Add your feed to SetSticker.com! Promote your sites and attract more customers. It costs only 100 EUROS per YEAR.

Pleasant surprises on every page! Discover new articles, displayed randomly throughout the site. Interesting content, always a click away

Duval Home Buyers

Sell your home todayFirst Look: State of the Jacksonville Market in 2025 4 Mar 2025, 10:05 pm

- The number of sold listings in February 2025 was down 24.8% year over year from 2024

- The number of active listings in February 2025 was up 29.7% year over year, reflecting the largest active inventory in over a decade

- The average number of days on the market rose by 2.7% year over year to 77 in February 2025. However, it’s important to note that this reflects a decrease from 85 days in January 2025.

- The average sales price for a listed home rose 1.74% year over year in February 2025.

- The number of pending listings dropped steeply, falling 39.8% year over year in February 2025 from early reporting

February is in the books and winter is almost behind us. With just a few weeks to go until the spring sales season starts to fully kick off, It’s time to take a first look at the numbers for 2025 – and well…things could be better for us here in Jacksonville.

Welcome to the Buyer’s Market

A buyer’s market occurs when the supply of available homes in an area exceeds the demand. Why does it matter? Because in a buyer’s market, the competition is low enough that buyers start to get the upper hand in negotiations. As a seller, you may see little or no activity on your listing, and the activity you do get may be competing with dozens of other homes for sale. It’s a recipe for price cuts and seller concessions, which can ultimately bring down the value of homes in an area – given enough time.

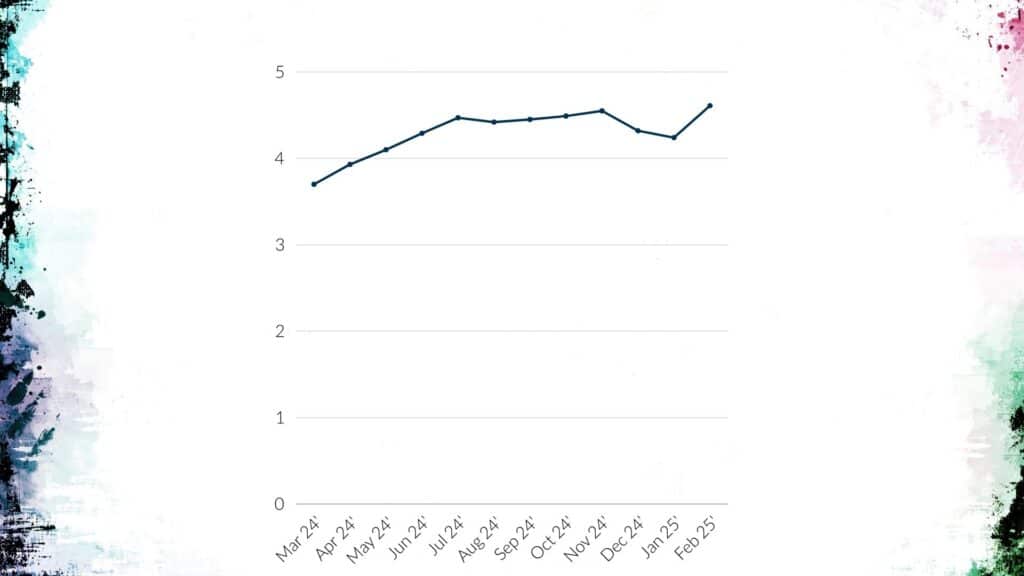

As of 2025, Jacksonville is a buyer’s market. But just barely. There’s currently more than 4.6 months of active residential inventory on the NEFMLS. Meaning that at the current rate of sales, if no new listings were added, it would take just over a third of a year for everything to sell. But the reality is that new listings are being added daily, only serving to drive that number up. For perspective, there were 3374 new residential listings added to the NEFMLS, and only 1579 closed sales in February. As time passes, that gulf will continue to grow unless we see a major market shift.

A chart showing the months supply of residential inventory in Jacksonville Florida

Expect the trend to continue into early spring unless there’s some give in either rates or home prices.

How higher interest rates affect our housing market

Back in 2022 as the average 30 year fixed soared to levels we hadn’t seen in a decade (the last time the average 30 year fixed was above 7% was April 2002) there was a ton of speculation of where things would begin to settle. Unfortunately that’s been a moving target.

Most of the sentiment was that, by the end of 2023, the worst of it was behind us, with rates hitting a high of 7.79% in October. Well respected voices such as Lawrence Yun, who serves as the Chief Economist for the National Association of Realtors®️ made predictions of rates returning to the 5’s by the end of 2024.

As inflation report after inflation report outlined what could only be described as a sticky economy, those expectations were revised to the low 6s, then the mid 6s. And for a while things appeared to be normalizing as rates hit a 2024 low of 6.09% in September. However, negative sentiment and fear around the US economy has dampened expectations further, and rates have again risen to the high 6’s hovering around 6.75% as of the March 2025 writing of this article.

The problem is that mortgage rates dictate a lot about the real estate market. It’s estimated that 70-80% of all home sales are financed. For every 10 homes that sell, 8 will probably need a mortgage. And the difference of just a percent can mean a huge difference in costs. For example, using the average sales price in Jacksonville of $450,000 in February, a buyer will pay more than $100,000 more for the same home at a 7% mortgage rate over a 6% mortgage rate during the lifetime of the loan. Hundreds more each month on the mortgage. That in turn prices buyer’s out, contracting an already tight pool at a time when inventory is soaring.

The good news

I’d describe the tone of our market as flat, bordering on down, but that’s not to say it’s all doom and gloom. There have been some positive markers that hint at resilience if not outright growth.

One such figure is the average number of cumulative days on the market, commonly known as the CDOM. This number tracks how long it takes from initial listing until the day the contract actually closes and everyone gets paid. Winter is historically a slow time for sales, but the CDOM is fairly stable compared to last year at 77, less than a 3% difference. Additionally, the CDOM fell from 84.8 to 77 in the period from January 2025 to February 2025, meaning homes are moving quicker as the year progresses.

The average sale price is also still growing, which is good news for homeowners waiting on the sidelines. In February 2025 the average residential sale price on the NEFMLS was $450,783, a 1.74% increase from $443,085 in February 2024.

Then there’s the Sold to List Ratio, which looks at the average percentage of asking price sellers get on their listings. In January 2025 the ratio dropped significantly, falling to 92.7%, the lowest by a decade. But as of February 2025, the ratio has returned to 94.3%, in line with most of 2024, including much of the summer.

A look at Jacksonville

Markets don’t exist in a vacuum, and as the old adage says: “location, location, location.” When I look at Jacksonville, it’s hard to see anything but potential. I’ve lived here for more than 25 years. In that time I’ve seen a monumental change in not only the city itself, but the energy behind Jacksonville’s growth. As a result, despite the numbers I’m still bullish on the Bold City.

Nothing puts a city on the map like an NFL franchise. And ours (despite last year’s abysmal record) has one heck of a following. The Stadium, currently called Everbank, has long been a focal point of the downtown area, sharing space with Daily’s Place, an outdoor amphitheater, Vystar Memorial Arena where our local hockey team the Iceman play, and Vystar Ballpark, home of the beloved Jumbo Shrimp, which together up our sports district. This year, it’s getting a major makeover.

In June 2024 the team through owner Shad Khan, reached an agreement with the City of Jacksonville to build the Stadium of the Future, a strikingly designed complex of river walks, storefronts, and of course a 63,000 seat NFL stadium that will likely be the envy of every team in the league. This 1.4 billion dollar project has already broken ground and is expected to be completed in 2028.

If 1.4 billion in city infrastructure development wasn’t enough, there are also plans to develop more of Jacksonville’s downtown riverfront, including a 4 seasons hotel with more than 170 luxury rooms on the St. Johns River, Riverfront Plaza with greenspaces are art installations, One Riverside, a major complex which will be home to a new Whole Foods, and of course Gateway Jax, a 5000+ unit mixed development. All on top of recent expansions to bike paths like the Emerald Trail, and outdoor park spaces around the city.

Then, there are the natural resources. Jacksonville has not one, but two major water features. First is the St. Johns River, which iconically cuts through the center of downtown. This river is one of the largest in the world, and our city sits just on the mouth where it joins the Atlantic Ocean. As a result, there are hundreds of miles of riverfront property with docks, boats, and views that can rival the most expensive neighborhoods in South Florida. Second is the Atlantic Ocean itself. Our city is home to miles upon miles of pristine beaches with popular parks, bars, restaurants and hotels. Hard to find anything like-kind on this coast.

