Add your feed to SetSticker.com! Promote your sites and attract more customers. It costs only 100 EUROS per YEAR.

Pleasant surprises on every page! Discover new articles, displayed randomly throughout the site. Interesting content, always a click away

OneDigital

Insurance, Financial Services and HR ConsultingGet a Financial Second Opinion: Regain Control in Uncertain Times 15 Apr 2025, 3:22 pm

In times like these, certainty is your greatest asset.

With market volatility and headlines that heighten anxiety, it’s only natural to wonder: Is my financial plan still working for me? Are your investments protected? Are your decisions aligned with your long-term goals, or just reacting to current events? Now is the time to get a second opinion.

A one-on-one session with a OneDigital financial advisor offers you the chance to ask tough questions, stress-test your strategy, and regain the confidence you need to feel more secure in your financial future.

Key Questions You Should Be Asking Right Now

- Is my current plan built to withstand market volatility?

- Are my investments still aligned with my long-term goals, or just reacting to market shifts?

- Am I adequately protecting my income and my family against potential financial shocks?

- Am I missing out on tax-saving opportunities or exposing myself to unnecessary risks?

What You Can Expect

At OneDigital, we don’t just offer advice—we advocate for your financial success.

We take a comprehensive approach, looking at all aspects of your financial life, from investments and insurance to estate planning and taxes. Our goal isn’t just to help you react to market conditions—it’s to help you move forward with clarity and control.

Together, we’ll have a focused conversation to review your current strategy and help ensure you're on the right path in these unpredictable times.

Now Is the Time to Act. Let a Fierce Advocate Help You Regain Control.

Here’s how we’ll work together:

- Understand your unique goals, priorities, and the concerns that keep you up at night.

- Review your complete financial picture to spot areas of misalignment or missed opportunities.

- Provide tailored recommendations that empower you to move forward with confidence.

Ready to take control of your financial future? Click here to schedule your personal strategy review today.

___________

ID: 00173924

Investment advice offered though OneDigital Investment Advisors LLC.

OneDigital Investment Advisors LLC and their associates are not estate planners and cannot provide tax or legal advice. Estate planning services may be accessed through a relationship through a third-party. Consult your estate-planning attorney or qualified tax advisor for specific advice regarding your situation.

The post Get a Financial Second Opinion: Regain Control in Uncertain Times appeared first on OneDigital.

OneDigital Acquires Fortune Insurance, Expanding Property & Casualty Presence in the Pacific Northwest 15 Apr 2025, 1:00 pm

Strategic acquisition strengthens OneDigital’s risk management capabilities in Washington and beyond

ATLANTA, GA – April 15, 2025 – OneDigital, a leading insurance brokerage, financial services, and HR consulting firm, has acquired Fortune Insurance (Fortune), a prominent property and casualty (P&C) firm headquartered in Tacoma, WA. With an established presence in employee benefits, HR, and financial services throughout Washington, this strategic acquisition expands our capabilities into property and casualty insurance—strengthening our risk management footprint in the region and advancing our commitment to delivering integrated, end-to-end solutions for employers.

Founded in 2014 by President Grant Baldwin, Fortune Insurance has earned a strong reputation for delivering a wide range of services—including general and professional liability, property and vehicle coverage, excess and umbrella policies, workers’ compensation, employment practices liability, and intellectual and product liability. As cyber threats continue to impact businesses of all sizes, Fortune has become a go-to resource for practical, industry-specific solutions that help clients safeguard their operations and stay ahead of evolving risks.

We are thrilled to welcome Grant and his team to the OneDigital family. Together, we’ll help clients navigate the increasing complexities of risk and people management. This partnership exemplifies our accelerating strategy to enhance our relevance and value to clients.

— Jeff Fallick, President of the West Region at OneDigital

Grant Baldwin, President of Fortune Insurance, shared his excitement:

Our team has always embraced the philosophy that ‘the client comes first.’ As a business owner, I understand the critical decisions my clients face, and my mission has been to engage with innovative ideas that positively impact their businesses. Joining OneDigital opens an exciting new chapter for us, providing more opportunities to advocate for our clients by leveraging expertise in employee benefits, retirement planning, wealth management, and HR consulting.

This partnership ensures that the Fortune team will continue to deliver personalized service while gaining access to OneDigital’s expansive nationwide network of P&C resources, guaranteeing that clients' evolving needs are consistently met. Furthermore, this collaboration will strengthen OneDigital’s P&C presence across the Western region, complementing its existing offices in California, Colorado, Idaho and Utah and reinforcing its position as a leader in the industry.

About OneDigital

OneDigital’s team of fierce advocates helps businesses and individuals achieve their aspirations of health, success and financial security. Our insurance, financial services and HR platform provides personalized, tech-enabled solutions for a contemporary work-life experience. Nationally recognized for our culture of caring, OneDigital’s teams enable employers and individuals to do their best work and live their best lives. More than 100,000 employers and millions of individuals rely on our teams for counsel and access to fully integrated worksite products and services and the retirement and wealth management advice provided through OneDigital Investment Advisors. Founded in 2000 and headquartered in Atlanta, OneDigital maintains offices in most major markets across the nation. For more information, visit onedigital.com.

About Fortune Insurance

Based in Tacoma, Washington, Fortune Insurance is a property & casualty firm offering general and professional liability to clients who require industry-specific coverage. The firm provides tailored risk management services to protect from traditional insurance risks, cyber threats, Error & Omissions and Directors & Officers claims. Fortune Insurance works with a range of industry-specific fields with experienced capabilities in technology, manufacturing, construction, healthcare, food and beverage, hospitality, retail and wholesale, and non-profits. For more information, visit fmgins.com.

The post OneDigital Acquires Fortune Insurance, Expanding Property & Casualty Presence in the Pacific Northwest appeared first on OneDigital.

Deferred Compensation Plans for Retaining Valued 1099 Independent Contractors 15 Apr 2025, 1:00 pm

Representing 38% of America’s workforce, independent contractors, consultants, and freelance workers fill critical needs in many industries, typically with little or no access to retirement plans or other employee benefits.[1]

Research by Upwork shows that 64 million Americans were self-employed as of December 2023. As the number of independent workers continues to rise annually, employers are challenged to find ways to retain and reward these integral members of their team.

Independent Contractors: Not Your Average Gig Worker

Unlike W-2 employees, independent contractors contract their services directly to individuals or companies and report their earnings on either Form 1099-NEC (Nonemployee Compensation) or 1099-MISC (Miscellaneous Income) rather than a W-2 tax form.

While contingent and gig workers, freelancers, consultants and independent contractors are all classified as 1099 employees for tax purposes, there are distinct differences between an independent contractor or consultant providing an employer with valued subject matter expertise or unique skills and a gig worker, who may support multiple employers almost always on a short-term or “gig-based” timeline.

Physicians, researchers, and other highly trained professionals in healthcare, finance, the arts, entertainment and subject matter experts (SMEs) with specialized knowledge may be independent contractors. As work experience increases, so can a worker’s likelihood of becoming a contract employee. Among all workers ages 55 and over, 11.5 percent are independent contractors in their sole or primary occupation, compared to just 6.9 percent among workers aged 25 to 54.

The Appeal of Deferred Compensation for Independent Contractors

Generally, independent contractors are self-employed individuals without access to traditional employer-sponsored retirement plans, such as a 401(k) plan. While retaining desirable aspects of job independence, independent contractors also retain full responsibility for paying or remitting their income, social security and Medicare taxes.

Independent contractors are, however, generally exempt from Internal Revenue Code (IRC) Section 409A. This distinction positions employers to offer independent contractors a nonqualified deferred compensation (NQDC) arrangement that would not constitute a top hat plan and not be subject to any ERISA[2] requirements because the contractor is not an employee of the company.

The option to defer compensation and income taxes on that compensation to a future time can appeal to an independent contractor. Because they are self-employed, contractors have limited options to save for retirement through investments in tax-friendly vehicles, such as an employer sponsored 401(k) plan.

