprehensive API or platform.

And we’ll continue innovating using technology, like AI and ChatGPT, to make the process of making better-informed decisions easier, allowing our clients to stay ahead of the curve.

Het bericht Business Radar wins big at FD Gazellen awards verscheen eerst op Business Radar.

The role of NLP, NER and AI in risk management 19 Sep 2023, 9:38 am

Risk management is crucial for companies aiming to achieve and sustain success. By identifying and controlling potential risks in a timely manner, businesses can safeguard their reputation, maintain compliance, and minimize the impact of negative events. In this blog, we’ll discuss how Natural Language Processing (NLP), Named Entity Recognition (NER), and Artificial Intelligence (AI) can contribute to enhancing risk management.

What is NLP and NER?

Natural Language Processing (NLP) and Named Entity Recognition (NER) are technologies used to analyze and understand large amounts of text. NLP enables computers to comprehend and interpret human language, while NER focuses on identifying important information in text, such as names of individuals, organizations, and locations.

Benefits of NLP and NER in risk management

By applying NLP and NER in risk management, companies can quickly and efficiently gather and analyze information. For instance, NLP and NER can be used to monitor news articles and social media posts for negative mentions about the company, enabling swift responses to potential reputation damage. Furthermore, NLP and NER can identify and manage compliance risks, such as analyzing legal documents for potential risks.

AI explained

Artificial Intelligence (AI) refers to technologies that enable computers to perform human tasks, including thinking, learning, and decision-making. AI encompasses machine learning, deep learning, and natural language processing, among others.

Benefits of AI in risk management

AI offers numerous opportunities for risk management. For instance, machine learning can recognize patterns in large datasets, enabling faster identification of risks. Deep learning can automatically categorize and prioritize negative news articles based on their potential impact on the company. Moreover, AI can conduct predictive analyses, identifying and addressing risks at an early stage.

The Business Radar advantage

NLP, NER, and AI provide companies with novel ways to swiftly identify and control risks and form a key part in our leading risk management capabilities. By applying advanced AI-driven analytics and NER, we help businesses maintain compliance, minimize the impact of negative events, and safeguard their reputations.

Curious how we do it?

Het bericht The role of NLP, NER and AI in risk management verscheen eerst op Business Radar.

The challenges of screening companies based on news articles 19 Sep 2023, 9:34 am

Screening companies based on news articles is a crucial part of risk management and compliance. However, it can be challenging to find and interpret the right information, especially when dealing with conflicting reports and fake news.

Below are some of the main challenges when using news articles for company screening and how Natural Language Processing (NLP), Named Entity Recognition (NER), and Artificial Intelligence (AI) can help.

Relevancy

Firstly, finding relevant news articles can be tough. Companies often operate on a global scale, making it difficult to locate reliable sources of information.

NLP and AI can provide solutions here.

By utilizing search algorithms and automatically filtering out irrelevant data, these technologies can assist in quickly and efficiently identifying the most relevant news articles.

Understanding what articles are really about

Another challenge is understanding the content of news articles. Often, there are subtle cues in the reporting that can impact a company’s assessment.

This is where Named Entity Recognition (NER) comes into play.

Through this technology, company names and other vital details can be identified and analyzed within the context of the news article.

Contradictory information and fake news

Additionally, screening companies based on news articles can lead to contradictory information. Some news sources might have different perspectives on the same event, or there could be uncertainty about the facts.

This is where AI and machine learning can help.

Through these technologies, multiple sources and data can be analyzed, and the reliability and relevance of the information can be assessed.

Another significant challenge is dealing with false information and fake news. There are many instances where companies are wrongly portrayed negatively in the news due to rumors or false data. Here, NLP, NER, and AI can help by analyzing the sources and content of news articles to assess the credibility of the information.

Harnessing the power of news for leading insights

Screening companies based on news articles can be challenging due to the intricacies and complexities of the available information.

That’s why we employ NLP, NER, and AI in our Business Radar solution to deliver reliable and actionable information, improving risk management and compliance.

Het bericht The challenges of screening companies based on news articles verscheen eerst op Business Radar.

How ESG influences reputations – and what you can do about it 19 Sep 2023, 9:33 am

ESG has become an important way for investors, consumers, and employees to consider the attractiveness and sustainability of a company. ESG (Environmental, Social, Governance) criteria are used to determine how responsibly companies interact with the environment, society, and their operations.

How ESG influences reputations

The rise of ESG also affects companies themselves. And it’s become increasingly crucial for them to demonstrate responsible business practices. This impacts a company’s reputation and can lead to positive or negative publicity. In other words: ESG’s importance can no longer be ignored.

Identify relevant ESG criteria for your company

But where do you start? A good first step is to identify the ESG criteria most relevant to your company. This could include environmental aspects like carbon emissions and sustainability, as well as social aspects like diversity and inclusion within the company.

Natural Language Processing (NLP), Named Entity Recognition (NER), and Artificial Intelligence (AI) can also contribute to monitoring and analyzing ESG-related information in news articles and social media. By using these technologies, companies can quickly gain insights into public opinions about their ESG efforts. This provides companies with the opportunity to proactively address any negative publicity and strengthen their reputation.

Lower costs, and increased customer loyalty

Companies that integrate ESG into their operations can not only enhance their reputation but also benefit from other advantages, such as lower costs and higher customer loyalty. Additionally, it can help attract and retain talent, as employees increasingly value responsible business practices.

In short, the rise of ESG and its impact on a number of business areas, including reputation, should be of key importance.

This is why we employ NLP, NER, and AI on our Business Radar platform. To help companies swiftly understand public sentiment about ESG, proactively respond to any negative publicity, and stay ahead of the competition.

Curious how we can help you improve your ESG monitoring capabilities?

Het bericht How ESG influences reputations – and what you can do about it verscheen eerst op Business Radar.