Takeaways and What to do as a seller

If you are on the fence about selling your home in Jacksonville, you’ve got some hard decisions ahead. There’s no sugar coating it. Competition amongst listings is high, and sales are slow, so finding ways to make your listing stand out are critical. That means repaired, updated, staged, and professionally photographed homes, ideally vacant and easy to show are your best bet, and anything else is looking at an uphill battle. But waiting for better conditions may not be your friend either.

There’s nothing right now that would indicate interest rates dropping back into the 5’s anytime soon, so I wouldn’t hold your breath that buyers are suddenly going to flock to the market. It’s possible that economic conditions may change, and there’s a lot of uncertainty right now with tariffs and rising inflation, but it won’t happen overnight. Waiting may only lead to more competition, but it could also lead to a higher sales price if values continue to appreciate.

Regardless, Jacksonville is still a reasonably priced market for everything it has to offer, and despite recent concerns over Jacksonvillians debt, there’s nothing to indicate that it won’t continue to grow.

Data Sources:

NEFMLS Residential Market Report February 2025

The views and opinions expressed in this article are those of the author and may not align or reflect those of Duval Home Buyers LLC and/or it’s management or agents. This article is for entertainment purposes only, and should not be relied upon for real estate advice. Always consult a licensed real estate agent or real estate attorney prior to making any real estate decisions.

The post First Look: State of the Jacksonville Market in 2025 appeared first on Duval Home Buyers.

3 Ways to Sell a House with Liens 24 Jan 2025, 10:15 pm

Many times when borrowing money, you are asked to put up collateral to back the loan. When that collateral is real property, such as a house or condo, the lender will typically place what is called a “lien” on your property. This “lien” effectively lets everybody know that there is a legal claim against your home for debt.

Unfortunately, until that claim is settled, selling your property is going to be a challenge. But we also know that sometimes there’s no other option but to sell. To help, we’re breaking down 3 ways to make your home sale happen, even if you owe money and have liens.

Common Liens

There are many types of liens that can be placed upon a house. We’ve written a fairly in-depth article on this subject that you can check out here if you want to learn more. Ultimately though, liens will be broken into two primary types: voluntary liens, and involuntary liens. Both of which will make selling your home difficult.

Voluntary Liens

Voluntary liens are typically liens for loan debt that you as a consumer and home owner take on…well, voluntarily. The most common type of voluntary lien is a mortgage loan, in which the home secured by the loan is used as collateral in the event that you fail to pay your mortgage. It’s these liens that trigger foreclosures.

Additional types of voluntary liens include mechanics liens and contractor liens, which typically result from hiring a licensed professional to do contractual work on your home. As well as homeowner’s association liens if you live in an HOA. Like Mortgage liens, each of these debts can result in foreclosure.

Involuntary Liens

Involuntary liens are liens…you guessed it… that are placed on your property against your will or without your consent. Most involuntary liens are issued by government agencies, such as the IRS, or your county property tax office.

Some involuntary liens, such as tax liens, can even force the sale of your home through a process called tax deed, which is similar to foreclosure.

Three ways to sell with liens

1. Satisfy the lien

The foremost and simplest way to sell a home with liens is to satisfy or remove the liens prior to selling. This can be done by paying off the loan in question, or by working with the lienholder or the individual who placed the lien, to find a suitable settlement that works for all parties.

Many state and federal agencies who lien properties have systems in place to assist with settling debts, but most are time consuming and may not work for you depending on your situation.

2. Get the lien dismissed

Often the riskiest and most difficult way of clearing a lien on your house is through the court system. Depending on your situation, you may be able to take legal action against your creditors to have the lien removed from your home without having to pay the debt.

This typically only applies in situations in which there may have been fraud or predatory practice on the part of the lienholder, such as a fake contractors lien to hold up the sale of a home as retribution. And yes, sadly, it does happen.

If you are considering this route, you will need to schedule a consultation with a licensed real estate attorney, as they can provide legal advice on how to best proceed.

3.Sell to an investor

When you go to sell a house, you typically hire a title company, or title agent to handle the paperwork and ensure that the transfer is legal, and insured. In order to protect the interest of all parties involved in the sale, the title agent will order what is called a lien search as part of the title search. This lien search will ensure that there are no liens against a property that might harm a potential buyer, as selling a liened property to a new owner does not remove a lien holder’s right to the property.

As a result, most of the time when a lien search comes back showing a lien, the sale won’t be able to continue until the lien is taken care of. This can sometimes be done through proceeds at closing, such as a mortgage payoff, but typically satisfying liens comes before closing.

However, there’s no laws stopping a buyer who has been informed of the liens from deciding to move forward with a purchase anyway. In most cases this isn’t possible, because lenders will not underwrite a purchase of a home when it has liens. But, there are buyers out there who don’t rely on lenders. Investors.

Investors typically buy homes with cash or private financing that isn’t bound by the typical regulations of the mortgage industry. They can take homes in any condition, any situation, including those with most lien types.

Investors are, in a way, gambling on homes with liens. They offer slightly less than market value for these types of houses, as it can be extremely costly to fix the problems they have, but in exchange, they assume all of the risk, letting the property owners simply take their proceeds from the sale and go.

Next Steps

If there is a lien on your home, and you are looking to sell it, you first need to understand how much the lien is, and what it’s for. From there, you can begin to formulate a plan of attack to get it sold.

Consulting with real estate agents and attorneys can help you figure out your options. If you decide that you do want to sell with the liens in place, consider calling a well reviewed and respected investor in your market. While they can’t buy homes with every type of lien (tax and IRS liens are very difficult), they can move forward in many circumstances that normal buyers can’t. Worst case, you’ll leave knowing what your home is worth and what the local marketplace can do for you.

The post 3 Ways to Sell a House with Liens appeared first on Duval Home Buyers.

Thinking of Selling Your house? Do These Repairs First. 18 Dec 2024, 8:41 pm

After three months on the market, you’ve finally found a buyer for your house. The contract is signed. The closing date is set. The inspection is one of the last things left on the to-do list.

A few days after the inspector visits you get a call from your agent and within seconds the whole deal falls apart. Back to square one. Do not pass Go, do not collect $200. The reason? The inspector found some cloth wiring, and the buyers are too concerned about what else might be wrong with your electrical system to chance it.

Each year hundreds of thousands of homes fall out of contract following the home inspection because of something major the inspector highlighted on the report. When most people think of repairs and upgrades to help sell their house, they think of a fresh coat of paint, or replacing the carpets. But while a nicely renovated interior may look appealing, it’s what’s going on behind the scenes with your home’s major systems that can make or break a sale.

These major systems such as the plumbing, electrical, roof, AC, and foundation directly affect the safety and wellbeing of the occupants. Many insurance providers and lenders will require they be in good working condition before the sale can go through. But for to give yourself the best chance at a successful sale, we highly recommend you make the repairs before trying to sell your home.

Foundation

One of the scariest things a potential home buyer can see on an inspection report is possible foundation damage. Much like the name implies, the foundation is what the rest of your house is built on top of, and once it starts failing, the rest of your home is also at risk.

Most homes are built with concrete slabs, crawlspaces, or pier and beam foundations here in Florida. While basement foundations are more common in areas with less groundwater. Each of these foundations can fail in a number of ways, but settlement, or the unintentional sinking of your foundation is among the most common issues.

This sinking can be caused by roots, groundwater saturation, or even just the shifting of soil over time. And the repairs can be extremely costly, often tens of thousands of dollars. Companies like Alpha Foundations or Ram

Jack typically attach piers to the places where your home is sinking to stabilize them with more compact soil and bedrock. But other solutions such as injecting concrete lifting foam may be sufficient.

Electrical

Electricity is dangerous. And there’s a lot of it in your home. As a result, most lenders and insurance companies have strict requirements for electrical systems, and damaged or out of date systems can instantly be a major deal killer.

As recently as the 1950s it was common for homes to have 30 amp service panels with a blade switch that could disconnect service from the whole board. However, as the power needs of our lives increased, residential electrical systems had to be upgraded to keep up. 60 amp fuse panels became normal until the mid 1960s, when modern and much safer circuit breaker electrical panels started entering the market.