Lack of access to employer-sponsored retirement plans can limit independent contractors to saving and investing for retirement through Individual Retirement Accounts (IRAs), Simplified Employee Pensions (SEPs), or Solo-401(k) Plans.). These savings plans all include a cap on how much a worker can defer annually.

Offering independent contractors access to an NQDC plan and the opportunity to defer receipt of the income and its tax obligations to a future date can help an employer secure the loyalty of a valued contractor. A deferred compensation plan can decrease the risk of losing a contractor to a competitor while providing a way to reward the contractor’s contribution to the company’s success.

Deferred Compensation for Independent Contractors: Simpler for Plan Sponsor and Plan Participant

As the plan sponsor, a company rarely has income or employment tax withholding obligations when offering deferred compensation to independent contractors. Employers that sponsor a deferred compensation plan for independent contractors are not required to collect Federal Insurance Contributions Act taxes (FICA) as they must do in deferred compensation plans for employees.

Although independent contractors are not subject to FICA and the Federal Unemployment Tax Act (FUTA), they are subject to the Self-Employed Contributions Act (SECA). While W2 employees must follow the special timing rule that requires them to pay FICA taxes immediately upon the vesting of deferred compensation, even if the contractor will not receive the compensation until later years, SECA does not have this requirement. Independent contractors find this aspect of an NQDC favorable because SECA taxes are applied only at the time the compensation is actually paid to them, even if such compensation is deferred years into the future.

Important Considerations When Working with a Consultant

Rarely should a nonqualified plan for an independent contractor be designed to trigger payment upon the contractor’s separation of service from the company. Instead, the plan should be structured to trigger payment on a specified date.

Class-year distribution elections provide independent contractors maximum flexibility in distribution management, including the ability to:

- Make a unique election each year.

- Select a different payment option each year.

- Ability to make payment modifications to an existing account, subject to a five-year delay.

Developing a deferred compensation plan for use with independent contractors or other 1099 employees calls for executive benefits consultants who are well-versed in the strategic design of class year plans, enabling options for plan participants to pivot on their payout schedules to best accommodate their savings and retirement goals. Download our deep-dive report, Deferred Compensation Plans for Rewarding and Retaining Valued 1099 Independent Contractors.

To learn about other executive benefits strategies, we invite you to read: Reasons to Reevaluate Your Rabbi Trust, How the 2025 Retirement Plan Limits Impact Highly Compensated Employees, and How Changes to Dodd-Frank Clawback Policies May Affect Your NQDC Plan.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any tax advice contained herein is of a general nature. You should seek specific advice from your tax professional before pursuing any idea contemplated herein. The examples shown are for illustrative purposes only. The material in this report may contain financial illustrations, which may reflect hypothetical dividends, interest, rates of return, and/or expense and mortality assumptions, none of which are guaranteed.

Sam Robert is affiliated with Valmark Securities, Inc. Securities offered through Valmark Securities, Inc. member FINRA, SIPC. Investment Advisory Services offered through Valmark Advisers, Inc. a SEC Registered Investment Advisor. Registration as an Investment Adviser does not imply any certain level of skill or training. 130 Springside Drive, Suite 300, Akron, OH 44333. 800-765-5201. OneDigital is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc. Valmark Securities, Inc. and Valmark Advisers, Inc. are independent of and unaffiliated with ODIA. California License #0I01065. Check the background of this investment professional on FINRA’s BrokerCheck.

Drew Biggs is affiliated with Valmark Securities, Inc. Securities offered through Valmark Securities, Inc. member FINRA, SIPC. 130 Springside Drive, Suite 300, Akron, OH 44333. 800-765-5201. OneDigital is a separate entity from Valmark Securities, Inc. Valmark Securities, Inc. is independent of and unaffiliated with ODIA. Check the background of this investment professional on FINRA’s BrokerCheck.

Some of the Financial Professionals associated with OneDigital are registered representatives of and offer securities through Valmark Securities, Inc. a registered broker-dealer, Member FINRA / SIPC. Additionally, some OneDigital Financial Professionals are also Investment Adviser Representatives and offer advisory services through Valmark Advisers, Inc., an SEC registered investment advisor. To help public members determine the specific registrations associated with our Financial Professionals, we recommend reviewing the Broker Check Link that provides insight to the securities registration and company affiliation of our Financial Professionals. Please note that while the individual Financial Professionals can be associated with multiple financial services organizations, the products and services of those independently owned and operated entities can be separate and segregate. OneDigital is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

Sources:

[1]Upwork Study Finds 64 Million Americans Freelanced in 2023, Adding $1.27 Trillion to U.S. Economy

[2]Employee Retirement Income Security Act of 1974

The post Deferred Compensation Plans for Retaining Valued 1099 Independent Contractors appeared first on OneDigital.

ABLE Accounts: Understanding the Savings Accounts for People with Disabilities 15 Apr 2025, 1:00 pm

The Achieving a Better Life Experience (ABLE) Act took effect in 2014 to help individuals with disabilities save money in tax-advantaged accounts without jeopardizing their eligibility for public benefits.

How are ABLE Accounts Used?

ABLE accounts are savings and investment accounts specifically for individuals with disabilities. These accounts allow eligible individuals to save money for disability-related expenses without affecting their eligibility for federally funded benefits like Supplemental Security Income (SSI) and Medicaid.

Funds in ABLE accounts can be used for a wide range of qualified disability expenses (QDEs), which include but are not limited to:

Education- Tuition, books, and other educational materials.

Housing- Rent, utilities, and home improvements.

Transportation- Public transit, vehicle modifications, and maintenance.

Employment- Job training and support.

Health- Medical expenses, therapies, and equipment.

Basic Living Expenses- Food, clothing, and personal care items.

Additional Benefits

Tax-Free Earnings:

While contributions to ABLE accounts are not tax-deductible, the earnings on investments within the account grow tax-free. Distributions from the account are also tax-free, if they are used for qualified disability expenses.

Saver's Credit:

Eligible ABLE account beneficiaries may qualify for the Saver's Credit, which is a non-refundable tax credit for contributions made to the account.

Rollovers from 529 Plans:

Families can roll over funds from a 529 education savings plan to an ABLE account without incurring taxes. However, these rollovers count toward the annual contribution limit.

Limitations

While ABLE accounts offer significant benefits, there are some important limits and limitations to be aware of.

Eligibility:

To open an ABLE account, the individual must have a disability that began before age 26. However, this age limit will expand to 46 effective January 1, 2026. Additionally, the account can be open at any age, if the disability onset was before the aforementioned age.

Contribution Limits:

The 2025 annual contribution limit for ABLE accounts is $19,000. Moreover, if the beneficiary is working and does not participate in an employer-sponsored retirement plan, they can contribute an additional amount up to the federal poverty level for a one-person household.

Resource Limits:

Supplemental Security Income (SSI) does not consider up to $100,000 in an ABLE account as a countable resource. However, exceeding this limit may affect SSI benefits.

State Plan Limits:

Contribution and total amount limits can vary by state.

How to Enroll

- Check Eligibility: Ensure the applying individual meets the eligibility criteria.

- Gather Personal Information: You'll need the following details:

- Account owner's name

- Date of birth

- Mailing address

- Social Security number or Taxpayer Identification number

- Email address

- Identification type (e.g., driver's license or state-issued ID card)

- Bank routing and account numbers for initial deposit

- Choose an ABLE Program: Select an ABLE program that best meets your needs. The ABLE National Resource Center offers tools to compare different programs.

Once you’ve chosen the ABLE program that best suits your needs, follow the instructions to complete the application. Folks can manage their accounts online, including making contributions, accessing funds, and tracking expenses.

Additional Considerations

Legal representatives can open accounts on behalf of individuals. Personal information of the representative along with the primary account owner will be needed for this process.

Lastly, the process does involve providing information about the primary disability that the account owner has. This may require including diagnosis codes and supporting documents.