These days, a circuit breaker panel is almost always required by lenders and insurance carriers, as fuse panels carry a much higher risk of fire. 200 amp service is the standard, but some homes still carry older 100 amp service panels. Although these 100-amp panels may work properly and pass inspections, the lower availability of electrical power in their homes might turn off buyers.

Unfortunately, when it comes to electrical, the panel type isn’t the only concern. The type of wiring used in your house can also be a major problem, even if it hasn’t caused any issues while you were living there.

Homes built before the 1960s may have a type of wiring called cloth wiring, which used fabrics or even asbestos based cloth to cover the electrical wires. This cloth can deteriorate over time, leading to fire hazards and a greater risk of electrical shock. Most lenders and insurance carriers will also require you to replace any cloth wiring, or other older wiring types such as copper, or knob and tube with modern NM wiring prior to approving a sale. And be sure, this is something home inspectors will be looking out for.

Plumbing

Depending on the type of home, most houses have pipes either running under the house in the crawlspace or slab, or above in the walls and ceilings. Regardless, even small undetectable leaks such as slab leaks can cause serious water damage. And because our water supply comes directly through our pipes, certain materials one common in homes can prove dangerous for human health.

The most prevalent of these is lead pipes. It wasn’t until 1986 that the use of lead pipes in plumbing systems was banned in the United States, and millions of homes built before that time utilize lead pipes because of their durability and rust resistance. Lead is toxic to humans, and over time, these pipes chip and erode, releasing lead into the water supply. If an inspector detects lead pipes in your house, the buyer may request you replace them before continuing with their purchase.

Roof

Depending on the type of roof your house has, the average lifespan is typically between 10 and 40 years. Shingle roofs are the most common in modern construction, and they typically last 15-20 years with maintenance. The only problem? In Florida, lenders have started requiring roofs that are only 11 or 12 years old to be replaced. Any shingle roof over 10 years is concern, even if it isn’t leaking.

Shady roofing practices following major hurricanes have caused lenders to be exceptionally wary of potential roof issues. A roof replacement can be more than ten thousand dollars depending on the size of the house. Be prepared to replace your roof if it’s nearing the end of its lifespan.

Again, best practice here is to replace it before trying to sell. A new roof looks flashy and clean, which can increase the curb appeal of your house. Trying to skimp may result in your home showing worse, and your buyer will likely ask you to replace it or pay for the replacement anyway, even if the lender doesn’t. In the current market, with low competition, buyers feel emboldened to ensure that what they’re getting fully matches their expectations.

Air Conditioner

Florida summers are hot. Air conditioning is incredibly important. Plus, Florida is humid, and a good central air system helps dehumidify your house, helping it to resist mold, mildew and the other nasty things that accompany water. How well does your AC work? To buyers, it matters.

Insurance companies almost always require what’s called a 4-point inspection here in Florida. This inspection looks at what the insurer thinks of as the four major systems in your home: plumbing, electrical, roof, and you guessed it…HVAC.

Most HVAC systems last between 10 and 15 years with routine maintenance and inspections. And yes, that includes changing out the air filter more than once a year. Overworking these systems in extremely hot or cold weather, or allowing debris to clog their air intakes, can significantly shorten their lifespan.

If your AC is an older model, or if it’s struggling to heat or cool your house, it’s time to fix or replace it. And as always, it’s best to do it before your house hits the market. Our senses have a huge impact on how we remember experiences, so a perfectly heated or cooled home goes a long way during a showing.

Inspectors will also check all of your vents and ducting to ensure air is reaching every part of your house. If it isn’t you may need to replace some of the ducting in your home as well as your system and that can be expensive.

Like roofs, most buyers are concerned about being stuck with an AC that fails shortly after they purchase a home. Anecdotally, we know someone who just purchased a home only to have their AC go out weeks later. The result was a bill of almost $7500 that they had to cover right after spending hundreds of thousands on the house itself.

Saying a house has a brand new AC is a huge selling point, as it gives the buyer a lot of peace of mind. Trying to squeak by with an old system is likely to end with it flagged on an inspection report, and the buyers requesting you replace it before closing anyway.

Do these repairs before selling for the best sale possible

Home repairs aren’t sexy. It’s not home improvement like you see on HGTV, you don’t get to pick out fancy hardwood floors or new tiles, and the return on investment is harder to justify at a glance. But any one of these items appearing on an inspection report can scare off a potential buyer and mean the death of your deal.

Making these repairs can be…will be expensive, typically thousands of dollars or more. But failure to do these repairs may require you to sell your house as-is, to someone not using a lender. Drastically reducing your sale price.

Before selling, talk to a real estate agent or real estate professional about your home. Go over the age and functionality of all of the systems. And show them any visible damage or areas of concern. A good agent will steer you in the right direction of what to fix, and what to leave for later.

The post Thinking of Selling Your house? Do These Repairs First. appeared first on Duval Home Buyers.

Why selling your house this Holiday Season might be a good idea 12 Dec 2024, 9:19 pm

Within the real estate industry, it’s fairly common knowledge that the period between Thanksgiving and New Years day is perhaps the slowest time of year for home sales. The weather turns sour, everybody is traveling, and uprooting your life during the festivities can be nearly impossible when your family is counting on you to host. But depending on your outlook, you can make winter the perfect season for your sale!

Serious Buyers

During the summer, lots of people window shop for potential moves. The weather is warm, daylight is plentiful, and kids are in transition between school years. But while buyers may be plentiful, motivations aren’t necessarily high.

The winter provides an exception. Buyers in winter are typically serious. By the time they get home from work, it’s usually dark and cold. Poor weather for house shopping. That leaves the option of either hunting in less than ideal circumstances, or giving up weekends or vacation time to conduct your search. The result is that when a buyer takes the time to tour your home, it usually means they have some serious interest. If you are lucky enough to hook someone on your home’s potential during this time, the likelihood is that you’ll have a successful sale.

Less Competition

Most seller’s view the holiday season as a difficult time to sell, and therefore, fewer sellers tend to list their homes in November and December. That creates a unique opportunity in today’s real estate landscape to avoid some of the competition.

When there are fewer homes for sale on the market, each individual listing gets more visibility, and you are far more likely to attract potential buyers to take a tour.

Improving Your Odds of Selling

Weather woes

In Jacksonville, we’re lucky enough to experience mild winters by comparison to most of the country – but that doesn’t make them pleasant. It’s wet here, incredibly wet, and when you combine that inherent moisture with nearly freezing weather, the result is a cold that sticks to your bones.

The problem? Our brains are wired to associate sensory information with experiences. If you are wet, cold, and miserable while house shopping, you are more likely to have a miserable feeling about a house you tour. The same is true for buyers looking at your home. But that also leaves an opening.

For most of us, there’s nothing better than walking out of the cold and into someplace dry and warm. This winter season, if you are looking to sell, that’s your queue. Crank up the heat and ensure that the inside is dry and inviting. Make it a sanctuary from the weather outside, and your buyers will begin to associate that relief and comfort with walking in the front door.

Smells like the season

There’s an interesting association between smell and memory thanks to the olfactory gland’s position within the brain. How something smells has a huge impact on how we remember the experience. And that’s an opportunity for sellers.

When trying to market a house for sale, you should always ensure it smells nice, or at the very least neutral. Scoop litter boxes and ensure pet danders aren’t present, give your carpets a quick cleaning, and give your fabrics a quick spraydown – these are just a few ways you can avoid a malicious odor ruining your seller’s experience. But you can also ensure a good odor enhances their experience. And the holidays are full of wonderfully memorable smells.

Lighting a fall or winter scented candle prior to a showing can help set the mood and tease buyers with the idea of a cozy place to settle in for the holidays. Baking bread, or even a pie can really leave an impression – just be careful not to overdo it. Heavy scents can overpower an experience, or even make your buyer uncomfortable if they are particularly sensitive.

Lastly, don’t forget the tree. If you celebrate Christmas, a live Christmas tree can add lovely natural winter scent to your home. Pine and Fir are both mild and heavily associated with winter festivities.

Decorate with care

We always recommend staging a home if you want to get the most out of your sale, but we understand that it’s not possible for everyone, especially if you are still living there. The holidays present some additional challenges, as many families decorate for the season. Holiday decorations are often gaudy, bright, and bold. That distracts from the subtle nuances that make your home special, and can leave a space feeling exceptionally cluttered.

But it is possible to decorate in a way that enhances your home’s features, rather than distracting from them. Using less is often more, and a few strings of warm lights, and extra throw blankets can turn a regular Jacksonville living room into a comfortable winter palace.

The same goes for the exterior. Stay away from large blow-up snowmen and bright flashing colored lights. Instead opt for traditional white or blue lighting, and subtle decorations that invoke warmth and calm. Help your buyer feel like they would feel at home there this holiday or next.

Be available

One thing we know from experience is that an available house is far more likely to sell than one that’s difficult to get inside. If you have to sell this holiday season, ensure that you don’t severely limit your showing windows. This can be difficult around holiday parties and family gatherings, but it’s important to remember that every walk-through is a potential sale.

Pets are another consideration. If you have dogs, ensure that they are safely crated or kenneled whenever prospective buyers come to view your home. Leaving a room locked off because of your pets hurts a buyer’s ability to visualize the home, and makes them worry about what damage the pets may have caused – even though we know your animal is an angel.

Being available also means ensuring your house always looks its best. Even when you aren’t home. A clean kitchen, made beds, and tidy living spaces go a long way.

It’s also imperative to keep your yard maintained and manicured. It’s easy to let the grass grow when it’s cold, since the progress is so slow. But keeping grass trimmed, edges neat, and beds free of fallen leaves provides a welcoming first impression.

Potential Issues

Lower Prices

December tends to be the month with the lowest sale prices for homes out of the year. That leaves many buyers thinking that they can negotiate a great deal, and you may find it difficult to get strong offers near your asking price. As of November 2024, the average sale to list ratio, the difference between asking price and the final sales price, has fallen to 93.8%.

Higher Days on Market

There’s plenty of data to back up the fact that the longer a home stays on the market, the less likely it is to sell. And if you are selling during the holidays, you should be prepared for the lengthy sale. As of November 2024 the average number of days a home in the NEFMLS stayed on the market was 73.8, a huge jump from 57.6 in July.

A few other considerations

It’s also important to remember that just because you find a buyer during the holidays, it doesn’t mean you have to close your sale during the holiday season. It’s not unrealistic for sales to take more than a month to close. Having a serious discussion with your realtor and your buyer about their needs and expectations can help ensure everybody wins, or atleast offer some good negotiating space.

Ultimately, the key to selling well in the winter is the same as selling well any other time of the year. Strategy. Ensuring you make a good effort to present and position your home, or hiring a good agent who will do it for you, makes all the difference in ensuring you make top dollar.

About Duval Home Buyers

This season, if you need to sell, but don’t have the energy, time, or resources to take the necessary steps, we can help ensure you’re still successful. Our cash buying program allows us to purchase homes in Jacksonville directly, without the need for repairs, cleaning, or anything else. We’ll take it exactly as-is, you take what you want and leave the rest to us. It’s the easiest way to sell your home this year – and it’s entirely local. Give us a call to get started.

The post Why selling your house this Holiday Season might be a good idea appeared first on Duval Home Buyers.

Existing Home Sales Spike – But not in Jacksonville 20 Nov 2024, 10:42 pm

It’s good news for American homeowners! Existing home sales rose 1.6 percent month over month, and 1.7 percent year over year in October 2024 according to data provided by the real estate brokerage Redfin. This increase represents the biggest gain since January 2022, and hints that lower rates and easing inflation pressures may finally be having the desired effect on prospective buyers.

But here’s the rub…Jacksonville just isn’t seeing the gains. In fact, according to data provided by the Northeast Florida Association of Realtors ®, ️home sales have actually fallen by 6.3 percent in Jacksonville year over year and 3.2% month over month. Now it’s worth noting that these figures only represent the initial sales figures for October 2024. The final results may be more favorable, but the trend is still deeply troubling for local owners.

Why aren’t Jacksonville homes selling?

At the risk of sounding like a broken record, most of the reasons why Jacksonville’s homes aren’t selling can be traced back to simple dollars and cents. At the start of the Covid 19 pandemic, Jacksonville was a relatively untapped and up and coming market, offering homes within a major metro and driving distance to the beach at a fraction of the cost of most other major Florida cities.

As an example, the median sale price of a listed home in Northeast Florida, which includes the Jacksonville Metro was $235,000 in October 2019 according to the Northeast Florida Association of Realtors®️. By contrast, the median sales price in Miami Dade county was $380,000 in that same period.

These days the median sales price in Northeast Florida is $350,990, representing a 49 percent increase for the period. This when wages across the united states have risen about 23 percent since 2019, and inflation on common household goods is about 20 percent. There’s a pretty obvious gulf, enormous even.

But it’s not just home prices. Property Taxes have also surged in Jacksonville, rising an estimated 59.6 percent since 2019. The 3rd highest increase across all US metros for that timeframe. Combined with increased costs of materials and labor for things like repairs, the burden of owning a home has grown significantly as well, and even those who are able to make the initial purchase may be second guessing the carrying costs.

The perfect storm

Another cause of buyer hesitation is…the weather. The 2024 Atlantic Hurricane Season has been pretty unkind to the state. Current FEMA estimates put the damages for hurricanes from this year at between 50 and 85 billion (that’s billion with a B) for just Florida alone.

Historically a popular destination for Northern and Western migrants, especially during the Zoom Boom that came with remote work during the Pandemic, the reality of Florida’s hurricane trouble has started to hit home. This recent news cycle was flooded with stories of recent migrants experiencing their first storm season, only to lose it all and be sent packing back to whence they came.

Then there’s insurance. The costs of these storms aren’t just felt by homeowners, federal, and state agencies. Florida is currently in the midst of an insurance crisis, as many home insurers have begun to cancel policies and withdraw from the state, citing the high rate of storm related claims and major damage as a primary reason.

Home buyers and sellers are being forced to jump through excessive hoops, replacing roofs that would have previously qualified, cutting down and trimming limbs, and paying exorbitant premiums along many of the coastal areas. The resulting expenses are placing additional strain on an already struggling market.

Hope on the horizon

Despite the setbacks, there’s a reason we’re still aggressively buying in Jacksonville. The city has a ton going for it, and even with the staggering increase in home prices, it’s still a relatively affordable city by comparison to its neighbors like Tampa, Orlando, and Miami.

One of the biggest benefits is job growth and retention. When wages in a city are high, the inhabitants can afford to pay more for their housing. And Jacksonville is a city ripe with opportunity for high paying work. Earlier this year Jacksonville was ranked the #2 hottest job market by the Wall Street Journal, and Jacksonville was the #1 destination for corporate moves from 2022-2023 according to the SEC.

Then there’s the city itself. Jacksonville isn’t known for its downtown. But that’s changing. This year the city approved a major 2+ billion dollar initiative to renovate and replace the existing stadium space for the Jacksonville Jaguars NFL franchise. This new space is expected to bring increased tourism to the Jacksonville area, and the economic impact is estimated to be over 25 billion during the period of the 30 year lease the Jaguars have signed as part of the agreement.

The result should be a city with relatively affordable housing, a bustling downtown, beach access, and a healthy and resilient job market, all of the ingredients for long term growth.

What should sellers expect?

Seller’s who have a need to sell in the next few months should prepare themselves for a challenge. The average number of days a home sits on the market has risen to 71. Up from 61 the same time last year. And the competition is stiff. The number of listings has remained fairly constant in the mid 10 thousands since July.

Price cuts are also becoming the norm. It’s estimated that as many as 33 percent of homes listing on the market in Jacksonville have experienced a price cut this year. Gone are the days of dozens of offers and a high stakes bidding war. Now it’s a waiting game where dialing in the perfect asking price is a requirement, rather than a bonus.

Lastly, winter is historically a slow season for home sales. Most people simply don’t want to move during the Holidays when travel, and time with family are the primary concerns. Yards die and don’t look as good. Leaves fall from trees creating clutter, and the beaches aren’t quite as appealing as a selling feature.

If you do need to sell, make sure to spend the money on professional photos, upgrades, and repairs. Or be ready to cut prices. When there’s high competition, homes that stand out, or offer a steal of a value are far more likely to attract a buyer.

Lastly, get creative. Arm yourself with as much information about your home’s value as possible. Explore options like porting a low mortgage rate to a buyer, or talk to local investors about cash offers. Lenders can also offer some incentives like point buydowns which help for the first few years of ownership. Ultimately, the choice to sell should be a well thought out and researched one. Be sure to talk to a professional about how to make sure your sale meets your needs.