The ABLE Act and ABLE accounts provide a valuable tool for individuals with disabilities to save and invest money for their future needs without losing access to essential public benefits. Understanding the eligibility criteria, contribution limits, and how to use these accounts effectively can help maximize their benefits and promote financial independence.

Looking for additional financial topics? Our Financial Academy page has you covered! Find helpful resources to help you do your best work and live your best life.

Investment advice offered through OneDigital Investment Advisors.

The post ABLE Accounts: Understanding the Savings Accounts for People with Disabilities appeared first on OneDigital.

Beyond Symptoms: A Doctor's Perspective on Healthcare in America 14 Apr 2025, 7:03 pm

With life expectancy decreasing for the first time in recorded history and chronic diseases continuing to rise, many are questioning what our healthcare system is doing for us.

That's why we sat down with Dr. Brian Williams, a family medicine physician in Mystic, Connecticut, to get his perspective on the current healthcare system in America and how we, as individuals, can live healthier lifestyles as well as create healthier workplaces for employees. During this discussion, we delve into why we don't see ads for broccoli or fish on TV, the controversial role GLP-1s play in weight management, and what the state of primary care is in this country. We also ask Dr. Williams how we can shift from a reactive sick-care model to a proactive well-care system and what actionable steps we can take, both individually and collectively, to promote healthier habits. Tune in for a thought-provoking discussion that aims to inspire healthier lifestyles and systemic change.

In this season of Friends with Employee Benefits, we're focused on one underlying theme: help employers contain their healthcare cost by, among other things, helping their employees live healthier lifestyles. This season, we’re tackling the biggest challenges in healthcare today: the obesity crisis, the rise of GLP-1s medications and skyrocketing pharmacy costs. But we’re not stopping there.

We’re diving into financial, mental and physical health – the mind-body connection, the financial stress-health link, and why America’s healthcare system focuses on sick care instead of prevention – and how that needs to change. We’re going to be sitting down with doctors, CEOs and HR professionals, pharmacy consultants, forward-thinking tech businesses, legislators and more – all with one goal – to answer the question: how are we impacting the health of our employees, and in turn, the health of the business.

If you’re ready for real talk, great insights, and practical solutions as it relates to all things healthcare, this season is for you. Subscribe to our Friends with Employee Benefits podcast and let’s rethink healthcare – together!

The post Beyond Symptoms: A Doctor's Perspective on Healthcare in America appeared first on OneDigital.

The Future of Simple IRA Plans: Meeting the Moment with Innovation and Intention 14 Apr 2025, 2:30 pm

In the fast-changing world of retirement planning, small business owners are facing a pivotal question: How can we offer retirement benefits that are simple, affordable, and still meet the evolving needs of a modern workforce?

SIMPLE IRA plans - officially known as Savings Incentive Match Plan for Employees - have long been a go-to solution for smaller companies looking for a tax-advantaged retirement plan with low administrative burden. But as financial expectations shift and employee needs become more diverse, it’s clear that “simple” can’t mean “static.”

The future of SIMPLE IRA plans lies not in reimagining the structure entirely, but in surrounding them with smarter tools, personalized support, and a deeper integration of financial wellness. The question isn’t whether these plans are still relevant - the answer is yes. The question is how to evolve them to meet the next generation of savers where they are.

A Strong Foundation - With Room to Grow

SIMPLE IRAs offer small businesses an approachable entry point into retirement benefits. They require employers to contribute either 2% of each eligible employee’s salary or match employee contributions up to 3%. The administrative lift is minimal, with no annual filing requirements for employers. That’s not changing - and for many, that’s the appeal.

What is changing is the level of sophistication employees expect from their workplace benefits.

Financial Wellness Is No Longer a “Nice-to-Have”

Increased financial stress, inflation, and student loan burdens mean that simply offering a retirement account is no longer enough. Employees want help navigating today’s financial pressures and planning for tomorrow. That’s where financial wellness and personalization come into play.

Think tools for budgeting. Workshops on debt management. One-on-one financial coaching. These services don’t just increase employee satisfaction - they directly impact contribution rates and long-term plan participation.

When employees feel more confident managing their finances today, they’re far more likely to engage with their retirement plan tomorrow.

Personalization and Technology: Raising the Bar

Another major opportunity for SIMPLE IRA evolution lies in personalization. Younger workers may prefer aggressive portfolios and digital-first tools. While other employees may value stability and hands-on support. Employers can now provide both, using technology to scale individualized experiences.

Modern platforms make it easy to offer personalized investment allocations based on goals, risk tolerance, and time horizon - even within SIMPLE IRA structures. Mobile access, educational content, and data-backed nudges help keep retirement top of mind, not out of sight.

Legislative Momentum: SECURE 2.0’s Impact

Federal legislation is also nudging SIMPLE IRAs into the future. The SECURE 2.0 Act introduced several updates aimed at improving access, boosting savings potential, and increasing plan flexibility.

Among the most notable:

- Higher catch-up contributions for employees between the ages of 60 and 63 during the calendar year.

- Expanded eligibility rules, allowing more part-time workers to participate.

- Employer matches for student loan repayments, helping those who may not be able to contribute directly to still benefit from the plan.

These updates offer a chance for employers to revisit how they present SIMPLE IRA benefits - and to reframe them as not just simple, but strategic.

What’s Next?

The future of SIMPLE IRA plans isn’t about turning them into complex 401(k) alternatives. It’s about building on what makes them great - accessibility, ease, and affordability - while expanding their impact through smart add-ons like financial wellness, personalization, and technology.

Let’s Build a Smarter SIMPLE IRA Together

The message is clear: SIMPLE IRAs have staying power, but to truly serve your workforce, they need to evolve. Now is the time to explore ways to modernize your plan - without sacrificing simplicity.

Get in touch with our team to talk through what a smarter SIMPLE IRA could look like for your business. Whether you’re just getting started or ready to enhance your current offering, we’re here to help.

Investment advice offered through OneDigital Investment Advisors LLC.

The post The Future of Simple IRA Plans: Meeting the Moment with Innovation and Intention appeared first on OneDigital.

Markets in Focus: Navigating Markets in a Climate of Uncertainty 14 Apr 2025, 12:30 pm

Reflecting on the market performance so far this year, it’s becoming increasingly evident that volatility is here.

The explanation for the spike in stock market volatility can be summarized in one word - uncertainty. We experienced uncertainty over the future of economic growth, uncertainty over the new presidential administration policies, and uncertainty over the future path of Federal Open Market Committee (FOMC) policies.

The performance of the U.S. economy in Q1 2025 reflected that uncertainty. Large-cap stocks, as represented by the S&P 500 index, posted negative returns of -4.2%, reflecting a decline in investor confidence amidst concerns over the potential for global trade wars and a potentially slowing domestic economy. The technology-heavy Nasdaq-100 index also saw a substantial decrease of -8.3%. This decline marked a notable shift from the previous two years of strong double-digit annual returns in the U.S. equity market.

International stocks, measured by the MSCI ACWI Ex USA, were much stronger in comparison, returning a positive 6.3% year-to-date through March 31st.

The U.S. bond market in Q1 2025 benefited from the economic uncertainties as investors shifted to the relative safety of fixed income. Treasury yields generally fell, driven by concerns about economic growth and the uncertain policy environment. The Bloomberg U.S. Aggregate Bond Index, a broad measure of the U.S. investment-grade bond market, gained 2.7% during the quarter. This indicates increased investor demand for safe-haven assets like U.S. government bonds as equity markets experienced volatility and the economic outlook became less certain.

Entering the Year from a Position of Strength

As we highlighted in our Q1 Markets in Focus, the U.S. economy entered the year in a position of strength. The final reading of 2024 GDP showed that the U.S. economy grew by 2.8% during the year, with the fourth quarter growth reported at 2.3% (BEA.gov). Growth continued to be driven by a strong U.S. consumer but was also helped by increased government spending, residential spending, and net exports.

The labor market also remains strong, with the unemployment rate remaining at 4.2% - the average monthly unemployment rate over the past 75 years is 5.7%. Monthly payrolls averaged 200,000 per month over the past three months (December 2024-February 2025). And there are still more jobs available for people actively seeking employment than there are prospective workers to fill them.