The post Existing Home Sales Spike – But not in Jacksonville appeared first on Duval Home Buyers.

De-listings: Going beyond the data 24 Sep 2024, 5:35 pm

Check your favorite news site, and it’s virtually guaranteed you’ll find a dozen articles written about housing affordability this year. The real estate market has been in no uncertain terms… turbulent. We’re still coming back down to reality after the unprecedented few years of low cost borrowing during the pandemic. Home sales have slumped while home costs have skyrocketed. And overall, in most markets, inventory has returned to pre-pandemic levels.

Despite this, there’s still a lot of buzz about housing shortages driving up costs. And it’s undeniably true. More than 60% of all current mortgage loans have rates below 4% and this presents a unique challenge. Most of these owners are “locked-in” to their rates, as the costs of borrowing have increased to the point where they could no longer repurchase their same home if it was on the market today. The result? A lot of homeowners who won’t or simply can’t sell anytime soon.

But that may be about to change. Last week, the Fed voted to reduce rates by half a percent, the first cut in over four years. This signals that borrowing costs are about to get cheaper. Mortgage rates preempted the cut, falling to an average of 6.09%, the lowest seen since early 2023. If rates continue to decline, many people, including those owners who are currently “locked-in” by their low rates will likely become buyers and sellers. In a perfect world more inventory and cheaper rates solves the issue completely. But there’s a little more to the story that isn’t being discussed, and I have a suspicion that it could complicate the conversation around inventory and costs. I’m talking about delistings, homes that failed to sell, and have been taken off of the market for one reason or another. These de-listings offer some pretty telling insight into what sellers should expect in the coming months, even as costs begin to come down.

Why don’t homes sell?

The real estate market is dictated by supply and demand. More supply and less demand = prices decreasing. More demand and less supply = prices increasing. But there are still plenty of factors that can make a home fail to sell, even when supply is low and demand is high.

Price

Price and value are often used synonymously, but in the world of real estate, they mean drastically different things. Simply put, price is how much a thing costs. In this case, a desired price is how much a seller wants to earn for their home. Value on the other hand, is what the home does for a buyer. Does it have a good school district? Does it have a pool? Is it functional? Does it suit their needs? A buyer makes their offer based on value, rather than price. When a listing price outweighs the perceived value of the purchase, there are only two options. The first is for the price to be reduced to be in-line with the value a buyer is putting on the home. The alternative is to pull the home from the market until a time in which the desired price and perceived value align.

This gap is something many sellers are struggling to bridge. In Jacksonville, the sold to list ratio has fallen in recent months. Currently homes are selling for 94.1% of list price on average*, meaning that seller’s have cut tens of thousands off of the original price in most situations before finding a buyer.

We’ve also seen that homes priced even 4-5% above their competition are more likely to be delisted after failing to sell. Buyers are looking for value, and with affordability tight, buyers are looking at the cheaper homes in a neighborhood first, especially when features are similar.

This data, both statistical and anecdotal, paints a picture that there aren’t many bidding wars occurring anymore. Sellers who find a buyer at or near list price, are usually willing to go with that buyer, and sellers have begun to get used to the idea of slashing prices whenever a listing goes stale.

Condition

In the height of the pandemic, everything was selling. And I mean everything. If it had 4 walls and a roof, there was a buyer who was ready and willing to fix it up, just to get a deal. That hasn’t been the case in recent months, at least from my observations here in Jacksonville. Homes in need of significant repairs are far more likely to de-list, or at the very least suffer significant price cuts.

I followed one home closely, which had major foundation damage in a difficult part of town. During the pandemic, buyers would have been lining up around the block. But in the current market, it went pending half a dozen times with unrealistic buyers who backed out of the deal, all well below asking, before eventually being pulled from the market altogether. And it’s not an isolated incident.

Buyers today are already facing higher costs of purchasing, and higher costs of maintenance. The last thing they want to do is make repairs or updates immediately after a major purchase like a new home. Construction material costs have risen steeply in the last four years, with things like ready-mix concrete and construction brick up more than 30%. It’s creating an expensive, double whammy, and the evidence points to buyers deciding to avoid that pain altogether.

Instead, the homes that are selling the fastest, and are the least likely to fail to sell, are homes in updated, live-in ready condition. Buyers are putting a greater emphasis on new roofs, updated electrical, new plumbing, new AC’s, updated kitchens, and other expensive items that they don’t want to have to replace in the first few years of homeownership.

Ease of access

Another surprising cause of homes delisting? The ease of showing. This is one I’ve seen firsthand, many times, especially over the past few months. Buyers aren’t looking to jump through hoops in order to view a home and put in an offer. Like most forces, they follow the paths of least resistance.

Owner occupied homes with limited showing windows place a burden on buyers to adapt their schedules to fit the seller. This is fine when the market is red hot, but in a cooler market like we’re seeing right now, there’s not much motivation when other homes in the area can be viewed on their time.

Pets and junk can also really hinder a sale right now. Buyers aren’t excited to wade through isles of belongings, wondering what’s underneath, or endure a barking dog for the entirety of their walkthrough. Again, not when there are options available where this isn’t the case.

Having a clean, accessible, and ideally staged home not only increases the number of buyers putting eyes on it and scheduling showings, but also helps increase offer prices, ensuring sellers earn a little more from their sale.

The Takeaway

Affordability and a shortage of housing units are undeniably causing some strain in the current real estate market. The Fed’s recent rate reduction is a good first step in helping bring the costs of ownership down, but there’s still a huge question mark around what it will do to inventory.

Hopefully, as more buyers are able to enter the market, more sellers will seek opportunities to make lifestyle changes of their own, bringing more previously unseen inventory to the market. But there’s a chance that a huge influx of buyers exacerbates the inventory problem, bringing back bidding wars for the most desirable homes, and actually decreasing affordability instead of helping it.

Ultimately, overpriced homes in poor condition are still going to suffer. Even if the bidding wars return, the buyer mentality around ease of access and the updated qualities they are looking for in their purchase are unlikely to shift significantly without some serious pressures.

Sellers should prepare themselves for a longer listing timeframe, and they should take careful consideration regarding any updates or repairs they plan to make, and how they plan to market and show their home. There’s still plenty of transaction volume, even here in Jacksonville, but it requires some effort to set yourself up for a successful sale. Go into it with that mentality, and no matter which way the wind shifts, you should be ok.

** NEFMLS Monthly Market Summary August 2024

The thoughts opinions expressed within this content are solely the author’s and do not reflect the opinions and beliefs of this website or its affiliates. Always consult a real estate professional.

The post De-listings: Going beyond the data appeared first on Duval Home Buyers.

Understanding the NAR changes and how they effect Sellers 27 Aug 2024, 8:06 pm

On August 17, 2024 seismic changes rocked the realm of real estate, decimating decades of tradition and forever changing the way we buy and sell houses. The result of a slew of antitrust lawsuits; NAR – the largest trade association in the United States with more than 1.5 million realtor members agreed to a settlement removing the responsibility for sellers to pay buyer’s agent commissions in a real estate transaction and barring further public advertising of commissions to buyers agents via the MLS (multiple listing service)

The goals of this settlement are simple: transparency and more market competition between real estate brokerages. But will the terms of the settlement have the desired effect for buyers and sellers? This author isn’t so sure.

The 6% standard commission

For decades the standard commission charged by real estate brokers has been 5-6% of the sales price. This fee is usually split evenly between the seller’s broker and the buyer’s broker, and almost always paid by the seller. But it’s never been a hard rule. Commissions are, and have always been entirely negotiable, with some modern brokerages offering discount listings for as low as 1%. Of course, sellers usually get what they pay for, and discount listings typically offer a greatly reduced service in exchange for the low cost.

So why force change if it’s not a strict requirement? The simple answer goes back to transparency. It’s no secret that real estate agents want, and need to get paid. Nobody works for free and a good agent brings an immense amount of professionalism and knowledge to the table. But because sellers typically paid the buyer’s agent’s commission, the amount that they offer had the ability to impact a buyer’s agent’s decisions about which properties to present to their clients.

Real estate agents have a fiduciary duty to ensure that they represent their clients interests to the best of their ability, but when they are being paid by the opposite party, things can get muddled quickly.

Under the settlement buyers will now establish agreements with their agents prior to viewing properties, similar to the way sellers have typically entered into long term agreements with their agents. Buyers will be responsible for paying their agent, and sellers will be responsible for paying their agent. No more conflict of interest. It seems like the perfect solution, but there’s a dark undercurrent of risk lurking just beneath the surface.

Kinks in an already imperfect system

There is a prevailing hope that these changes will help to ease the extreme prices of purchasing a home in the current market. Seller’s can better negotiate terms with their agents, and in a perfect world they can pass those savings on directly to the buyer. But we don’t live in a perfect world, and behavioral economics gives us some clues about how sellers may react to the possibility of saving on commissions. The most likely outcome? Greed.

But there’s another potential snag. Lenders. One of the main concerns many first time homebuyers have is cash savings. Historically buyers would put down around 20% of their home’s purchase price as a cash down payment, financing the remainder. But over the years as the average home price has outpaced wage growth by a significant factor, lenders had to get creative with new financing options tailored to lower down payments, and less cash to close.

Some of these programs, including the government backed FHA loans which offer down payments as low as 3.5%, have strict requirements for how much a seller can contribute to a buyer’s costs, making it harder to abuse the system. But these requirements haven’t been revised under the settlement changes. As a result, buyer’s are unlikely to be able to finance their agent’s commissions which could be as high as 3% of the purchase price. With the average house sale in Jacksonville approaching $450,000 as of July 2024 that extra cost burden can amount to tens of thousands at a time when affordability is already hampering sales.

There’s a strong likelihood that lenders will begin to adopt new loan products to support buyers, but it will take time. The period of uncertainty that time gap will create has the potential to hurt both buyers and sellers alike.

Out of the frying pan….

There is of course another option for buyers. Go unrepresented. While it’s always been an option, it was never a compelling one under the old system. After all, if the seller is paying for it, why not get the expertise and negotiating prowess of a professional to assist you in your transaction?

Under the new system with buyers footing the bill for their own representation, there’s a strong likelihood that we see an uptick of unrepresented buyers entering the marketplace and trying to brave it on their own. I’ve obviously got some bias as someone inside the industry, but buying and selling real estate is complicated, and it’s difficult. We can look at the failure rate of FSBO listings for some real world data on just how tough it can be to go unrepresented.

There are a ton of pitfalls an unrepresented buyer can fall into, including many that can be costly to both sides. Without representation, buyers may enter into contracts that they don’t fully understand, putting binder deposits, inspection fees, and appraisal fees at risk. Delays are already common when multiple professionals are working together on a file, and even a few days can cost hundreds or thousands in holding costs.

But here’s the kicker. The buyers who need representation the most, those who are already shopping on narrow margins and who can’t afford a few thousand dollars in expected setbacks, are the ones most likely to decline it for the same reason. Savings. Homeownership is a difficult enough dream to obtain for most Americans, and there’s a real concern that first time homebuyers may be at an ever greater disadvantage now.

The upside

While I’m skeptical that this settlement will have the desired effect, it does open the door for some great improvements.

The people of the United States have collectively and correctly agreed that monopolies are bad. They hamper growth and innovation, and they harm consumers. Please understand that I’m not accusing NAR of being a monopoly. But some of their policies have undeniably stifled competition. The renewed attention on commission negotiations should force brokerages to find new and exciting ways to gain a competitive edge, a good thing for an industry that hasn’t changed much in the past five decades.

Additionally, there’s likely to be a greater focus on the value of real estate agent’s services and expertise. It’s an incredible opportunity for high caliber agents and brokerages to set themselves apart, and may even help to fight some of the negative stigmas that have begun to surround the benefits that having an agent actually provides.

What sellers should expect

Real estate is a slow beast. Except on a few unique occasions, it doesn’t usually react in real time. It’s likely going to take a few months for the dust to settle and any real direction to become apparent, but in the meantime sellers should prepare themselves for a bit of turbulence.

Real estate sales have always been uncertain. Disruptors such as Duval Home Buyers have built much of their business on offering certainty in an uncertain market. But these settlement changes are unprecedented. That usually causes confusion. Confusion leads to…you guessed it… uncertainty. Brokerages are still getting their processes ironed out, so there are likely going to be some delays in places that have historically been fairly smooth and straightforward.

Sellers should also get used to the idea of offering some sort of concession directly to the buyer where allowed by the buyer’s lender. Nothing in the settlement precludes sellers from offering or marketing incentives directly to the buyer, and if buyers are going to be footing the cost of their own representation, they’re going to expect some concessions. At least at the start.

I’ve already begun to see them pop up in the public comment sections of MLS listings, peruse Zillow for a few minutes and I’m certain you’d find some as well.

Should I stay or should I go?

Timing is always a big question in any home sale. Sell at the right time and you could make huge gains on your investment. Sell at the wrong time and you may spend the rest of your life kicking yourself. So which is it right now?

Well, it’s a loaded question, and that’s the answer I’ll always give. If you need to sell, you need to sell, and any timing that achieves your goals is the right time. If you just want to maximize your returns, the wind is gusting in both directions. Interest rates are falling and affordability is slowly rising. Home values are appreciating, so waiting it out could bring a bigger yield.

But unemployment is also on the rise, and home sales have been slowing. If too much inventory floods the market without a stable supply of buyers, home prices will inevitably drop.

The best advice? Seriously take some time to think about why you are looking to sell, and make the decision that will check your boxes. The NAR rules change is going to cause some shakeup, but only time will tell how it will all settle.

The thoughts opinions expressed within this content are solely the author’s and do not reflect the opinions and beliefs of this website or its affiliates. Always consult a real estate professional.

The post Understanding the NAR changes and how they effect Sellers appeared first on Duval Home Buyers.

An Old Mortgage Product is Making a Comeback – and Alarm Bells are Ringing 5 Jun 2024, 6:54 pm

These days, it’s hard to go more than a few hours without seeing a headline about the troubled state of America’s housing market. With trillions tied up in real property, and a culture obsessed with homeownership, it’s no surprise that housing is top of mind for many Americans.

What’s obvious is that we’re facing a housing shortage. Or at least a shortage of housing that most middle-class Americans can afford. State, local, and even the federal governments are all looking for solutions. And for what it’s worth, there has been some downward pressure on interest rates, which dropped below the 7% mark at the end of May for the first time in months.

Private lenders have been quick to address the affordability problem. Focusing on limited cash savings that hold many buyers back, even when they can afford the monthly payments. Rate buydowns, assumable mortgages, and low down payment options are now more common. However, one lender’s solution—a 0% down mortgage—raises concerns.

How it works

Unlike traditional conventional mortgages requiring 3% to 20% of the home’s value as a down payment, or the federally backed FHA loan with a 3.5% down payment for those with lower credit scores and incomes, the 0% down mortgage allows buyers to close on a home without any cash down—up to a point.

Instead of having to come up with the cash for your down payment, you are given an interest free loan of 3% of the home’s value up to $15,000. The remaining 97% of the home’s cost is covered by your mortgage.

But here’s the catch. If you decide to sell, refinance, or pay off the home early, you have to pay back the $15,000 in full, all at once. Not a big deal given that home values have increased 5.2% year over year as of April 2024. Except, what happens if home values stall, or, like we saw in 2008, begin to decline?

The answer: you may not be able to afford to sell. And that’s a situation nobody wants to find themselves in.

The Big Risk

Without a down payment, you start with no equity in your home. It may take years, or a significant increase in home value, to build equity. Including closing costs and other fees, even selling at or slightly above the purchase price can leave you underwater.

And that’s all assuming that prices don’t decrease. Or that you don’t run into any major maintenance issues, which almost as every homeowner will tell you, you will. Being underwater on a home is never a good feeling. Being underwater and owing an additional $15,000 to be able to sell is a nightmare, especially if tragedy strikes.

Death, divorce, diamonds, diapers, and disaster make up the major reasons that people decide to part with their houses. These scenarios, often referred to as the 5 D’s of real estate, all require immediate action. Nobody wants to get stuck with a loan they can’t repay when they need to sell immediately.

Alarm Bells

As a result, some industry professionals have begun to ring alarm bells about similarities between these offerings and the NINJA (no income, no job, no assets) type loans that were being offered at the peak of the market right before the 2008 crash.