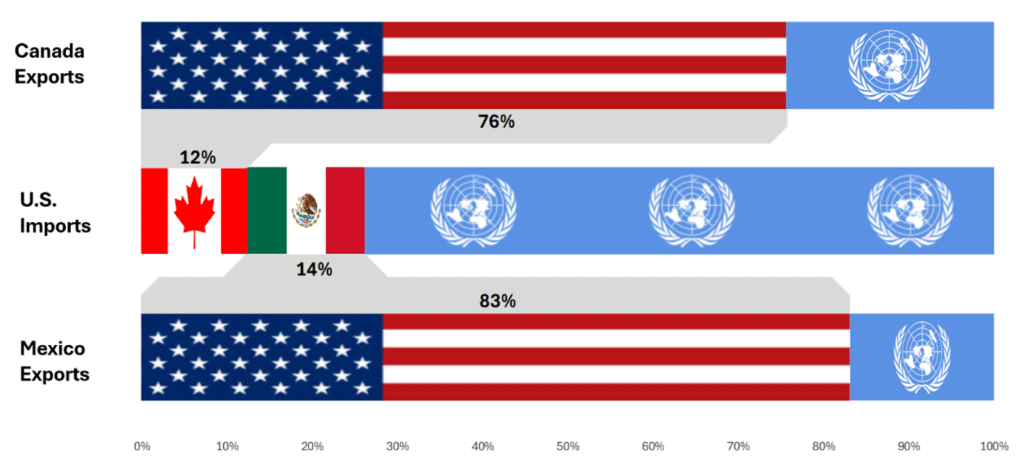

Tariffs and their Impact

One of the most dominant themes shaping the U.S. economic outlook for the remainder of 2025 is the implementation of broad and reciprocal tariffs. As mentioned in our Q1 commentary, this was one of the largest risks to continued growth - unknown policies of the new presidential administration. The shift in U.S. trade policy has generated significant uncertainty across global markets and has the potential to meaningfully reshape international trade relationships. The unexpected size and scope of these tariffs, along with the possible retaliatory measures from trading partners, could lead to wide-ranging disruptions in global supply chains and increased costs for businesses and consumers within the U.S.

An overview of tariffs, including why countries use them and their potential impact on the economy and businesses, can be found here, Understanding Tariffs: Their Mechanisms, Motivations, and Impacts.

Expectations for the Fed

The Federal Open Market Committee (FOMC) oversees monetary policy, meaning the committee alters short-term interest rates depending on whether they think the economy is overheating (inflation is too high) or slowing down too much (unemployment is too high). Over the past few years, its primary focus has been on inflation, meaning they have increased interest rates to maintain stable prices.

Inflation has declined meaningfully since 2022 but hasn’t yet reached its target, a Core PCE reading of 2% (as of February 2025, Core PCE was 2.8%). Meanwhile, as mentioned earlier, the employment picture in the United States is strong, with the unemployment rate at 4.2%.

Expectations coming into the year were that monetary policy in the U.S. would generally see a cautious and gradual easing throughout 2025. The Federal Reserve is navigating the delicate balance between controlling inflation, which remains above target, and supporting economic growth, which shows signs of slowing. The pace and extent of any interest rate cuts will likely depend on the evolving trends in inflation and overall economic activity.

Key Economic Risks Heading into Q2

-

Risk 1: Impact of U.S. Tariffs and Trade Tensions:

The implementation of broad and reciprocal tariffs by the United States poses a significant downside risk to the U.S. economic outlook for the remainder of the year. The tariffs outlined in early April could lead to substantial disruptions in how trade occurs on a global scale, resulting in increased costs for businesses through higher import duties, which could pass through to consumers in the form of higher-priced goods. Estimates suggest that these tariffs could have a material negative impact on U.S. GDP growth and could also contribute to increased inflationary pressures. Furthermore, the likelihood of other countries increasing their tariffs on U.S. goods imports could further escalate trade tensions and worsen the negative consequences for international trade. The prospect of a full-blown trade war scenario represents a significant threat to the stability and growth of the U.S. economy.

-

Risk 2: Persistent Inflation or Stagflation Concerns:

Despite the slow moderation in inflation during the first quarter of 2025, inflation rates in the U.S. remain stubbornly above the Federal Reserve's target. This persistence of higher-than-target inflation raises concerns about the potential for stagflation, a challenging economic condition characterized by a combination of high inflation and slow economic growth. The risk of stagflation is particularly concerning because it presents a dilemma for policymakers, potentially requiring trade-offs between controlling price increases and supporting economic activity. The cautious approach adopted by the U.S. Federal Reserve regarding interest rate cuts reflects these concerns. The potential for tighter monetary policy in response to persistent inflation could dampen economic growth by increasing borrowing costs and reducing investment and consumer spending.

-

Risk 3: Potential for Economic Slowdown:

Beyond the risks associated with tariffs and inflation, there are concerns about a broader economic slowdown in the U.S. The Atlanta Fed's GDPNow model's projection of a contraction in Q1 2025 highlights the possibility of weakening economic momentum. Factors such as slowing consumer spending, cautious corporate investment, and the lingering effects of higher interest rates could contribute to a more pronounced economic slowdown than currently anticipated by some forecasts. Such a slowdown could negatively impact corporate earnings, employment, and overall market sentiment.

Managing the Urge to Make Rash Decisions

Market volatility can be unsettling, and it’s common to want to make a quick change to your investment portfolio to try to minimize the pain of loss. However, it’s important to remember that trying to time the market is very difficult. We describe some of the reasons in further detail in this post, Staying the Course: The Benefits of Sticking to Your Asset Allocation During Market Volatility.

Historically, days of large equity market drawdowns are usually clustered around days of large equity market returns – volatility usually works in both directions.

We will continue to assess the tariff situation and provide updates as necessary. While we remain optimistic about the long-term growth of the U.S. economy, we acknowledge that volatility will likely remain for the foreseeable future. The most important thing for investors is to make sure they remain in-line with their overall financial plan and, if something within that plan changes, to work with a trusted advisor to make any tweaks necessary.

Want to read more about the markets and economy? Check out our blog post, "Impact of Trump's Tariffs on Equity Markets"

___________

Investment advice offered through OneDigital Investment Advisors LLC. The materials and the information provided are not designed or intended to be applicable to any person's individual circumstances. These statements do not constitute an offer or solicitation in any jurisdiction. Any reference to a specific company is not a recommendation to buy, sell, or hold any security. Any economic forecasts in this commentary are merely opinion, and any referenced performance data is historical. Past performance is no guarantee of future results. All investment involved risk of loss. Some information has been obtained by sources we believe to be reliable. OneDigital Investment Advisors LLC makes no representations as to the accuracy or validity of this information. Additionally, OneDigital Investment Advisors does not have any obligation to provide revised investment commentary in the event of changed circumstances. Views and Opinions expressed herein are provided as of April 11, 2025.

The post Markets in Focus: Navigating Markets in a Climate of Uncertainty appeared first on OneDigital.

OneDigital Georgia Market Leader April Husted Featured in CXO Inc. Magazine’s April 2025 Issue 11 Apr 2025, 2:05 pm

April Husted Pioneers a New Era in Employee Benefits Consulting at OneDigital

ATLANTA, GA – April 11, 2025 – Women are increasingly taking on more leadership roles across industries, breaking barriers, and redefining what it means to be successful in the workplace. April Husted, Senior Managing Principal of Georgia at OneDigital, is no stranger to this path to success. In her recent interview with CXO Inc. Magazine, April shared valuable insights on what it takes to succeed as a woman leader. Her advice? Take risks, speak up, and spend less time second-guessing yourself.

Leadership is about fostering a culture where diverse perspectives and innovative ideas thrive. By balancing creativity with data-driven decision-making and promoting open communication, we can drive sustainable growth and empower our teams to achieve their fullest potential.

— April Husted, Senior Managing Principal, OneDigital Georgia

April’s resilience was evident through her positive mindset and ability to face challenges head-on. As a leader, she found value in balancing creativity with data-driven decision-making and fostering a culture of collaboration and innovation.

To read the full feature published in CXO Inc. Magazine, click here.

The post OneDigital Georgia Market Leader April Husted Featured in CXO Inc. Magazine’s April 2025 Issue appeared first on OneDigital.

How Tariffs and Economic Changes Are Impacting Small Businesses: What You Need to Know 9 Apr 2025, 7:41 pm

With the current economic challenges and new tariff policies under the Trump administration, it's crucial for small business owners to understand the impact tariffs can have on their operations.

Whether you're directly importing goods or are part of the supply chain, these tariffs can affect your costs, margins, and customer buying behavior. Let’s break down what tariffs are, why they exist, and how they might impact your business in today’s ever-changing economic environment.

What is a Tariff?

Simply put, a tariff is a tax imposed on imported goods. When products cross international borders – think from a foreign supplier to your warehouse – tariffs are applied. The goal is often to protect domestic industries by making foreign products more expensive, encouraging consumers to buy local alternatives. Want to dive deeper? Check out this quick overview from the U.S. International Trade Commission.

Why Do Tariffs Exist?

Tariffs aren’t arbitrary; they’re often used for several strategic reasons:

- Protecting Domestic Industries: By making imported goods more expensive, tariffs aim to give local businesses a competitive edge.

- Encouraging Fair Trade Practices: Tariffs can be a tool for ensuring other countries play by fair trade rules.

- Generating Government Revenue: Governments use tariffs as a source of income.

- Leverage in International Negotiations: Tariffs can be used as bargaining chips in trade deals or disputes, like the recent tariff standoff between the U.S. and China.

For small businesses, understanding the context of tariffs – especially as they relate to President Trump’s new policies – can help you anticipate the effects on your operations and plan accordingly.

The Impact of Tariffs on Your Small Business

As a small business, if you import goods, materials, or parts, the effects of tariffs can be substantial:

- Higher Costs: Increased tariffs can directly raise the cost of goods and materials you import, squeezing your margins. For a deeper understanding of the broader economic impact, including how tariffs are influencing equity markets, read Impact of Trump's Tariffs on Equity Markets.

- Supply Chain Disruptions: Tariffs can cause delays and unpredictability in your supply chain, making it harder to meet demand on time.

- Price Fluctuations: Changes in tariff rates can cause the prices of goods to fluctuate unexpectedly.

“In today’s economic landscape, where tariffs introduce uncertainty and complexity, small businesses must remain agile. Focusing on controllable costs, like optimized employee benefits and operational efficiencies, isn't just prudent, it's essential. Partnering with OneDigital can empower small businesses to stabilize cash flow, limit administrative burdens, and focus on adaptation and growth."

— Joe Chevalier, Senior Vice President of Finance, PEO

How Tariffs Impact Consumer Behavior in the Current Economic Climate

Tariffs aren’t just affecting your business; they’re also influencing the way your customers think and spend. In today’s economic climate, many consumers are becoming more value-conscious and are reassessing their purchasing decisions. Here are a few trends to keep in mind:

- Price Sensitivity is Rising: As prices climb due to tariffs, customers may delay purchases, look for cheaper alternatives, or demand more value for their money. It’s critical to ensure your value proposition remains clear and competitive.

- Transparency Builds Trust: Customers appreciate businesses that are transparent about pricing changes. If tariffs are affecting your costs, let your customers know how you’re managing those changes, and demonstrate your commitment to providing value.

- The “Buy Local” Movement: In uncertain economic times, many consumers are leaning toward supporting local businesses. You can position your business as a trusted, locally sourced alternative to imported goods.

- Sustainability is Gaining Importance: With tariffs impacting sourcing decisions, there may be an opportunity to explore more sustainable or ethically sourced materials. Many consumers are actively seeking brands that align with their values on sustainability.

Essential Strategies for Small Businesses Navigating Tariffs

As small business owners, there are steps you can take to adapt to these changing economic conditions:

- Diversify Your Supply Chain: If you rely heavily on international suppliers, it’s wise to consider alternate vendors, particularly domestic ones, to mitigate the impact of tariffs.

- Reassess Your Customer Conversations: As customer expectations evolve in response to rising costs, make sure your messaging emphasizes the value you're offering – not just the price. Start by understanding how your customers' needs have shifted.

- Optimize Internal Costs: While tariffs may be beyond your control, other business costs – like employee benefits, insurance, or operational efficiencies – are within your grasp. Look for areas to streamline and optimize.

- Consult with an Expert: Speak with your accountant or tax advisor to understand how the new tariff policies may impact your pricing, cash flow, and tax planning.

Empowering Your Business to Thrive Amid Economic Change

We understand that navigating the complexities of tariffs in today’s economic climate can be daunting. But you’re not alone. At OneDigital, we’re committed to helping your small business thrive, even in these challenging times. Whether it's optimizing your benefits plan, managing costs, or adjusting to economic shifts, we’re here to support you.

For more information, watch Tariffs, Inflation & Uncertainty: How Employers Can Stay Ahead.

If you have more questions on how changing policies may impact your bottom line, connect with our team to discuss additional strategies to stay ahead of the curve.

The post How Tariffs and Economic Changes Are Impacting Small Businesses: What You Need to Know appeared first on OneDigital.

DEI Development: Legal Challenges and Agency Guidance 9 Apr 2025, 2:10 pm

Injunction on Executive Orders is Lifted, While Another TRO Gets Issued

Applies to: All Employers

Effective: As Indicated

Quick Look

- The injunction barring the Trump Administration from enforcing certain executive actions has been lifted.

- A new national temporary restraining order was issued against the Certification Provision of Executive Order 14173, but only for DOL grant recipients.

- Two new technical assistance documents from the DOJ and the EEOC outline what may constitute unlawful discrimination based on DEI-related workplace practices.

Discussion

On March 14, 2025, in National Association of Diversity Officers in Higher Education v. Trump, the U.S. Court of Appeals for the Fourth Circuit stayed enforcement of the preliminary injunction that was issued by a Maryland district court judge, initially barring the Trump administration from proceeding with several elements of Trump’s executive orders regarding DEI (Nos. 14151, 14173). As a result of this ruling, the injunction on President Trump’s executive orders targeting DEI was lifted and such initiatives may move forward. In making its ruling, the Fourth Circuit noted that while the Executive Orders are not unconstitutional on their face, actions taken by federal administrative agencies may prove to be unconstitutional. As a result, the district court case against the executive orders will continue without an injunction on enforcement.

In a further twist, on March 27, 2025, a federal district court in Illinois imposed a limited temporary restraining order (TRO) against the Termination and Certification Provisions of those same executive orders. Specifically, the Certification Provision TRO applies nationwide to those who are Department of Labor grant recipients; the Termination Provision TRO applies only to enforcement by the Department of Labor against the plaintiff and any federal grantee through which the plaintiff holds a subcontract or is a subrecipient of federal funds.

With the Fourth Circuit injunction lifted, employers should expect increased federal investigations and compliance reviews of DEI programs, especially those in federal agencies and businesses with government contracts. However, the subsequent district court ruling sets an example of how other organizations may challenge the executive orders going forward.

Administrative Guidance Issued for “Unlawful DEI-Related Discrimination”

On March 19, 2025, the Equal Employment Opportunity Commission (EEOC) and the U.S. Department of Justice (DOJ) released two technical assistance documents focused on educating the public about unlawful discrimination related to DEI in the workplace. The first jointly-published document, titled “What To Do If You Experience Discrimination Related to DEI at Work,” provides a one-page overview of what DEI-related discrimination may look like. The second document, titled “What You Should Know About DEI-Related Discrimination at Work,” provides expanded guidance from the EEOC in a question-and-answer format on whether certain DEI-related practices may be considered unlawful under Title VII.