Despite this, lenders are pushing back on criticism. Stating that underwriting guidelines have improved significantly from 2008. As an extremely truncated recap of what happened in 2008: loose underwriting guidelines and a lack of oversight allowed hundreds of thousands of under qualified buyers to obtain loans that they couldn’t afford, which were traded on the secondary market as “Prime Loans”. These were often adjustable rate loans, which left many buyers scrambling when rates rose. A little dip in home prices made it difficult to sell and impossible to refinance. As a result, the real estate market crashed, taking years to begin a full recovery.

These lenders aren’t entirely wrong. Underwriters have severely clamped down in recent years. Setting stricter requirements for income verification, employment history, credit, and cash reserves. But the optics remain similar for industry insiders.

At a time when many Americans are struggling to build savings, and rates are sky high, there is a greater risk of default. Homeowners spend an average of 1-2% on home maintenance annually, and insurance rates have risen as much as 24% in areas with severe weather, such as Florida with its annual hurricane season. If a homeowner can’t come up with 3% in cash at the time of closing, it’s unlikely they’ll have it for maintenance or to cover rising costs.

Hurricane damage from Ian in Florida

When you can’t pay your mortgage, there’s usually only one option. Sell. But with the 0% down payment option, sellers will have to come up with that extra $15,000 before being able to do so. And unless their value has risen significantly, it’s unlikely that they’ll be able to do so. Homeowners in these situations often find themselves facing short sales or foreclosures, and both of those options are bad for lenders and homeowners alike.

We believe that homeownership should be affordable to everyone. It’s the American Dream after all. But it has to be done in a way that doesn’t put people at greater risk. The 0% down payment loan may not be the solution.

Positive Signals but an Uncertain Future

Despite the concern, it’s not all doom and gloom. There are plenty of signals for positivity in the housing market. Home prices continue to reach record highs each month, and while there is more available inventory, the average amount of time a home sits on the market before a sale is still historically low. There are fewer bidding wars, but homes are still selling for a high % of their listing price.

Most analysts do not predict a market crash, and there’s hope for lower rates, with the Fed expected to make at least one cut in 2024. However, home sales are slowing, and prices may stall by year-end if rates do not ease.

Summer is a historically good time to sell, so those on the fence about the right time might consider making some moves. Many buyers are waiting on the sidelines, but there are still plenty of options available for sellers.

The views and opinions expressed in this article are not financial advice and are for entertainment purposes only. It’s best to speak with a qualified real estate professional or attorney before making any real estate decisions.

The post An Old Mortgage Product is Making a Comeback – and Alarm Bells are Ringing appeared first on Duval Home Buyers.

How to Sell Your Home to an Investor in Jacksonville: A Guide 5 Apr 2024, 8:26 pm

It’s 7:45 on a Friday and you are late for work. As you grab your keys, your phone rings. It’s your realtor, telling you that there is an interested buyer and that they want to show the house that afternoon. You clean in a frenzy to ensure that everything is perfect for the showing. It’s pure stress. That afternoon your agent calls and says the buyer has decided to go a different direction. You’ll get the next one.

For home sellers, this can be one of the many realities they face when trying to find a buyer for their home. According to the data from NEFAR, it takes an average of 69 days on the market before a sale. And even when a buyer is found, there are still inspections, repairs, and financing questions. All which can derail your sale. In fact, in some months it’s been reported that up to 15% of contracts fall through. Forcing a seller start over and find a new buyer.

For sellers who don’t have the luxury of time, don’t have the funds needed to make required repairs, or who simply don’t want to deal with the usual stress of selling, there is always the option of selling to an investor. Investors can offer speed, simplicity, and convenience compared to the traditional way of selling a home, though you typically make a little less from the sale.

Selling to an investor is easy, but making sure you find the right investor to fulfill your needs is important. This guide will break down what to look for in a good investment buyer, and the process of getting a home sold to an investor.

The Basics of Selling to an Investor

Real estate investors are individuals or companies that purchase real estate assets, typically homes, in order to make a profit. Using cash or an established line of business credit they can avoid the typical lender requirements for condition and value.

Investors typically prefer properties that need maintenance, repairs, or have other issues that the traditional system fails to address. But many investors are happy to purchase any type of home, as long as the seller is willing to part with a little bit of their equity – the profit they would earn from selling.

When you sell to an investor, you should expect to earn less from your sale than you would with a real estate agent. Though with a good investor as a buyer, it shouldn’t be by much. In return, you will get a nearly guaranteed sale, rather than having your home become one of thousands on the market. There are over 8,000 homes listed on the Northeast Florida MLS as of April 2024. With just 2542 sales in March 2024, the chances of successfully selling the traditional way are a lot slimmer.

Preparing Your Home to Sell to an Investor

The first step in any sale is to understand the value of what you are selling. When it comes to your home, there are many tools that can be used to give a value estimate, but it’s always best to get the opinion of a local professional for the most accurate valuation. Tools like Zillow can provide a ballpark, but they can’t take into account information that isn’t public record such as condition.

Many of the best investors are licensed real estate agents, and will be more than happy to provide comparable sales as evidence of their pricing to ensure everything is as transparent as possible.

One of the biggest benefits of selling to an investor, is that reputable investors buy homes “as-is” which means that they won’t ask you to make any repairs or changes. Unlike a traditional sale in which buyers routinely request thousands of dollars in repairs such as new roofs, updated plumbing, or repairing wood rot. Often as a requirement of the bank giving them their loan.

An as-is house sold to Duval Home Buyers in Jacksonville Florida

Selling as-is also means that you can take what you want and leave the rest, and don’t need to worry about deep cleaning, patching nail holes, or touching up paint. If you’re a landlord and have had bad tenants, or have inherited a home, it can also save you the huge hassle of cleaning it up for showings.

Finding the Right Investor in Jacksonville

You wouldn’t let just anybody into your home. Be just as careful with investors. Making sure you find the right investor or investment company is the most important part of ensuring a good sale. There are thousands of people and hundreds of companies out there that claim to buy houses for cash, so how do you know who to trust?

- Locality – Choosing a local investor is always a good idea. Local investors operate in a small market, so their reputation matters. Ensuring you have a good experience is critical to their future business, so they’ll go the extra mile to ensure you are cared for. Local investors also have a better understanding of local laws, customs, and even pricing. If you are in Jacksonville, make sure you choose a company that buys houses from Jacksonville.

- Licensure – Doctors know medicine, real estate agents know housing. Ensuring your buyer is licensed offers a few benefits. First, they are bound by the laws and regulations of the state real estate board. This ensures an extra level of protection for you as a seller. They understand the sales process, and know how to keep a sale moving forward smoothly, ensuring you close on time. Finally, they have a realistic understanding of their local market, and can offer more transparency in pricing.

- Reputation – Using companies with visibility on sites like Google can help ensure you work with a reputable buyer. Companies with large numbers of user reviews and positive feedback are often the best options. You can also check websites like The Better Business Bureau to see if the company you choose has had any complaints.

- Contactability – A good investment company should be easy to contact. They should prominently display a local telephone number, with actual humans on the other end. Not a Google voice line and an answering service. They should have a local, verifiable address, and an office you could visit if necessary.

- History of Success – Check online with websites like the Duval County Property Appraiser or the Official Records Department for deeds and titles in the name of the individual or company that you are thinking of working with. You should see a history of recent transactions if the buyer is active and legitimate.

The Sales Process

Once you’ve determined that you are going to work with an investor, and have an idea of which reputable investors you can trust, you will be ready to start the sales process. Here are the usual steps you can expect when working with an investor.

- Contact – Reach out via phone, email, or an online contact form to let the investor know you’d like to discuss selling your home to them.

- Discuss – Over the phone or via email the investor will ask you questions such as the condition of the home, your situation and why you want to sell, and how much you hope to get from it.

- Schedule – Schedule an appointment for the investor to come and inspect your home. They’ll take photos and notes about the condition. Using these notes they’ll prepare a valuation and present an offer. Some companies provide offers without needing to visit your home, but these are often lower due to the increased risk, so we advise that you always have the buyer walk the property.

- Negotiate – Agree on a suitable price and set timeframes that meet your needs.

- Contract – The investor will send a real estate contract with the details you agreed on. This is often done using a digital signing service, but it can also be done with a pen and ink in person. Once signed, the buyer will send a deposit to a local, licensed title company, who will handle the legal side of the transaction.