Tasked with enforcing Title VII of the Civil Rights Act, the EEOC acknowledges that Title VII does not define DEI. Title VII prohibits employment discrimination based on protected characteristics such as race and sex, and the EEOC opines that DEI initiatives, policies, programs, or practices may be unlawful if they involve an employer or other covered entity taking an employment action motivated—in whole or in part—by an employee’s or applicant’s race, sex, or another protected characteristic. This may include, but is not limited to, enforcing job quotas or workforce balancing based on protected characteristics.

Additionally, employers may run afoul of Title VII’s protections if they limit, segregate, or classify employees based on a protected classification. This could look like limiting membership in workplace groups, such as Employee Resource Groups (ERG) or other employee affinity groups, to certain protected groups or separating employees into groups based on a protected characteristic when administering DEI or other trainings, or other privileges of employment, even if the separate groups receive the same programming content or amount of employer resources. Employers should also be aware that an employee’s reasonable opposition to a DEI training program may constitute protected activity that could support a claim of retaliation.

The new guidance confirms that employees who feel they have been subjected to unlawful DEI-related discrimination must file a complaint with the EEOC, before pursuing a federal claim under Title VII.

Action Items for Employers

1. Review workplace DEI practices for compliance with Title VII.

2. Consult with legal counsel when developing or modifying new or existing DEI programs.

Check out the What to Watch Hub for federal policy updates. Stay ahead of what’s coming to ensure your organization is prepared for what’s next.

The post DEI Development: Legal Challenges and Agency Guidance appeared first on OneDigital.

Some Signs Point to an Economic Slowdown and High Inflation in 2025. What Does This Mean for Employers? 9 Apr 2025, 11:00 am

Tariffs, Inflation & Uncertainty: How Employers Can Stay Ahead

From a traditional economic perspective, many of the policies being pursued by the new President and Congress are associated with recessionary and inflationary outcomes. In addition to this, the haphazard rollout of some policies has rattled markets and generated a great deal of uncertainty.

How should employers interpret news about worsening inflation, stock selloffs, and slowing growth? In this webinar, OneDigital's panel of industry leaders will break down the implications of recent developments for benefit plan sponsors and commercial insurance policyholders.

Tune in to learn how changing policies could affect your bottom line.

To stay informed about other recent federal actions that may be impacting your business operations, visit the 2025 Federal Updates for Employers hub page.

Copyright © 2024 Digital Insurance LLC. All Rights Reserved. OneDigital® is a registered trademark of Digital Insurance LLC in the United States. All other trademarks are those of their respective owners. Investment advice is offered through OneDigital Investment Advisors LLC, a wholly owned subsidiary of OneDigital.

The post Some Signs Point to an Economic Slowdown and High Inflation in 2025. What Does This Mean for Employers? appeared first on OneDigital.

A Compliance Deep Dive: San Francisco Health Care Security Ordinance (SF HCSO) 8 Apr 2025, 4:00 pm

If you employ workers in San Francisco, you’re likely aware of the city’s distinct employment laws—but are you fully compliant?

In this on-demand webinar, our compliance experts will break down the most critical HR and benefits regulations affecting San Francisco employers.

Whether you’re expanding into the San Francisco market or looking to double-check your current compliance strategy, this session offers valuable insights to help you reduce risk and stay ahead of local requirements.

Key Takeaways:

- Understand the scope and application of the Health Care Security Ordinance (HCSO)

- Review additional local mandates that impact benefits and workplace policies

- Get practical tips for managing compliance in a complex regulatory environment

To stay informed about other recent federal actions that may be impacting your business operations, visit the 2025 Federal Updates for Employers hub page.

The post A Compliance Deep Dive: San Francisco Health Care Security Ordinance (SF HCSO) appeared first on OneDigital.

How Economic Uncertainty and New Tariffs Could Impact Your Workforce Strategy 8 Apr 2025, 1:35 pm

Recent policy shifts, including the announcement of sweeping new tariffs, are sending ripple effects across global markets, business operations, and employer strategies.

And while the headlines often focus on market volatility and trade balances, HR leaders are beginning to feel the pressure in far more immediate ways: rising costs, strained budgets, and increased employee anxiety.

If this moment feels familiar, it's because we’ve been here before. During the 2018–2019 tariff cycle, organizations faced widespread economic disruption — including inflationary pressures, supply chain challenges, and rising operational costs. Today, those patterns are reemerging, but with heightened urgency and greater implications for HR leaders managing already complex demands: talent acquisition and retention, escalating healthcare spend, and growing employee wellbeing needs.

As you prepare to lead your organization through this period of uncertainty, here are 4 key considerations to keep in mind:

1. Tariffs Can Fuel Rising Healthcare and Pharmacy Costs

The healthcare system is highly reliant on imported goods — from medical devices to pharmaceuticals. In fact, 69% of medical devices sold in the U.S. are manufactured abroad, and many hospitals expect to pass tariff-related cost increases to employer-sponsored plans.

For HR and benefits teams, this could mean:

-

- Higher-than-expected midyear premium adjustments

- Increased pressure to reduce benefits or shift more costs to employees

- Greater strain on workers already facing affordability challenges

Now is the time to revisit your plan design strategy and explore cost containment tools — from pharmacy benefit audits to alternative funding models.

2. When Financial Stress Grows, So Do Workplace Risks

Inflation, stagnant wage growth, and rising medical costs can create a perfect storm of financial insecurity. For employees living paycheck to paycheck, one medical bill or pharmacy copay can become a crisis.

And where there’s stress, there’s risk:

-

- Higher absenteeism and presenteeism

- Increased behavioral health needs

- A potential rise in workplace injuries or workers’ comp claims due to distraction, burnout, or deferred training

HR leaders can counteract this by investing in financial wellbeing programs, communicating clearly about available resources, and ensuring safety and mental health support remain top priorities — not cost-cutting casualties.

3. Uncertainty Demands Stronger Business Continuity Planning

In times of economic uncertainty, HR becomes central to business continuity. Workforce planning, leave management, safety protocols, and cross-functional coordination will play a key role in helping businesses stay agile and operational -- especially in industries hit hardest by supply chain disruption or pricing volatility.

Now is a smart time to ask:

-

- Do we have the right technology and partners to support a rapidly shifting environment?

- Are our leave policies, payroll, and benefits systems aligned?

- Do we have a strategy in place to protect our workforce and manage risk during sustained instability?

4. This Is the Time for Creative, People-Centered Strategy

Economic headwinds can often lead to reactive decisions: leaner plans, smaller teams, deferred investments. But the most resilient organizations find ways to maintain employee trust and deliver value- even when conditions are tough.

That might mean:

-

- Redesigning benefits to protect lower-wage workers

- Offering voluntary benefits or tiered care navigation support

- Exploring captives, pooled solutions, or new funding models

- Leading with transparency around change and cost pressures

When headlines are swirling and economic uncertainty feels relentless, your employees look to HR for clarity, stability, and care. Tariffs and inflation may not be in your job description -- but the impact on your people and your business definitely is.

For a deeper dive, check out the recent webinar here: Some Signs Point to an Economic Slowdown and High Inflation in 2025. What Does This Mean for Employers?

Need a pulse check on your current strategy?

OneDigital’s benefits, pharmacy, property & casualty and HR consultants are here to help you navigate today’s uncertainty so you’re prepared to weather whatever the future holds.

The post How Economic Uncertainty and New Tariffs Could Impact Your Workforce Strategy appeared first on OneDigital.

Why HR and Finance Teams Struggle to Align—and What to Do About It 7 Apr 2025, 5:35 pm

In today’s evolving business landscape, HR and finance teams must work hand in hand to drive organizational success.

Yet, despite their shared responsibility for workforce planning, these two departments often struggle to align. HR prioritizes recruitment, retention, and employee experience, while finance focuses on cost control and risk management. These differing perspectives can create friction—but with the right approach, businesses can foster collaboration and strategic alignment.

The Core Disconnect Between HR and Finance

The tension between HR and finance teams largely stems from their differing priorities:

- HR Professionals focus on employee engagement, benefits, and long-term talent strategy.

- Finance Leaders prioritize budgeting, cost containment, and financial forecasting.

For example, HR may advocate for enhanced benefits to attract and retain talent, while finance seeks to minimize expenses. These differences can lead to siloed decision-making, inefficient budget allocation, and missed opportunities for growth.

The Role of Data in Bridging the Gap

Data is the key to breaking down barriers between HR and finance. By leveraging shared insights, companies can create a unified approach to workforce planning. Here’s how:

When evaluating benefits programs, finance teams rely on financial models to assess the total cost and return on investment, while HR teams use engagement surveys and turnover rates to measure the impact on retention and productivity. Predictive analytics further enhances collaboration by allowing finance to forecast future benefits expenses through actuarial data, while HR analyzes workforce demographics to anticipate employee needs before they arise.

Retirement plan participation and financial wellness represent another intersection of priorities. Finance departments assess contribution rates and the long-term sustainability of retirement plans, while HR teams leverage employee financial literacy data to advocate for stronger employer contributions, ensuring employees feel financially secure.

Similarly, when it comes to healthcare utilization and claims data, finance teams analyze claims to contain costs, whereas HR professionals focus on wellness programs that can help prevent long-term expenses. By aligning these efforts, organizations can strike a balance between cost efficiency and employee well-being.

Turnover and retention metrics also require joint attention. Finance leaders calculate the financial impact of employee turnover, while HR teams analyze exit interview data to refine benefits offerings and retention strategies, helping to mitigate costly turnover.

Finding Common Ground: Key Areas for Collaboration

Despite their differences, HR and finance teams can align in several critical areas:

- Controlling Costs While Maximizing Value: Both teams strive to balance affordability and competitiveness in benefits, health plans, and retirement contributions.

- Employee Retention & Reducing Turnover Costs: Investing in benefits and financial wellness programs can lead to lower turnover, benefiting both HR and finance.

- Workforce Planning & Budgeting: Accurate forecasting of salary and benefits costs helps ensure sustainable growth.

- Compliance & Risk Management: Collaboration ensures adherence to ERISA, ACA, HIPAA, COBRA, and fair compensation laws.

- Employee Productivity & Business Performance: Engaged employees contribute to business success, making wellness and development programs a shared priority.

- Data-Driven Decision Making: HR and finance can use total rewards analysis, turnover cost metrics, and healthcare utilization trends to make informed choices.

How Impact Studio Bridges the HR-Finance Divide

Impact Studio brings HR and finance together in a way that allows both teams to make informed, strategic decisions—without compromising their individual priorities. By integrating workforce planning, benefits, and financial data into a single platform, Impact Studio ensures that HR professionals have the insights they need to enhance employee experience, while finance teams gain the clarity required for cost-effective decision-making. This synergy empowers organizations to maximize workforce investments, striking the perfect balance between financial responsibility and employee well-being.

Key Features of Impact Studio:

- A Unified View of Workforce Investments – Consolidates benefits, retirement, compensation, and total rewards data in one place.

- AI-Driven Insights – Translates workforce trends into clear, strategic action steps.

- Long-Term Strategic Planning – Provides a five-year forecast for benefits and compensation strategies.

- Consultant-Led Guidance – Combines expert consulting with a centralized system to manage total workforce spending.

By leveraging AI-driven insights and strategic consulting, businesses can align workforce investments with long-term objectives—leading to better outcomes for both employees and the organization.

Aligning for Greater Workforce Impact

HR and finance leaders don’t have to work in silos. By embracing data-driven collaboration, they can develop a clear strategy for workforce planning that balances employee experience with financial sustainability.

Want to see how Impact Studio can help your organization bridge the HR-finance gap? Get started here: Impact Studio

The post Why HR and Finance Teams Struggle to Align—and What to Do About It appeared first on OneDigital.

OneDigital Recognized in the 2025 NAPA TOP DC Advisor Multi-Office Firms Award 7 Apr 2025, 1:00 pm

Overland Park, KS – April 1, 2025 - OneDigital Investment Advisors LLC (“OneDigital”) announced that they have been named to the NAPA 2025 Top DC Advisor Multi-Office Firms.

The firms are recognized for having more than one office/physical location and have more than $1 billion in DC assets under advisement (AUA) as of December 31, 2024. This total list of DC Firms represents more than $2 Trillion in AUA. The NAPA organization stated that they are thankful for the opportunity to recognize the firms on the list for their commitment and hard work.

It’s an incredible honor to be recognized once again as a Top Advisor Multi-Office Team. At OneDigital, our commitment is to delivering customized retirement solutions that evolve with the needs of our clients. This recognition helps affirm the dedication and effort we pour into our practice, and we are grateful for the opportunity to continue to make a meaningful impact.

—Vince Morris, President, OneDigital Retirement + Wealth

This achievement is a testament to the dedication of OneDigital advisers nationwide and the invaluable support staff who make it all possible. We deeply appreciate the contributions of every individual who played a part in growing our business.

—Frank Zugaro, National Vice President, Retirement Solutions, OneDigital Financial Services

The full NAPA TOP DC Advisor Multi-Office Firms List and award criteria can be found here.

Want to read more on OneDigital? Check out this recent article: Thirty-Seven OneDigital Advisor Teams Named in the 2025 NAPA Top DC Advisor Teams Awards.

Investment advice offered through OneDigital Investment Advisors LLC.

This year’s National Association of Plan Advisors list recognized 42 multi-office firms representing over $2 trillion in AUA. This recognition is based solely on quantitative figures, there is no judging or subjective measurement. No compensation was provided to obtain or promote the award. This award is not an indication of future performance or client experience.

About OneDigital

OneDigital’s team of fierce advocates helps businesses and individuals achieve their aspirations of health, success and financial security. Our insurance, financial services and HR platform provides personalized, tech-enabled solutions for a contemporary work-life experience. Nationally recognized for our culture of caring, OneDigital’s teams enable employers and individuals to do their best work and live their best lives. More than 100,000 employers and millions of individuals rely on our teams for counsel and access to fully integrated worksite products and services and the retirement and wealth management advice provided through OneDigital Investment Advisors. Founded in 2000 and headquartered in Atlanta, OneDigital maintains offices in most major markets across the nation. For more information, visit onedigital.com.

OneDigital® is a registered trademark of Digital Insurance LLC (“OneDigital”) and is the marketing name used by Digital Insurance LLC and its affiliates to market their products and services. Each company has financial responsibility only for its own products and services. Investment advisory services offered through OneDigital Investment Advisors, a wholly owned subsidiary of OneDigital.

About the National Association of Plan Advisors

The National Association of Plan Advisors was created by and for retirement plan advisors. Membership is also open to other retirement industry professionals who support the interests of plan advisors. NAPA is the only advocacy group exclusively focused on the issues that matter to retirement plan advisors. NAPA is part of the American Retirement Association, based in the Washington, D.C. area. More information about NAPA is available at napa-net.org.

ID: 00164487

The post OneDigital Recognized in the 2025 NAPA TOP DC Advisor Multi-Office Firms Award appeared first on OneDigital.

Navigating Layoffs: How to Prepare and Recover 4 Apr 2025, 9:05 pm

Have you noticed that reports of layoffs have jumped back into the news lately? And with that, there is also more uncertainty in the economy than we’ve seen for a while.

That can sometimes mean that the job security many of us had may be slipping. If you, a family member, or a friend are worried about the possibility of being laid off, there are proactive steps to take. And if the worst happens, knowing how to recover can make all the difference.

Preparing for the Possibility of Being Laid Off

While the prospect of layoffs is daunting, being prepared can help soften the blow. Here’s some steps you can take to help stay prepared:

1. Build Financial Resilience:

Start by creating an emergency fund that can cover 6 - 12 months of your living expenses. This financial cushion can alleviate stress while you plan your next steps. Also keep credit card and other high-interest debt as low as possible.