- Move – If you live in the house, take the possessions you want and leave the rest. Good investors are flexible with moving timeframes, and can allow you to move out the day of closing, or even months after you sell the home. Be sure to ask your buyer about your options.

- Close – Sign the sales paperwork with the title company handling the sale. This needs to be done in front of a Notary and two witnesses. Most title companies in Florida offer this service as part of closing your sale. You can choose to have your money sent directly to your bank via a wire transfer, or you can opt to get a check from the title company. Note, that it can take up to 1 business day for funds to clear, so don’t be alarmed if it takes a few hours. Using a local, reputable title company will ensure you are protected.

Is Selling to an Investor Right for Me?

While it is ultimately your decision if selling to an investor is the best way to sell your home, it’s important to weigh the pros and cons.

Benefits include:

- A faster sale (usually less than 30 days from the day you first contact the investor)

- No need for repairs

- Can be flexible with code violations and permitting issues

- No cleaning

- As little as one showing

- Leave what you don’t want

- Move on your timeline

- No real estate agent fees

Where the main drawback of selling to an investor buyer is that you will likely receive a lower offer than you would from selling the traditional way with an agent.

Regardless of your decision, all reputable investors offer free consultations, and offers with absolutely no obligation to accept. It doesn’t hurt to see what a local investor would pay, even if you decide to sell with an agent. The worst case scenario is you have more information. And that information can help empower you to make a great sale.

The post How to Sell Your Home to an Investor in Jacksonville: A Guide appeared first on Duval Home Buyers.

The Start of the Home Selling Season and a Look at 2024 to Come 16 Feb 2024, 3:21 pm

As fans in Kansas City celebrated their Super Bowl LVIII victory over San Francisco last Sunday, Realtors® all around the country were gearing up for the start of the 2024 spring home selling season. Each year the Super Bowl kicks off what is considered the season’s unofficial start, and buyers and sellers alike should begin considering their plans for the upcoming year.

But what does the 2024 selling season have in store for sellers in the Jacksonville market? Here’s our take on the current data from 2023 and what it could mean for the coming year.

Housing Affordability

According to reports published by Black Knight, a mortgage data company headquartered here in Jacksonville, 2023 was the least affordable real estate market since 1985, almost 40 years prior.

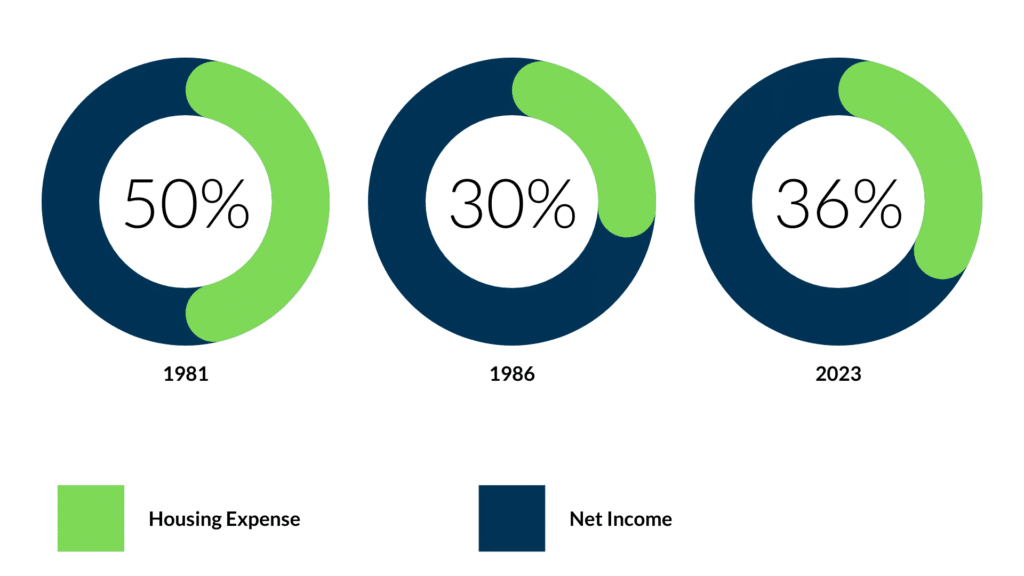

For reference, In 1981 the average monthly payment of a newly originated mortgage took up about 55% of the median household income, indicating that most buyers would become “severely cost-burdened” by purchasing a home. By 1986 that figure had decreased to 30%, which is only considered “cost-burdened”.

Housing burdens over time for newly originated mortgages.

With rates for a 30 year fixed mortgage in the high 6’s and low 7s for a majority of the year, and home values continuing to climb, the average mortgage payment for a new loan in 2023 took up 36% of the monthly income, higher than that of 1986, and putting a majority of would-be homebuyers into a bracket that would make them “cost-burdened”.

As a result home sales have slowed, and many homes are spending far longer on the market before selling, even if they sell for a premium price.

2023 Jacksonville Sales Data

2023 was a difficult year for real estate at the national level. Nearly 1 million fewer homes sold in 2023 when compared to 2022. Considering that the average year sees about 5.5 million sales nationally, 1 million represents an incredibly steep decline of just over 18% .

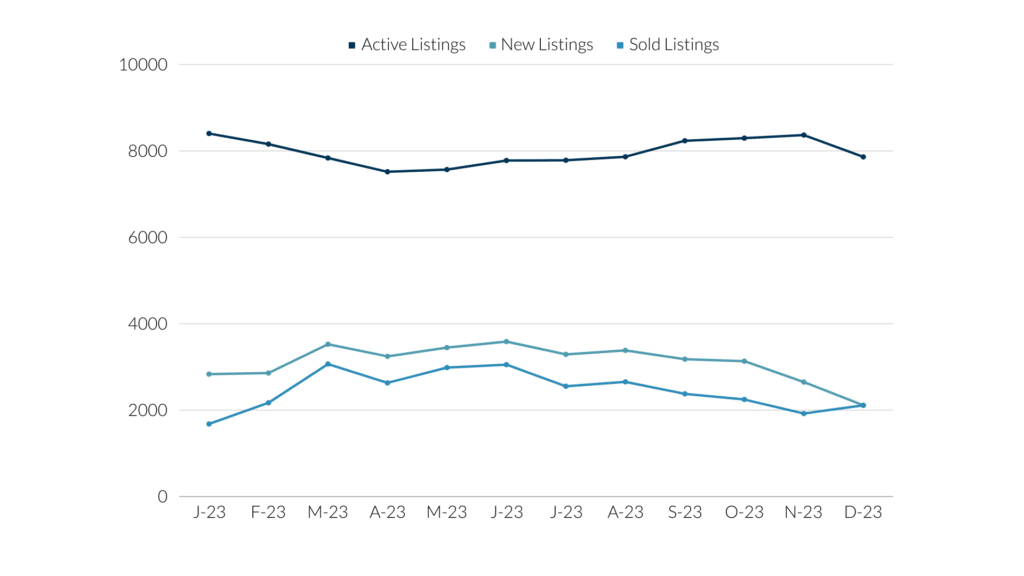

According to reports from the Northeast Florida Association of Realtors, there were 29446 residential sales of on-market Jacksonville homes in 2023. An 11% decrease from the 33072 sales in 2022. Homes in the $120,000-250,000 price range saw the biggest declines, though this can be largely attributed to rising home prices reducing the overall volume of lower-cost home options.

2023 NEFAR Listings Data

A First Look at 2024

According to the same reports provided by the Northeast Florida Association of Realtors, January 2024 is also off to a slow start, showing only 1510 residential sales. A 10.1% decrease year over year from the 1680 residential sales in January 2023. Additionally, the average number of days on the market has increased to 68, a 3.03% increase year over year.

The average sales price offers a silver lining however, showing an 11.7% year over year increase from $406,789 in Jan 2023 to the current average of $454,365 in Jan 2024.

Additionally, the ratio of selling price vs listing price is also showing promise at 93.8%, a .8% increase from 2023. This statistic is highly seasonal, and tends to rise as the spring season gets underway.

Other Factors to Consider

For buyers and sellers alike, interest rates will dictate much of how the real estate market in Jacksonville operates this year. Rates have been at historically high levels since late 2022 when the average 30-year fixed rate suddenly spiked from the unprecedented lows brought on by the COVID-19 pandemic to values last seen in 2008 during the real estate crash.