2. Review Your Spending

Take a look at your monthly spending with a more cautious eye. Is this something I really need, or can I live without it? Are there monthly subscriptions that I can cut? This type of review is always a good practice, but knowing what the essentials are and reducing expenses can help you save more.

3. Enhance Your Skill Set:

Stay competitive in the job market by upskilling or reskilling where needed. There is no shortage of online platforms in many fields available to help. Certifications in emerging industries or technologies can be especially valuable.

4. Strengthen Your Network:

Professional relationships are invaluable during times of transition. Attend industry events, connect with former colleagues, and engage on platforms like LinkedIn. A strong network can open doors to new opportunities.

5. Organize Important Documents:

Before access is potentially restricted, gather copies of performance reviews, work samples, and any other relevant documentation from your current employer. These can be useful for job applications or interviews.

6. Stay Informed:

Keep an eye on industry trends and your company’s financial health. Early warning signs of layoffs might include budget cuts, hiring freezes, or changes in leadership.

Steps to Take If You’ve Been Laid Off

A layoff can be an emotional and financial shock, but there are concrete steps to regain stability:

1.Take Time to Process:

It’s normal to feel a range of emotions—anger, sadness, frustration. Allow yourself to grieve but avoid making impulsive decisions. Rely on a support system of family and friends to help you through this period.

2. Understand Your Rights and Benefits

Carefully review your severance or exit package and any benefits, such as health insurance extensions or outplacement services. File for unemployment benefits promptly and familiarize yourself with local resources.

3. Reassess Finances:

If you don’t already have a Financial Advisor, this is an ideal time to find a professional advisor who you can rely on to guide you through the many decisions you will face. You may find one through your employer or a referral from a colleague or friend.

4. Re-evaluate Your Career Path:

Use this time as an opportunity to reflect on your long-term goals. Update your resume and LinkedIn profile, highlighting your achievements. Explore temporary or freelance opportunities as a way to stay active and maintain income.

5. Focus on Personal Growth:

Consider this a chance for reinvention. Whether it’s pursuing a passion project, starting a side hustle, or dedicating time to family, use this transition to explore new possibilities.

Conclusion

While layoffs can feel overwhelming, they don’t have to define your career or future. By preparing ahead of time and taking proactive steps after a layoff, individuals can navigate this challenging period with resilience and determination. Remember, some of the most inspiring success stories begin with an unexpected change.

Your journey won’t end there – it will just represent the beginning of a new chapter.

ID: 00166705

Investment advice offered through OneDigital Investment Advisors LLC.

The post Navigating Layoffs: How to Prepare and Recover appeared first on OneDigital.

Investment Viewpoint: A Deeper Look at Cryptocurrency 4 Apr 2025, 6:54 pm

History has shown us that every generation experiences its own wave of “next big thing” investments—whether it was the dot-com boom of the late 1990s, real estate speculation in the early 2000s, or even the gold rushes of the 19th century.

While these opportunities often captivate headlines and spark enthusiasm, they can also lead to speculative frenzies where emotions, rather than careful planning, drive decisions. Cryptocurrency is the latest example of such a phenomenon, capturing public imagination and creating dramatic market stories.

Cryptocurrencies, particularly Bitcoin, have garnered significant attention over the past decade. Initially envisioned as a decentralized alternative to traditional currencies, their role has evolved. At OneDigital, we believe that there are many factors to consider when working with an advisor to decide about the inclusion of any investment in a portfolio. Some of these factors include risk tolerance, liquidity needs, suitability and long-term objectives. Discussing the role of each of these critical components with a financial professional and understanding impacts is a critically important step.

While cryptocurrencies such as bitcoin have introduced innovative concepts and technologies, their current role is more aligned with speculative investments than practical currencies. Unlike traditional investments, they lack natural methods for generating returns and rely heavily on market demand and speculation.

As the market evolves, it remains to be seen whether cryptocurrencies will develop into stable, widely accepted currencies or continue to be viewed primarily as speculative assets.

Opportunities and Risks of Portfolio Inclusion

The cryptocurrency market offers both potential opportunities and significant risks for investors. Each of these pros & cons should be weighed when considering them for portfolio inclusion.

Opportunities:

- Portfolio Diversification: Cryptocurrencies can serve as a non-correlated asset class, potentially reducing portfolio risk during market downturns.

- Potential for High Return: As an emerging industry, cryptocurrencies could provide substantial growth opportunities, with the potential for high returns as demand increases and technology continues to evolve.

- Global Accessibility: Cryptocurrencies can facilitate cross-border transactions with lower fees and greater speed.

Risks:

- Volatility: Extreme price swings can lead to significant gains or losses over a short time.

- Regulatory Uncertainty: Governments worldwide are still defining their approaches to cryptocurrencies and policies could impact the viability and value of cryptocurrencies.

- Security Concerns: Despite blockchain’s inherent security, exchanges and wallets remain vulnerable to hacking and loss.

- Speculative Nature: Many investors buy cryptocurrencies hoping for price appreciation rather than using them for transactions. However, it's important to note that the IRS treats cryptocurrency as property for tax purposes. This means that any transaction—whether for investment or for the purchase of goods—could be subject to capital gains tax. (See IRS Notice 2014-21 for more details.)1

Matters of Reliance

Traditional investments like stocks and bonds have intrinsic mechanisms for generating returns. Stocks represent ownership in a company, which can generate profits and pay dividends, while bonds are debt instruments that pay interest over time. Both have underlying assets or business activities that create value. In contrast, cryptocurrencies do not have inherent value-generating mechanisms. They do not produce cash flows, dividends, or interest. The value of a cryptocurrency is primarily driven by market demand and the willingness of others to buy it at a higher price.

This reliance on market demand for value appreciation in cryptocurrencies aligns with what is referred to as the "Greater Fool Theory.” This theory suggests that one can profit from buying an overvalued asset by selling it to someone else at a higher price. This strategy relies on finding a new buyer willing to pay more. However, if the market realizes the asset is overvalued, the price can drop quickly, leaving the last buyer with a loss. This speculative nature makes cryptocurrencies highly dependent on market sentiment and investor behavior rather than any type of economic value.

We are not suggesting that incorporating these types of assets into a portfolio is foolish. In fact, the U.S. dollar itself is only valuable as long as we, the people, believe it to be. For some investors it may be appropriate to consider adding speculative investments, like cryptocurrencies, to a diversified portfolio. A small allocation might enhance a portfolio's overall risk-return profile. What we are suggesting is that it is crucial to approach any allocation with caution, given the high volatility and speculative nature of these assets.

Conclusion

As your financial professionals, our role is to provide perspective amid this noise and help you focus on what truly matters: your long-term financial plan. While it’s tempting to chase trends or react to short-term excitement, history teaches us that disciplined investing and adhering to a thoughtful strategy are what ultimately lead to success. Markets will always change, and new opportunities will emerge, but your goals remain the foundation of everything we do.

The cryptocurrency market may evolve in ways we can’t yet predict, and it’s natural to feel curious or even anxious about “missing out.” However, staying calm, informed, and deliberate is key. Together, we can determine what—if any—role these investments should play in your broader portfolio, ensuring every decision aligns with your needs, risk tolerance, and long-term vision.

The Mechanics of Cryptocurrency

To understand cryptocurrencies and their implications, it’s essential to grasp the underlying technology and economic principles:

- Blockchain Technology: At the core of most cryptocurrencies is blockchain, a decentralized digital ledger that records transactions across multiple computers. This technology works to provide transparency, immutability, and security, which are vital to cryptocurrency’s functionality.

- Supply and Demand Dynamics: Many cryptocurrencies, such as Bitcoin, have a capped supply (e.g., 21 million coins). This scarcity principle, combined with growing demand, is a significant driver of price. However, while supply may be capped within a single cryptocurrency, there is no limit to the number of cryptocurrencies that may be launched.

- Decentralization: Unlike traditional currencies, cryptocurrencies are generally not controlled by a central authority. This feature appeals to those seeking an alternative to fiat money, particularly during periods of political or economic uncertainty.